>Major world stock indexes closed on Friday in positive territory on the prospects of more stimulus in Europe and the US. One of the biggest losers was Netflix (-10%) amid expectations that subscriber growth would slow in the second half of the year. Facebook, meanwhile, has totally recovered from its recent loss and is growing 15%+ on Year to Date basis. Amazon is well overperforming the market with a 60% increase in YTD. A similar situation is observed with Apple (+28%), Alphabet (+13%), and Microsoft (+26%). Even though, tech stocks are tumbling as investors started to view them as expensive and over held.

Talking about stimulus packages it is important to mention that in the U.S. democrats apparently have not been consulted on the initiative or on any provisions in the bill that McConnell, Kentucky’s senior United States senator, is expected to present next week. The senator hopes it will be the last coronavirus aid bill this year and that it would not cost more than $1 trillion.

The question now is how the end of relief will affect the market. Here are some of the key dates to keep in mind:

- July 24: Last day of eviction moratorium for federally insured multifamily homes.

- Late July: Final payments of additional $600-a-week federal unemployment insurance.

- Early August: Congress due to recess and last chance to pass benefit extension.

- August 8: Deadline for small businesses to apply for PPP loans.

- September 30: End of payroll support for airlines and end of the freeze on student loan payments

- December 31: Deadline for companies to seek payroll-tax deferral and apply for Employee Retention Tax Credit

In Europe, leaders are approaching closer do a deal for a 750 billion-euro stimulus package, with the Dutch government indicating support for the direction of the negotiations. According to a new proposal, the overall size of the fund will remain the same but the distributed amount will be reduced to 50 billion euros. The new plan would see 450 billion euros disbursed as grants. Still, some member states believe the proposed €750bn package is too large and should come as loans instead of grants.

On the other hand, it is still important to follow coronavirus data as the World Health Organization reporting a record increase in global coronavirus cases. Some believe that together with the increasing number of hospitalizations there would be an increase in deaths. To date, more than 14 million people around the world have been diagnosed with COVID-19, while more than 7.8 million have recovered and more than 600,000 have died, according to data from the Johns Hopkins University.

Hopefully, we see some progress towards a vaccine. For now, Moderna said preliminary results for its coronavirus vaccine were promising. The US company will initiate phase III trials on July 27. AstraZeneca partnered with Oxford University.

Another problem is the tense situations between the US and China. The Donald Trump administration is considering a complete ban on the entry of members of the Chinese Communist Party (CCP) and their families into the United States in accordance with the President’s Hong Kong Autonomy Act. Besides that, Donald Trump ended Hong-Kong’s special status and the UK banned Huawei from its 5G program.

In terms of macroeconomic data, China continues to register improvements in trade, industrial production, and GDP. 2Q20 GDP grew by 3,2%, whereas June’s new Total Social Financing increased by RMS 3,43 trillion. Retail sales in June, on the other hand, decreased 1.8% YoY. Slowly but steadily quarantine measures are lifting. There are no more restrictions on local travel.

The European Central Bank left its rates unchanged but added it was ready to deploy any tools if necessary. In the U.S., weekly jobless claims came in at 1.3 million.

Macroeconomic Data & Events

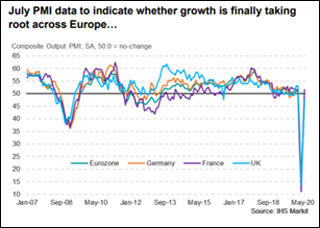

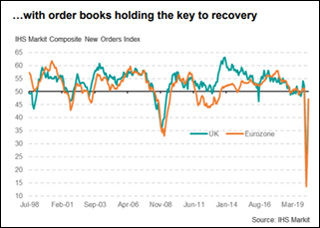

The upcoming week traders will focus on Flash PMI surveys for July covering manufacturing and services for the US, Eurozone, UK, Japan, and Australia; US jobless claims and home sales; South Korea GDP updates and RBA meeting minutes and BoJ summary of opinions.

July 20: China loan prime rate for July, Germany PPI for June, Japan inflation for June and UK Household Finance Index for June.

July 21: UK Public Sector Borrowing, Canada Retail Sales for May, RBA meeting minutes, and US Chicago Fed national activity index for June.

July 22: European Commission Economic Growth Forecasts, US existing home sales for June and South Korea GDP.

July 23: Consumer & Producer Price Index in China and Jobless Claims in the U.S.

July 24: UK, France, and Germany flash PMIs for July; UK Retail sales for June

Hot Features

Hot Features