AS

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 5, 2025

Registration

Statement No. 333-________

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

TRIO

PETROLEUM CORP.

(Exact

name of registrant as specified in its charter)

| Delaware

|

|

87-1968201 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

5401

Business Park South, Suite 115

Bakersfield,

CA |

|

93309 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Trio

Petroleum Corp. 2022 Equity Incentive Plan, as Amended by Amendment No. 1

Trio

Petroleum Corp. Non-Plan Based Shares

(Full

title of the plan)

Robin

Ross

Chief

Executive Officer

Trio

Petroleum Corp.

5401

Business Park South, Suite 115

Bakersfield,

CA 93309

(Name

and address of agent for service)

(661)

324-3911

(Telephone

number, including area code, of agent for service)

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

Trio

Petroleum Corp. (the “Company”) has prepared this registration statement on Form S-8 (the “Registration Statement”)

in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”), (i)

for the purpose of registering 300,000 shares of the Company’s common stock, par value $0.0001 per share (“Common

Stock”), available for issuance under the Company’s 2022 Equity Incentive Plan (the “Plan”), as amended by Amendment

No. 1 to increase the number of shares of Common Stock reserved for issuance thereunder, which amendment was approved by the Company’s

stockholders on August 15, 2024 (the “Amended Plan”), and (ii) for the purpose of resale or reoffer thereof, 210,000

shares of Common Stock issued prior to the filing of this Registration Statement and held by the selling stockholders named herein in

connection with such selling stockholders’ provision of services to the Company.

Pursuant

to the Registration Statement (the “Prior Registration Statement”) on Form S-8 filed by the Company on May 4, 2023 (Registration

No. 333-271639), the Company previously registered an aggregate of 200,000 (on a post-Reverse Split (as hereinafter defined) basis)

shares of Common Stock. The additional shares of Common Stock being registered by this Registration Statement are of the same class

as those securities registered on the Prior Registration Statement and represent an increase in the total shares available for issuance

under the Plan by 300,000. Pursuant to General Instruction E to Form S-8, the registrant incorporates by reference into this Registration

Statement the contents of the Prior Registration Statement, including all exhibits filed therewith or incorporated therein by reference,

except as expressly modified herein.

On November 14, 2024, the Company effectuated

a 1-for-20 reverse stock split of its Common Stock (the “Reverse Split”). The Common Stock began trading on the NYSE American

on a post-Reverse Split basis at the beginning of trading on November 15, 2024. Unless otherwise specifically provided, all share and

per share information presented herein reflects the Reverse Split.

This

Registration Statement contains two parts: Part I and Part II.

Part

I contains a “reoffer” prospectus prepared in accordance with Part I of Form S-3 (in accordance with Instruction C of the

General Instructions to Form S-8). The reoffer prospectus permits reoffers and resales of those shares referred to above that constitute

“restricted securities,” within the meaning of Form S-8, by the selling stockholders named herein. Certain information relating

to future issuances under the Plan is omitted from Part I, as further described below in the next paragraph and under the heading, “Item

1. Plan Information.”

Part

II contains information required to be set forth in the Registration Statement pursuant to Part II of Form S-8. Pursuant to the Note

to Part I of Form S-8, the Plan information specified by Part I of Form S-8 is not required to be filed with the Securities and Exchange

Commission.

The

Company will provide, without charge, to any person, upon written or oral request of such person, a copy of each document incorporated

by reference in Item 3 of Part II of this Registration Statement (which documents are also incorporated by reference in the reoffer prospectus

as set forth in Form S-8), other than exhibits to such documents that are not specifically incorporated by reference.

Part

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item

1. Plan Information

The

documents containing the information in Part I relating to the registrant’s 2022 Equity Incentive Plan (the “Plan”),

as amended by Amendment No. 1 (the “Amended Plan”), will be sent or given to participants in the Amended Plan as specified

by Rule 428(b)(1) promulgated under the Securities Act. In accordance with the instructions to Part I of Form S-8, such documents will

not be filed with the Securities and Exchange Commission either as part of this Registration Statement or as prospectuses or prospectus

supplements pursuant to Rule 424 promulgated under the Securities Act. These documents and the documents incorporated by reference pursuant

to Item 3 of Part II of this Registration Statement, taken together, constitute the prospectus that meets the requirements of Section

10(a) of the Securities Act (the “Section 10(a) Prospectus”) in respect of future issuances under the Amended Plan.

Item

2. Registrant Information and Employee Plan Annual Information

Upon

written or oral request, any of the documents incorporated by reference in Item 3 of Part II of this Registration Statement, which are

also incorporated by reference in the Section 10(a) Prospectus, other documents required to be delivered to eligible participants pursuant

to Rule 428(b) promulgated under the Securities Act, or additional information about the Amended Plan, will be made available without

charge by contacting our Corporate Secretary, c/o Trio Petroleum Corp., 5401 Business Park South, Suite 115, Bakersfield, CA 93309.

REOFFER

PROSPECTUS

210,000

SHARES

TRIO

PETROLEUM CORP.

COMMON

STOCK

This

prospectus relates to 210,000 shares (the “Shares”) of common stock, par value $0.0001 per share, of Trio Petroleum

Corp. (“Trio,” the “Company,” “TPET,” “we” or “our”) which may be offered

from time to time by the selling stockholders of the Company, named herein, for such stockholders’ own account. We will not receive

any proceeds from any sale of common stock offered pursuant to this prospectus.

The

selling stockholders may offer and sell the Shares at various times and in various types of transactions, including sales in the open

market, sales in negotiated transactions and sales by a combination of these methods. The Shares may be sold at the market price of our

common stock at the time of a sale, at prices relating to the market price over a period of time, or at prices negotiated with the buyers

of shares. The Shares may be sold through underwriters or dealers which the selling stockholders may select. If underwriters or dealers

are used to sell the Shares, we will name them and describe their compensation in a prospectus supplement. For a description of the various

methods by which the selling stockholders may offer and sell the Shares described in this prospectus, see the section entitled “Plan

of Distribution.”

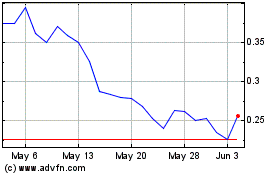

Our

common stock is listed on quoted on the NYSE American under the symbol “TPET.” On March 3, 2025, the closing price

of our common stock was $1.38.

THE

SHARES BEING OFFERED ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. THEY SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE

LOSS OF THEIR ENTIRE INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 15 OF THIS PROSPECTUS FOR A DISCUSSION OF INFORMATION

THAT SHOULD BE CONSIDERED IN CONNECTION WITH AN INVESTMENT IN OUR SECURITIES.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED

UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You

should rely only on the information contained in this prospectus. We have not, and the selling stockholders have not, authorized anyone

to provide you with different information from that contained in this prospectus or in any free writing prospectus that we may authorize.

The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of

this prospectus or of any sale of our common stock. This prospectus does not constitute an offer to sell, or a solicitation of an offer

to buy the securities in any circumstances under which the offer or solicitation is unlawful. Neither the delivery of this prospectus

nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change

in our affairs since the date of this prospectus.

The

date of this prospectus is March 5, 2025.

TABLE

OF CONTENTS

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements contained herein constitute forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Forward-looking statements are not guarantees of future performance. These forward-looking statements represent our intentions,

plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Our future results, financial condition,

results of operations and business may differ materially from those expressed in these forward-looking statements. You can find many

of these statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,”

“estimates,” “intends,” “plans,” “would,” “may” or other similar expressions

in this prospectus. Many of the factors that will determine these items are beyond our ability to control or predict. For a further discussion

of factors that could materially affect the outcome of our forward-looking statements, see “Risk Factors” herein and

other risk factors included in our reports filed with the Securities and Exchange Commission (the “SEC”).

