false

0001667313

0001667313

2024-10-29

2024-10-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 29, 2024

Zedge, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-37782 |

|

26-3199071 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

1178 Broadway, Ste. 1450 (3rd Floor)

New York, NY |

|

10001 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (330) 577-3424

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Class B common stock, par value $0.01 per share |

|

ZDGE |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial

Condition

On October 29, 2024, Zedge,

Inc. (the “Registrant”) issued a press release announcing its results of operations for its fourth fiscal quarter and fiscal

year ended July 31, 2024. A copy of the press release issued by the Registrant concerning the foregoing is furnished herewith as Exhibit

99.1 and is incorporated herein by reference.

The Registrant is furnishing the information contained in this Report,

including Exhibit 99.1, pursuant to Item 2.02 of Form 8-K promulgated by the Securities and Exchange Commission (the “SEC”).

This information shall not be deemed to be “filed” with the SEC or incorporated by reference into any other filing with the

SEC unless otherwise expressly stated in such filing. In addition, this Report and the press release contain statements intended as “forward-looking

statements” that are subject to the cautionary statements about forward-looking statements set forth in the press release.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ZEDGE, INC. |

| |

|

|

| |

By: |

/s/ Jonathan Reich |

| |

Name: |

Jonathan Reich |

| |

Title: |

Chief Executive Officer |

Dated: October 29, 2024

EXHIBIT INDEX

3

Exhibit 99.1

Zedge Announces Fourth Quarter

and Full Year Fiscal 2024 Results

Fourth

quarter total revenue growth of 14%

Fourth

quarter Zedge Marketplace subscription revenue grew

31%

Fourth

quarter Zedge Marketplace ARPMAU1 increased

43%

New York, NY – October 29, 2024: Zedge,

Inc. (NYSE AMERICAN: ZDGE), a leader in digital marketplaces and interactive games that provides

content, enables creativity, empowers self-expression and facilitates community, today announced results for its fourth quarter

and full year fiscal 2024, ended July 31, 2024.

Jonathan Reich, Zedge’s CEO, commented, “We concluded

the year with strong momentum, achieving 14% overall company revenue growth in the fourth quarter, including impressive Zedge Marketplace

subscription revenue growth of 31%, Zedge Premium Gross Transaction Value (GTV)1 growth of 56% and ARPMAU growth of

43%.

“In fiscal 2024, we drove double-digit revenue growth

and strong cash flow from operations, even while repositioning GuruShots for success. In addition to our relentlessly optimizing our ad

stack, our focus on innovation by developing, enhancing and launching new features and embracing Gen AI across our core products and operations,

is yielding positive results, as demonstrated by the growth in subscription revenue and the increased use of pAInt. Taken together these

actions helped us close the year with a more than 10% increase in our cash reserves, even after paying off our $2 million term loan balance

and repurchasing over $600,000 in common stock. These efforts also contributed to our stock’s 71% gain during fiscal 2024, leading

to ZDGE’s inclusion in the Russell Microcap Index.”

