I became interested in 3D printing technology almost ten years ago when I visited the Mid-America Technology Center at Pittsburg State University in Kansas to learn about what was then called “rapid prototyping” and its potential uses in the automotive industry. A few days ago I was doing some research and I discovered that the technology is no longer limited to to prototyping. I investigated a few companies who specialize in what is now known as “3D Printing,” to discover that share prices in these companies are increasing at incredible rates.

When I began to do research specifically for this article, I was flabbergasted to learn that a new exhibition opened just this week at the London Science Museum. It’s called “3D: Printing the Future.” The timing could not be more exquisite. It is rare, indeed, to suggest that investors consider a trip to the museum, but I am encouraging you to do exactly that. The exhibit will open your eyes to the future. Once you grasp the vision, it will not be difficult to see the potential rewards. I’ll tell you about that in a moment.

The Concept

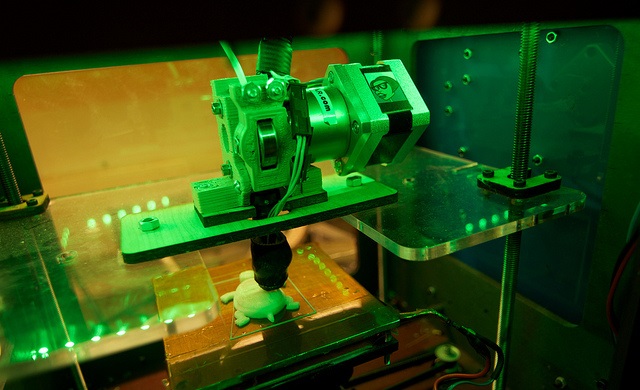

Whilst 3D printing is emerging publicly, the fact that I witnessed a sampling of it ten years ago indicates that it is also a mature technology. Perhaps it would be better to describe it as a maturing technology. Much of the commercialization of 3D printing is involved in the production of figurines, art, and jewelry. To a great extent what the general public will notice is the novelty. In fact, shoppers at Selfridges will be able to purchase three dimensional figurines of themselves. A temporary suite will be set up where you may have a full body scan by a representative of iMakr. The digital scan information will be fed to a 3D printer and, voila, a miniature sized you will be produced. I have also learned that Asda supermarket is offering the same service on a trial basis in York before rolling it out nationwide. iMakr has a vision to make 3D printers affordable for everyone. I expect that this venture capitalist funded company will want to go public at some point.

So much for the novelty aspect. As visitors to the museum exhibit will learn, the serious side of the business that includes very complex components, from prosthetic body parts to titanium spacecraft parts. The range of applications is almost beyond comprehension. In fact, in another amazing coincidence, Lockheed Martin Space Systems recently demonstrated its in-house 3D printing capabilities at Manufacturing Day 2013 near Denver, Colorado. Lockheed is already producing simple satellite components and is planning to produce more complex components and, perhaps, even complete satellites.

The Opportunity

In the quiet, little town of Bella Vista, Arkansas, there are probably more non-celebrity, non-executive millionaires per capita than anywhere else in the world. They are people who were mostly hourly paid employees of a small, three-store company called Wal-Mart. Instead of raises, for years, they received shares of stock in the company. Do you get my point? The first ones in have the most to gain. Take a look at what is happening to 3D printing companies that have gone public.

3D Systems (NYSE:DDD) share price one year ago was $22.59. It closed yesterday at $49.46, and is currently at $51.29. Stratasys (NASDAQ:SSYS) share price one year ago was $60.02. After climbing to $110.00 on 03 September, it is at $97.65 this morning. These are the two largest 3D printers in the world. Some of their dominance is due to active M&A strategies, and I anticipate that will continue.

ExOne (NASDAQ:XONE) went public on 07 February 2013 at $23.66. By 13 August shares were valued at $75.50. They have drawn back recently to $51.70. Nonetheless, all three companies have impressive records.

But wait. There’s more. Voxeljet, a German company that “makes high-speed, large format 3D printers and provides on-demand parts and services to industrial and commercial customers,” is planning an imminent IPO of its own on the New York Exchange. It’s ticker symbol will be VJET when it seeks to raise $97.5 million in what may be the next few weeks.

My objective in this article is simple – to expose a wave of industry that has enormous potential, no matter how that potential is measured. This technology is, at the very least, worthy of any investor’s consideration.

Hot Features

Hot Features