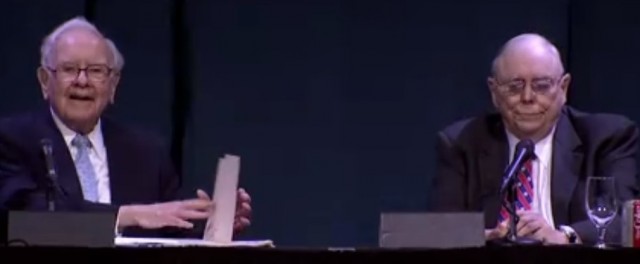

Ever since he was a 19 year-old student of Benjamin Graham (1950-1) Buffett knew he would have to accept long periods when it didn’t make sense to buy, years when Mr Market is full of vim and excitement. By the same token, he knew that exuberance would eventually pass and opportunities to buy at reasonable prices appear again. In the mean-time iron discipline was required not to submit to the urge to “do something”. Sir James Mackintosh (and Winston Churchill) had a term for it, “masterly inactivity”. That does not mean doing nothing. Charlie Munger declares four actions are required of investors:

- Preparation

- Discipline

- Patience

- Decisiveness

The actual act of buying or selling shares/companies, the “decisiveness” element, is less than one-quarter of what was required. Before that there is weeks of hard preparation, for example, examining company after company to find one or two gems per year. Peter Lynch refers to this as looking for grubs under rocks “if you turn over 10 rocks you’ll likely find one grub; if you turn over 20 rocks you’ll find two”.

In 1986-7 Buffett and Munger were looking under hundreds, but not finding any. Still, the work had to go on. The act of looking is valuable in itself: even if a good company is over-priced at the time of analysis and therefore not a good investment, perhaps it’s worth continuing to so that you can follow its progress in the hope that the price will one day fall to a reasonable level, one with intrinsic value above market price by a comfortable margin of safety.

Discipline is required to stick to a sound investment philosophy. This is especially hard when people around you are making seemingly easy profits despite being ill-informed speculators jumping on the latest craze. Your mind starts to waver: should you join with them, going with what is currently in vogue?

Months, even years, go by when following intelligent investment principles means you under-perform, or that you simply can’t invest. These moments call for a great deal of patience, waiting for the tide to turn.

Munger also advises us to “commit more

………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

Hot Features

Hot Features