| Fourth Quarter Select Financial Metrics: FY24 versus FY23* |

| (in $M except for EPS) | |

Q4 ’24 | | |

Q4 ’23 | | |

Change | | |

FY24 YTD | | |

FY23 YTD | | |

Change | |

| Total Revenue | |

$ | 7.6 | | |

$ | 6.6 | | |

| 14.3 | % | |

$ | 30.1 | | |

$ | 27.2 | | |

| 10.5 | % |

| Advertising Revenue | |

$ | 5.2 | | |

$ | 4.6 | | |

| 12.6 | % | |

$ | 21.0 | | |

$ | 18.3 | | |

| 15.1 | % |

| Digital goods and services | |

$ | 0.7 | | |

$ | 1.0 | | |

| -24.2 | % | |

$ | 3.5 | | |

$ | 4.6 | | |

| -25.2 | % |

| Subscription Revenue | |

$ | 1.2 | | |

$ | 0.9 | | |

| 30.7 | % | |

$ | 4.3 | | |

$ | 3.5 | | |

| 24.7 | % |

| Other Revenue | |

$ | 0.5 | | |

$ | 0.2 | | |

| 185.2 | % | |

$ | 1.2 | | |

$ | 0.8 | | |

| 47.3 | % |

| GAAP Operating Income (Loss) | |

$ | (0.1 | ) | |

$ | 0.2 | | |

| -126.4 | % | |

$ | (11.8 | ) | |

$ | (6.9 | ) | |

| nm | |

| Operating Margin | |

| -0.9 | % | |

| 3.7 | % | |

| | | |

| -39.2 | % | |

| -25.4 | % | |

| | |

| GAAP Net Income (Loss) | |

$ | (0.0 | ) | |

$ | 0.2 | | |

| -124.8 | % | |

$ | (9.2 | ) | |

$ | (6.1 | ) | |

| nm | |

| GAAP Diluted Earnings (Loss) Per Share | |

$ | (0.00 | ) | |

$ | 0.01 | | |

| -100.0 | % | |

$ | (0.65 | ) | |

$ | (0.44 | ) | |

| nm | |

| Non-GAAP Net Income2 | |

$ | 0.3 | | |

$ | 0.6 | | |

| -45.3 | % | |

$ | 1.8 | | |

$ | 1.9 | | |

| -4.9 | % |

| Non- GAAP Diluted Earnings Per Share2 | |

$ | 0.02 | | |

$ | 0.04 | | |

| -47.5 | % | |

$ | 0.13 | | |

$ | 0.13 | | |

| -4.7 | % |

| Adjusted EBITDA2 | |

$ | 0.8 | | |

$ | 1.6 | | |

| -52.0 | % | |

$ | 4.7 | | |

$ | 5.7 | | |

| -17.4 | % |

| Cash Flow from Operations | |

$ | 0.7 | | |

$ | 0.4 | | |

| 65.9 | % | |

$ | 5.9 | | |

$ | 3.2 | | |

| 85.0 | % |

nm = not measurable/meaningful

| * | numbers may not add due to rounding |

Fiscal 2025 Outlook

Reich continued, “In FY’25, we’re building on the

solid foundation laid in FY’24 by investing in growth and scaling across all business areas. A key focus at the Company level is

the continued infusion of generative AI throughout our product portfolio enhancing the user experience with innovative technology and

features. Our recent introduction of pAInt 2.0 is a great example. In September, we expanded pAInt’s capabilities beyond

text-to-image wallpaper creation along with filters, photo editing, avatar and/or sticker creation and rendering output in any size –

not phone wallpapers alone. These capabilities make our offering relevant to a wider target audience.

“Our primary goal for the Zedge Marketplace this

year is to convert our users from consumers of content into creators. This transformation is critical in helping us increase our penetration

as a critical platform in the Creator Economy. Looking forward to what’s next, we’re already exploiting the recent introduction

of pAInt 2.0 and are hard at work on introducing AI audio capabilities in the next several months. Audio is an exciting advancement

that we believe can drive more users to our platform and create greater engagement from existing users.

“However, product enhancements and new feature releases

are only part of the story. Over the past year, we built a world-class marketing team that has successfully acquired users with attractive

ROAS profiles, particularly in well-developed economies, while also contributing to our hockey stick-like growth on the iOS platform in

FY’24. This team is a key asset in helping us drive growth in conjunction with product innovations.

“We’re also excited about the upcoming expansion

of Emojipedia’s ‘Emoji Playground,’ which debuted last year with emoji mashups and quizzes. This year, we expect

to add new features, including AI-driven emoji and digital sticker creation. These new features and enhancements, combined with plans

to revamp the Emojipedia website, are expected to drive higher engagement, elevate the user experience and further reinforce Emojipedia’s

position as the ‘go-to’ platform for emoji enthusiasts.

“Reversing losses and resuming growth at GuruShots

are our top priorities for GuruShots. To accomplish this, our strategy has shifted, prioritizing new user growth away from legacy players.

