false

Q3

--12-31

0000771999

P1Y

0000771999

2024-01-01

2024-09-30

0000771999

2024-11-11

0000771999

2024-09-30

0000771999

2023-12-31

0000771999

2024-07-01

2024-09-30

0000771999

2023-07-01

2023-09-30

0000771999

2023-01-01

2023-09-30

0000771999

DSS:PrintedProductsMember

2024-07-01

2024-09-30

0000771999

DSS:PrintedProductsMember

2023-07-01

2023-09-30

0000771999

DSS:PrintedProductsMember

2024-01-01

2024-09-30

0000771999

DSS:PrintedProductsMember

2023-01-01

2023-09-30

0000771999

DSS:RentalIncomeMember

2024-07-01

2024-09-30

0000771999

DSS:RentalIncomeMember

2023-07-01

2023-09-30

0000771999

DSS:RentalIncomeMember

2024-01-01

2024-09-30

0000771999

DSS:RentalIncomeMember

2023-01-01

2023-09-30

0000771999

DSS:NetInvestmentIncomeMember

2024-07-01

2024-09-30

0000771999

DSS:NetInvestmentIncomeMember

2023-07-01

2023-09-30

0000771999

DSS:NetInvestmentIncomeMember

2024-01-01

2024-09-30

0000771999

DSS:NetInvestmentIncomeMember

2023-01-01

2023-09-30

0000771999

DSS:DirectMarketingMember

2024-07-01

2024-09-30

0000771999

DSS:DirectMarketingMember

2023-07-01

2023-09-30

0000771999

DSS:DirectMarketingMember

2024-01-01

2024-09-30

0000771999

DSS:DirectMarketingMember

2023-01-01

2023-09-30

0000771999

DSS:CommissionRevenueMember

2024-07-01

2024-09-30

0000771999

DSS:CommissionRevenueMember

2023-07-01

2023-09-30

0000771999

DSS:CommissionRevenueMember

2024-01-01

2024-09-30

0000771999

DSS:CommissionRevenueMember

2023-01-01

2023-09-30

0000771999

2022-12-31

0000771999

2023-09-30

0000771999

us-gaap:CommonStockMember

2022-12-31

0000771999

us-gaap:PreferredStockMember

2022-12-31

0000771999

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000771999

us-gaap:RetainedEarningsMember

2022-12-31

0000771999

us-gaap:ParentMember

2022-12-31

0000771999

us-gaap:NoncontrollingInterestMember

2022-12-31

0000771999

us-gaap:CommonStockMember

2023-12-31

0000771999

us-gaap:PreferredStockMember

2023-12-31

0000771999

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0000771999

us-gaap:RetainedEarningsMember

2023-12-31

0000771999

us-gaap:ParentMember

2023-12-31

0000771999

us-gaap:NoncontrollingInterestMember

2023-12-31

0000771999

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0000771999

us-gaap:PreferredStockMember

2023-01-01

2023-09-30

0000771999

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-09-30

0000771999

us-gaap:RetainedEarningsMember

2023-01-01

2023-09-30

0000771999

us-gaap:ParentMember

2023-01-01

2023-09-30

0000771999

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-09-30

0000771999

us-gaap:CommonStockMember

2024-01-01

2024-09-30

0000771999

us-gaap:PreferredStockMember

2024-01-01

2024-09-30

0000771999

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-09-30

0000771999

us-gaap:RetainedEarningsMember

2024-01-01

2024-09-30

0000771999

us-gaap:ParentMember

2024-01-01

2024-09-30

0000771999

us-gaap:NoncontrollingInterestMember

2024-01-01

2024-09-30

0000771999

us-gaap:CommonStockMember

2023-09-30

0000771999

us-gaap:PreferredStockMember

2023-09-30

0000771999

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0000771999

us-gaap:RetainedEarningsMember

2023-09-30

0000771999

us-gaap:ParentMember

2023-09-30

0000771999

us-gaap:NoncontrollingInterestMember

2023-09-30

0000771999

us-gaap:CommonStockMember

2024-09-30

0000771999

us-gaap:PreferredStockMember

2024-09-30

0000771999

us-gaap:AdditionalPaidInCapitalMember

2024-09-30

0000771999

us-gaap:RetainedEarningsMember

2024-09-30

0000771999

us-gaap:ParentMember

2024-09-30

0000771999

us-gaap:NoncontrollingInterestMember

2024-09-30

0000771999

DSS:SharingServicesGlobalCorpMember

2023-05-04

2023-05-04

0000771999

DSS:SharingServicesGlobalCorpMember

2023-05-04

0000771999

2023-05-04

2023-05-04

0000771999

DSS:SharingServicesGlobalCorpMember

2023-12-31

0000771999

DSS:CustomerOneMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-09-30

0000771999

DSS:CustomerTwoMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-09-30

0000771999

DSS:CustomerOneMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-09-30

0000771999

DSS:CustomerTwoMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2024-01-01

2024-09-30

0000771999

DSS:CustomerOneMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0000771999

DSS:CustomerOneMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0000771999

DSS:CustomerTwoMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0000771999

DSS:CustomerOneMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0000771999

DSS:CustomerTwoMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0000771999

DSS:CustomerOneMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0000771999

DSS:CustomerTwoMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0000771999

DSS:PremierSubsidiaryMember

2024-09-30

0000771999

DSS:PremierSubsidiaryMember

2023-12-31

0000771999

stpr:UT

2024-06-30

0000771999

DSS:AMRELifeCarePortfolioLLCMember

2024-09-30

0000771999

DSS:AMREWinterHavenLLCMember

2024-09-30

0000771999

2023-01-01

2023-12-31

0000771999

DSS:PremierPackagingCompanyMember

2024-09-30

0000771999

DSS:ImpactBioMedicalMember

2024-09-30

0000771999

DSS:AmericanPacificBancorpMember

2023-12-31

0000771999

DSS:SentinelCompanyMember

2023-12-31

0000771999

us-gaap:EmployeeStockOptionMember

2023-07-01

2023-09-30

0000771999

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-09-30

0000771999

us-gaap:EmployeeStockOptionMember

2024-07-01

2024-09-30

0000771999

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-09-30

0000771999

2023-01-01

2023-06-30

0000771999

2023-06-30

0000771999

srt:ScenarioPreviouslyReportedMember

2023-09-30

0000771999

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2023-09-30

0000771999

DSS:RestatementMember

2023-09-30

0000771999

srt:ScenarioPreviouslyReportedMember

2023-01-01

2023-09-30

0000771999

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2023-01-01

2023-09-30

0000771999

DSS:RestatementMember

2023-01-01

2023-09-30

0000771999

DSS:NoteOneMember

2021-05-14

0000771999

DSS:NoteOneMember

2021-05-14

2021-05-14

0000771999

DSS:NoteOneMember

2024-09-30

0000771999

DSS:NoteOneMember

2023-12-31

0000771999

DSS:NoteTwoMember

2021-09-23

0000771999

DSS:NoteTwoMember

2023-12-31

0000771999

DSS:NoteThreeMember

srt:MaximumMember

2021-10-25

0000771999

DSS:NoteThreeMember

2021-10-25

0000771999

DSS:NoteThreeMember

2021-10-24

2021-10-25

0000771999

DSS:NoteThreeMember

2022-12-31

0000771999

DSS:NoteFourMember

2021-12-28

0000771999

DSS:NoteFourMember

2021-12-29

2021-12-29

0000771999

DSS:NoteFourMember

2022-12-29

2022-12-29

0000771999

DSS:NoteFourMember

2023-11-27

0000771999

DSS:NoteFourMember

2023-12-31

0000771999

DSS:NoteFiveMember

2022-01-24

0000771999

DSS:NoteFiveMember

2022-01-23

2022-01-24

0000771999

DSS:NoteFiveMember

2024-09-30

0000771999

DSS:NoteFiveMember

2023-12-31

0000771999

DSS:NoteSixMember

2022-03-02

0000771999

DSS:NoteSixMember

2022-03-02

2022-03-02

0000771999

DSS:NoteSixMember

2024-09-30

0000771999

DSS:NoteSixMember

2023-12-31

0000771999

DSS:NoteSevenMember

2022-05-09

0000771999

DSS:NoteSevenMember

2022-05-09

2022-05-09

0000771999

DSS:NoteSevenMember

2024-09-30

0000771999

DSS:NoteSevenMember

2024-12-31

0000771999

DSS:NoteEightMember

2022-08-29

0000771999

DSS:NoteEightMember

2022-08-28

2022-08-29

0000771999

DSS:NoteEightMember

2024-09-30

0000771999

DSS:NoteEightMember

2023-12-31

0000771999

DSS:NoteEightMember

DSS:DSSFinancialManagementIncMember

2022-08-29

0000771999

DSS:NoteNineMember

2023-05-08

0000771999

DSS:NoteNineMember

2024-09-30

0000771999

DSS:NoteNineMember

2023-12-31

0000771999

DSS:NoteNineMember

2023-05-08

2023-05-08

0000771999

DSS:NoteNineMember

2024-06-30

0000771999

DSS:NoteNineMember

DSS:DSSFinancialManagementIncMember

2023-05-08

0000771999

DSS:NoteTenMember

2022-07-26

0000771999

DSS:NoteTenMember

2022-07-25

2022-07-26

0000771999

DSS:NoteTenMember

2024-09-30

0000771999

DSS:NoteTenMember

2024-03-31

0000771999

DSS:NoteTenMember

2023-12-31

0000771999

DSS:NoteTenMember

2023-01-01

2023-12-31

0000771999

DSS:NoteElevenMember

2021-02-19

0000771999

DSS:NoteElevenMember

2021-02-19