For

these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date

of this prospectus or the date of any document incorporated by reference. All subsequent written and oral forward-looking statements

attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained

or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements

to reflect events or circumstances after the date of this prospectus.

THE

COMPANY

Overview

TPET

is a California-based oil and gas exploration and development company headquartered in Bakersfield, California, with its principal executive

offices located at 5401 Business Park South, Suite 115, Bakersfield, California 93309, and with operations in Monterey County, California,

and Uintah County, Utah. The Company was incorporated on July 19, 2021, under the laws of Delaware to acquire, fund, and operate oil

and gas exploration, development and production projects, initially focusing on one major asset in California, the South Salinas Project

(“South Salinas Project”).

We have had revenue-generating

operations since the McCool Ranch Oil Field was restarted on February 22, 2024, and as of the fiscal year ended October 31, 2024, we

recorded approximately $200,000 in net revenues from our McCool Ranch Oil Field.

TPET

was formed to initially acquire from Trio Petroleum LLC (“Trio LLC”) an approximate 82.75% working interest, which was subsequently

increased to an approximate 85.775% working interest, in the large, approximately 9,300-acre South Salinas Project that is located in

Monterey County, California, and subsequently partner with certain members of Trio LLC’s management team to develop and operate

those assets. TPET holds an approximate 68.62% interest after the application of royalties (“net revenue interest”) in the

South Salinas Project. Trio LLC holds an approximate 3.8% working interest in the South Salinas Project. TPET and Trio LLC are separate

and distinct companies.

California

is a significant part of TPET’s geographic focus and we recently acquired a 22% working interest in the McCool Ranch Oil Field

(the “McCool Ranch Oil Field”, “McCool Ranch Field” or “McCool Ranch”) in Monterey County, California.

TPET’s interests extend beyond California, however, and we recently acquired an interest in the Asphalt Ridge Project in Uintah

County, Utah. We may acquire additional assets both inside and outside of California and Utah.

Trio

LLC is a licensed Operator in California and currently operates the South Salinas Project and the McCool Ranch Oil Field on behalf of

TPET and other working interest owners. Trio LLC operates these assets pursuant to joint operating agreements (“JOAs”) between

and among Trio LLC and the non-operating, third-party, working interest owners. The non-operating parties have agreed under the JOAs

to have the Operator explore and develop these assets for the production of oil and gas as provided thereunder. Trio LLC, as Operator,

generally conducts and has significant control of operations, subject to the limitations and constraints of the JOAs, and acts in the

capacity of an independent contractor. Operator is obligated to conduct its activities under the JOAs as a reasonable prudent operator,

in good workmanlike manner, with due diligence and dispatch, in accordance with good oilfield practices, and in compliance with applicable

laws and regulations.

For the fiscal year

ended October 31, 2024, we generated $213,204 of revenues, reported a net loss of $9,626,797 and net cash used in operating activities

of $3,840,744. For the year ended October 31, 2023, we generated no revenues, reported a net loss of $6,544,426 and net cash used in

operating activities of $4,036,834. As of October 31, 2023 and 2024, we had an accumulated deficit of $10,446,882 and $20,073,679 respectively.

There is substantial doubt regarding our ability to continue as a going concern as a result of our accumulated deficit and no source

of revenue sufficient to cover our cost of operation as well as our dependence on private equity and financings. See “Risk Factors-Risks

Relating to Our Business-We have a history of operating losses, our management has concluded that factors raise substantial doubt about

our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue

as a going concern in its audit report for the years ended October 31, 2024 and 2023.”

Recent

Business Developments

Changes

to Company Management

Changes

were made in June 2024 to our management team, including the following: (i) Robin Ross, one of the original founders of the Company,

became our new Chairman and a Director; (ii) Stanford Eschner, our former Executive Chairman, became our Vice Chairman; and (iii) Frank

Ingriselli stepped down from his position as Vice Chairman and also from his position as a member of the Board of Directors. Additionally,

in July 2024, Michael Peterson resigned as Chief Executive Officer (“CEO”) of the Company and Robin Ross became our new CEO

as of that date. Further, effective as of October 11, 2024, James H. Blake was added as an additional Class II member of the Board of

Directors.

Effective

as of January 2, 2025, Terence B. Eschner’s position as President of the Company was terminated and Steven Rowlee’s position

as Chief Operating Officer was also terminated.

Changes

to Independent Registered Public Accounting Firm

On

May 6, 2024, the Company dismissed BF Borgers CPA PC (“Borgers”) as the Company’s independent registered public accounting

firm, as a result of Borgers no longer being able to audit the Company’s financial statements, pursuant to an order by the SEC

against Borgers (the “SEC Order”). Effective May 8, 2024, the Company retained Bush & Associates CPA LLC (“Bush

& Associates”) as its new independent registered public accounting firm. Also, pursuant to the requirements of the SEC Order,

Bush & Associates re-audited the Company’s financial statements for the fiscal years ended October 31, 2023 and 2022, which

financial statements were filed with Amendment No. 1 to the Company’s Annual Report on Form 10-K/A filed with the SEC on

June 13, 2024.

South

Salinas Project

Efforts

to obtain from Monterey County conditional use permits and a full field development permit for the South Salinas Project are progressing.

Efforts to obtain from the California Geologic Energy Management Division (“CalGEM”) and from the California Water Boards

a permit for a water disposal project at the South Salinas Project are also progressing. In the meantime, the Company recently determined

that existing permits allow production testing to continue at the HV-3A discovery well at Presidents Field and, consequently, testing

operations were restarted at this well on March 22, 2024. Oil production from this well has occurred with a generally favorable oil-water

ratio and the Company has idled operations currently pending an assessment of the viability of increasing the well’s gross production

rate, for example by adding up to 650 feet of additional perforations in the oil zone and/or acidizing the well for borehole cleanup.

First oil sales from the HV-3A well occurred in the third calendar quarter of 2024.

McCool

Ranch Oil Field

On

October 16, 2023, TPET entered into a Purchase and Sale Agreement with Trio LLC (the “McCool Ranch Purchase Agreement”) pertaining

to the McCool Ranch Oil Field. Pursuant to this agreement, effective October 1, 2023, we acquired an approximate 22% working interest

in and to certain oil and gas assets at the McCool Ranch Field, which is located in Monterey, County, California, just seven miles from

our flagship South Salinas Project. The assets are situated in what is known as the “Hangman Hollow Area” of the McCool Ranch

Field. The acquired property is a relatively new oil field (discovered in 2011) developed with six oil wells, one water-disposal well,

steam generator, boiler, three 5,000 barrel tanks, 250 barrel test tank, water softener, two freshwater tanks, two soft water tanks,

in-field steam pipelines, oil pipelines and other facilities. The property is fully and properly permitted for oil and gas production,

cyclic-steam injection and water disposal. We are acquiring the working interest at McCool Ranch through primarily work commitment expenditures

that are being allocated to restart production at the field and establish cash flow for us, with upside potential given the numerous

undrilled infill and development well locations. Oil production was restarted on February 22, 2024.

McCool

Ranch operations have been successfully restarted, including the restarting of oil production at the HH-1, 35X and 58X wells. The HH-1

well has a short horizontal completion in the Lombardi Oil Sand, whereas the 35X and 58X wells are both vertical wells with similar oil

columns in the Lombardi Oil Sand and with similar subsurface borehole completions. The HH-1 well at McCool Ranch upon restart was initially

producing about 47 BOPD.

The

HH-1 and 35X wells collectively have been producing about 10 to 15 BOPD. The 58X well is temporarily idle. Oil production at the HH-1

and 35X wells has been “cold” (i.e., without steam). Both wells have been temporarily idled pending further assessment to

place on steam during the first half of 2025.

