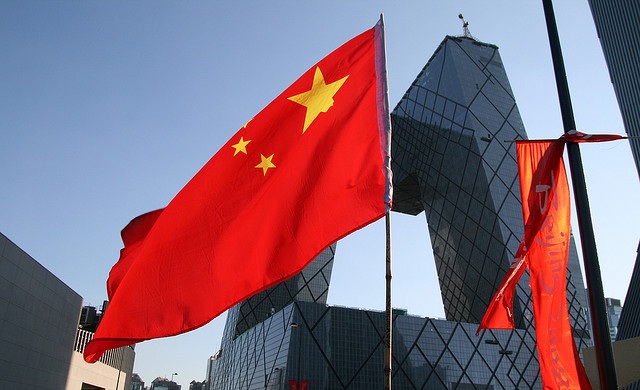

GlaxoSmithKline (LSE:GSK) share price plummeted today by 25.50 pence to 1719.00 after the noon hour. Although it would be difficult to determine precisely why GSK’s share price has dropped, it might have something to do with its inability to distinguish itself from the illegal drug trade in China.

Reports this morning indicate that at least four Chinese GSK executives have taken up residence at a local detention center. Government officials have vaguely indicated that they may be joined by additional GSK staff.

In a country known for bribery and corruption as the pillars of operating a successful business, it appears that GSK has been operating according to those standards, but that it is wrong for them to run their business in a manner similar to the status quo. Don’t get me wrong. Neither I nor ADVFN advocate bribery and corruption. Goodness knows, British headlines reveal some of our own homegrown versions every day. It’s just that we are much more polite about it than the Chinese.

As far as I can tell there have been no formal charges brought as yet. However, from the information at hand, it seems reasonable that charges could include bribery, money laundering, illegal kickbacks, and gifts of sexual favors in exchange for preferential treatment. Charges might also include preferential treatment in exchange for sexual favors.

It appears that one of GSK’s tactics was to book expenses at highly inflated amounts so that the company could skim off the top to have the cash necessary to manipulate deals, entice potential customers and to bribe government officials. It looks like the money was spent, but only a portion actually was. Speaking of which, there are no reports at this point of any government officials being detained. Makes you wonder, doesn’t it?

I believe that it was Erasmus who said that “In the land of the blind, the one-eyed man is king.” Were he alive today he might say, “In the land of unfettered corruption, the man with the most money is king.” The last time I looked, GSK had £4,265 million in cash. But that doesn’t count the amount of cash they have hidden by clever bookkeeping in China.

In effect, GSK China is making money the old-fashioned way. They are stealing it. Some might say, “But they are stealing it from themselves,” but that would as far from the truth as where the sun rises is from where it sets. They are using other people’s money. They are stealing from shareholders – shareholders who are going to begin to get nervous about the size of the fines that will be levied against the company by the Chinese government. The fact is that investors may earn more per share once the fines are levied and the business stops cooking the books.

Personally, I am confident of GSK’s ability to weather this storm. I do wonder, however, it will be able grow its business quite as much in the land of corruption, once it resolves to not participate in the Chinese pillars of business.

Hot Features

Hot Features