Probably it was on the most eventful six months in modern history. The second half of the year also will not be simple as economies have to recover, but the virus has not disappeared yet. Talking about the recovery it should be mentioned that the Fed released the results of its stress tests for 2020 and additional sensitivity analyses that the Board.

In light of the results, the Board took several actions following its stress tests to ensure large banks remain resilient despite the economic uncertainty from the coronavirus event. For the third quarter of this year, the Board is requiring large banks to preserve capital by suspending share repurchases, re-evaluate their longer-term capital plans, resubmit and update their capital plans later this year to reflect current stresses, and no share repurchases will be permitted. Now banks will try to build up liquid capital by freeing up balances from risky assets.

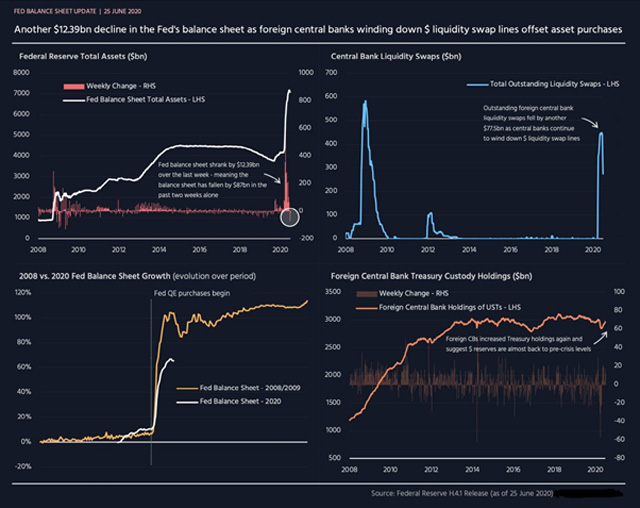

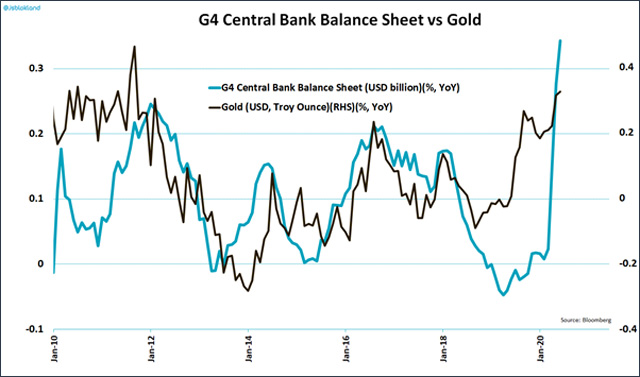

Thus, some banks are close to the minimum capital buffer requirements in the case of the worst scenario (unemployment at 19.5% and loan losses of up to $700B). Meanwhile, the Fed’s balance sheet “continues to decline”. In reality, it has nothing to do with a slowdown in QE. The decrease is caused by a drop in demand for liquidity from other world securities. The situation is gradually stabilizing, banks are unwinding back swap operations on the US dollar.

On the European side, countries failed to reach an agreement on the 2021-27 budget and the €750bn stimulus package. The reason is very simple: so-called frugal four countries do not agree with Southern states about the loan breakdown, allocations, and conditions in the stimulus plan.

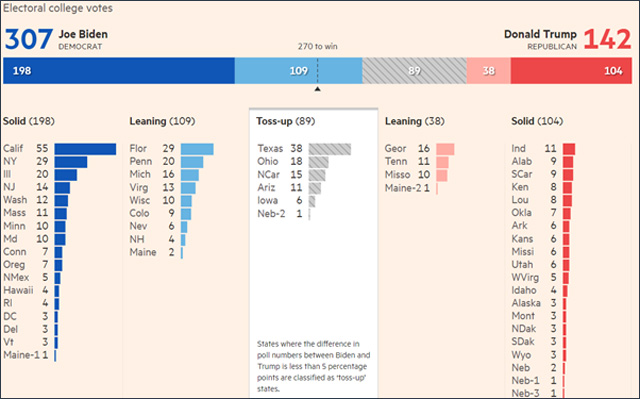

In the US, Wall Street executives are preparing for Biden win as Trump fades in polls. Even though, it is not the end yet, back in 2016 Hillary was also winning in polls. It is expected that China will remain the target of his campaign. Meanwhile, China confirmed that it was increasing purchases of US agricultural products and wanted to respect the agreement. The Pentagon, on the other hand, listed 20 companies related to the Chinese military including China Mobile, China Telecom, CRRC, and Hikvision. China messages that US pressure could jeopardize purchases of US exports.

Besides that, the Trump administration is considering to reimpose tariffs on Canadian aluminum over concerns about rising exports to the United States. Washington is also planning to impose $3.1bn in new import duties on goods from France, Germany, Spain, and the UK.

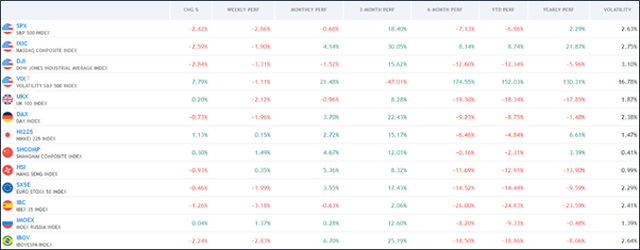

Talking about Covid-19, countries still have problems in getting the epidemic under control. It also disappoints the fact that US weekly jobless claims for the week totaled 1.5 million, higher than expected. It signals that pandemic-induced layoffs remain highly elevated even with the US economy reopening.

With regard to macroeconomic data, Europe’s advanced PMI for June suggests that economic activity is recovering. General business activity fell by the smallest amount since the start of the COVID-19 outbreak in March. The composite index came in at 47.5 compared to 31.9 in May and expectations of 42.4. In France, the PMI rose to 51.3.

Macroeconomic Data & Events

For the upcoming week, it is important to highlight the Riksbank decision on July 1st (no changes expected so far), unemployment numbers from Norway on July 3rd, Flash HICP for EA on June 30th, as well as ISM data from the US on July 1st. Additionally, special attention should be paid to the escalation of Covid-19 cases in the US and whether any states begin to reverse some of the lockdown easings.

Another important data will be the Bank of Japan’s quarterly Tankan report, the NFP report, Consumer Confidence, and Economic Sentiment data for the EU, first-quarter GDP figures from the UK and Nonfarm Payrolls from the US. Finally, the EU and the UK will kick off the next round of Brexit negotiations.

Hot Features

Hot Features