The

aforementioned initial three wells at McCool Ranch were each restarted and produced “cold” (i.e. without steam injection),

which allows for lower operating costs, with expectation that each would be produced cold as long as profitable. The Company is assessing

the transition of each well from cold to cyclic-steam production, also known as “huff and puff,” which is expected

to significantly increase production. The wells at McCool Ranch historically have responded favorably when cyclic-steam operations have

been applied.

The

Company is assessing the viability of restarting the last two wells in the restart program, the HH-3 and HH-4 wells, in the first half

of 2025. The HH-3 and HH-4 wells will have horizontal completions similar to but longer than that of the HH-1 well. All water produced

from these wells will be disposed in the on-site water disposal well.

The

HH-1 well was initially produced cold for about 380 days in 2012-2013, during which time peak production was about 156 BOPD, average

production was about 35 BOPD and cumulative production was about 13,147 barrels of oil (“BO”). The 58X well was initially

produced cold for about 230 days in 2011-2013, during which time peak production was about 41 BOPD, average production was about 13 BOPD

and cumulative production was about 2,918 BO.

KLS

Petroleum Consulting LLC (“KLSP”), a third-party, independent engineering firm, recommends that McCool Ranch be developed

with horizontal wells, each landed in the Lombardi Oil Sand with a 1,000-foot lateral. Management estimates that TPET’s property

can probably accommodate approximately 22 additional such horizontal wells. TPET expects to add the reserve value of the McCool Ranch

Field to the Company’s reserve report after a further period of observation and review of the oil production that was restarted

on February 22, 2024.

Asphalt

Ridge Option Agreement

On

November 10, 2023, TPET entered into a Leasehold Acquisition and Development Option Agreement (the “Asphalt Ridge Option Agreement”)

with Heavy Sweet Oil LLC (“HSO”). Pursuant to the Asphalt Ridge Option Agreement, the Company acquired an option to purchase

up to a 20% working interest in certain leases at a long-recognized, major oil accumulation in northeastern Utah, in Uintah County, southwest

of the city of Vernal, totaling 960 acres. HSO holds the right to such leases below 500 feet depth from surface and the Company acquired

the option to participate in HSO’s initial 960-acre drilling and production program (the “HSO Program”) on such leases

(the “Asphalt Ridge Leases”). TPET also holds the right of first refusal to participate with up to 20% working

interest on the greater approximate 30,000-acre leasehold at terms offered to other third-parties. On December 29, 2023, the Company

and HSO entered into an Amendment to Leasehold Acquisition and Development Agreement (the “Amendment to the Asphalt Ridge Option

Agreement”), pursuant to which the Company and HSO amended the Asphalt Ridge Option Agreement to provide that, within three (3)

business days of the effective date of the Amendment to the Asphalt Ridge Option Agreement, the Company would fund $200,000 of the $2,000,000

total purchase price in advance of HSO satisfying the closing conditions set forth in the Asphalt Ridge Option Agreement, in exchange

for the Company receiving an immediate 2% interest in the Asphalt Ridge Leases, which advanced funds would be used solely for the building

of roads and related infrastructure in furtherance of the development plan. In January 2024, the Company funded an additional $25,000

resulting in a 2.25% working interest in the Asphalt Ridge Leases.

The

Asphalt Ridge Project, according to J. Wallace Gwynn of Energy News, is estimated to be the largest measured tar sand resource in the

United States, and is unique given its low wax and negligible sulfur content, which is expected to make the oil produced very desirable

for many industries, including shipping.

Asphalt

Ridge is a prominent, northwest-southeast trending topographic feature (i.e., a dipping slope called a hog’s back or cuesta) that

crops-out along the northeast flank of the Uinta Basin. The outcrop is comprised largely of Tertiary and Cretaceous age sandstones that

are locally highly-saturated with heavy oil and/or tar. The oil-saturated sandstones extend into the shallow subsurface of the Uinta

Basin to the southwest, which is the site of the Asphalt Ridge Development Project, and where the sandstones are estimated in various

independent studies to contain billions of barrels of oil-in-place. The project leasehold comprises over 30,000 acres and trends northwest-southeast,

along the trend of Asphalt Ridge, over a distance of about 20 miles.

The

area has been underdeveloped for decades due, in large part, to lease ownership issues and the definition of heavy oil falling under

mining regulations in the State of Utah. These factors created conflict between surface rights and subsurface mineral rights and were

obstacles to developing the asset using proven advanced cyclic-steam production techniques. Necessary permits have now been secured that

should allow drilling to commence by our operating partner. HSO hopes to continue to work with the State of Utah to supplement prior

receipt of permits with other state incentives, including working with the State on an arrangement requiring only an 8% state royalty

in connection with this project.

An

early development phase contemplates the development of 240 acres with an estimated 119 wells in the Northwest Asphalt Ridge Area. The

plan is to develop the 240 acres using advanced cyclic-steam production techniques, including initial CO2 injection. This phase contemplates

seventeen 7-spot hexagonal well patterns on 2 ½ acre spacing (a 7-spot has a central steam/CO2 injection well that is surrounded

by six producing oil wells). Upgrades have been made to existing roads and well pads as part of this early development phase.

Two

oil-saturated Cretaceous sandstones are targeted for development at Asphalt Ridge: the Rimrock Sandstone and the underlying Asphalt Ridge

Sandstone. TPET expects to add the reserve value, if any, of the Asphalt Ridge Project to the Company’s reserve report after a

brief period of observation and review of the oil development operations that commenced in the second quarter of 2024.

During

the quarterly period ended April 30, 2024, we announced the commencement of drilling activities at Asphalt Ridge. The first well, HSO

8-4 (API# 4304757202), was spud on May 10, 2024 and drilled to a total depth of 1,020 feet. The well found 100 feet of Rimrock Sandstone

tar-sand pay zone with good oil saturation and good porosity. Thirty feet of the Rimrock was cored. A small, representative piece of

Rimrock core was placed in water and brought to boiling point, and within a few minutes the sand disaggregated and the bitumen became

liquid, mobile-oil, floating on top of the water – this simple laboratory test indicates that the bitumen becomes mobile-oil at

relatively low temperatures and supports our contention that oil extraction using subsurface thermal-recovery methods may be very successful.

A second well, the HSO 2-4 (API# 430475201), was spud on May 19, 2024 and drilled to a total depth of 1,390 feet. The well drilled through

both the Rimrock tar-sand, which had a thickness of 135 feet, and the Asphalt Ridge tar-sand, which had a thickness of 59 feet. Oil production

has commenced using downhole heaters, whereas the operator plans to transition to production using advanced cyclic-steam and steam-drive

methods.

The

Company has until April 10, 2025, to pay HSO an additional $1,775,000 to exercise an option for the remaining 17.75% working interest

in the initial 960 acres. If this option is not exercised on or before the deadline or any extension thereof, the option will expire

and the Company will forfeit any further right to acquire this additional 17.75% working interest in the initial 960 acres.

Carbon

Capture and Storage Project as part of Company’s South Salinas Project

TPET

is committed to attempting to reduce its own carbon footprint and, where possible, that of others. For this reason, TPET is taking initial

steps to launch a Carbon Capture and Storage (CCS) project as part of the South Salinas Project. The South Salinas Project covers a vast

area and is uniquely situated at a deep depocenter where there are thick geologic zones (e.g., Vaqueros Sand, up to approximately 500’

thick), about two miles deep, which could potentially accommodate and permanently store vast volumes of CO2. Four existing deep wells

in the South Salinas Project (i.e., the HV 1-35, BM 2-2, BM 1-2-RD1 and HV 3-6 wells) are excellent candidates for use as CO2 injection

wells. A CCS project in the future may help reduce TPET’s carbon footprint by sequestering and permanently storing CO2 deep underground

at one or more deep wells, away from drinking water sources. Furthermore, three of the aforementioned deep wells are directly located

on three idle oil and gas pipelines that could be used to import CO2 to the Company’s CCS Project. TPET has opened discussions

with third parties who wish to reduce their own greenhouse gas emissions and who may be interested in participating in our CCS project.

