false

0001898766

0001898766

2025-01-28

2025-01-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 28, 2025

| Trio

Petroleum Corp. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-41643 |

|

87-1968201 |

(State

or other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5401

Business Park South, Suite 115

Bakersfield,

CA 93309

(661)

324-3911

(Address

and telephone number, including area code, of registrant’s principal executive offices)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry Into a Material Definitive Agreement.

As

previously reported in a Form 8-K filed by Trio Petroleum Corp. (the “Company”) with the Securities and Exchange Commission

on August 8, 2024, the Company executed a Securities Purchase Agreement, dated August 6, 2024 (the

“SPA”) with an institutional investor (the “Investor”), pursuant to which the Company raised gross proceeds of

$225,000 and received net proceeds of $199,250, after payment of offering expenses (the “Financing”). In connection with

the Financing, the Company issued an unsecured promissory note to the Investor in the principal amount of $255,225, having an original

issue discount of $30,225 or approximately 11.8% (the “Investor Note”). Interest accrues on the Investor Note at a rate of

12% and the maturity date of the Investor Note is May 30, 2025 (the “Investor Note Maturity Date”). The Investor Note provides

for five payments of principal and accrued interest which are payable: (i) $142,926 on January 30, 2025; (ii) $35,731.50 on February

28, 2025; (iii) $35,731.50 on March 30, 2025; (iv) $35,731.50 on April 30, 2025; and (v) $35,731.50 on May 30, 2025.

Amendment

No. 1 to Promissory Note

On

January 28, 2025, the Company and the Investor signed Amendment No. 1 to Promissory Note (the “Note Amendment”) extending

the payment dates of the Investor Note to (i) $142,926 on February 28, 2025; (ii) $35,731.50 on March 30, 2025; (iii) $35,731.50 on April

30, 2025; (iv) $35,731.50 on May 30, 2025; and (v) $35,731.50 on June 30, 2025.

The

above description of the Note Amendment is qualified in its entirety by the text of the Note Amendment, a copy of which is attached as

Exhibit 4.1 to this Current Report on Form 8-K.

Note

Exchange Agreement

On

January 28, 2025, the Company and the Investor also signed a Note Exchange Agreement (the “Exchange Agreement”), pursuant

to which the Company and the Investor agreed, on February 10, 2025, to the exchange of the $285,852 outstanding balance of the Investor

Note for a number of shares of common stock, par value $0.001 per share, of the Company (the “Common Stock”) equal to $285,852

divided by the product of (i) the lowest closing price of the Common Stock on the NYSE American during the 10 trading days immediately

prior to February 10, 2025, and (ii) 75% (the “Exchange”). The Exchange will be an exempt transaction pursuant to Section

3(a)(9) of the Securities Act of 1933, as amended.

The

above description of the Exchange Agreement is qualified in its entirety by the text of the Exchange Agreement, a copy of which is attached

as Exhibit 10.1 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Trio

Petroleum Corp. |

| |

|

|

| Date:

January 29, 2025 |

By: |

/s/

Robin Ross |

| |

Name: |

Robin

Ross |

| |

Title: |

Chief

Executive Officer |

Exhibit

4.1

EXECUTION

VERSION

January

28, 2025

AMENDMENT

NO. 1 TO

PROMISSORY

NOTE

This

serves as Amendment No. 1 to Promissory Note (“Amendment”) with an original issuance date of August 6, 2024

(the “Note”), issued by Trio Petroleum Corp. (the “Maker” or the “Company”)

to Target Capital 1 LLC (the “Holder”). All initially capitalized terms not otherwise defined herein shall

have the meanings given to those terms in the Note.

WHEREAS,

the Company and the Holder desire to amend the Note, by this Amendment, with respect to the installment payment dates of the Note, as

set forth below in this Amendment.

NOW

THEREFORE, the undersigned agree as follows:

1.

Amendment

Section

1.2 of the Note is amended and restated in its entirety to read as follows:

“1.2 Mandatory

Monthly Payments. Accrued, unpaid interest and outstanding principal, subject to adjustment, shall be paid in five (5) payments as

follows:

| Payment Date | |

Amount of Payment |

| February 28, 2025 | |

$ | 142,926.00 | |

| March 30, 2025 | |

$ | 35,731.50 | |

| April 30, 2025 | |

$ | 35,731.50 | |

| May 30, 2025 | |

$ | 35,731.50 | |

| June 30, 2025 | |

$ | 35,731.50 | |

(a

total payback to the Holder of $285,852.00).

The

Company shall have a five (5) day grace period with respect to each payment. The Company has right to prepay in full at any time with

no prepayment penalty. All payments shall be made by bank wire transfer to the Holder’s wire instructions, attached hereto as Exhibit

A. For the avoidance of doubt, a missed payment shall be considered an Event of Default.”

2.

