Alphawave IP Group (LSE:AWE) has announced an extension of the timeline for Qualcomm to submit a formal acquisition proposal. The new deadline is now set for June 2, 2025, providing both parties additional time to advance discussions. This development reflects ongoing negotiations and hints at a potentially transformative deal for Alphawave that could reshape its competitive standing and influence investor sentiment.

Outlook for Alphawave IP Group

While Alphawave faces hurdles related to profitability and cash flow efficiency, the company maintains a solid balance sheet and continues to invest in strategic growth opportunities. Technical analysis reveals a neutral market trend, although some downward pressure may persist. Concerns over valuation remain, particularly due to a negative price-to-earnings ratio and the absence of dividend payouts. Nonetheless, the company benefits from recent positive developments and partnerships, lending moderate optimism to its forward-looking outlook.

About Alphawave IP Group

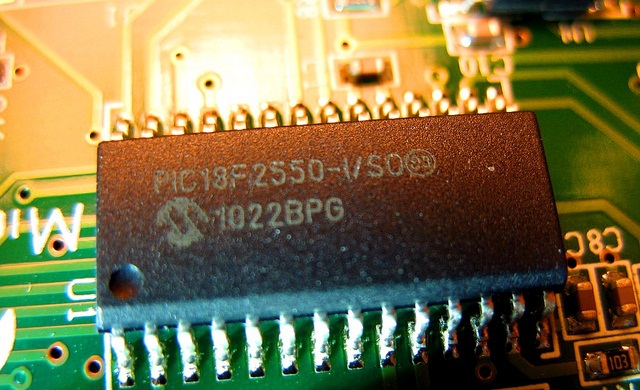

Alphawave IP Group operates within the global semiconductor space, specializing in high-speed connectivity solutions. The firm develops and licenses intellectual property (IP) aimed at accelerating data flow in applications such as data centers, networking infrastructure, and storage systems. Innovation in ultra-fast, energy-efficient data transfer technologies lies at the core of Alphawave’s business strategy.

-

Average Daily Trading Volume: 2,291,319

-

Technical Sentiment: Buy

-

Market Capitalization: £1.08 billion

Hot Features

Hot Features