2021-02-19

0000771999

DSS:NoteElevenMember

2024-09-30

0000771999

DSS:NoteElevenMember

2023-12-31

0000771999

DSS:NoteElevenMember

2024-06-30

0000771999

DSS:NoteTwelveMember

2023-06-27

0000771999

DSS:NoteTwelveMember

2023-06-27

2023-06-27

0000771999

DSS:NoteThirteenMember

2023-03-31

0000771999

DSS:NoteThirteenMember

2024-09-30

0000771999

DSS:NoteThirteenMember

2023-12-31

0000771999

DSS:NoteThirteenMember

2023-03-31

2023-03-31

0000771999

DSS:NoteThirteenMember

2024-06-30

0000771999

DSS:NoteForteenMember

2024-08-30

0000771999

DSS:NoteForteenMember

2024-09-30

0000771999

DSS:NoteForteenMember

2024-08-19

2024-08-29

0000771999

us-gaap:CashMember

2024-01-01

2024-09-30

0000771999

us-gaap:CashMember

2024-09-30

0000771999

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2024-01-01

2024-09-30

0000771999

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2024-09-30

0000771999

DSS:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel1Member

2024-01-01

2024-09-30

0000771999

DSS:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel1Member

2024-09-30

0000771999

us-gaap:CashMember

2023-01-01

2023-12-31

0000771999

us-gaap:CashMember

2023-12-31

0000771999

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2023-01-01

2023-12-31

0000771999

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2023-12-31

0000771999

DSS:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel1Member

2023-01-01

2023-12-31

0000771999

DSS:MarketableSecuritiesMember

us-gaap:FairValueInputsLevel1Member

2023-12-31

0000771999

DSS:LoanMember

2024-01-01

2024-09-30

0000771999

DSS:LoanMember

2023-01-01

2023-09-30

0000771999

DSS:GeneralLoanPortfolioReserveMember

DSS:AmericanPacificBancorpMember

2024-01-01

2024-09-30

0000771999

DSS:GeneralLoanPortfolioReserveMember

DSS:AmericanPacificBancorpMember

2023-01-01

2023-12-31

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerThreeMember

2023-01-01

2023-12-31

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerThreeMember

2024-01-01

2024-09-30

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerOneMember

2023-12-31

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerOneMember

2024-09-30

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerTwelveMember

2023-12-31

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerTwelveMember

2024-09-30

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerTenMember

2024-03-31

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerThirteenMember

2024-03-31

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerEightMember

2024-03-31

0000771999

DSS:SpecificLoanReservesMember

DSS:BorrowerEightMember

2024-09-30

0000771999

DSS:HWHWorldIncMember

DSS:SharingServicesGlobalCorporationMember

2023-07-01

2023-07-01

0000771999

DSS:SharingServicesGlobalCorporationMember

DSS:AmendedAgreementMember

2023-07-01

2023-07-01

0000771999

DSS:SharingServicesGlobalCorporationMember

DSS:AmendedAgreementMember

2023-07-01

2023-09-30

0000771999

DSS:HWHWorldIncMember

2023-07-01

0000771999

DSS:HWHWorldIncMember

2023-07-01

2023-07-01

0000771999

DSS:HWHWorldIncMember

2023-07-01

2023-09-30

0000771999

2024-06-13

2024-06-13

0000771999

DSS:AlsetInternationalLimitedMember

2024-09-30

0000771999

DSS:AlsetInternationalLimitedMember

2024-01-01

2024-09-30

0000771999

DSS:AlsetInternationalLimitedMember

2023-12-31

0000771999

DSS:AlsetInternationalLimitedMember

2023-01-01

2023-09-30

0000771999

DSS:WestParkCapitalIncMember

2020-12-30

2020-12-30

0000771999

DSS:WestParkCapitalIncMember

2023-12-31

0000771999

DSS:WestParkCapitalIncMember

2024-09-30

0000771999

DSS:DSSSecuritiesIncMember

2020-09-10

0000771999

DSS:DSSSecuritiesIncMember

2020-09-09

2020-09-10

0000771999

DSS:BMICapitalInternationalLLCMember

2021-01-01

2021-01-31

0000771999

DSS:BMICapitalInternationalLLCMember

2020-09-10

0000771999

DSS:BMICapitalInternationalLLCMember

2024-01-01

2024-09-30

0000771999

DSS:BMICapitalInternationalLLCMember

2023-01-01

2023-09-30

0000771999

DSS:BioMedTechnologiesAsiaPacificHoldingsLimitedMember

2020-12-18

2020-12-19

0000771999

DSS:BioMedTechnologiesAsiaPacificHoldingsLimitedMember

2020-12-19

0000771999

DSS:PremierPackagingBankOfAmericaNAMember

2021-05-20

0000771999

DSS:PremierPackagingBankOfAmericaNAMember

2024-09-30

0000771999

DSS:PremierPackagingBankOfAmericaNAMember

2023-12-31

0000771999

DSS:PremierPackagingBankOfAmericaNAMember

2024-01-01

2024-09-30

0000771999

DSS:PremierPackagingBankOfAmericaNAMember

2023-01-01

2023-09-30

0000771999

DSS:LoanAgreementMember

DSS:AMRESheltonLLCMember

2021-08-01

0000771999

DSS:LoanAgreementMember

DSS:AMRESheltonLLCMember

2021-07-29

2021-08-01

0000771999

DSS:LoanAgreementMember

DSS:AMRESheltonLLCMember

2024-09-30

0000771999

DSS:FacilityMember

DSS:LoanAgreementMember

DSS:AMRESheltonLLCMember

2021-07-29

2021-08-01

0000771999

us-gaap:LandMember

DSS:LoanAgreementMember

DSS:AMRESheltonLLCMember

2021-07-29

2021-08-01

0000771999

DSS:TenantImprovementsMember

DSS:LoanAgreementMember

DSS:AMRESheltonLLCMember

2021-07-29

2021-08-01

0000771999

us-gaap:OtherIntangibleAssetsMember

DSS:LoanAgreementMember

DSS:AMRESheltonLLCMember

2021-08-01

0000771999

DSS:LoanAgreementMember

DSS:AMRESheltonLLCMember

2024-01-01

2024-06-30

0000771999

DSS:LoanAgreementMember

DSS:AMRESheltonLLCMember

2023-01-01

2023-06-30

0000771999

DSS:BMICLoanMember

2021-10-13

0000771999

DSS:BMICLoanMember

2021-10-13

2021-10-13

0000771999

DSS:BMICLoanMember

2024-09-30

0000771999

DSS:BMICLoanMember

2023-12-31

0000771999

DSS:WilsonLoanMember

2021-10-13

0000771999

DSS:WilsonLoanMember

2021-10-13

2021-10-13

0000771999

DSS:WilsonLoanMember

2024-09-30

0000771999

DSS:WilsonLoanMember

2023-12-31

0000771999

DSS:PinnacleBankMember

DSS:LifeCareAgreementMember

2021-11-02

0000771999

DSS:PinnacleBankMember

DSS:LifeCareAgreementMember

2021-11-01

2021-11-02

0000771999

DSS:FacilityMember

DSS:LifeCareAgreementMember

DSS:PinnacleBankMember

2021-11-01

2021-11-02

0000771999

us-gaap:LandMember

DSS:LifeCareAgreementMember

DSS:PinnacleBankMember

2021-11-01

2021-11-02

0000771999

DSS:SiteImprovementsMember

DSS:LifeCareAgreementMember

DSS:PinnacleBankMember

2021-11-01

2021-11-02

0000771999

DSS:LifeCareAgreementMember

DSS:PinnacleBankMember

srt:MinimumMember

2021-11-02

0000771999

DSS:LifeCareAgreementMember

DSS:PinnacleBankMember

srt:MaximumMember

2021-11-02

0000771999

DSS:LifeCareAgreementMember

DSS:PinnacleBankMember

2024-09-30

0000771999

DSS:PinnacleBankMember

DSS:LifeCareAgreementMember

2023-12-31

0000771999

DSS:PinnacleBankMember

DSS:LifeCareAgreementMember

2024-01-01

2024-09-30

0000771999

DSS:PinnacleBankMember

DSS:LifeCareAgreementMember

2023-01-01

2023-09-30

0000771999

DSS:PinnacleLoanMember

2022-03-17

0000771999

DSS:PinnacleLoanMember

2022-03-16

2022-03-17

0000771999

DSS:FacilityMember

DSS:PinnacleLoanMember

2022-03-16

2022-03-17

0000771999

us-gaap:LandMember

DSS:PinnacleLoanMember

2022-03-16

2022-03-17

0000771999

DSS:SiteAndTenantImprovementsMember

DSS:PinnacleLoanMember

2022-03-16

2022-03-17

0000771999

DSS:PinnacleLoanMember

2024-09-30

0000771999

DSS:PinnacleLoanMember

2023-01-01

0000771999

DSS:PinnacleLoanMember

2023-12-31

0000771999

DSS:PinnacleLoanMember

2024-06-30

0000771999

DSS:PinnacleLoanMember

2024-01-01

2024-09-30

0000771999

DSS:PinnacleLoanMember

2023-01-01

2023-09-30

0000771999

DSS:SecurityAgreementMember

2023-03-30

0000771999

DSS:SecurityAgreementMember

DSS:UnionBankAndTrustCompanyMember

2023-03-30

0000771999

DSS:SecurityAgreementMember

2023-03-30

2023-03-30

0000771999

DSS:SecurityAgreementMember

2024-09-30

0000771999

DSS:SecurityAgreementMember

2023-12-31

0000771999

DSS:SecurityAgreementMember

2024-01-01

2024-09-30

0000771999

DSS:SecurityAgreementMember

2023-01-01

2023-09-30

0000771999

srt:MinimumMember

2024-09-30

0000771999

srt:MaximumMember

2024-09-30

0000771999

DSS:LicenseAgreementMember

DSS:EquivirLicenseMember

2024-09-30

0000771999

DSS:LicenseAgreementMember

DSS:EquivirLicenseMember

2023-12-31

0000771999

DSS:FrankHeuszelMember

DSS:EmploymentAgreementMember

2023-04-10

2023-04-10

0000771999

2024-01-04

2024-01-04

0000771999