No Event of Default. Holder acknowledges and agrees that from the Issue Date through and until the date of this Amendment no Event

of Default has occurred under the Note.

3.

No Other Changes. Except as specifically provided in this Amendment, all other terms and conditions of the Note and the Purchase

Agreement shall remain in full force and effect.

4.

Governing Law. This Amendment shall be governed by and construed in accordance with the Purchase Agreement. This Amendment

shall not be interpreted or construed with any presumption against the party causing this Amendment to be drafted.

5.

Exclusive Jurisdiction; Venue. Any action, proceeding or claim arising out of, or relating in any way to, this Amendment shall

be brought and enforced as provided in the Purchase Agreement.

6.

Execution. This Amendment may be executed in two or more counterparts, all of which when taken together shall be considered one

and the same agreement and shall become effective when counterparts have been signed by each party and delivered to each other party,

it being understood that the parties need not sign the same counterpart. If any signature is delivered by facsimile transmission or by

e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party executing

(or on whose behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf” signature page

were an original thereof.

[signature

page follows]

IN

WITNESS WHEREOF, the Parties have executed this Amendment No. 1 to Amended and Restated Senior Secured Convertible Promissory Note on

the date set forth above.

| |

MAKER: |

| |

|

| |

TRIO PETROLEUM CORP. |

| |

5401 Business Park South, Suite 115 |

| |

Bakersfield, CA 93309 |

| |

By: |

/s/ Robin Ross |

| |

Name: |

Robin Ross |

| |

Title: |

Chief Executive Officer |

| |

TARGET CAPITAL LLC |

| |

144 Hillside Village |

| |

Rio Grande, PR 00745 |

| |

By: |

/s/ Dmitriy Shapiro |

| |

Name: |

Dmitriy Shapiro |

| |

Title: |

Managing Member |

Exhibit

10.1

EXECUTION

VERSION

NOTE

EXCHANGE AGREEMENT

THIS

NOTE EXCHANGE AGREEMENT (the “Agreement”), dated as of January 28, 2025, is entered into by and among TRIO PETROLEUM

CORP., a Delaware corporation (the “Company”), and Target Capital 1 LLC (the “Holder”).

WHEREAS,

pursuant to a Securities Purchase Agreement dated August 6, 2024, between the Company and the Holders (the “Purchase Agreement”),

the Company issued to the Holder a Promissory Note with an issued date of August 6, 2024, in the principal amount of $255,225, with an

original issue discount of $30,225, and a one-time interest payment in the amount of $30,627 (the “Note”); and

WHEREAS,

pursuant to Amendment No. 1 to Promissory Note, dated January 28, 2025, (the “Amendment” and collectively with the

Note, the “Amended Note”), the Company and the Holder agreed to certain amendments to the dates of the installment

payments under the Note; and

WHEREAS,

subject to the terms and conditions set forth herein, the Company and the Holder desire to cancel and retire the Amended Note in exchange

(the “Exchange”) for shares of common stock of the Company, par value $0.0001 per share (“Common Stock”),

in reliance on the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities

Act”).

NOW

THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company and the Holder

hereby agrees as follows:

1.

Definitions. Terms used as defined terms herein and not otherwise defined shall have the meanings provided therefore in the Purchase

Agreement and the Amended Note.

2.

Agreements and Acknowledgements.

(a)

Exchange of Note for Common Stock. On February 10, 2025 (the “Exchange Date”), the Company hereby agrees to

issue to the Holder such number of shares of Common Stock in exchange for and cancellation of the Note, as provided in Section 2(b)

hereafter. The Holder acknowledges and agrees that, upon the issuance and delivery of the shares of Common Stock, the Note will be

deemed cancelled and the Holder will deliver the original Note to the Company for cancellation of the Company’s books and records.

(b)

Determination of the Number of Shares of Common Stock Deliverable. The number of shares of Common Stock deliverable to the Holder

in exchange for the Note shall be equal to (i) the outstanding principal amount of the Note on the date of this Agreement, plus the one-time

interest payment of $30,627, divided by the Exchange Price (as defined herein). For the purposes hereof, “Exchange Price”

shall mean 75% multiplied by the Market Price (as defined herein) (representing a discount rate of 25%). “Market Price”

means the lowest Trading Price (as defined herein) for the Common Stock on the NYSE American during the ten (10) Trading Days (as defined

herein) ending on the latest complete Trading Day prior to the Exchange Date. “Trading Day” means any day on which

the Common Stock is tradable for any period on the NYSE American. “Trading Price” means the closing price of the shares

of Common Stock on the NYSE American on each Trading Day.