The path forward is clear from the changes we made to the game and the roadmap that we have planned for in this fiscal year. To date we

have introduced a robust onboarding experience to ease more users into the game, adopted a coin-based in-game economy and more recently

launched Missions, a recognized gamification technique for driving engagement and improving retention by rewarding players for accomplishing

specific goals. These actions are already yielding early returns, and we believe we are on the right track for accomplishing our goals.

Looking beyond Missions, we’re targeting the release of a new competitive capability, player-vs-player (PvP), in time for the year-end

holiday season.

“Finally, introducing new products remains a high priority

for our long-term strategy. With promising projects like Wishcraft and AI Art Master in beta and more in the pipeline, we’re

centralizing our development platform in order to foster rapid iteration and efficient product rollouts, enabling us to make key decisions

quickly - doubling down on initiatives that show promise while pulling back from ones that aren’t performing well. This approach

positions us to deliver new hits—whether incremental successes or major breakthroughs—that will drive sustained growth for

Zedge.

“We’re proud of our progress in FY’24 and

believe there is lots more to come. As we continue to evolve our business for sustainable long-term growth, we’re committed to smart

capital allocation strategies, including share repurchases, that will drive long-term shareholder value.”

Fourth Quarter Highlights

(fiscal 2024 versus fiscal 2023)

| ● | Revenue

increased 14.3% to $7.6 million; |

| ● | GAAP

operating loss of ($0.1) million, compared to operating income of $0.2 million; |

| ● | GAAP

net income and earnings per share (EPS) were nil compared to $0.2 million and $0.01, respectively; |

| ● | Non-GAAP

net income and EPS were $0.3 million $0.02 compared to $0.6 million and $0.04, respectively; |

| ● | Adjusted

EBITDA of $0.8 million; |

| ● | Zedge

Premium Gross Transaction Value, or GTV, increased 55.7% to $0.6 million. |

Full Year Highlights

(fiscal 2024 versus fiscal 2023)

| ● | Revenue

increased 10.5% to $30.1 million; |

| ● | GAAP

operating loss of ($11.8) million, compared to ($6.9) million; |

| o | GAAP operating loss for 2024 included non-cash write-downs

related to an acquisition of $12.0 million compared to $6.8 million in 2023; |

| ● | GAAP

net loss and loss per share (EPS) were ($9.2) million and ($0.65) compared to ($6.1) million and ($0.44), respectively, including the

impact of the write-downs; |

| ● | Non-GAAP

net income and EPS were $1.8 million and $0.13 compared to $1.9 million and $0.13, respectively; |