us-gaap:ConvertibleCommonStockMember

2023-12-31

0000771999

us-gaap:ConvertibleCommonStockMember

2023-01-01

2023-12-31

0000771999

2024-01-01

2024-06-30

0000771999

DSS:ImpactBioMedicalIncMember

2023-05-10

0000771999

DSS:ImpactBioMedicalIncMember

2023-05-10

2024-11-05

0000771999

DSS:ImpactBioMedicalIncMember

2023-05-11

0000771999

DSS:ImpactBioMedicalIncMember

DSS:PriorToSplitMember

2023-05-11

0000771999

2023-10-31

2023-10-31

0000771999

DSS:DSSBioHealthSecuritiesIncMember

us-gaap:CommonStockMember

2023-10-31

0000771999

DSS:DSSBioHealthSecuritiesIncMember

DSS:SeriesAConvertiblePreferredStockMember

2023-10-31

0000771999

DSS:DSSBioHealthSecuritiesIncMember

us-gaap:CommonStockMember

srt:MaximumMember

2023-10-31

0000771999

DSS:DSSBioHealthSecuritiesIncMember

us-gaap:CommonStockMember

srt:MinimumMember

2023-10-31

0000771999

DSS:ImpactBioMedicalIncMember

2024-09-30

0000771999

DSS:ImpactBioMedicalIncMember

2023-12-31

0000771999

DSS:ImpactBioMedicalIncMember

2024-06-30

0000771999

2023-07-10

0000771999

DSS:ImpactBioMedicalIncMember

2023-07-10

0000771999

DSS:ImpactBioMedicalMember

2023-10-31

2023-10-31

0000771999

DSS:ImpactBioMedicalMember

2022-12-31

0000771999

DSS:ImpactBioMedicalMember

2024-01-01

2024-09-30

0000771999

DSS:ImpactBioMedicalMember

us-gaap:CommonStockMember

2024-01-01

2024-09-30

0000771999

DSS:ImpactBioMedicalMember

DSS:SeriesAConvertiblePreferredStockMember

2023-10-31

2023-10-31

0000771999

DSS:ImpactBioMedicalMember

us-gaap:IPOMember

2024-09-16

2024-09-16

0000771999

DSS:ImpactBioMedicalMember

us-gaap:IPOMember

2024-09-16

0000771999

DSS:ImpactBioMedicalMember

us-gaap:IPOMember

2024-09-30

0000771999

DSS:ImpactBioMedicalMember

us-gaap:IPOMember

2024-01-01

2024-09-30

0000771999

DSS:DirectMarketingMember

2023-01-01

2023-12-31

0000771999

us-gaap:OperatingSegmentsMember

DSS:ProductPackagingMember

2024-07-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:CommercialBankingMember

2024-07-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:DirectMarketingOnlineSalesMember

2024-07-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:BiotechnologyMember

2024-07-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:SecuritiesMember

2024-07-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

us-gaap:CorporateMember

2024-07-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

2024-07-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:ProductPackagingMember

2023-07-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:CommercialBankingMember

2023-07-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:DirectMarketingOnlineSalesMember

2023-07-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:BiotechnologyMember

2023-07-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:SecuritiesMember

2023-07-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

us-gaap:CorporateMember

2023-07-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

2023-07-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:ProductPackagingMember

2024-01-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:CommercialBankingMember

2024-01-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:DirectMarketingOnlineSalesMember

2024-01-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:BiotechnologyMember

2024-01-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:SecuritiesMember

2024-01-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

us-gaap:CorporateMember

2024-01-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

2024-01-01

2024-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:ProductPackagingMember

2023-01-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:CommercialBankingMember

2023-01-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:DirectMarketingOnlineSalesMember

2023-01-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:BiotechnologyMember

2023-01-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

DSS:SecuritiesMember

2023-01-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

us-gaap:CorporateMember

2023-01-01

2023-09-30

0000771999

us-gaap:OperatingSegmentsMember

2023-01-01

2023-09-30

0000771999

DSS:PackagingPrintingandFabricationMember

DSS:PrintedProductsMember

2024-07-01

2024-09-30

0000771999

DSS:CommercialandSecurityPrintingMember

DSS:PrintedProductsMember

2024-07-01

2024-09-30

0000771999

DSS:PackagingPrintingandFabricationMember

DSS:PrintedProductsMember

2023-07-01

2023-09-30

0000771999

DSS:CommercialandSecurityPrintingMember

DSS:PrintedProductsMember

2023-07-01

2023-09-30

0000771999

DSS:PackagingPrintingandFabricationMember

DSS:PrintedProductsMember

2024-01-01

2024-09-30

0000771999

DSS:CommercialandSecurityPrintingMember

DSS:PrintedProductsMember

2024-01-01

2024-09-30

0000771999

DSS:PackagingPrintingandFabricationMember

DSS:PrintedProductsMember

2023-01-01

2023-09-30

0000771999

DSS:CommercialandSecurityPrintingMember

DSS:PrintedProductsMember

2023-01-01

2023-09-30

0000771999

DSS:DirectMarketingInternetSalesMember

DSS:DirectMarketingMember

2024-07-01

2024-09-30

0000771999

DSS:DirectMarketingInternetSalesMember

DSS:DirectMarketingMember

2023-07-01

2023-09-30

0000771999

DSS:DirectMarketingInternetSalesMember

DSS:DirectMarketingMember

2024-01-01

2024-09-30

0000771999

DSS:DirectMarketingInternetSalesMember

DSS:DirectMarketingMember

2023-01-01

2023-09-30

0000771999

DSS:RentalIncomeMember

DSS:RentalRevenueIncomeMember

2024-07-01

2024-09-30

0000771999

DSS:RentalRevenueIncomeMember

2024-07-01

2024-09-30

0000771999

DSS:RentalIncomeMember

DSS:RentalRevenueIncomeMember

2023-07-01

2023-09-30

0000771999

DSS:RentalRevenueIncomeMember

2023-07-01

2023-09-30

0000771999

DSS:RentalIncomeMember

DSS:RentalRevenueIncomeMember

2024-01-01

2024-09-30

0000771999

DSS:RentalRevenueIncomeMember

2024-01-01

2024-09-30

0000771999

DSS:RentalIncomeMember

DSS:RentalRevenueIncomeMember

2023-01-01

2023-09-30

0000771999

DSS:RentalRevenueIncomeMember

2023-01-01

2023-09-30

0000771999

DSS:CommissionIncomeMember

DSS:CommissionRevenueMember

2024-07-01

2024-09-30

0000771999

DSS:CommissionIncomeMember

DSS:CommissionRevenueMember

2023-07-01

2023-09-30

0000771999

DSS:CommissionIncomeMember

DSS:CommissionRevenueMember

2024-01-01

2024-09-30

0000771999

DSS:CommissionIncomeMember

DSS:CommissionRevenueMember

2023-01-01

2023-09-30

0000771999

DSS:NetInvestmentIncomeMember

DSS:NetInvestmentRevenueIncomeMember

2024-07-01

2024-09-30

0000771999

DSS:NetInvestmentRevenueIncomeMember

2024-07-01

2024-09-30

0000771999

DSS:NetInvestmentIncomeMember

DSS:NetInvestmentRevenueIncomeMember

2023-07-01

2023-09-30

0000771999

DSS:NetInvestmentRevenueIncomeMember

2023-07-01

2023-09-30

0000771999

DSS:NetInvestmentIncomeMember

DSS:NetInvestmentRevenueIncomeMember

2024-01-01

2024-09-30

0000771999

DSS:NetInvestmentRevenueIncomeMember

2024-01-01

2024-09-30

0000771999

DSS:NetInvestmentIncomeMember

DSS:NetInvestmentRevenueIncomeMember

2023-01-01

2023-09-30

0000771999

DSS:NetInvestmentRevenueIncomeMember

2023-01-01

2023-09-30

0000771999

DSS:BMICapitalInternationalLLCMember

2023-01-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

DSS:Segments

utr:sqft

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT

OF 1934

For

the quarterly period ended September 30, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT

OF 1934

001-32146

Commission

file number

| DSS,

INC. |

| (Exact

name of registrant as specified in its charter) |

| New

York |

|

16-1229730 |

(State

or other Jurisdiction of

incorporation-

or Organization) |

|

(IRS

Employer

Identification

No.) |

275

Wiregrass Pkwy,

West

Henrietta, NY 14586

(Address

of principal executive offices)

(585)

325-3610

(Registrant’s

telephone number, including area code)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Date File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files) Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| Emerging

growth company ☐ |

|

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.02 par value per share |

|

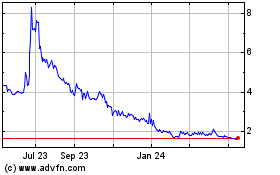

DSS |

|

The

NYSE American LLC |

As

of November 11, 2024 there were 7,066,772 shares of the registrant’s common stock, $0.02 par value, outstanding.

DSS,

INC.