(c)

Exchange Limitation. Notwithstanding the foregoing, in no event shall the Company issue to the Holder shares of Common Stock greater

than 19.99% of the number of shares of Common Stock issued and outstanding on the date of this Agreement (the “Maximum Exchange

Amount”). In the event that the Exchange for the full amount of the outstanding principal amount of the Note would result in

the issuance of greater than the Maximum Exchange Amount, then the maximum number of shares of Common Stock issuable to the Holder shall

be equal to the Maximum Exchange Amount, the outstanding principal amount of the Amended Note shall be correspondingly reduced and the

Company shall issue the Holder a new promissory note, identical to the Amended Note and evidencing the remaining outstanding principal

amount of the Amended Note.

3.

Representations, Warranties and Covenants. The Company hereby makes to the Holders the following representations, warranties and

covenants:

(a)

Organization and Qualification. The Company is an entity duly incorporated or otherwise organized, validly existing and in good

standing under the laws of the State of Delaware, with the requisite power and authority to own and use its properties and assets and

to carry on its business as currently conducted. The Company is not in violation or default of any of the provisions of its certificate

incorporation, bylaws or other organizational or charter documents. The Company is duly qualified to conduct business and is in good

standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned

by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, could

not have or reasonably be expected to result in: (i) a material adverse effect on the legality, validity or enforceability of this Agreement,

(ii) a material adverse effect on the results of operations, assets, business, prospects or condition (financial or otherwise) of the

Company, taken as a whole, or (iii) a material adverse effect on the Company’s ability to perform in any material respect on a

timely basis its obligations under this Agreement (any of (i), (ii) or (iii), a “Material Adverse Effect”) and no

action has been instituted in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power

and authority or qualification.

(b)

Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions

contemplated by this Agreement and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this

Agreement by the Company and the consummation by it of the transactions contemplated hereby have been duly authorized by all necessary

action on the part of the Company and no further action is required by the Company, its board of directors or its shareholders in connection

therewith. This Agreement has been duly executed by the Company and, when delivered in accordance with the terms hereof will constitute

the valid and binding obligation of the Company enforceable against the Company in accordance with its terms except (i) as limited by

general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application

affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance,

injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable

law.

(c)

No Conflicts. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of

the transactions contemplated hereby do not and will not: (i) conflict with or violate any provision of the Company’s certificate

of incorporation, bylaws or other organizational or charter documents, or (ii) conflict with, or constitute a default (or an event that

with notice or lapse of time or both would become a default) under, result in the creation of any lien or encumbrance upon any of the

properties or assets of the Company, or (iii) conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction,

decree or other restriction of any court or governmental authority to which the Company is subject (including federal and state securities

laws and regulations), or by which any property or asset of the Company is bound or affected; except in the case of each of clauses (ii)

and (iii), such as could not have or reasonably be expected to result in a Material Adverse Effect.

(d)

Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any

notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority or other

Person in connection with the execution, delivery and performance by the Company of this Agreement, other than: (i) the filing required

pursuant to Section 3(f) of this Agreement and (ii) such filings as are required to be made under applicable state securities laws.

(e)

Issuance of the Shares of Common Stock. The shares of Common Stock, will be duly authorized and reserved for issuance in accordance

with their terms, will be validly issued, fully paid and non-assessable, and free from all taxes, liens, claims and encumbrances with

respect to the issue thereof, and shall not be subject to any preemptive rights or other similar rights of stockholders of the Company

and will not impose personal liability upon the Holder.

(f)

Disclosures. The Company shall, within four (4) days after the date of this Agreement, issue a Current Report on Form 8-K disclosing

all material terms of the Exchange and attaching the form of this Agreement as an exhibit thereto (such Current Report on Form 8-K with

all exhibit attached thereto, the “8-K Filing”).

(g)

No Commission Paid. Neither the Company nor any of its affiliates nor any person acting on behalf of or for the benefit of any

of the foregoing, has paid or given, or agreed to pay or give, directly or indirectly, any commission or other remuneration (within the

meaning of Section 3(a) (9) of the Securities Act and the rules and regulations of the SEC promulgated thereunder) for soliciting the

Exchange.

4.