TPET believes it feasible to develop the major oil and gas resources of the South Salinas Project and to concurrently establish a substantial

CCS project and potentially a CO2 storage hub and/or Direct Air Capture (DAC) hub.

Entry

into a Letter of Intent to Acquire Novacor Exploration Ltd. Oil and Gas Assets in Saskatchewan, Canada

On

December 18, 2024, TPET entered into a non-binding Letter of Intent (“LOI”) for the acquisition of a 100% working interest

in certain petroleum and natural gas assets held by Novacor Exploration Ltd. (“Novacor”), which are located in the prolific

Lloydminster, Saskatchewan heavy oil region (the “Proposed Novacor Acquisition”). The stated purchase price of the Proposed

Novacor Acquisition is CD$2 million (approximately US$1.4 million based on exchange rates on the date of the LOI) payable US$650,000

in cash and the remainder in shares of common stock of Trio, which TPET would agree to use its commercially reasonable efforts to register

for resale in a registration statement filed with the SEC. Upon execution of the LOI, the Company paid Novacor a good faith deposit of

$65,000, which will be applied to the cash portion of the purchase price at closing. Other than obligations of confidentiality and exclusivity

contained in the LOI, no other terms are binding until definitive acquisition documents are signed by the parties. The definitive acquisition

documents would likely contain customary representations and warranties of the parties and certain conditions to closing, including approval

of the Proposed Novacor Acquisition by the board of directors of each of Novacor and TPET, and a condition that TPET raises sufficient

financing to consummate the Proposed Novacor Acquisition. Unless extended by the mutual agreement of the parties, the LOI will terminate

on the earlier of (i) the mutual agreement of Novacor and TPET, (ii) the execution of definitive acquisition documents or (iii) on February

15, 2025, which date was extended to March 15, 2025, by an amendment to the LOI dated January 29, 2025.

Market

Opportunity

We

believe that we can establish oil and gas operations that have the potential to achieve profitability in California and Utah, where we

currently have projects, and elsewhere.

The

oil and gas industry is operationally challenging in California, where we have the South Salinas and McCool Ranch assets, due primarily

to regulatory issues and to efforts to facilitate an energy transition away from fossil fuels, but California nevertheless is a major

consumer of petroleum products, and TPET believes that it has the capacity to continue to operate in California and that the market for

oil and gas in California will remain strong for the foreseeable future. Furthermore, TPET is attempting to launch a Carbon Capture and

Storage Project as part of the South Salinas Project, consistent with efforts in California to reduce carbon footprint. The Company hopes

and expects TPET’s commitment to reduce carbon footprint through a Carbon Capture and Storage Project to be viewed favorably by

California regulatory bodies, perhaps helping to facilitate operations at the South Salinas Project and elsewhere.

The

oil and gas industry currently appears operationally favorable in Utah, where we have the Asphalt Ridge asset. TPET believes that the

overall operating environment and the market for oil and gas in Utah should remain favorable for the foreseeable future.

TPET’s

operations may help meet the USA’s demanding oil and gas needs that are expected to remain strong for the foreseeable future, while

supporting the country’s goal of energy independence, and supporting local and state economies with tax revenue and jobs. TPET’s

Carbon Capture and Storage Project may help reduce the Company’s and California’s carbon footprint.

Estimated

undeveloped reserves and cash flow

The

following table summarizes the Company’s estimated undeveloped reserves and cash flow at the South Salinas Project, as of April

30, 2024. The Company expects to have estimates of reserves and cash flow for the McCool Ranch Field and for the Asphalt Ridge Project,

after further observations of initial operations at those properties, which is expected by the second calendar quarter of 2025.

Table

1: Estimated Undeveloped Reserves and Cash Flow

| A. |

Phase

1 Undeveloped Reserve Categories |

|

Net

Trio

Undeveloped

Oil

Reserves

(Stock

Tank

Barrels) |

|

|

Net

Trio

Undeveloped

Gas

Reserves

(1000

CF,

or

MCF) |

|

|

Net

Trio

Undeveloped

Reserves

(Barrels

Oil

Equivalent) |

|

|

Trio

Undiscounted

Net

Cash

Flow

($) |

|

|

Trio

Net

Cash

Flow

Discounted

at

10% ($) |

|

| |

Probable

(P2) Undeveloped of Phase 1 |

|

|

2,017,620.0 |

|

|

|

2,133,250.0 |

|

|

|

2,373,161.7 |

|

|

$ |

107,374,250.00 |

|

|

$ |

33,698,230.00 |

|

| |

Possible

(P3) Undeveloped of Phase 1 |

|

|

3,841,380.0 |

|

|

|

7,449,100.0 |

|

|

|

5,082,896.7 |

|

|

$ |

307,886,460.00 |

|

|

$ |

139,189,600.00 |

|

| B. |

Phase

2 Undeveloped Reserve Categories |

|

Net

Trio

Undeveloped

Oil

Reserves

(Stock

Tank

Barrels) |

|

|

Net

Trio

Undeveloped

Gas

Reserves

(1000

CF,

or

MCF) |

|

|

Net

Trio

Undeveloped

Reserves

(Barrels

Oil

Equivalent) |

|

|

Trio

Undiscounted

Net

Cash

Flow

($) |

|

|

Trio

Net

Cash

Flow

Discounted

at

10% ($) |

|

| |

Probable

(P2) Undeveloped of Phase 2 |

|

|

3,227,940.0 |

|

|

|

3,392,940.0 |

|

|

|

3,793,430.0 |

|

|

$ |

168,622,080.00 |

|

|

$ |

45,938,680.00 |

|

| |

Possible

(P3) Undeveloped of Phase 2 |

|

|

6,759,630.0 |

|

|

|

11,735,140.0 |

|

|

|

8,715,486.7 |

|

|

$ |

527,635,330.00 |

|

|

$ |

210,766,130.00 |

|

| C. |

Phase

3 (Full Development) Undeveloped Reserve Categories |

|

Net

Trio

Undeveloped

Oil

Reserves

(Stock

Tank

Barrels) |

|

|

Net

Trio

Undeveloped

Gas

Reserves

(1000

CF,

or

MCF) |

|

|

Net

Trio

Undeveloped

Reserves

(Barrels

Oil

Equivalent) |

|

|

Trio

Undiscounted

Net

Cash

Flow

($) |

|

|

Trio

Net

Cash

Flow

Discounted

at

10% ($) |

|

| |

Probable

(P2) Undeveloped of Phase 3 |

|

|

34,940,100.0 |

|

|

|

36,918,030.0 |

|

|

|

41,093,105.0 |

|

|

|

1,837,183,060.0 |

|

|

|

394,874,030.0 |

|

| |

Possible

(P3) Undeveloped of Phase 3 |

|

|

90,057,820.0 |

|

|

|

149,348,300.0 |

|

|

|

114,949,203.3 |

|

|

|

7,054,575,390.0 |

|

|

|

2,185,998,350.0 |

|

| D. |

(P2)