FORM

10-Q

TABLE

OF CONTENTS

PART

I – FINANCIAL INFORMATION

ITEM

1 - FINANCIAL STATEMENTS

DSS,

INC. AND SUBSIDIARIES

Condensed

Consolidated Balance Sheets

| | |

September 30, 2024 (unaudited) | | |

December 31, 2023

(restated) | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 11,631,000 | | |

$ | 6,615,000 | |

| Accounts receivable, net | |

| 2,653,000 | | |

| 3,994,000 | |

| Inventory | |

| 3,307,000 | | |

| 2,819,000 | |

| Assets held for sale | |

| 46,071,000 | | |

| 51,595,000 | |

| Current portion of notes receivable | |

| 3,365,000 | | |

| 8,772,000 | |

| Prepaid expenses and other current assets | |

| 1,779,000 | | |

| 839,000 | |

| Total current assets | |

| 68,806,000 | | |

| 74,634,000 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 5,860,000 | | |

| 6,417,000 | |

| Investment in real estate, net | |

| 6,199,000 | | |

| 6,279,000 | |

| Other investments | |

| 1,282,000 | | |

| 1,282,000 | |

| Investment, equity method | |

| 131,000 | | |

| 128,000 | |

| Marketable securities | |

| 7,263,000 | | |

| 9,979,000 | |

| Notes receivable | |

| 254,000 | | |

| 111,000 | |

| Other assets | |

| 133,000 | | |

| 97,000 | |

| Right-of-use assets | |

| 6,654,000 | | |

| 7,210,000 | |

| Goodwill | |

| 26,862,000 | | |

| 26,862,000 | |

| Other intangible assets, net | |

| 19,213,000 | | |

| 20,193,000 | |

| Total assets | |

$ | 142,657,000 | | |

$ | 153,192,000 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 3,399,000 | | |

$ | 3,654,000 | |

| Accrued expenses and deferred revenue | |

| 2,411,000 | | |

| 2,511,000 | |

| Other current liabilities | |

| 2,760,000 | | |

| 983,000 | |

| Current portion of lease liability | |

| 638,000 | | |

| 686,000 | |

| Current portion of long-term debt, net | |

| 49,873,000 | | |

| 47,776,000 | |

| Total current liabilities | |

| 59,081,000 | | |

| 55,610,000 | |

| | |

| | | |

| | |

| Long-term debt, net | |

| 7,443,000 | | |

| 7,451,000 | |

| Long term lease liability | |

| 6,454,000 | | |

| 6,917,000 | |

| Total liabilities | |

| 72,979,000 | | |

| 69,978,000 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 12) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, $.02 par value; 47,000 shares authorized, zero shares issued and outstanding (zero on December 31, 2023); Liquidation value $1,000 per share, zero aggregate. zero on December 31, 2023). | |

| - | | |

| - | |

| Common stock, $.02 par value; 200,000,000 shares authorized, 7,066,772 shares issued and outstanding (7,066,772 on December 31, 2023) | |

| 141,000 | | |

| 140,000 | |

| Additional paid-in capital | |

| 322,189,000 | | |

| 319,963,000 | |

| Accumulated deficit | |

| (270,210,000 | ) | |

| (256,176,000 | ) |

| Total DSS stockholders’ equity | |

| 52,120,000 | | |

| 63,927,000 | |

| Non-controlling interest in subsidiaries | |

| 17,559,000 | | |

| 19,287,000 | |

| Total stockholders’ equity | |

| 69,679,000 | | |

| 83,214,000 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 142,657,000 | | |

$ | 153,192,000 | |

See

accompanying notes to the condensed consolidated financial statements.

DSS,

INC. AND SUBSIDIARIES

Condensed

Consolidated Statements of Operations

(unaudited)

| | |

| | |

| | |

| | |

| |

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023

(restated) | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Printed products | |

$ | 4,828,000 | | |

$ | 3,315,000 | | |

$ | 11,429,000 | | |

$ | 12,976,000 | |

| Rental income | |

| 496,000 | | |

| 236,000 | | |

| 1,334,000 | | |

| 3,464,000 | |

| Net investment income | |

| 45,000 | | |

| 108,000 | | |

| 181,000 | | |

| 422,000 | |

| Direct marketing | |

| - | | |

| 523,000 | | |

| - | | |

| 1,763,000 | |

| Commission revenue | |

| 230,000 | | |

| - | | |

| 737,000 | | |

| 295,000 | |

| Total revenue | |

| 5,599,000 | | |

| 4,182,000 | | |

| 13,681,000 | | |

| 18,920,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 6,603,000 | | |

| 6,072,000 | | |

| 17,266,000 | | |

| 18,179,000 | |

| Selling, general and administrative (including stock based compensation) | |

| 3,667,000 | | |

| 3,213,000 | | |

| 10,702,000 | | |

| 16,308,000 | |

| Total costs and expenses | |

| 10,270,000 | | |

| 9,285,000 | | |

| 27,968,000 | | |

| 34,487,000 | |

| Operating loss | |

| (4,671,000 | ) | |

| (5,103,000 | ) | |

| (14,287,000 | ) | |

| (15,567,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 28,000 | | |

| 682,000 | | |

| 331,000 | | |

| 1,220,000 | |

| Dividend income | |

| - | | |

| - | | |

| - | | |

| 12,000 | |

| Other income (expense) | |

| 2,000 | | |

| (44,000 | ) | |

| 39,000 | | |

| 138,000 | |

| Interest expense | |

| (53,000 | ) | |

| (51,000 | ) | |

| (242,000 | ) | |

| (438,000 | ) |

| Foreign Currency Translation Adjustment | |

| 8,000 | | |

| - | | |

| (5,000 | ) | |

| - | |

| (Loss) gain on equity method investment | |

| (4,000 | ) | |

| (6,000 | ) | |

| 3,000 | | |

| (28,000 | ) |

| (Loss) gain on investments | |

| (449,000 | ) | |

| 301,000 | | |

| (1,021,000 | ) | |

| (2,471,000 | ) |

| Impairment of assets upon deconsolidation | |

| - | | |

| - | | |

| - | | |

| (6,220,000 | ) |

| Provision for loan losses | |

| (562,000 | ) | |

| (1,179,000 | ) | |

| (908,000 | ) | |

| (4,936,000 | ) |

| (Loss) gain on sale of asset | |

| - | | |

| (1,281,000 | ) | |

| 165,000 | | |

| (1,281,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit (expense) | |

| - | | |

| - | | |

| 163,000 | | |

| (9,000 | ) |

| Loss from continuing operations | |

| (5,701,000 | ) | |

| (6,681,000 | ) | |

| (15,762,000 | ) | |

| (29,580,000 | ) |

| Loss from discontinued operations, net of tax | |

| - | | |

| - | | |

| - | | |

| (3,481,000 | ) |

| Net loss | |

$ | (5,701,000 | ) | |

$ | (6,681,000 | ) | |

$ | (15,762,000 | ) | |

$ | (33,061,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss attributed to noncontrolling interest | |

| 418,000 | | |

| 2,339,000 | | |

| 1,728,000 | | |

| 2,736,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to common stockholders | |

$ | (5,283,000 | ) | |

$ | (4,342,000 | ) | |

$ | (14,034,000 | ) | |

$ | (30,325,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Amounts attributable to DSS stockholders | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations net of taxes | |

| (5,283,000 | ) | |

| (4,342,000 | ) | |

| (14,034,000 | ) | |

| (27,033,000 | ) |

| Loss from discontinued operations net of taxes | |

| - | | |

| - | | |

| - | | |

| (3,292,000 | ) |

| Net loss attributable to DSS shareholders | |

$ | (5,283,000 | ) | |

$ | (4,342,000 | ) | |

$ | (14,034,000 | ) | |

$ | (30,325,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common share attributable to common stock holders - continuing operations | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.75 | ) | |

$ | (0.62 | ) | |

$ | (1.99 | ) | |

$ | (3.87 | ) |

| Diluted | |

$ | (0.75 | ) | |

$ | (0.62 | ) | |

$ | (1.99 | ) | |

$ | (3.87 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common share attributable to common stock holders - discontinued operations | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (0.47 | ) |

| Diluted | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (0.47 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Shares used in computing loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 7,066,772 | | |

| 7,013,213 | | |

| 7,066,772 | | |

| 6,990,456 | |

| Diluted | |

| 7,066,772 | | |

| 7,013,213 | | |

| 7,066,772 | | |

| 6,990,456 | |

See

accompanying notes to the condensed consolidated financial statements.

DSS,

INC. AND SUBSIDIARIES

Condensed

Consolidated Statements of Cash Flows

For

the Nine Months Ended September 30,

(unaudited)

| | |

2024 | | |

2023 (restated) | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (15,762,000 | ) | |

$ | (33,061,000 | ) |

| Loss from discontinued operations | |

| - | | |

| (3,481,000 | ) |

| Loss from continuing operations | |

$ | (15,762,000 | ) | |

$ | (29,580,000 | ) |

| Adjustments to reconcile net loss to net cash used by

operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,692,000 | | |

| 4,150,000 | |

| Loss (income) on equity method investment | |

| (3,000 | ) | |

| 28,000 | |

| Loss on investments | |

| 1,021,000 | | |

| 4,292,000 | |

| Change in ROU assets | |

| 556,000 | | |

| 749,000 | |

| (Loss) gain on sale of assets | |

| (165,000 | ) | |

| 1,281,000 | |

| Impairment of assets upon deconsolidation | |

| - | | |

| 6,220,000 | |

| Provision for loan losses | |

| 1,627,000 | | |

| 4,936,000 | |

| Decrease (increase) in assets: | |

| | | |

| | |

| Accounts receivable | |

| 1,557,000 | | |

| 2,520,000 | |

| Inventory | |

| (488,000 | ) | |

| 4,368,000 | |

| Prepaid expenses and other current assets | |

| (80,000 | ) | |

| 323,000 | |

| Other assets | |

| (36,000 | ) | |

| 2,448,000 | |

| Increase (decrease) in liabilities: | |

| | | |

| | |

| Accounts payable | |

| (255,000 | ) | |

| (2,896,000 | ) |

| Accrued expenses | |

| (111,000 | ) | |

| (15,549,000 | ) |

| Change in ROU liabilities | |

| (511,000 | ) | |

| (763,000 | ) |

| Other liabilities | |

| 1,777,000 | | |

| (81,000 | ) |

| Net cash used by operating activities - continuing operations | |

| (9,181,000 | ) | |

| (17,554,000 | ) |

| Net cash used by operating activities - discontinued operations | |

| - | | |

| (3,481,000 | ) |

| Net cash used by operating activities | |

| (9,181,000 | ) | |

| (21,035,000 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property, plant and equipment | |

| (29,000 | ) | |

| (679,000 | ) |

| Purchase of investment | |

| (1,861,000 | ) | |

| - | |

| Disposal of property, plant and equipment | |

| 5,140,000 | | |

| 215,000 | |

| Sale of marketable securities | |

| 3,029,000 | | |

| 11,330,000 | |

| Issuance of new notes receivable, net origination fees | |

| (402,000 | ) | |

| (400,000 | ) |

| Payments received on notes receivable | |

| 4,039,000 | | |

| 1,419,000 | |

| Net cash provided by investing activities | |

| 9,916,000 | | |

| 11,885,000 | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Payments of long-term debt | |

| (1,492,000 | ) | |

| (4,056,000 | ) |

| Borrowings of long-term debt | |

| 3,546,000 | | |

| 813,000 | |

| Issuances of common stock, net of issuance costs | |

| 2,227,000 | | |

| - | |

| Net cash provided (used) by financing activities | |

| 4,281,000 | | |

| (3,243,000 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash - continuing operations | |

| 5,016,000 | | |

| (8,912,000 | ) |

| Net increase (decrease) in cash - discontinued operations | |

| - | | |

| (3,481,000 | ) |

| Cash and cash equivalents at beginning of period | |

| 6,615,000 | | |

| 19,290,000 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

$ | 11,631,000 | | |

$ | 6,897,000 | |

See

accompanying notes to the condensed consolidated financial statements.

