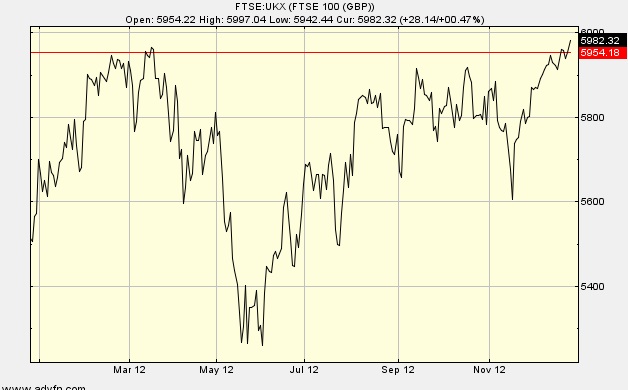

FTSE 100, a compilation of the biggest companies listed on the London Stock Exchange many of which are also the largest in the world, opened on a high today, after two days on break for the holidays. As 2012 nears its end to welcome the new year, with three trading days left (including today), some of us who follow the market may have asked this at least once: “Will LSE reach 6,000 points by 2013?”

A Little Overview

To put into perspective, what better way to start than where LSE picked up when 2011 ended? FTSE 100 finished 2011 at 5,572 points, down from 5,900 points when 2010 closed – a sad 328 points drop, or about 5.5%.

Earlier today, the index had already reached 5,969, replacing its best performance during the year back on 16th March 2012 at 5,966, whilst at the same time 69 points more than its 2011 year-end finish.

But why would one even bother contemplating the idea of FTSE 100 reaching the 6,000 mark?

Needless to say, the index represents the general make-up of the market in London as these 100 companies take account for over 80% of the total market capitalisation of all the listed companies on the London Stock Exchange.

A drop or rise of the index, therefore, gives us a glimpse of how the markets, and in turn, the many industries and sectors these blue-chip companies represent, fair given micro- and macro- economic factors that befall them.

The last time FTSE 100 reached beyond the 6,000 mark was on 7th July 2011, at 6,055. Prior to that, the index played up and down the mark, with more downs than the ups. In fact, the highest the highest record in the FTSE 100 history is on 30 December 1999 when it hit 6,950.60 points.

Will it or will it not?

The year 2012 is one of the toughest years capital markets have faced. Sure it may be nothing compared to the darkest days during the financial crash but the ghosts of those horrid months still haunt the ever cautious and sometimes panicky investors.

This year saw banks still at the centre of unending controversies, mining companies hurt by falling commodities prices, and oil companies affected by developments in the middle east, whilst the rest of the greater spectrum of industries were either pushed aside, even bankrupt, due in part to the uncertainty of the sovereign debt crisis the EU has been trying to resolve and the slowdown in growth in other parts of the world, notably in China and the US.

But through it all, these 100 companies (101 listings, actually as Royal Dutch Shell has two types of shares being traded) have made it a little better than 2011, not without others falling from grace, of course.

At 13:00 GMT, the index is now at 5,991.91 points to be exact. Looking at the RNS’s today, not much updates were released from the top gainers, saved for some indirect reference to Rio Tinto (LSE:RIO) and BHP Billiton (LSE:BLT). In fact, seven out of the ten largest companies on the LSE went up.

Three trading days before the new year starts, the mood still feels like Christmas in London as the markets are hyped by the holiday cheer. Though I don’t want to be a spoiler, I can’t help but think about the fate of the fiscal cliff the US is about to reach. That country should better reach a deal before the New Year or we all suffer, as analysts point out, and we can kiss our 6,000 mark goodbye.

Will FTSE 100 Reach 6,000 mark? Here’s hoping.

Hot Features

Hot Features