Undeveloped Reserves for Phases 1, 2 & 3 |

|

Net

Trio

Undeveloped

Oil

Reserves

(Stock

Tank

Barrels) |

|

|

Net

Trio

Undeveloped

Gas

Reserves

(1000

CF,

or

MCF) |

|

|

Net

Trio

Undeveloped

Reserves

(Barrels

Oil

Equivalent) |

|

|

Trio

Undiscounted

Net

Cash

Flow

($) |

|

|

Trio

Net

Cash

Flow

Discounted

at

10% ($) |

|

| |

Probable

(P2) Undeveloped of Phase 1 |

|

|

2,017,620.0 |

|

|

|

2,133,250.0 |

|

|

|

2,373,161.7 |

|

|

$ |

107,374,250.00 |

|

|

$ |

33,698,230.00 |

|

| |

Probable

(P2) Undeveloped of Phase 2 |

|

|

3,227,940.0 |

|

|

|

3,392,940.0 |

|

|

|

3,793,430.0 |

|

|

$ |

168,622,080.00 |

|

|

$ |

45,938,680.00 |

|

| |

Probable

(P2) Undeveloped of Phase 3 |

|

|

34,940,100.0 |

|

|

|

36,918,030.0 |

|

|

|

41,093,105.0 |

|

|

$ |

1,837,183,060.00 |

|

|

$ |

394,874,030.00 |

|

| |

Total

Probable (P2) Undeveloped of Phases 1, 2 & 3 |

|

|

40,185,660.0 |

|

|

|

42,444,220.0 |

|

|

|

47,259,696.7 |

|

|

$ |

2,113,179,390.00 |

|

|

$ |

474,510,940.00 |

|

| E. |

(P3)

Undeveloped Reserves for Phases 1, 2 & 3 |

|

Net

Trio

Undeveloped

Oil

Reserves

(Stock

Tank

Barrels) |

|

|

Net

Trio

Undeveloped

Gas

Reserves

(1000

CF,

or

MCF) |

|

|

Net

Trio

Undeveloped

Reserves

(Barrels

Oil

Equivalent) |

|

|

Trio

Undiscounted

Net

Cash

Flow

($) |

|

|

Trio

Net

Cash

Flow

Discounted

at

10% ($) |

|

| |

Possible

(P3) Undeveloped of Phase 1 |

|

|

3,841,380.0 |

|

|

|

7,449,100.0 |

|

|

|

5,082,896.7 |

|

|

$ |

307,886,460.00 |

|

|

$ |

139,189,600.00 |

|

| |

Possible

(P3) Undeveloped of Phase 2 |

|

|

6,759,630.0 |

|

|

|

11,735,140.0 |

|

|

|

8,715,486.7 |

|

|

$ |

527,635,330.00 |

|

|

$ |

210,766,130.00 |

|

| |

Possible

(P3) Undeveloped of Phase 3 |

|

|

90,057,820.0 |

|

|

|

149,348,300.0 |

|

|

|

114,949,203.3 |

|

|

$ |

7,054,575,390.00 |

|

|

$ |

2,185,998,350.00 |

|

| |

Total

Possible (P3) Undeveloped of Phases 1, 2 & 3 |

|

|

100,658,830.0 |

|

|

|

168,532,540.0 |

|

|

|

128,747,586.7 |

|

|

$ |

7,890,097,180.00 |

|

|

$ |

2,535,954,080.00 |

|

| F. |

Undeveloped

Reserve Categories for Phases 1, 2 & 3 |

|

Net

Trio

Undeveloped

Oil

Reserves

(Stock

Tank

Barrels) |

|

|

Net

Trio

Undeveloped

Gas

Reserves

(1000

CF,

or

MCF) |

|

|

Net

Trio

Undeveloped

Reserves

(Barrels

Oil

Equivalent) |

|

|

Trio

Undiscounted

Net

Cash

Flow

($) |

|

|

Trio

Net

Cash

Flow

Discounted

at

10% ($) |

|

| |

Total

Probable (P2) Undeveloped of Phases 1, 2 & 3 |

|

|

40,185,660.0 |

|

|

|

42,444,220.0 |

|

|

|

47,259,696.7 |

|

|

$ |

2,113,179,390.00 |

|

|

$ |

474,510,940.00 |

|

| |

Total

Possible (P3) Undeveloped of Phases 1, 2 & 3 |

|

|

100,658,830.0 |

|

|

|

168,532,540.0 |

|

|

|

128,747,586.7 |

|

|

$ |

7,890,097,180.00 |

|

|

$ |

2,535,954,080.00 |

|

Reasonable

Expectations of Reserve Analyses

This

prospectus provides a summary of risks and detailed discussions of risks relating to our business and risks relating to our common

stock. The Company recognizes these risks as being real and substantial.

Nevertheless,

the Company has reasonable expectations that the Company’s South Salinas Project should prove to be economically viable

assets, that the Company should have adequate funding to develop these assets, that there should exist the legal

right to develop these assets, and that the Company should be able to establish long-term production and to deliver oil and

natural gas to markets, recognizing as discussed elsewhere hereunder that there are technical risks and that there

may be project delays and/or obstacles related to obtaining necessary permits from regulatory agencies and/or related to other matters.

Notwithstanding the foregoing, there is no assurance that any of the foregoing expectations will be realized. Furthermore and more

specifically, the Company has a reasonable expectation that the primary governmental regulatory agencies that are currently and/or that

will be involved in the permitting processes, which agencies will primarily be CalGEM, State Water Boards and Monterey County, should

determine to approve the Company’s applications for permits for various reasons that are discussed elsewhere in this prospectus,

although there can be no assurance of our obtaining any of such approvals.

Additionally, TPET

does not yet have a final reserve report for the McCool Ranch Oil Field, but plans to add the reserve value of the McCool Ranch Field

to the Company’s reserve report after a brief period of observation and review of the oil production that was restarted on February

22, 2024. Nevertheless, TPET has reasonable expectations that the McCool Ranch Oil Field should prove to have economic reserves based,

in part, on an in-progress evaluation by KLS Petroleum Consulting LLC (“KLSP”), a third-party, independent engineering firm,

and based on various historical analyses by other independent third-party reservoir engineers, and based also on the experience of the

field operator Trio LLC. TPET has reasonable expectation that the McCool Ranch Oil Field should prove to have economic reserves, that

the Company should have adequate funding to develop the reserves, and that there should exist the legal right to develop the Company’s

reserves at McCool Ranch, including the rights to full-field development and to long-term production, rights to cyclic-steam operations

and water disposal and similar matters, recognizing as discussed elsewhere hereunder that there are technical risks and that there may

be project delays and/or obstacles related to obtaining necessary permits from regulatory agencies and/or related to other matters. Notwithstanding

the foregoing, there is no assurance that any of the foregoing expectations will be realized. Furthermore and more specifically, the

Company has a reasonable expectation that the primary governmental regulatory agencies that are currently and/or that will be involved

in the permitting processes, which agencies will primarily be CalGEM, State Water Boards and Monterey County, should determine to approve

the Company’s applications for permits for various reasons that are discussed elsewhere in this prospectus.

An initial two wells

were drilled at our Asphalt Ridge Project in the second calendar quarter of 2024, and both wells were completed across the encountered

tar sands and testing operations have commenced at both wells. TPET has not yet assigned reserves to the Asphalt Ridge Project. However,

TPET has reasonable expectations that reserves may be assigned to the Asphalt Ridge Project after a brief period of observation and review

of the oil development operations that are in progress at the aforementioned initial two wells, that the Company should have adequate

funding to develop the reserves, and that there should exist the legal right to develop the Company’s reserves in the Asphalt Ridge

Project, including the rights to full-field development and to long-term production, recognizing as discussed elsewhere hereunder that

there are technical risks and that there may be project delays and/or obstacles related to obtaining necessary permits from regulatory

agencies and/or related to other matters. Notwithstanding the foregoing, there is no assurance that any of the foregoing expectations

will be realized, including, without limitation, the ability to raise sufficient funds to exercise the option to acquire the additional

17.75% working interest in the Asphalt Ridge Leases on or before the expiration date of the option on April 10, 2025, or on or before

any extension thereof. TPET expects to add the reserve value, if any, of the Asphalt Ridge Project to the Company’s reserve report

after a brief period of observation and review of the oil development operations that commenced in the second calendar quarter of 2024.