DSS,

INC. AND SUBSIDIARIES

Condensed

Consolidated Statements of Changes in Stockholders’ Equity

(unaudited)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Common

Stock | | |

Preferred

Stock | | |

Additional

Paid-

| | |

Accumulated | | |

Total

DSS | | |

Non-controlling

| | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

in

Capital | | |

Deficit

(restated) | | |

Equity

(restated) | | |

Interest in

Subsidiary | | |

Total

(restated) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance, December

31, 2022 | |

| 6,950,858 | | |

$ | 139,000 | | |

| - | | |

$ | - | | |

$ | 319,766,000 | | |

$ | (194,343,000 | ) | |

$ | 125,562,000 | | |

$ | 31,119,000 | | |

$ | 156,681,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| - | | |

| | | |

| | |

| Stock based payments | |

| 62,350 | | |

| 1,000 | | |

| - | | |

| - | | |

| 267,000 | | |

| - | | |

| 268,000 | | |

| - | | |

| 268,000 | |

| Dividend in kind - Deconsolidation

of Sharing Services Global Corporation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,206,000 | ) | |

| (1,206,000 | ) | |

| - | | |

| (1,206,000 | ) |

| Deconsolidation of Sharing

Services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| 5,064,000 | | |

| 5,064,000 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (30,325,000 | ) | |

| (30,325,000 | ) | |

| (2,736,000 | ) | |

| (33,061,000 | ) |

| Balance,

September 30, 2023 | |

| 7,013,208 | | |

$ | 140,000 | | |

| - | | |

$ | - | | |

$ | 320,033,000 | | |

$ | (225,874,000 | ) | |

$ | 94,299,000 | | |

$ | 33,447,000 | | |

$ | 127,746,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2023 | |

| 7,066,772 | | |

$ | 140,000 | | |

| - | | |

$ | - | | |

$ | 319,963,000 | | |

$ | (256,176,000 | ) | |

$ | 63,927,000 | | |

$ | 19,287,000 | | |

$ | 83,214,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Initial public offering of

Impact BioMedical | |

| - | | |

| 1,000 | | |

| - | | |

| - | | |

| 2,226,000 | | |

| - | | |

| 2,227,000 | | |

| - | | |

| 2,227,000 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (14,034,000 | ) | |

| (14,034,000 | ) | |

| (1,728,000 | ) | |

| (15,762,000 | ) |

| Balance,

September 30, 2024 | |

| 7,066,772 | | |

$ | 141,000 | | |

| - | | |

$ | - | | |

$ | 322,189,000 | | |

$ | (270,210,000 | ) | |

$ | 52,120,000 | | |

$ | 17,559,000 | | |

$ | 69,679,000 | |

See

accompanying notes to the condensed consolidated financial statements.

DSS,

INC. AND SUBSIDIARIES

NOTES

TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September

30, 2024

(Unaudited)

1.