| ● | Adjusted

EBITDA of $4.7 million; |

| ● | Repurchased

0.2 million shares of Class B Common Stock. |

| Select Zedge Marketplace Metrics: FY24 versus FY23* |

| (in MM except for ARPMAU and where noted) | |

Q4 ’24 | | |

Q4 ’23 | | |

Change | |

| Total Installs1 - Cumulative | |

| 674.3 | | |

| 621.0 | | |

| 8.6 | % |

| MAU1 | |

| 26.1 | | |

| 30.9 | | |

| -15.5 | % |

| Well-developed Markets | |

| 5.5 | | |

| 6.8 | | |

| -19.1 | % |

| Emerging Markets | |

| 20.6 | | |

| 24.1 | | |

| -14.5 | % |

| Active Subscriptions1 (in 000s) | |

| 669 | | |

| 647 | | |

| 3.4 | % |

| ARPMAU | |

$ | 0.079 | | |

$ | 0.055 | | |

| 43.3 | % |

| Zedge Premium - Gross Transaction Value (GTV) | |

$ | 0.6 | | |

$ | 0.4 | | |

| 55.7 | % |

| * | numbers may not add due to rounding |

| Trended Financial Information* |

| (in $M except for EPS, ARPMAU, Paid Subscriptions) | |

Q123 | | |

Q223 | | |

Q323 | | |

Q423 | | |

Q124 | | |

Q224 | | |

Q324 | | |

Q424 | | |

FY22 | | |

FY23 | | |

FY24 | |

| Total Revenue | |

$ | 6.9 | | |

$ | 7.0 | | |

$ | 6.7 | | |

$ | 6.6 | | |

$ | 7.1 | | |

$ | 7.8 | | |

$ | 7.7 | | |

$ | 7.6 | | |

$ | 26.5 | | |

$ | 27.2 | | |

$ | 30.1 | |

| Advertising Revenue | |

$ | 4.5 | | |

$ | 4.6 | | |

$ | 4.6 | | |

$ | 4.6 | | |

$ | 4.9 | | |

$ | 5.5 | | |

$ | 5.5 | | |

$ | 5.2 | | |

$ | 20.3 | | |

$ | 18.3 | | |

$ | 21.0 | |

| Digital goods and services | |

$ | 1.3 | | |

$ | 1.2 | | |

$ | 1.1 | | |

$ | 1.0 | | |

$ | 0.9 | | |

$ | 0.9 | | |

$ | 0.9 | | |

$ | 0.7 | | |

$ | 1.7 | | |

$ | 4.6 | | |

$ | 3.5 | |

| Subscription Revenue | |

$ | 0.9 | | |

$ | 0.9 | | |

$ | 0.8 | | |

$ | 0.9 | | |

$ | 1.0 | | |

$ | 1.1 | | |

$ | 1.1 | | |

$ | 1.2 | | |

$ | 3.7 | | |

$ | 3.5 | | |

$ | 4.3 | |

| Other Revenue | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | 0.3 | | |