For

additional information on risks and detailed discussions of risks, see

“Risk Factors—Risks Relating to Our Business—We may face delays and/or obstacles in project development due to difficulties

in obtaining necessary permits from federal, state, county and/or local agencies, which may materially affect our business;” “Risk

Factors—Risks Relating to Our Business—We face substantial uncertainties in estimating the characteristics of our assets,

so you should not place undue reliance on any of our measures;” “Risk Factors—Risks Relating to Our Business—The

drilling of wells is speculative, often involving significant costs that may be more than our estimates, and drilling may not result

in any discoveries or additions to our future production or future reserves, or it may result in disproving or diminishing our current

reserves; “Risk Factors—Risks Relating to Our Business—Seismic studies do not guarantee that oil or gas is present

or, if present, will produce in economic quantities;” and “Risk Factors—Risks Relating to Our Business—We

are subject to numerous risks inherent to the exploration and production of oil and natural gas.”

Business

Strategies

Our

primary business strategies and objectives currently are to develop our existing assets at the South Salinas Project, McCool Ranch Oil

Field and Asphalt Ridge Project, and to acquire projects that generate immediate cash flow or offer transformative growth potential with

strategic investment. TPET’s current strategy and focus at the South Salinas Project is multifaceted and includes restarting oil

and gas production at the HV-3A discovery well at Presidents Field, securing approval from CalGEM and WaterBoards of a proposed short-term

water-disposal program that should significantly reduce lease operating costs, evaluating options for drilling the HV-2 and HV-4 wells,

evaluating options for accelerating the further testing of Humpback Field and particularly the Vaqueros Sand and the Monterey Formation

Blue-Zone reservoir objectives, launching a Carbon Capture and Storage Project, pursuing permits for full field development, and similar

matters. Efforts to obtain from Monterey County conditional use permits and a full field development permit for the South Salinas Project

are progressing. Efforts to obtain from the California Geologic Energy Management Division (“CalGEM”) and from the California

Water Boards a permit for a water disposal project at the South Salinas Project are also progressing. In the meantime, the Company recently

determined that existing permits allow production testing to continue at the HV-3A discovery well at Presidents Field and, consequently,

testing operations were restarted at this well on March 22, 2024. Oil production from this well has occurred with a generally favorable

oil-water ratio and the Company has idled operations currently pending an assessment of the viability of increasing the well’s

gross production rate, for example by adding up to 650 feet of additional perforations in the oil zone and/or acidizing the well for

borehole cleanup. First oil sales from the HV-3A well occurred in the third calendar quarter of 2024.

TPET’s

current strategy and focus at McCool Ranch is to optimize production at the recently restarted HH-1, 58X and 35X wells, to restart the

HH-3 and HH-4 wells, and subsequently to commence permitting and drilling new wells in the field. KLS Petroleum Consulting LLC (“KLSP”),

a third-party, independent engineering firm, recommends that McCool Ranch be developed with horizontal wells, each landed in the Lombardi

Oil Sand with a 1,000-foot lateral. Management estimates that TPET’s property can probably accommodate approximately 22 additional

such horizontal wells. TPET expects to add the reserve value of the McCool Ranch Field to the Company’s reserve report after a

further period of observation and review of the oil production that was restarted on February 22, 2024.

TPET’s

current strategy and focus at the Asphalt Ridge asset is to monitor the results of the new 2-4 and 8-4 wells and additional planned wells,

and to exercise the option to secure a full 20% working interest in the Asphalt Ridge Project; provided, however, that if we do not raise

sufficient funds prior to the expiration date of April 10, 2025, or any extension thereof, it is unlikely that we will be able to pay

the $1,775,000 required for exercise of the option for the remaining 17.75% working interest in the Asphalt Ridge Project and we would

continue to own our current 2.25% working interest. We believe this asset has potential to produce significant future revenues for the

Company. TPET expects to add the reserve value, if any, of the Asphalt Ridge Project to the Company’s reserve report after a further

period of observation and review of the oil production at the new wells, which is expected by the end of the second calendar quarter

of 2025.

TPET’s

primary strategies and objectives are focused on growing the Company into a highly profitable, independent oil and gas company.

Trio

LLC’s Services as an Operator in California

Trio

LLC is a licensed Operator in California and currently operates the South Salinas Project and the McCool Ranch Oil Field on behalf of

TPET and other working interest owners. Trio LLC operates these assets pursuant to joint operating agreements (“JOAs”) between

and among Trio LLC and the non-operating, third-party, working interest owners. The non-operating parties have agreed under the JOAs

to have the Operator explore and develop these assets for the production of oil and gas as provided thereunder. Trio LLC, as Operator,

generally conducts and has significant control of operations, subject to the limitations and constraints of the JOAs, and acts in the

capacity of an independent contractor. Operator is obligated to conduct its activities under the JOAs as a reasonable prudent operator,

in good workmanlike manner, with due diligence and dispatch, in accordance with good oilfield practices, and in compliance with applicable

laws and regulations.

TPET

holds an approximate 85.775% working interest and Trio LLC an approximate 3.8% working interest in the South Salinas Project. TPET and

Trio LLC each hold an approximate 21.918315% working interest in the McCool Ranch Oil Field. TPET and Trio LLC are separate and distinct

companies.

Trio

LLC has significant prior experience in oil and gas operations, exploration and production in California and an experienced management

team. Some of the members of Trio LLC’s management team are also senior executives of the Company.

Our

Growth Strategy

TPET’s

goal is the building and growing of a substantial independent oil and gas company by developing and/or producing the South Salinas Project,

McCool Ranch Oil Field and Asphalt Ridge Asset (as may be limited by our ability to exercise the option for the remaining 17.75% working

interests in the Asphalt Ridge Leases), and by acquiring and developing other oil and gas assets. Since our initial public offering,

we have added working interests in the McCool Ranch Oil Field and the Asphalt Ridge Project to our asset portfolio, growing from one

project to three projects. Additionally, the Company is evaluating other oil and gas projects that are candidates for acquisition. Our

primary business strategies and objectives currently are to develop our existing assets at the South Salinas Project, McCool Ranch Oil

Field and Asphalt Ridge Project, and to acquire projects that generate immediate cash flow or offer transformative growth potential with

strategic investment.

Competition

There

are many large, medium, and small-sized oil and gas companies and third-parties that are our competitors. Many of these competitors have

extensive operational histories, experienced oil and gas industry management, profitable operations, and significant reserves and funding

resources. Our efforts to acquire additional oil/gas properties in California and elsewhere may be met with competition.

Government

Regulation

We

are subject to a number of federal, state, county and local laws, regulations and other requirements relating to oil and natural gas

operations. The laws and regulations that affect the oil and natural gas industry are under constant review for amendment or expansion.

Some of these laws, regulations and requirements result in challenges, delays and/or obstacles in obtaining permits, and some carry substantial

penalties for failure to comply. The regulatory burden on the oil and natural gas industry increases our cost of doing business, can

affect and even obstruct our operations and, consequently, can affect our profitability. These burdens include regulations relating to

transportation of oil and gas, drilling and production and other regulatory matters.

Recent

Loan and Financings

March

2024 Debt Financing

The

Company executed a Securities Purchase Agreement, dated March 27, 2024 (the “March 2024 SPA”) with an institutional investor

(the “March 2024 Investor”), which March 2024 Investor signed and funded on April 5, 2024, and pursuant to which the Company

raised gross proceeds of $184,500 and received net proceeds of $164,500, after payment of offering expenses (the “March 2024 Debt

Financing”). The March 2024 SPA contains certain representations and warranties by the March 2024 Investor and the Company and

customary closing conditions.