Basis of Presentation and Significant Accounting Policies

The

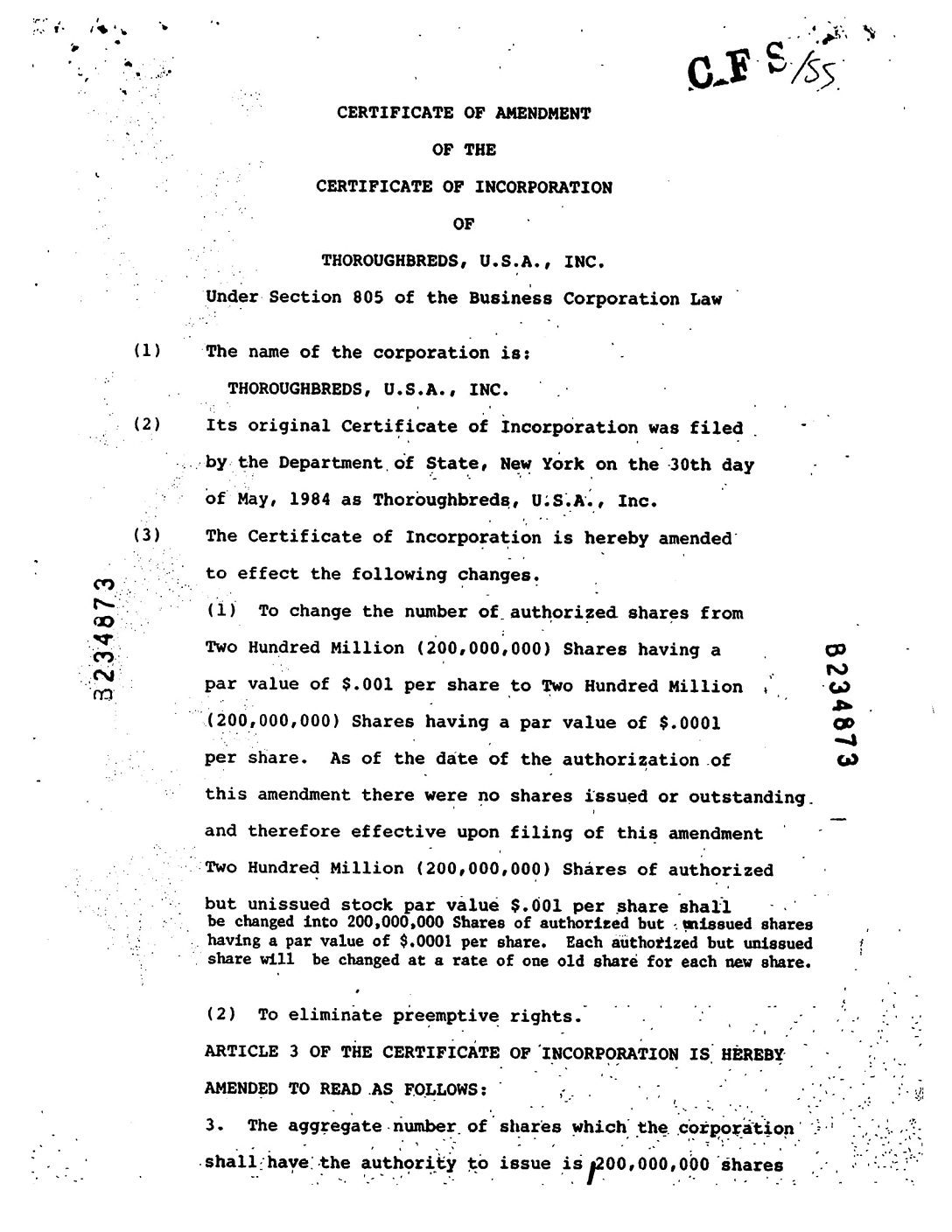

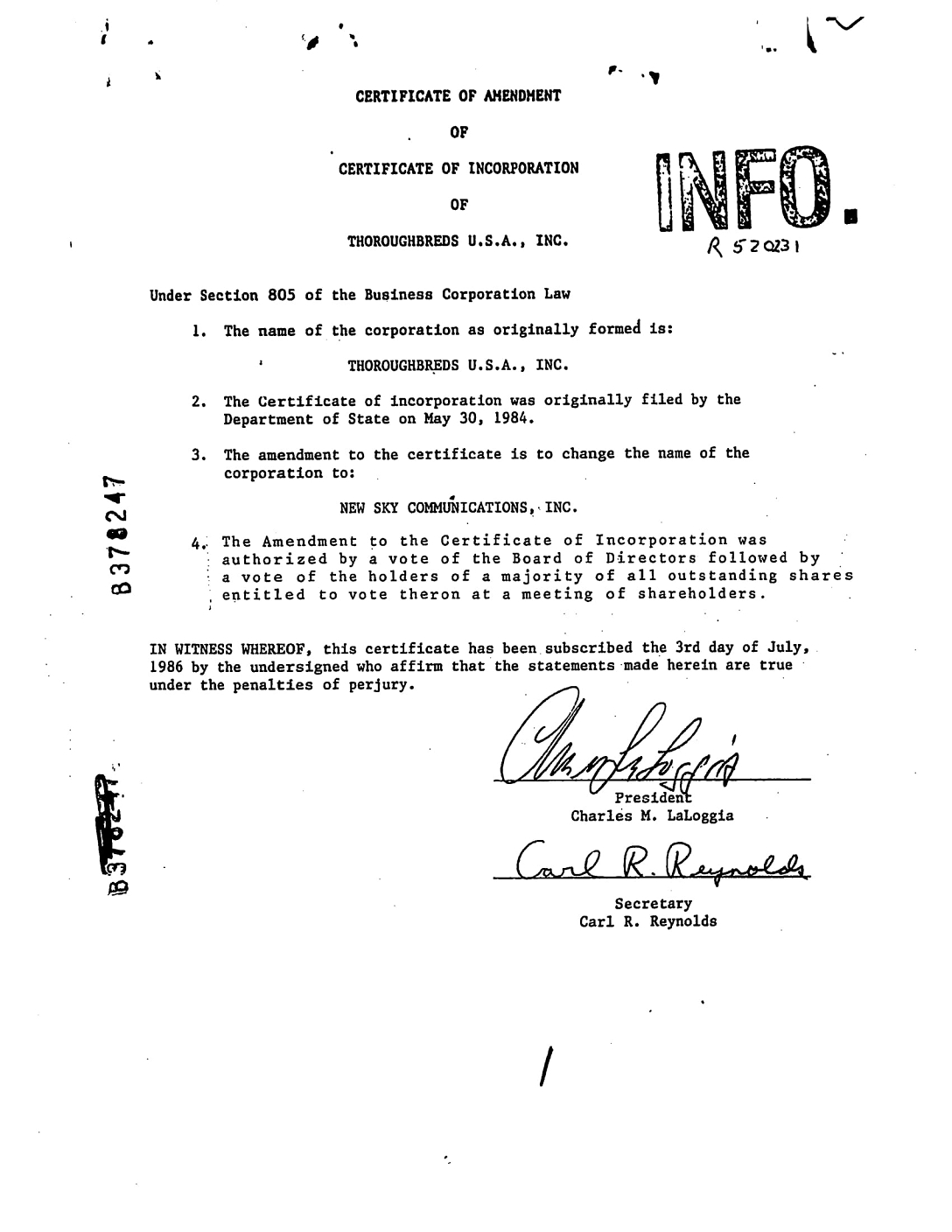

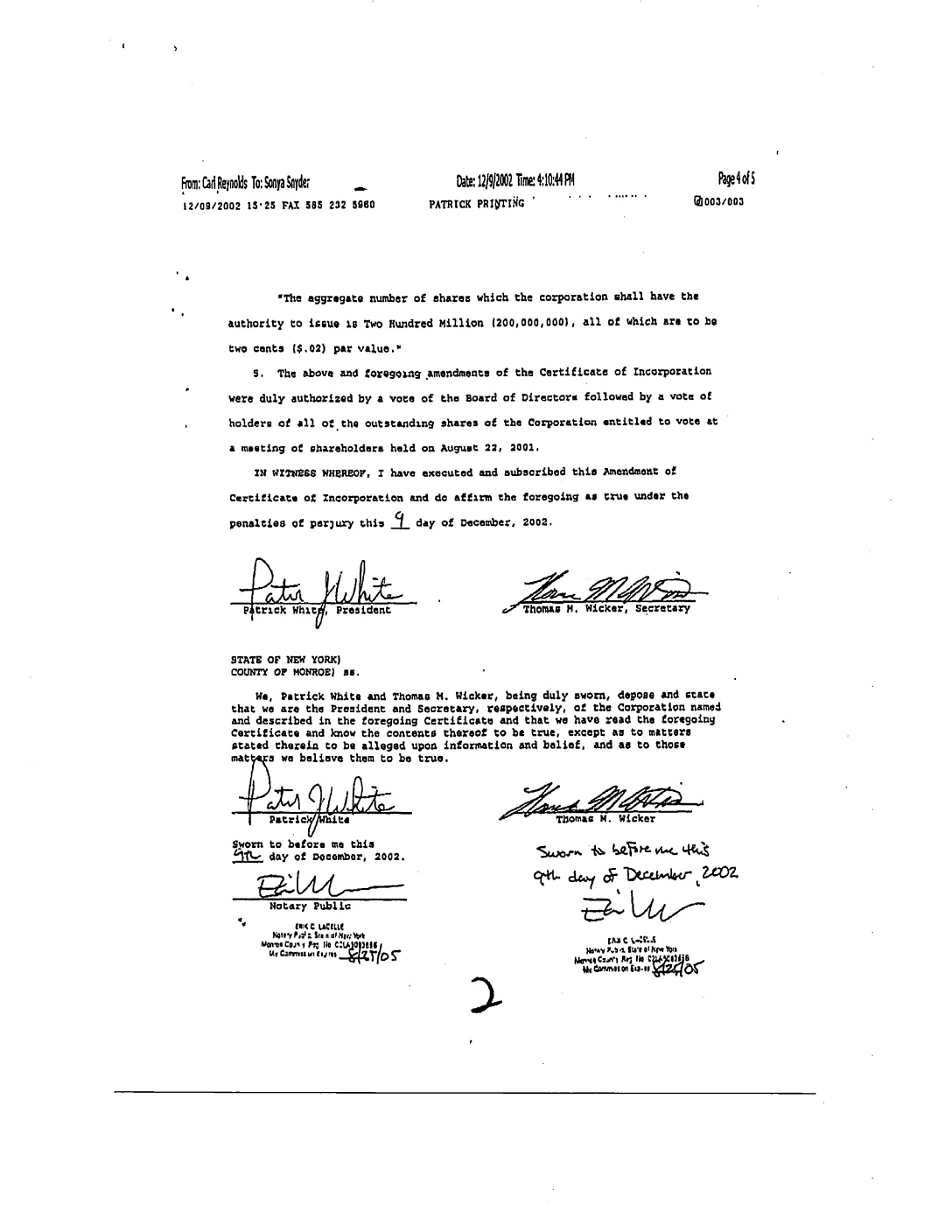

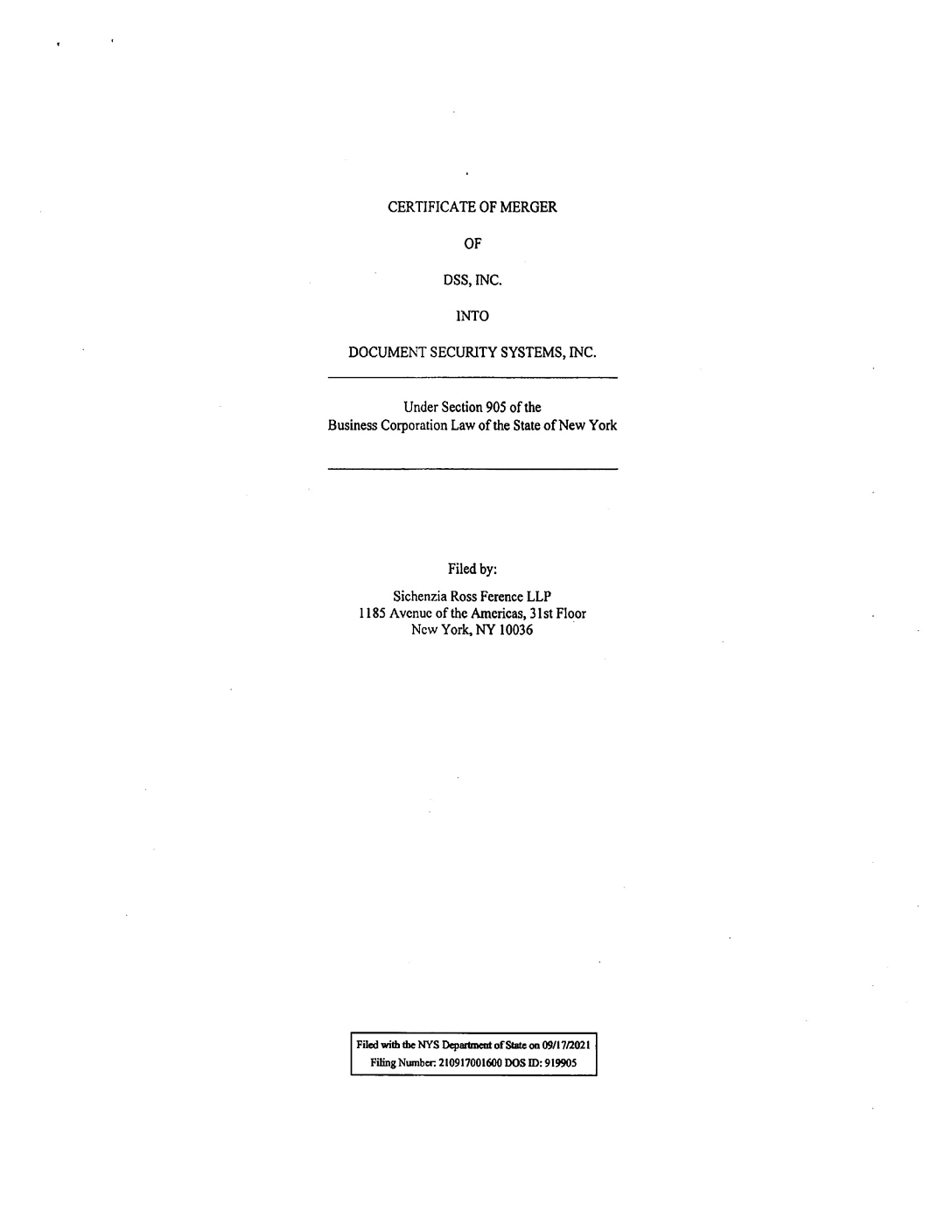

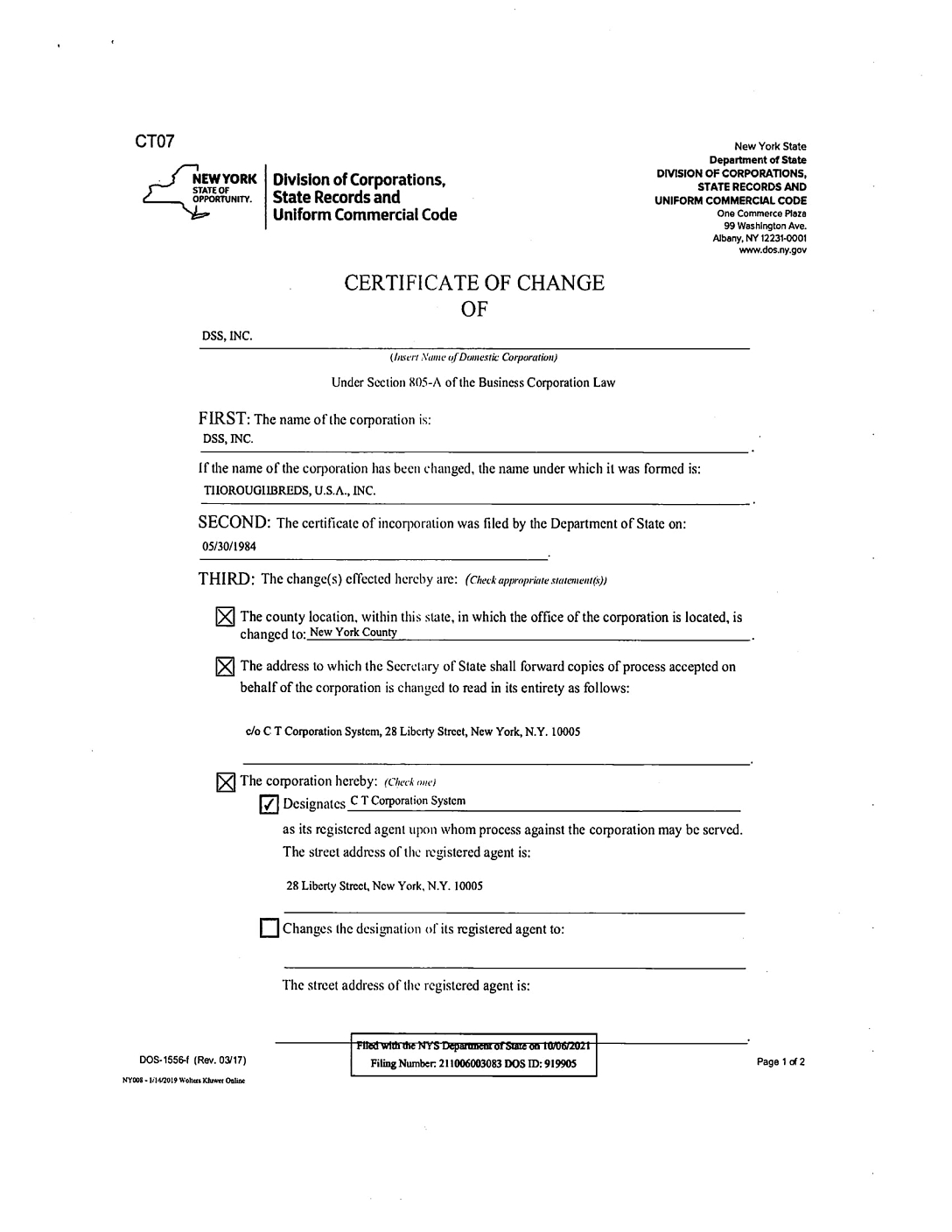

Company, incorporated in the state of New York in May 1984 has conducted business in the name of DSS, Inc. On September 16, 2021, the

board of directors approved an agreement and plan of merger with a wholly owned subsidiary, DSS, Inc. (a New York corporation, incorporated

in August 2020), for the sole purpose of effecting a name change from Document Security Systems, Inc. to DSS, Inc. This change became

effective on September 30, 2021. DSS, Inc. maintained the same trading symbol “DSS”.

DSS,

Inc. (together with its consolidated subsidiaries, referred to herein as “DSS,” “we,” “us,” “our”

or the “Company”), currently operates nine (9) distinct business lines with operations and locations around the globe. These

business lines are: (1) Product Packaging, (2) Biotechnology, (3) Direct, (4) Commercial Lending, (5) Securities and Investment Management,

(6) Alternative Trading (7) Digital Transformation (discontinued in 2023), (8) Secure Living (discontinued in 2023), and (9) Alternative

Energy (discontinued in 2023). Each of these business lines are in different stages of development, growth, and income generation.

Our

divisions, their business lines, subsidiaries, and operating territories: (1) Our Product Packaging line is led by Premier Packaging

Corporation, Inc. (“Premier”), a New York corporation. Premier operates in the paper board and fiber based folding carton,

consumer product packaging, and document security printing markets. It markets, manufactures, and sells sophisticated custom folding

cartons, mailers, photo sleeves and complex 3-dimensional direct mail solutions. Premier is currently located in its new facility in

Rochester, NY, and primarily serves the US market. (2) The Biotechnology business line was created to invest in or acquire companies

in the BioHealth and BioMedical fields, including businesses focused on the advancement of drug discovery and prevention, inhibition,

and treatment of neurological, oncological, and immune related diseases. This division is also targeting unmet, urgent medical needs,

and is developing open-air defense initiatives, which curb transmission of air-borne infectious diseases, such as tuberculosis and influenza.

(3) Direct Marketing, led by the holding corporation, Decentralized Sharing Systems, Inc. (“Decentralized”) provides services

to assist companies in the emerging growth “Gig” business model of peer-to-peer decentralized sharing marketplaces. Direct

Marketing’s products include, among other things, nutritional and personal care products sold throughout North America, Asia Pacific,

Middle East, and Eastern Europe. (4) Our Commercial Lending business division, driven by American Pacific Financial, Inc. (“APF”, formally American

Pacific Bancorp, Inc. “APB”), focused on acquiring equity positions in (i) undervalued

commercial bank(s), bank holding companies and nonbanking licensed financial companies operating in the United States, South East Asia,

Taiwan, Japan and South Korea, and (ii) companies engaged in—nonbanking activities closely related to banking, including loan syndication

services, mortgage banking, trust and escrow services, banking technology, loan servicing, equipment leasing, problem asset management,

SPAC (special purpose acquisition company) consulting services, and advisory capital raising services. (5) Securities and Investment

Management was established to develop and/or acquire assets in the securities trading or management arena, and to pursue, among other

product and service lines, broker dealers, and mutual funds management. Also in this segment is the Company’s real estate investment

trusts (“REIT”), organized for the purposes of acquiring hospitals and other acute or post-acute care centers from leading

clinical operators with dominant market share in secondary and tertiary markets, and leasing each property to a single operator under

a triple-net lease. the REIT was formed to originate, acquire, and lease a credit-centric portfolio of licensed medical real estate.

(6) Alternative Trading was established to develop and/or acquire assets and investments in the securities trading and/or funds management

arena. Alternative Trading, in partnership with recognized global leaders in alternative trading systems, intends to own and operate

in the US a single or multiple vertical digital asset exchanges for securities, tokenized assets, utility tokens, and cryptocurrency

via an alternative trading platform using blockchain technology. The scope of services within this section is planned to include asset

issuance and allocation (securities and cryptocurrency), FPO, IPO, ITO, PPO, and UTO listings on a primary market(s), asset digitization/tokenization

