Moving iMage Technologies, Inc. (NYSE AMERICAN: MITQ), (“MiT”),

a leading technology and services company for cinema, Esports,

stadiums, arenas and other out-of-home entertainment venues, today

announced results for its first quarter ended September 30,

2024.

Phil Rafnson, Chairman and Chief Executive Officer of MiT

commented:

“Our first fiscal quarter delivered promising results,

underscoring a positive shift in the industry. The combined impact

of a robust summer box office and a critical technology upgrade

cycle has provided theaters with the confidence to start releasing

budgets to invest in premium technologies. We successfully

fulfilled orders for high-end solutions including immersive audio

systems, laser projection upgrades and our own proprietary

products, reinforcing our commitment to excellence.

"With the strikes now behind us, the industry demonstrated

remarkable resilience propelled by a strong domestic box office

performance this summer. As we move into the holiday season,

momentum is clearly building. Major players like AMC, Regal and

Cinemark are reporting solid gains. AMC has experienced increased

attendance, especially for major releases, and Cinemark’s

third-quarter results surpassed expectations as audiences

enthusiastically embrace both premium experiences and traditional

moviegoing.

"This resurgence aligns seamlessly with our premium offerings

such as immersive sound systems and advanced laser projection

upgrades, which are increasingly in demand as customers seek to

enhance the theater experience. We are energized by this

reinvigorated interest and remain committed to supporting the

industry’s growth with innovative high-quality solutions.”

Fiscal 2025 Commentary

“We are optimistic that the industry’s strong box office

momentum will extend through the holiday season and transition into

an exciting lineup of releases for 2025. While our fiscal Q2 is

typically slower due to the holiday season, the current industry

climate presents a unique opportunity for favorable year-over-year

comparisons due to last year’s setbacks related to the Hollywood

strikes. Despite this improved environment, we still have not made

back all the ground lost from the post-Covid recovery that was

occurring prior to the strikes. However, the industry is re-gaining

momentum, and we expect our customers to allocate more of their

refreshed budgets in the second half of our fiscal year, which

aligns with the first half of calendar 2025.

"In parallel, we are advancing our internal growth initiatives

across the cinema and out-of-home entertainment markets, all aimed

at driving revenue growth and margin expansion with the majority

introducing recurring revenue streams. As we make progress on these

initiatives, we look forward to keeping our investors updated on

these initiatives and the value they bring.”

Select Financial Metrics: FY25

versus FY24*

in millions, except for Income (loss) per

Share and percentages

1Q25

1Q24

Change

Total Revenue

$5.3

$6.6

-20.8%

Gross Profit

$1.4

$1.8

-24.6%

Gross Margin

26.1%

27.4%

Operating Income (Loss)

($0.1)

$0.4

NM

Operating Margin

-1.3%

5.8%

Net Income (Loss)

($0.0)

$0.4

NM

Diluted Income (Loss) per Share

($0.00)

$0.04

NM

nm = not measurable/meaningful; *may not

add up due to rounding

First Quarter Highlights

(Fiscal 2025 versus Fiscal 2024)

- Revenue decreased 20.8% to $5.3 million compared to $6.6

million;

- Gross Profit decreased 24.6% to $1.4 million compared to $1.8

million; Gross Margin was 26.1%;

- Operating Loss of ($0.1) million compared to Operating Income

$0.4 million;

- Net Income and Earnings per Share (EPS) of ($0.0) million and

($0.00) compared to $0.4 million and $0.04, respectively;

- As of September 30, 2024, the Company held cash of $5.2

million.

Trended Financials* in millions, except for Income (loss)

per Share and percentages

1Q24

2Q24

3Q24

4Q24

1Q25

FY21

FY22

FY23

FY24

Total Revenue

$6.6

$3.3

$3.9

$6.3

$5.3

$8.5

$18.4

$20.2

$20.1

Gross Profit

$1.8

$0.8

$0.7

$1.4

$1.4

$2.0

$4.5

$5.3

$4.7

Gross Margin

27.4%

23.2%

17.4%

22.5%

26.1%

23.6%

24.3%

26.3%

23.3%

Operating Income (Loss)

$0.4

($0.8)

($0.6)

($0.5)

($0.1)

($1.5)

($1.8)

($2.0)

($1.6)

Operating Margin

5.8%

-25.4%

-16.7%

-7.3%

-1.3%

-17.6%

-9.6%

-9.8%

-7.7%

Net Income (Loss)

$0.4

($0.8)

($0.6)

($0.4)

($0.0)

($1.6)

($1.3)

($1.8)

($1.4)

Diluted Income (Loss) per Share

$0.04

(0.07)

($0.06)

($0.04)

$0.00

($0.23)

($0.13)

($0.16)

($0.13)

*may not add up due to rounding

Dial-in and Webcast

Information

Date/Time: Thursday, November 14, 2024, 12:00 p.m. ET

Toll-Free: 1-877-407-4018 Toll/International:

1-201-689-8471 Call me™: Participants can use Guest dial-in

#s above and be answered by an operator OR click the Call me™ Link

for instant telephone access to the event. Call me™ link will be

made active 15 minutes prior to scheduled start time.

Webcast:

https://viavid.webcasts.com/starthere.jsp?ei=1697703&tp_key=fc786ab55c

Telephone Replay

Telephone Replays will be made available after conference end

time.