In

connection with the March 2024 Debt Financing, the Company issued an unsecured promissory note to the March 2024 Investor, dated March

27, 2024, in the principal amount of $211,500, having an original issue discount of $27,000 or approximately 13% (the “March 2024

Investor Note”). Interest accrues on the March 2024 Investor Note at a rate of 12% per annum and the maturity date of the March

2024 Investor Note is January 30, 2025 (the “March 2024 Investor Note Maturity Date”). The March 2024 Investor Note provides

for five payments of principal and accrued interest which are payable: (i) $118,440 on September 30, 2024; (ii) $29,610 on October 30,

2024; (iii) $29,610 on November 30, 2024; (iv) $29,610 on December 30, 2024; and (v) $29,610 on January 30, 2025. The Company may prepay

the March 2024 Investor Note, in full and not in part, any time during the 180 day period after the issuance date of the March 2024 Investor

Note at a 3% discount to the outstanding amount of principal and interest due and payable; provided, that in the event of a prepayment,

the Company will still be required to pay the full amount of interest that would have been payable through the term of the March 2024

Investor Note, in the amount of $25,380. The March 2024 Investor Note contains provisions constituting an Event of Default (as such term

is defined in the March 2024 Investor Note) and, upon an Event of Default, the March 2024 Investor Note will be accelerated and become

due and payable in an amount equal to 150% of all amounts due and payable under the March 2024 Investor Note with interest at a default

rate of 22% per annum. In addition, upon an Event of Default, the March 2024 Investor has the right to convert all or any outstanding

amount of the March 2024 Investor Note into shares of the Company’s common stock at a conversion price equal to the greater of

(i) 75% of the Market Price (as such term is defined in the March 2024 Investor Note) or (ii) the conversion floor price, which is $0.07117

(the “Floor Price”); provided, however, that the Floor Price shall not apply after October 5, 2024, and thereafter, the conversion

price will be 75% of the Market Price. Issuance of shares of common stock to the March 2024 Investor is subject to certain beneficial

ownership limitations and not more than 19.99% of the shares of common stock outstanding on March 29, 2024 may be issued upon conversion

of the March 2024 Investor Note. The conversion price is also subject to certain adjustments or other terms in the event of (i) mergers,

consolidations or recapitalization events or (ii) certain distributions made to holders of shares of common stock.

The March 2024 Investor Note was repaid, in full,

as of January 30, 2025.

Loan

from Former Chief Executive Officer

On

March 26, 2024, our former Chief Executive Officer, Michael L. Peterson, who then served as a consultant to the Company, until October

11, 2024, made a loan to us in the principal amount of $125,000 (the “Peterson Loan”). The Company repaid the entire outstanding

principal balance of the Peterson Loan and all accrued interest thereon on November 26, 2024.

April

2024 Financing

On April 16, 2024,

the Company entered into a securities purchase agreement (the “Initial April 2024 SPA”) with an institutional investor (the

“Initial April 2024 Investor”). Pursuant to the terms and conditions of the Initial April 2024 SPA, the Initial April 2024

Investor provided financing to the Company for gross proceeds in the amount of $360,000 resulting in net proceeds to the Company, after

offering expenses, of $310,000 (the “Initial April 2024 Financing”). The Company also issued to the Initial April 2024 Investor

37,500 shares of common stock, par value $0.0001 per share, as and for a commitment fee in connection with the Initial April 2024 Financing

(the “Commitment Shares”). In connection with the Initial April 2024 Financing, the Company issued a Senior Secured Convertible

Promissory Note to the Initial April 2024 Investor in the principal amount of $400,000, having an original issue discount of $40,000,

or 10% (the “Initial Investor April 2024 Note”).

To secure the obligations

of the Company to repay the Initial April 2024 Investor Note, the Company and the Initial April 2024 Investor entered into a Security

Agreement, dated April 16, 2024 (the “Initial April 2024 Security Agreement”).

On April 24, 2024,

the Company entered into an Amended and Restated Securities Purchase Agreement (the “A&R April 2024 SPA”), amending and

restating the Initial April 2024 SPA, in its entirety, and amending the Initial April 2024 Financing by adding an additional institutional

investor (the “Additional April 2024 Investor” and collectively with the Initial April 2024 Investor, the “April 2024

Investors”). Pursuant to the terms of the A&R April 2024 SPA, the Additional April 2024 Investor provided financing to the

Company, on the same terms as provided by the April 2024 Initial Investor, for gross proceeds in the amount of $360,000 resulting in

net proceeds to the Company, after offering expenses, of $328,000 for total net proceeds to the Company of $638,000 (the “April

2024 Financing”). As a result of the financing provided by the Additional April 2024 Investor, April 2024 Investor Notes in an

aggregate principal amount of $800,000 are outstanding and mature on August 16, 2024. The April 2024 Investor Notes provide for mandatory

prepayment, in full, if the Company raises gross proceeds of not less than $1,000,000, in one or a series of related transactions, at

any time that the April 2024 Investor Notes are outstanding.

The Company also issued

to the Additional April 2024 Investor 37,500 Commitment Shares, as and for a commitment fee in connection with the April 2024 Financing,

so that after such issuance the Company had issued an aggregate of 1,500,000 Commitment Shares to the April 2024 Investors.

In connection with the Amended April 2024 Financing,

the Company issued a Senior Secured Convertible Promissory Note to the Additional April 2024 Investor in the principal amount of $400,000,

having an original issue discount of $40,000, or 10% (the “Additional April 2024 Investor Note”) and otherwise on substantially

the same terms as the Initial Investor April 2024 Investor Note. The Company also issued to the Initial April 2024 Investor an Amended

and Restated Senior Secured Convertible Promissory Note, amending and replacing the Initial Investor April 2024 Note (the “A&R

Initial Investor April 2024 Note” and collectively with the Additional April 2024 Investor Note, the “April 2024 Investor

Notes”). The April 2024 Investor Notes are each convertible into shares of common stock (“Conversion Shares”) at an

initial per share conversion price of $5.00, subject to certain adjustments. Pursuant to the provisions of the A&R April 2024 SPA,

the Company granted to the April 2024 Investors certain “piggy-back registration rights” for the registration for resale

of the Commitment Shares and the Conversion Shares. Additionally, for a period beginning on April 16, 2024 and terminating 18 months

after the later of (i) August 16, 2024 or the full repayment of the April 2024 Investor Notes, the Company provided the April 2024 Initial

Investors with a joint right to participate in future financings in an aggregate amount up to 100% of any debt financing and up to 45%

of any other type of financing. Further, the Company is prohibited from entering into any variable rate transactions for as long as the

April 2024 Initial Investors hold any of the Commitment Shares; provided, however, that the Company is permitted to enter into At-the-Market

offerings with a nationally recognized broker-dealer.

As a result of the

Amended April 2024 Financing, the Company entered into an Amended and Restated Security Agreement, dated April 24, 2024, with the April

2024 Investors (the “A&R April 2024 Security Agreement”), amending and restating the Initial April 2024 Security Agreement,

in its entirety, and adding the Additional April 2024 Investor as a secured party. Under the terms of the A&R April 2024 Security

Agreement, the Company has granted

to the April 2024 Investors a senior security interest in and to substantially all of the Company’s assets and properties.

The

Company entered into two amendments the April 2024 Investor Notes extending the maturity date of the April 2024 Note through October

16, 2024, changing the conversion price to a formula based on a five-day average of the closing price of the Company’s common stock

on the NYSE American and adding a floor conversion price of $3.00 per share. As of the date of this prospectus, the April 2024 Investor

Notes have been fully converted and are no longer outstanding.

The April 2024 Investor Notes were repaid, in

full, as October 18, 2024, and the security interest securing payment of the April 2024 Investor Notes was also terminated.