(securities, currency, and cryptocurrency), and the listing and trading of digital assets (securities and cryptocurrency) on a secondary

market(s). (7) Digital Transformation was established to be a Preferred Technology Partner and Application Development Solution for mid

cap brands in various industries including the direct selling and affiliate marketing sector. Digital improves marketing, communications

and operations processes with custom software development and implementation (discontinued in 2023). (8) The Secure Living division has

developed a plan for fully sustainable, secure, connected, and healthy living communities with homes incorporating advanced technology,

energy efficiency, and quality of life living environments both for new construction and renovations for single and multi-family residential

housing (discontinued in 2023). (9) The Alternative Energy group was established to help lead the Company’s future in the clean

energy business that focuses on environmentally responsible and sustainable measures. Alset Energy, Inc, the holding company for this

group, and its wholly owned subsidiary, Alset Solar, Inc., pursue utility-scale solar farms to serve US regional power grids and to provide

underutilized properties with small microgrids for independent energy (discontinued in 2023).

The

accompanying condensed consolidated financial statements contain all adjustments (consisting of normal recurring adjustments, unless

otherwise indicated) necessary to present fairly our consolidated financial position as of September 30, 2024 and December 31, 2023,

and the results of our consolidated operations for the interim periods presented. We follow the same accounting policies when preparing

quarterly financial data as we use for preparing annual data. These statements should be read in conjunction with the consolidated financial

statements and the notes included in our latest annual report on Form 10-K/A, for the fiscal year ended December 31, 2023 (“Form

10-K/A”), and our other reports on file with the Securities and Exchange Commission (the “SEC”).

Principles

of Consolidation - The consolidated financial statements include the accounts of DSS, Inc. and its subsidiaries. All significant

intercompany balances and transactions have been eliminated in consolidation.

Deconsolidation

of Sharing Services Global Corporation(“SHRG”) - On May 4, 2023, the Company distributed approximately 280 million

shares of SHRG beneficially held by DSS and Decentralized Sharing Systems in the form of a dividend to the shareholders of DSS common

stock. Upon completion of this distribution, DSS will retain an ownership interest in SHRG of approximately 7%. Immediately prior to

this distribution, DSS owned approximately 81% of the issued and outstanding common shares of SHRG. As a result, SHRG, whose operations

represented a significant portion of our Direct Marketing segment, was deconsolidated from our consolidated financial statements effective

as of May 1, 2023 (the “Deconsolidation”). The consolidated statement of operations for the fiscal quarter ended September

30, 2023, therefore includes one month of activity related to SHRG prior to the Deconsolidation. Subsequent to April 30, 2023 the assets

and liabilities of SHRG are no longer included within our consolidated balance sheets. Any discussions related to results, operations,

and accounting policies associated with SHRG refer to the periods prior to the Deconsolidation.

Upon

Deconsolidation, we recognized an impairment of assets due to the deconsolidation of SHRG approximately $6,220,000 which

is recorded as an impairment of assets due to the deconsolidation in our consolidated statements

of operations. Subsequent to the Deconsolidation, we accounted for our equity ownership interest in SHRG as a marketable security and

at the quoted price stock price of SHRG, valued at approximately $74,000 at December 31, 2023.

Use

of Estimates - The preparation of consolidated financial statements in conformity with accounting principles generally accepted

in the United States requires the Company to make estimates and assumptions that affect the amounts reported and disclosed in the financial

statements and the accompanying notes. Actual results could differ materially from these estimates. On an ongoing basis, the Company

evaluates its estimates, including those related to the accounts receivable, convertible notes receivable, inventory, fair values of

investments, intangible assets and goodwill, useful lives of intangible assets and property and equipment, fair values of options and

warrants to purchase the Company’s common stock, preferred stock, deferred revenue and income taxes, among others. The Company

bases its estimates on historical experience and on various other assumptions that are believed to be reasonable, the results of which

form the basis for making judgments about the carrying values of assets and liabilities.

