Last week, we learned that the deadly coronavirus can negatively affect the aircraft carriers together with the oil prices, at the same time helping streaming service platforms, such as Netflix, to earn new subscribers; and that the future growth of the global economy remains questionable as the IMF decreases forecasts for this year and the next.

Despite the fact that the International Monetary Fund decreased its growth forecasts for the global economy, to the lowest level since the 2008 financial crisis, it has also softened previous risk warnings and registered some improvement in the auto sector as disruptions from new emission standards start to fade. Even though, as has been observed by CNN, “Automakers are facing challenges that mean they will have to make changes to business models above and beyond those required by technological reconfiguration”.

The world economy is now expected to grow 3,3% in 2020 and 3,4% in 2021, whereas previously these numbers were 3,4% and 4,6%, correspondingly. Nevertheless, thanks to the signature of a phase one trade agreement between China and the U.S. certain risks disappeared. In addition, the latest data suggests that the manufacturing sector is showing signs of improvement. Cheaper borrowing, in turn, theoretically could lead to higher company profits, at the same time making their dividend payments more attractive.

On the other hand, Coutts, the 327-year-old private bank showed some enthusiasm about rebounding economic indicators. In this context, the bank began shifting clients’ money to riskier assets such as stocks and emerging market bonds. According to Coutts, UK equities are “unloved, undervalued and under-owned”, considering the fact that Brexit uncertainty is finally over.

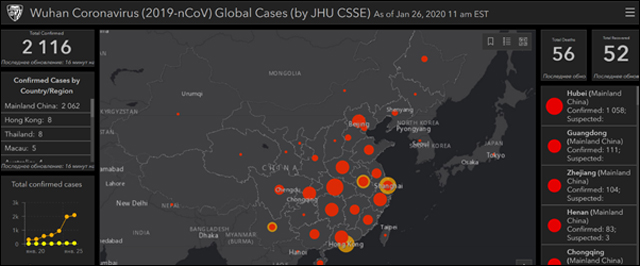

Another important news to consider is the deadly Coronavirus that surges all over China. According to the Washington post, health authorities in China are struggling to deal with a skyrocketing infection rate in the country of the new coronavirus, with the number of cases increasing 50% in just 24 hours.

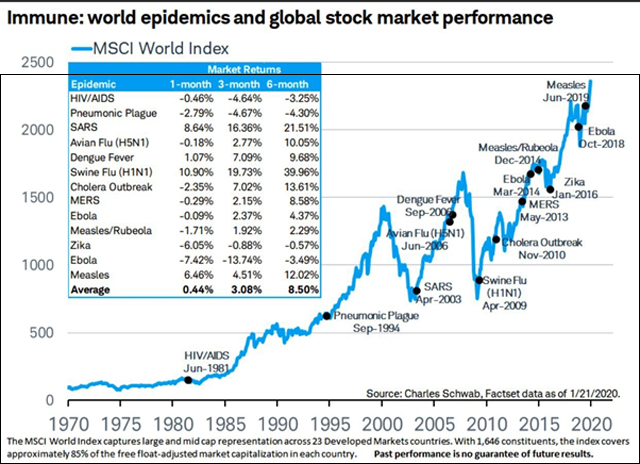

Charles Schwab elaborated a chart that shows the impact of past world pandemics has not been significant on the global stock market:

It means that the spread of the coronavirus may affect the markets, in particular, commodities prices and aircraft carriers.

For curious minds, you can follow Wuhan Coronavirus global cases here:

Finally, on Thursday, the ECB left policy unchanged. However, the ECB President mentioned that inflationary pressures remained subdued and that weaker international trade remained a key risk to global growth.

The previous week in the markets

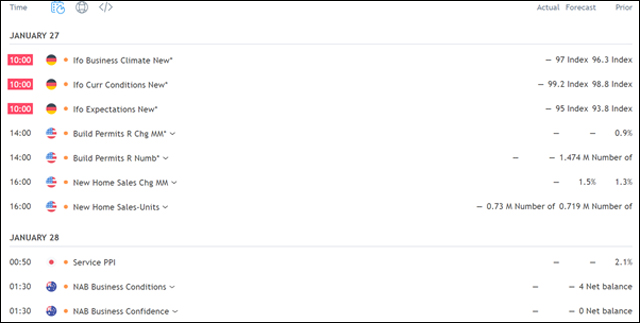

On Monday, we will know the U.S. new home sales and Germany’s IFO Business Climate Index

On Tuesday, consumer confidence will be released.

On Wednesday, the first Fed rate decision of the year will be out, together with Germany’s GfK Consumer Climate figures

On Thursday, fourth-quarter U.S. GDP, Germany, and the Eurozone’s unemployment figures will be presented.

On Friday, French, Spanish, and Eurozone 4th quarter GDP figures and consumer spending numbers out of France and Germany will be provided.

Hot Features

Hot Features