One of the most important events of the past week was the transfer of power from Donald Trump to Joe Biden. Does it mean that ex-President has finally acknowledged his defeat and in few weeks we will forget about him? Not so fast. The 45th president yet has to face the second impeachment trial, which will begin next month.

There are also some rumors that Donald Trump is looking into forming his own political party, which will be called “the Patriot Party”. According to the polls, Mr. Trump retains strong support among rank-and-file GOP voters. What we should keep in mind is that in case Republican Party officials see the danger in Trump’s efforts to start a new party, most probably the impeachment vote might not be in his favor.

The question now is how long Trump’s legacy will stay with us. Should we expect broad free markets and free trade arrangements? Will the new US government fix or adjust the China-US relations? What about the Iran nuclear deal?

It is hard to forecast, as uncertainty is still high, while tensions are far from over and could soon escalate again. For example, escalation over Taiwan hit high gear less than a week after the American president took office. On the good side, astrologers have predicted a “bright future” for the new US president Joe Biden, as the stars align almost perfectly on the day of his inauguration, which sets him in good stead for the next four years…

Jokes apart, few would disagree that Biden’s team looks good enough to make America great again. Despite the fact that Senate should yet to approve Biden cabinet picks, it is worth highlighting certain candidates. As Secretary of State-designate, Biden team chose Antony Blinken — a longtime Biden adviser who went to Harvard as an undergraduate and then moved through decades of prestigious posts in the Washington foreign policy establishment. Jake Sullivan, a previous Biden adviser who went to Yale, before winning a Rhodes scholarship, will be the National Security Council. The Senate already confirmed the nominee to lead the U.S. intelligence agencies – Avril Haines. Finally, David Cohen, the one that was a deputy director at the agency under Obama will be acting CIA director.

Another member of his team, Janet Yellen, has testified at the confirmation hearing. As expected, she said that the incoming administration would focus on approving its $1.9 trillion pandemic relief plan, despite Republican arguments that the measure is too big given the size of U.S. budget deficits. According to Yellen, pandemic relief would take priority over tax increases, but corporations and the wealthy, which both benefited from 2017 Republican tax cuts “need to pay their fair share.” Overall, markets have taken Yellen’s comments as a green light to bet against the dollar one more time.

Why is a team important? Right people can achieve the right results. Besides that, it tells us that Biden’s presidency will be predictable and calm. Or, at least, the pressure will not be as chaotic as during Trump’s term.

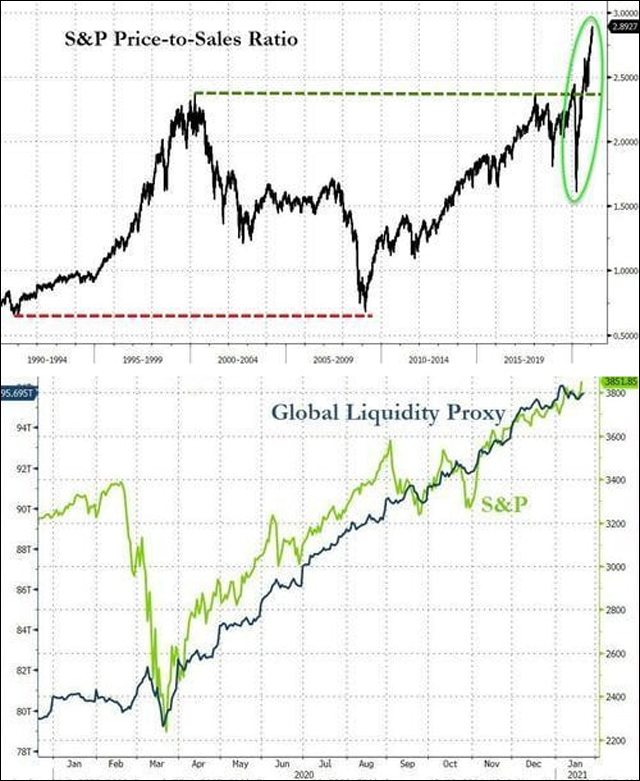

The question then should be asked, will the market rally continue? Currently, US stock valuations are at their top levels. However, considering the yield on Treasuries, corporate credit, as well as cash, the aggregate stock market index is at below-average historical valuation. An economist Robert Shiller, for example, recently pointed out, his oft-cited Cyclically Adjusted P/E Ratio (“CAPE”) shows that equity valuations are “not as absurd as some people think,” provided interest rates remain relatively low.

Talking about Covid-19, the EU regulator is due to decide on the approval of AstraZeneca’s vaccine on 29 January, with a deal to purchase at least 300m doses. The only problem is that the company expects to cut deliveries of its Covid-19 vaccine to the EU by 60% in the first quarter of the year due to production problems.

Johnson & Johnson COVID-19 vaccine, meanwhile, could win emergency-use authorization in just two weeks. Data from a Phase 3 trial of the Johnson & Johnson Covid-19 vaccine are expected in the coming days. The only issue could be that The vaccine is expected to be slightly less effective than the currently available Pfizer and Moderna vaccines.

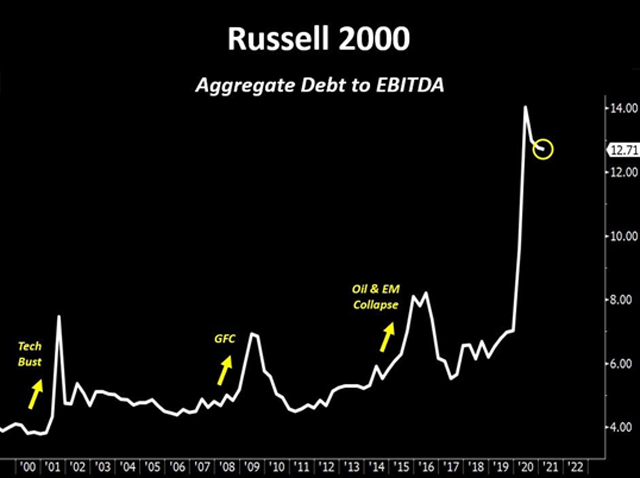

Charts of the week

Companies to report this week: J&J, Abbott Labs, Ely Lilly, Microsoft, AMD, Texas Instruments, Apple, Tesla, Netflix, Comcast, AmEx, 3M, GE, Caterpillar, Honeywell, Lockheed, Raytheon, Southwest Airlines, American Airlines, JetBlue Airlines, AT&T, Starbucks, McDonald’s, Verizon, Chevron, Altria.

Events to follow: The ECB, the BOJ, the Bank of Canada, and Norway’s Norges Bank meetings; Japan BoJ monetary policy meeting minutes; Germany Ifo survey; US Chicago Fed National Activity Index; US Dallas Fed survey and US FOMC rate decision plus press conference.

Hot Features

Hot Features