Reclassifications

- Cost associated with Professional fees for the three

and nine months ended September 30, 2023 and the nine months September 30, 2024 have been reclassified to Research and development to

conform with current period presentation.

Cash

Equivalents – All highly liquid investments with maturities of three months or less at the date of purchase are classified

as cash equivalents. Amounts included in cash equivalents in the accompanying consolidated balance sheets are money market funds whose

adjusted costs approximate fair value.

Accounts/Rents

Receivable - The Company extends credit to its customers in the normal course of business. The Company performs ongoing credit

evaluations and generally does not require collateral. Payment terms are generally 30 days but up to net 120 for certain customers. The

Company carries its trade accounts receivable at invoice amounts and its rent receivables at contract amounts, less an allowance for

credit losses. On a periodic basis, the Company evaluates its accounts receivable and establishes an allowance for credit losses based

upon management’s estimates that include a review of the history of past write-offs and collections and an analysis of current

credit conditions. In estimating expected losses in the accounts receivable portfolio, customer-specific financial data and macro-economic

assumptions are utilized to project losses over a reasonable and supportable forecast period. Assumptions and judgment are applied to

measure amounts and timing of expected future cash flows, collateral values and other factors used to determine the customers’

abilities to pay.

At

September 30, 2024, and December 31, 2023, the Company established a reserve for credit losses of approximately $2,497,000 and $2,494,000,

respectively. The Company does not accrue interest on past due accounts receivable.

Concentration

of Credit Risk - The Company maintains its cash in bank deposit accounts, which at times may exceed federally insured limits.

The Company believes it is not exposed to any significant credit risk because of any non-performance by the financial institutions. As

of September 30, 2024, two customers accounted for approximately 20% and 10% of our consolidated revenue and two customers accounted for

approximately 26% and 23% of our trade accounts receivable balance.

As

of September 30, 2023, one customer accounted for approximately 21% of our consolidated revenue and two customers accounted for approximately

32% and 15% of our consolidated trade accounts receivable balance.

As

of December 31, 2023, two customers accounted for approximately 20% and 11% of our consolidated revenue and 39% and 30% of our trade

accounts receivable balance.

Notes

receivable, unearned interest, and related recognition - The Company records all future payments of principal and interest on

notes as notes receivable, which are then offset by the amount of any related unearned interest income. For financial statement purposes,

the Company reports the net investment in the notes receivable on the consolidated balance sheet as current or long-term based on the

maturity date of the underlying notes. Such net investment is comprised of the amount advanced on the loans, adjusting for net deferred

loan fees or costs incurred at origination, amounts allocated to warrants received upon origination, and any payments received in advance.

The unearned interest is recognized over the term of the notes and the income portion of each note payment is calculated so as to generate

a constant rate of return on the net balance outstanding. Net deferred loan fees or costs, together with discounts recognized in connection

with warrants acquired at origination, are accreted as an adjustment to yield over the term of the loan.

Allowance

For Loans And Lease Losses - On January 1, 2022, the Company adopted amended accounting guidance “ASU No.2016-13 –

Credit Losses” which requires an allowance for credit losses to be deducted from the amortized cost basis of financial assets

to present the net carrying value at the amount that is expected to be collected over the contractual term of the asset considering relevant

information about past events, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported

amount. In estimating expected losses in the loan and lease portfolio, borrower-specific financial data and macro-economic assumptions

are utilized to project losses over a reasonable and supportable forecast period. Assumptions and judgment are applied to measure amounts

and timing of expected future cash flows, collateral values and other factors used to determine the borrowers’ abilities to repay

obligations. After the forecast period, the Company utilizes longer-term historical loss experience to estimate losses over the remaining

contractual life of the loans.

Investments

– Investments in equity securities with a readily determinable fair value, not accounted for under the equity method, are

recorded at fair value with unrealized gains and losses included in earnings. For equity securities without a readily determinable fair

value, the investment is recorded at cost, less any impairment, plus or minus adjustments related to observable transactions for the

same or similar securities, with unrealized gains and losses included in earnings. For equity method investments, the Company regularly

reviews its investments to determine whether there is a decline in fair value below book value. If there is a decline that is other-than-temporary,

the investment is written down to fair value. See Note 9 for further discussion on investments.

Fair

Value of Financial Instruments - Fair value is defined as the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at the measurement date. The Fair Value Measurement Topic

of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) establishes a

three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value. The hierarchy gives the highest priority to

unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable

inputs (Level 3 measurements). These tiers include:

●

Level 1, defined as observable inputs such as quoted prices for identical instruments in active markets.

●

Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable such as quoted

prices for similar instruments in active markets or quoted prices for identical or similar instruments in markets that are not active;

and

●

Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions,

such as valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable.

The

carrying amounts reported in the consolidated balance sheet of cash and cash equivalents, accounts receivable, prepaids, accounts payable

and accrued expenses approximate fair value because of the immediate or short-term maturity of these financial instruments. Marketable

securities classify as a Level 1 fair value financial instrument. The fair value of notes receivable approximates their carrying value

as the stated or discounted rates of the notes do not reflect recent market conditions. The fair value of revolving credit lines notes

payable and long-term debt approximates their carrying value as the stated or discounted rates of the debt reflect recent market conditions.

The fair value of investments where the fair value is not considered readily determinable, are carried at cost.

Inventory

– Inventories consist primarily of paper, pre-printed security paper, paperboard, fully prepared packaging, air filtration

systems, and health and beauty products which and are stated at the lower of cost or net realizable value on the first-in, first-out

(“FIFO”) method. Packaging work-in-process and finished goods included the cost of materials, direct labor and overhead.

At the closing of each reporting period, the Company evaluates its inventory in order to adjust the inventory balance for obsolete and

slow-moving items. An allowance for obsolescence of approximately $45,000 and $18,000 associated with the inventory at our Premier subsidiary

for September 30, 2024, and December 31, 2023, respectively. Write-downs and write-offs are charged to cost of revenue.

Investments

in real estate, net – Acquisition of assets are recorded at their relative fair value based on total accumulated costs

of the acquisition. Direct acquisition-related costs are capitalized as a component of the acquired assets. This includes all costs related

to finding, analyzing and negotiating a transaction. The allocation of the purchase price is an area that requires judgment and significant

estimates. Tangible and intangible assets include land, building and improvements, furniture, fixtures and equipment, acquired above

market and below market leases, in-place lease value (if applicable). Acquisition date fair values of assets and assumed liabilities

are determined based on replacement costs, appraised values, and estimated fair values using methods similar to those used by independent

appraisers and that use appropriate discount and/or capitalization rates and available market information. Depreciation and amortization

is computed using the straight-line method over the estimated useful lives of the assets. During 2023, the land and buildings related

to AMRE LifeCare and AMRE Winter Haven were reclassified to Assets held for sale.

Assets

held for sale – The Company has several buildings and the associated land they occupy for sale as of September 30, 2024

and December 31, 2023. These consist of primarily of retail space in Lindon, Utah approximating $5,593,000 (sale of this building was

finalized during Q2 2024) and the medical facilities associated with AMRE LifeCare of approximately $41,610,000 and AMRE Winter Haven

of approximately $4,396,000, and $65,000 of other assets.

Intangible

Assets - The estimated fair values of acquired intangibles are generally determined based upon future economic benefits such

as earnings and cash flows. Acquired identifiable intangible assets are recorded at fair value and are amortized over their estimated

useful lives. Acquired intangible assets with an indefinite life are not amortized but are reviewed for impairment at least annually

or more frequently whenever events or changes in circumstances indicate that the carrying amounts of those assets are below their estimated

fair values. Impairment is tested under ASC 350. At December 31, 2023, The Company impaired approximately $7,418,000 associated with

intangible assets for AMRE Lifecare and AMRE Winter Haven. No circumstances or events have occurred since the most recent analysis that

would indicate the need for an impairment is needed for the nine months ended September 30, 2024.

Goodwill

– Goodwill is the excess of cost of an acquired entity over the fair value of amounts assigned to assets acquired and liabilities

assumed in a business combination. Goodwill is subject to impairment testing at least annually and will be tested for impairment between

annual tests if an event occurs or circumstances change that would indicate the carrying amount may be impaired. FASB ASC Topic 350 provides

an entity with the option to first assess qualitative factors to determine whether the existence of events or circumstances leads to

a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If, after completing

the assessment, it is determined that it is more likely than not that the fair value of a reporting unit is less than its carrying value,

the Company will proceed to a quantitative test. The Company may also elect to perform a quantitative test instead of a qualitative test

for any or all of our reporting units. The test compares the fair value of an entity’s reporting units to the carrying value of

those reporting units. This quantitative test requires various judgments and estimates. The Company estimates the fair value of the reporting

unit using a market approach in combination with a discounted operating cash flow approach. Impairment of goodwill is measured as the

excess of the carrying amount of goodwill over the fair values of recognized and unrecognized assets and liabilities of the reporting

unit. The Company performed its annual goodwill impairment test as of December 31, 2023, and no impairment was deemed necessary for the

goodwill associated with Premier Packaging Company, and Impact BioMedical of $1,769,000 and $25,093,000, respectively. The goodwill for

APB, and Sentinel Co. of approximately $29,744,000, and $1,234,000 respectively, were deemed impaired and written off at December 31,

2023. No circumstances or events have occurred since the most recent analysis that would indicate the need for an impairment is needed

for the nine months ended September 30, 2024.

Impairment

of Long-Lived Assets and Goodwill - The Company monitors the carrying value of long-lived assets for potential impairment and

tests the recoverability of such assets whenever events or changes in circumstances indicate that the carrying amounts may not be recoverable.