Covid cases continue growing all over the world, Italy issues first negative-yield three-year bond, democrats, and republicans still cannot agree on new fiscal relief for American workers and businesses, better than expected macro-economic data relieved some fears about a slow economic recovery, and third-quarter corporate earnings reporting season kicked off.

Coronavirus is back on track with over 1,000,000 new cases over the week. Governments have to choose between imposing new lockdown measures and saving businesses. As well noted by McKinsey, large-scale quarantines, travel restrictions, and social-distancing measures caused a drastic fall in consumer and business spending. A decrease in spending, could not but end up triggering corporate layoffs and a rise in bankruptcies. Once countries were able to take the outbreak under control, the situation slightly improved. The problem now is that hopes in a faster recover melt away like the air… The disruption of the current outbreak is shifting industry structures. Credit markets may seize up, in spite of stimulus.

In its World Economic Outlook, the IMF said that the global economy is still in a deep recession and the risk of a worse outcome than in its new forecast is “sizable”. Global growth is projected at −4.4 percent in 2020, a less severe contraction than forecast in June 2020. After the rebound in 2021, global growth is expected to gradually slow to about 3.5 percent into the medium term. Among major economies, only China is expected to expand in 2020 (checkmate, Trump).

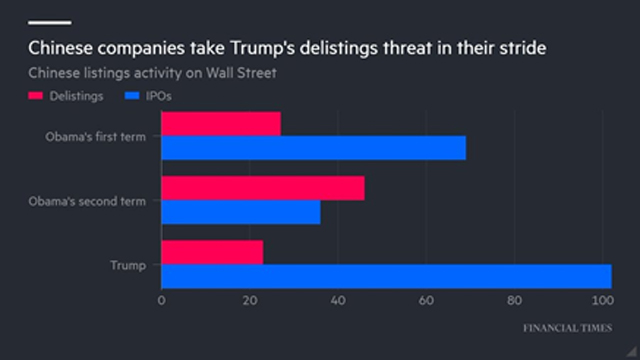

Talking about the current president, despite Donald Trump’s populist threats to exclude Chinese companies from the stock list, 102 companies went public during his presidency in the United States, compared with 105 during the two terms of Barack Obama. Delisting of Chinese companies has also been less than under Obama.

The Brexit saga continues with no real signs of compromise. Sides still can’t agree on the kind of trade relationship after the separation Boris Johnson has claimed there will be no more trade and security talks unless the EU adopts a “fundamental change of approach”. In case of a hard-exit, the WTO rules will be applied.

Its also worth mentioning that the ECB has slowed down the pace of its purchases, but it is clear that the ECB will continue to absorb an amount exceeding the equivalent of EUR government bond issuance, even with a slower pace of purchases.

In the near future, the ECB could increase the size of its Pandemic Emergency Purchase Programme (PEPP) by a further EUR 500bn in December. The general issuance pressure could also be amplified by the large borrowing plans of the European Union, both in terms of the EUR 100bn Support to Mitigate Unemployment Risks in an Emergency (SURE) program, the financing of which will start in October, and the EUR 750bn recovery fund, of which financing is set to start only in 2021.

In terms of macroeconomic data, retail sales increased by 1.9% in September from August. Remove autos and fuel, and retail sales grew by 1.5%. Sales rose 5.4% YoY, meaning the consumption is recovering. Finally, first-time jobless claims rose by 53,000 in the week ended Oct. 10 to a seasonally adjusted 898,000.

In Europe, investor confidence fell more than expected in Germany when the ZEW Institute’s record reached 56.1 due to greater economic uncertainty, due to a possible Brexit without an agreement, the elections in the USA, and the increase in the number of infections.

Finally, the third-quarter corporate earnings reporting season kicked off. The bank registered $20.3 billion in revenue in the third quarter, thus falling 11% YoY. Net income at the bank grew to $4.9 billion, 15% lower YoY. Banks benefitted from market volatility and much lower levels of loan loss reserve build than in the first half of 2020 have been registered. Overall, uncertainty in the sector persists.

Chart of the week

Macroeconomic Data & Events

Looking ahead to next week, markets will continue to monitor the progress of Covid-19. In terms of data, we will get Q3 GDP in China, retail sales, or industrial production; In Europe, PMIs, and in the US, PMIs, and fresh real estate data.

Earnings reports to follow next week: Netflix, Procter & Gamble, Verizon, Morgan Stanley, Microsoft, Harley-Davidson, Kimberly-Clark, AT&T, NextEra Energy, Intel, McDonald’s, Coca-Cola, eBay, American Express, Visa, American Airlines Group, Nasdaq, Tesla.

October 19: RBA meeting minutes, China GDP (Q3), Spain trade balance (Aug), Euro area construction output (Aug), and US monthly budget statement (Sep).

October 20: Euro area and Italy’s current account (Aug), US housing starts, building permits (Sep), China loan prime rate (Oct).

October 21: UK inflation (Sep) and US Fed beige book.

October 22: Euro area consumer confidence (Flash, Oct), US jobless claims, Kansas Fed manufacturing index (Oct), and US third presidential debate.

October 23: UK retail sales (Sep) and Russia interest rate decision.

Hot Features

Hot Features