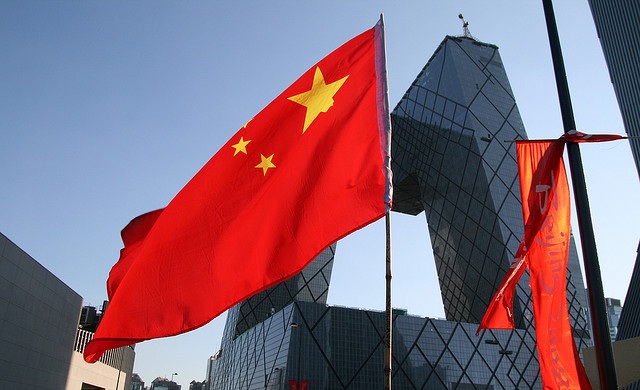

The penultimate week of 2021 was rich in events. First thing first, the People’s Bank of China lowered the one-year prime lending rate to 3.8% from 3.85%. Moreover, it is expected that the Chinese central bank will continue easing its policy to curb the economic slowdown. No surprise the regulator recently cut the reserve requirement ratio by 50 basis points to 11.5%. Will the bank succeed in supporting growth in a slowing economy? Knowing the Chinese commitment to their cause, most probably yes.

In the case of the US, last week analysts at Goldman Sachs have once again downgraded their economic growth forecast for the world’s leading economy following Democratic Senator Joe Manchin’s statements that he would not support the $2 trillion spending plan. US GDP forecasts for the first quarter were downgraded from 3% to 2%. The forecast for the second quarter was lowered to 3% from 3.5% previously and for the third quarter to 2.75% from 3%.

It is worth noting that Manchin’s vote is critical for the Democrats to secure a majority. The bill calls for massive government investment in social protection programs and measures to address climate change. The package is expected to be funded by tax hikes. With Republicans unanimously opposing the initiative, Democrats must meet two conditions to pass it. First, they need the support of all 50 senators in their party.

In Europe, meanwhile, one of the biggest risks is the energy crisis. The closure of nuclear power plant reactors in France has reduced their capacity by 10%. It is estimated that the situation could be exacerbated by low wind power capacity. As temperatures remain below normal Europe’s energy crisis is not expected to be resolved soon. Still, this does not mean that natural resource prices will continue to break records. In fact, last week gas prices have fallen after the US shipped 30 LNG tankers to the EU.

On the coronavirus side, European countries re-imposing restrictions as the new Omicron strain spreads. In particular, Germany is closing nightclubs as of December 28 and banning gatherings of more than 10 people. Finland and Sweden restrict access to bars and restaurants. The United Kingdom is not yet planning to tighten its measures in the run-up to Christmas, although it has recorded the highest increase in new cases of COVID-19 in Europe. The Netherlands has imposed a strict blockade since Monday (December 20).

The good news is that the U.S. Food and Drug Administration (FDA) approved last Thursday the use of COVID-19 tablets, developed by U.S. drugmaker Merck in collaboration with Ridgeback Biotherapeutics. The drug, called Molnupiravir, is designed to treat mild to moderate disease in at-risk adults. The day before, the FDA had approved Pfizer Pharmaceuticals’ Paxlovid tablets.

The Merck and Pfizer drugs could be promising tools in the fight against the COVID-19 pandemic, especially given the rapid spread of a new variant of the “omicron” coronavirus. The drug developed by Merck is expected to be less popular than Pfizer’s drug, which reduces the likelihood of hospitalization and death among at-risk patients by 90%, and has virtually no side effects. On the other hand, the Megsk drug has much less ability to prevent severe disease progression than originally claimed, with only a 30% reduction in hospital admissions and deaths among at-risk patients.

Hot Features

Hot Features