Replay Dial-In: 1-844-512-2921 or 1-412-317-6671

Replay Expiration: November 28, 2024 at 11:59 p.m. ET

Access ID: 13750141

About Moving iMage

Technologies

Moving iMage Technologies (NYSE American: MITQ) is a leading

provider of technology, products, and services for the Motion

Picture Exhibition industry, with expanding ventures into live

entertainment venues and Esports. We design and manufacture a wide

range of proprietary products in-house, including developing

potentially disruptive SaaS and subscription-based solutions.

Committed to excellence and innovation, Moving iMage Technologies

aims to revolutionize the out of home entertainment experience with

cutting-edge technology and superior service. For more information,

visit www.movingimagetech.com.

Forward-Looking

Statements

All statements above that are not purely about historical facts,

including, but not limited to, those in which we use the words

“believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,”

“target” and similar expressions, are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. While these forward-looking statements represent our

current judgment of what may happen in the future, actual results

may differ materially from the results expressed or implied by

these statements due to numerous important factors. Our filings

with the SEC provide detailed information on such statements and

risks and should be consulted along with this release. To the

extent permitted under applicable law, we assume no obligation to

update any forward-looking statements.

MOVING IMAGE TECHNOLOGIES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands except share and

per share amounts)

September 30,

June 30,

2024

2024

(unaudited)

Assets

Current Assets:

Cash

$

5,246

$

5,278

Accounts receivable, net

1,027

1,048

Inventories, net

2,616

3,117

Prepaid expenses and other

312

470

Total Current Assets

9,201

9,913

Long-Term Assets:

Right-of-use asset

1,074

144

Property and equipment, net

24

28

Intangibles, net

407

422

Other assets

16

16

Total Long-Term Assets

1,521

610

Total Assets

$

10,722

$

10,523

Liabilities And

Stockholders’ Equity

Current Liabilities:

Accounts payable

$

1,832

$

2,261

Accrued expenses

347

320

Customer refunds

398

399

Customer deposits

1,309

1,651

Lease liability–current

170

151

Unearned warranty revenue

54

31

Total Current Liabilities

4,110

4,813

Long-Term Liabilities:

Lease liability–non-current

922

—

Total Long-Term Liabilities

922

—

Total Liabilities

5,032

4,813

Stockholders’ Equity

Common stock, $0.00001 par value,

100,000,000 shares authorized, 9,896,850 and 9,896,850 shares

issued and outstanding at September 30, 2024 and June 30, 2024,

respectively

—

—

Additional paid-in capital

11,971

11,965

Accumulated deficit

(6,281

)

(6,255

)

Total Stockholders’ Equity

5,690

5,710

Total Liabilities and Stockholders’

Equity

$

10,722

$

10,523

MOVING IMAGE TECHNOLOGIES,

INC.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(in thousands except share and

per share amounts)

(unaudited)

Three Months Ended

September 30,

2024

2023

Net sales

$

5,252

$

6,635

Cost of goods sold

3,880

4,816

Gross profit

1,372

1,819

Operating expenses:

Research and development

61

67

Selling and marketing

529

542

General and administrative

850

826

Total operating expenses

1,440

1,435

Operating (loss) income

(68

)

384

Other income (expense)

Interest and other income, net

43

55

Total other income

43

55

Net (loss) income

$

(25

)

$

439

Weighted average shares outstanding: basic

and diluted (Note 5)

9,896,850

10,685,778

Net (loss) income per common share basic

and diluted

$

(0.00

)

$

0.04

MOVING IMAGE TECHNOLOGIES,

INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended

September 30

2024

2023

Cash flows from operating

activities:

Net (loss) income

$

(25

)

$

439

Adjustments to reconcile net (loss)/income

to net cash (used in) operating activities:

Provision for credit losses

11

1

Inventory reserve

80

80

Depreciation expense

4

3

Amortization expense

15

14

Right-of-use amortization

58

66

Stock option compensation expense

5

5

Changes in operating assets and

liabilities

Accounts receivable

10

(1,138

)

Inventories

421

(413

)

Prepaid expenses and other

158

203

Accounts payable

(429

)

1,405

Accrued expenses and customer refunds

26

225

Unearned warranty revenue

23

(14

)

Customer deposits

(342

)

(1,016

)

Lease liabilities

(47

)

(67

)

Net cash (used in) operating

activities

(32

)

(207

)

Cash flows from investing

activities

Purchases of property and equipment

—

(1

)

Net cash (used in) investing

activities

—

(1

)

Net (decrease) increase in cash

(32

)

(208

)

Cash, beginning of the period

5,278

6,616

Cash, end of the period

$

5,246

$

6,408

Non-cash investing and financing

activities:

Right-of-use assets from lease

modification

$

(988

)

$

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114552512/en/

Brian Siegel, IRC, MBA Vice President, Investor Relations and

Strategic Communications for MiT Senior Managing Director, Hayden

IR (346) 396-8696 Brian@haydenir.com

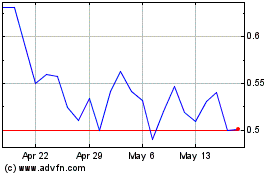

Moving iMage Technologies (AMEX:MITQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

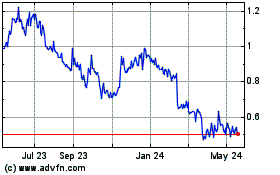

Moving iMage Technologies (AMEX:MITQ)

Historical Stock Chart

From Nov 2023 to Nov 2024