June

2024 Convertible Debt Financing

On June 27, 2024, the Company entered into a

securities purchase agreement (the “June 2024 SPA”) with the same April 2024 Investors (the “June 2024 Investors”).

Pursuant to the terms and conditions of the June 2024 SPA, each June 2024 Investor provided financing of $360,000 to the Company (net

of a 10% original issuance discount as described below) in the form of the June 2024 Notes (as defined below) for aggregate gross proceeds

in the amount of $720,000 (the “June 2024 Financing”). In consideration of the June 2024 Investors’ funding under the

June 2024 SPA, on June 27, 2024, the Company issued and sold to each June 2024 Investor: (A) a Senior Secured 10% Original Issue Discount

Convertible Promissory Note in the aggregate principal amount of $400,000 (the “June 2024 Notes”) and (B) a warrant to purchase

37,230 shares (the “June 2024 Warrant Shares”) of the company’s common stock, at an initial exercise price of $7.905

per share of common stock, subject to certain adjustments (the “June 2024 Warrants”).

The June 2024 Notes

are initially convertible into shares of common stock (the “June 2024 Conversion Shares”) at a conversion price of $7.90500

per share, subject to certain adjustments (the “June 2024 Notes Conversion Price”), provided that the June 2024 Conversion

Price shall not be reduced below $2.40 (the “June 2024 Floor Price”), and provided further that, subject to the applicable

rules of the NYSE American, the Company may lower the June 2024 Floor Price at any time upon written notice to the June 2024 Investors.

The June 2024 Notes do not bear any interest, except in the case of an Event of Default (as such term is defined in the June 2024 Notes),

and the June 2024 Notes mature on June 27, 2025. Upon the occurrence of any Event of Default, interest shall accrue on the June 2024

Notes at a rate equal to 10% per annum or, if less, the highest amount permitted by law.

Pursuant to the provisions

of the June 2024 SPA, for a period beginning on June 27, 2024 and terminating 18 months of the anniversary of the June 2024 SPA, the

Company provided the June 2024 Investors with the right to participate in future financings in an amount up to 100% of any debt financing

and up to 45% of any other type of financing. Each June 2024 Investor has the right to participate in future financing based upon such

June 2024 Investor’s pro rata portion of the aggregate original principal amount of such June 2024 Investor’s Note purchased

under the June 2024 SPA. Further, the Company is prohibited from entering into any “variable rate transactions” until such

time no June 2024 Investor holds any of the June 2024 Notes, provided, however, that the Company is permitted (i) to enter into At-the-Market

offerings with a nationally recognized broker-dealer or to (ii) enter into a variable rate transaction with either of the June 2024 Investors.

Commencing on the 90th

day following the original issue date of the June 2024 Notes, the Company is required to pay to the June 2024 Investors

the outstanding principal balance under the June 2024 Notes in monthly installments, on such date and each one (1) month anniversary

thereof, in an amount equal to 103% of the total principal amount under the June 2024 Notes multiplied by the quotient determined by

dividing one by the number of months remaining until the maturity date of the June 2024 Notes, until the outstanding principal amount

under the June 2024 Notes has been paid in full or, if earlier, upon acceleration, conversion or redemption of the June 2024 Notes in

accordance with their terms. All monthly payments are payable by the Company in cash, provided that under certain circumstances, as provided

in the June 2024 Notes, the Company may elect to pay in shares of common stock.

The Company may repay

all or any portion of the outstanding principal amount of the June 2024 Notes, subject to a 5% pre-payment premium; provided that (i)

the Equity Conditions (as such term is defined in the June 2024 Notes) are then met, (ii) the closing price of the common stock on the

trading day prior to the date that a prepayment notice is provided by the Company is not below the then June 2024 Conversion Price, and

(iii) a resale registration statement registering June 2024 Conversion Shares and June Financing Warrant Shares has been declared effective

by SEC. If the Company elects to prepay the June 2024 Notes, the June 2024 Investors have the right to convert all of the principal amount

of the June 2024 Notes at the applicable June 2024 Conversion Price into June 2024 Conversion Shares.

Further, if the Company

directly or indirectly receives proceeds from and closes any kind of financing including through the issuance of any equity or debt securities,

generating, in a single transaction or a series of related transactions, gross proceeds of not less than $1,000,000, the June 2024 Investors

may request a prepayment of all or any portion of the principal amount of the June 2024 Notes and any accrued and unpaid interest thereon

(if any) from the proceeds received by the Company. Notwithstanding the foregoing, if all or a portion of the proceeds of any such financing

closed after the issue date of the June 2024 Notes and prior to the closing of a public offering of the Company’s securities are

to be used to fund the $1,775,000 payable by the Company for the Lafayette Energy/Heavy Sweet Oil option to obtain an additional 17.75%

working interest in the Utah Asphalt Ridge project, then only net proceeds in excess of the $1,775,000 payable for such option may be

applied to any prepayment of the June 2024 Notes.

In connection with the June 2024 SPA, on June

27, 2024, the Company entered into a registration rights agreement with the June 2024 Investors pursuant to which the Company is required

to, within 30 days after the closing date of the June 2024 Financing, file with the SEC a registration statement to register the June

2024 Conversion Shares and the June Financing Warrant Shares and to cause such resale registration statement to be effective within 60

days after the applicable filing date. In addition, in connection with the June 2024 SPA and in the event the transactions contemplated

under the June 2024 SPA would require to comply with the applicable NYSE/NYSE American Rules requiring stockholder approval for the Company’s

issuance of shares of common stock in excess of 20% of the number of shares of common stock outstanding on the date thereof, the Company

agreed to enter into voting agreements with certain Company stockholders, directors and officers, pursuant to which, each stockholder

party thereto will agree to vote its shares of common stock to approve the issuance of the securities under the June 2024 SPA.

To secure the obligations of the Company to

repay the June 2024 Notes, the Company has granted to the June 2024 Investors a senior security interest in and to all of the Company’s

assets and properties, subject to certain exceptions, as set forth in that certain Security Agreement, dated June 27, 2024, between the

Company and the June 2024 Investors.

On September 16, 2024, the Company amended the

conversion price applicable to the June 2024 Notes to a formula based on a five-day average of the closing price of the Company’s

common stock on the NYSE American, provided that such conversion price is not less than the Floor Conversion Price of $2.40 per share.

The June 2024 Notes were repaid, in full, on January

7, 2025, and the security interest securing payment of the June 2024 Notes was also terminated.

August

2024 Debt Financing

August

1, 2024 Financing

The

Company executed a Securities Purchase Agreement, dated August 1, 2024 (the “August 1st SPA”) with the “March

2024 Investor”, pursuant to which the March 2024 Investor provided additional debt financing to the Company, and pursuant to which

the Company raised gross proceeds of $134,000 and received net proceeds of $110,625, after payment of offering expenses (the “August

1st Debt Financing”). The August 1st SPA contains certain representations and warranties by the March 2024

Investor and the Company and customary closing conditions.

In

connection with the August 1st Debt Financing, the Company issued an unsecured promissory note to the March 2024 Investor,

dated August 1, 2024, in the principal amount of $152,000, having an original issue discount of $18,000 or approximately 11.8% (the “August

1st Investor Note”). Interest accrues on the August 1st Investor Note at a rate of 12% per annum and the

maturity date of the August 1st Investor Note is May 30, 2025. The August 1st Investor Note provides for five payments

of principal and accrued interest which are payable: (i) $85,120 on January 30, 2025; (ii) $21,280 on February 28, 2025; (iii) $21,280

on March 30, 2025; (iv) $21,280 on April 30, 2025; and (v) $21,280 on May 30, 2025 for a total of $170,240. The Company, subject to certain