Representations and Warranties of the Holders. The Holder hereby represents and warrants as of the date hereof to the Company

as follows (unless as of a specific date therein):

(a)

Organization; Authority. The Holder is an entity duly incorporated or formed, validly existing and in good standing under the

laws of the jurisdiction under which it was incorporated or formed with full right, corporate, partnership, limited liability company

or similar power and authority to enter into and to consummate the transactions contemplated by his Agreement and otherwise to carry

out its obligations hereunder. The execution and delivery of this Agreement and performance by the Holder of the transactions contemplated

by this Agreement have been duly authorized by all necessary corporate, partnership, limited liability company or similar action, as

applicable, on the part of the Holder. This Agreement has been duly executed by the Holder, and when delivered by such Holder in accordance

with the terms hereof, will constitute the valid and legally binding obligation of the Holder, enforceable against it in accordance with

its terms, except: (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and

other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the

availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution

provisions may be limited by applicable law.

(b)

Own Account. The Holder is acquiring the shares of Common Stock as principal for its own account and has no direct or indirect

arrangement or understandings with any other persons to distribute or regarding the distribution of such shares of Common Stock (this

representation and warranty not limiting the Holder’s right to sell the shares of Common Stock in compliance with applicable federal

and state securities laws). The Holder is acquiring the shares of Common Stock hereunder in the ordinary course of its business.

(c)

Holder Status. At the time the Holder was offered the shares of Common Stock, it was, and as of the date hereof it is (i) an “accredited

investor” as defined in Rule 501(a)(1), (a)(2), (a)(3), (a)(7), (a)(8), (a)(9), (a)(12) or (a)(13) under the Securities Act or

(ii) a “qualified institutional buyer” as defined in Rule 144A(a) under the Securities Act.

5.

Miscellaneous.

(a)

Except as expressly set forth above, all of the terms and conditions of the Purchase Agreement and Amended Note shall continue in full

force and effect after the execution of this Agreement and shall not be in any way changed, modified or superseded by the terms set forth

herein.

(b)

The parties acknowledge and agree that in accordance with Section 3(a)(9) of the Securities Act, the shares of Common Stock being delivered

in Exchange for the Amended Note shall take on the restricted and unregistered characteristics of the Amended Note. The Company and the

Holder each agrees not to take any position contrary to this Section 5(b).

(c)

This Agreement may be executed in two or more counterparts and by facsimile signature or otherwise, and each of such counterparts shall

be deemed an original and all of such counterparts together shall constitute one and the same agreement. Each party shall pay the fees

and expenses of its advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such party incident

to the negotiation, preparation, execution, delivery and performance of this Agreement.

(d)

If any provision of this Agreement is prohibited by law or otherwise determined to be invalid or unenforceable by a court of competent

jurisdiction, the provision that would otherwise be prohibited, invalid or unenforceable shall be deemed amended to apply to the broadest

extent that it would be valid and enforceable, and the invalidity or unenforceability of such provision shall not affect the validity

of the remaining provisions of this Agreement so long as this Agreement as so modified continues to express, without material change,

the original intentions of the parties as to the subject matter hereof and the prohibited nature, invalidity or unenforceability of the

provision(s) in question does not substantially impair the respective expectations or reciprocal obligations of the parties or the practical

realization of the benefits that would otherwise be conferred upon the parties. The parties will endeavor in good faith negotiations

to replace the prohibited, invalid or unenforceable provision(s) with a valid provision(s), the effect of which comes as close as possible

to that of the prohibited, invalid or unenforceable provision(s).

(f)

This Agreement shall be governed by and interpreted in accordance with laws of the State of New York, excluding its choice of law rules.

The parties hereto hereby waive the right to a jury trial in any litigation resulting from or related to this Agreement. The parties

hereto consent to exclusive jurisdiction and venue in the federal courts sitting in the southern district of New York, unless no federal

subject matter jurisdiction exists, in which case the parties hereto consent to exclusive jurisdiction and venue in the New York state

courts in the borough of Manhattan, New York. Each party waives all defenses of lack of personal jurisdiction and forum non conveniens.

Process may be served on any party hereto in the manner authorized by applicable law or court rule.

***********************

IN

WITNESS WHEREOF, this Agreement is executed as of the date first set forth above.

| |

TRIO PETROLEUM CORP. |

| |

|

|

| |

By: |

/s/ Robin Ross |

| |

Name: |

Robin Ross |

| |

Title: |

Chief Executive Officer |

| |

TARGET CAPITAL LLC |

| |

|

|

| |

By: |

/s/ Dmitriy Shapiro |

| |

Name: |

Dmitriy Shapiro |

| |

Title: |

Managing Member |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

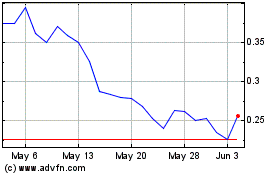

Trio Petroleum (AMEX:TPET)

Historical Stock Chart

From Feb 2025 to Mar 2025

Trio Petroleum (AMEX:TPET)

Historical Stock Chart

From Mar 2024 to Mar 2025