$ | 0.2 | | |

$ | 0.5 | | |

$ | 0.8 | | |

$ | 0.8 | | |

$ | 1.2 | |

| GAAP Operating Income (Loss) | |

$ | (0.2 | ) | |

$ | 1.5 | | |

$ | (8.4 | ) | |

$ | 0.2 | | |

$ | 0.3 | | |

$ | (11.9 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | 11.8 | | |

$ | (6.9 | ) | |

$ | (11.8 | ) |

| GAAP Net Income (Loss) | |

$ | (0.2 | ) | |

$ | 1.6 | | |

$ | (7.7 | ) | |

$ | 0.2 | | |

$ | (0.0 | ) | |

$ | (9.2 | ) | |

$ | 0.1 | | |

$ | (0.0 | ) | |

$ | 9.7 | | |

$ | (6.1 | ) | |

$ | (9.2 | ) |

| GAAP Diluted Earnings (Loss) Per Share | |

$ | (0.01 | ) | |

$ | 0.11 | | |

$ | (0.55 | ) | |

$ | 0.01 | | |

$ | 0.00 | | |

$ | (0.66 | ) | |

$ | 0.01 | | |

$ | 0.00 | | |

$ | 0.65 | | |

$ | (0.44 | ) | |

$ | (0.65 | ) |

| Non GAAP Net Income | |

$ | 0.2 | | |

$ | 0.8 | | |

$ | 0.3 | | |

$ | 0.6 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.3 | | |

$ | 8.8 | | |

$ | 1.9 | | |

$ | 1.8 | |

| Non-GAAP Diluted EPS | |

$ | 0.01 | | |

$ | 0.06 | | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.03 | | |

$ | 0.02 | | |

$ | 0.59 | | |

$ | 0.13 | | |

$ | 0.13 | |

| Adjusted EBITDA | |

$ | 1.0 | | |

$ | 1.4 | | |

$ | 1.7 | | |

$ | 1.6 | | |

$ | 1.5 | | |

$ | 1.5 | | |

$ | 0.9 | | |

$ | 0.8 | | |

$ | 12.4 | | |

$ | 5.7 | | |

$ | 4.7 | |

| Adjusted EBITDA Margin | |

| 13.8 | % | |

| 20.5 | % | |

| 25.4 | % | |

| 24.2 | % | |

| 21.7 | % | |

| 19.9 | % | |

| 11.1 | % | |

| 10.2 | % | |

| 46.6 | % | |

| 20.9 | % | |

| 15.6 | % |

| Cash Flow from Operations | |

$ | 1.1 | | |

$ | 0.0 | | |

$ | 1.6 | | |

$ | 0.4 | | |

$ | 1.3 | | |

$ | 1.6 | | |

$ | 2.3 | | |

$ | 0.7 | | |

$ | 11.5 | | |

$ | 3.2 | | |

$ | 5.9 | |

| MAU | |

| 31.9 | | |

| 32.2 | | |

| 32.0 | | |

| 30.9 | | |

| 28.5 | | |

| 28.7 | | |

| 27.7 | | |

| 26.1 | | |

| nm | | |

| nm | | |

| nm | |

| Well-developed Markets | |

| 7.1 | | |

| 7.4 | | |

| 7.2 | | |

| 6.8 | | |

| 6.2 | | |

| 6.2 | | |

| 6.0 | | |

| 5.5 | | |

| nm | | |

| nm | | |

| nm | |

| Emerging Markets | |

| 24.8 | | |

| 24.8 | | |

| 24.8 | | |

| 24.1 | | |

| 22.3 | | |

| 22.5 | | |

| 21.7 | | |

| 20.6 | | |

| nm | | |

| nm | | |

| nm | |

| Active Subscriptions (in 000s) | |

| 674 | | |

| 654 | | |

| 631 | | |

| 647 | | |

| 648 | | |

| 648 | | |

| 654 | | |

| 669 | | |

| nm | | |

| nm | | |

| nm | |

| ARPMAU | |

$ | 0.054 | | |

$ | 0.052 | | |

$ | 0.053 | | |

$ | 0.055 | | |

$ | 0.063 | | |

$ | 0.072 | | |

$ | 0.074 | | |

$ | 0.079 | | |

| nm | | |

| nm | | |

| nm | |

| Zedge Premium – GTV | |

$ | 0.3 | | |

$ | 0.4 | | |

$ | 0.4 | | |

$ | 0.4 | | |

$ | 0.4 | | |

$ | 0.5 | | |

$ | 0.6 | | |

$ | 0.6 | | |

$ | 1.5 | | |

$ | 1.5 | | |

$ | 2.1 | |

nm = not measurable/meaningful

| * | numbers may not add due to rounding |

| 1 | We use the following business metrics in this release because

we believe they are useful in evaluating Zedge’s operational performance. |

| ● | Monthly

active users, or MAU, captures the number of unique users that used our Zedge App during the previous 30 days of the relevant period,

is useful for evaluating consumer engagement with our App, which correlates to advertising revenue as more users drive more ad impressions

for sale. It also allows readers and potential advertisers to evaluate the size of our user base. |

| ● | Zedge

Premium Gross Transaction Value, or GTV, is the total dollar amount of transactions conducted through Zedge Premium. As Zedge Premium

is an internal focus for growth, we believe this metric will help investors evaluate our progress in growing this part of our business. |

| ● | Average

Revenue Per Monthly Active User for our Zedge App, or ARPMAU, is useful in evaluating how well we monetize our user base. |

| ● | An

Active Subscription is a subscription that has commenced and not been canceled, including paused subscriptions and subscriptions in free

trials, grace periods, or account hold. This is important because it is a source of recurring revenue. |

| ● | Total

Installs – Cumulative measures the number of times the Zedge App has been downloaded since inception. |

| 2 | Throughout this release, Non-GAAP Net Income, Non-GAAP EPS

and Adjusted EBITDA are non-GAAP financial measures intended to provide useful information that supplement Zedge’s results in accordance

with GAAP. Please refer to the Reconciliation of Non-GAAP Financial measures at the end of this release for an explanation of Zedge’s

formulations of Non-GAAP Net Income, Non-GAAP EPS and Adjusted EBITDA and reconciliations to the most directly comparable GAAP measures. |

Earnings Announcement and Supplemental Information

Management will host an earnings conference call beginning

at 11:00 a.m. Eastern to discuss its results, outlook, and strategy, followed by a Q&A with investors.

Live Call-in Info:

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 311549

Webcast URL: https://www.webcaster4.com/Webcast/Page/2205/51461

Replay:

Toll Free: 877-481-4010

International: 919-882-2331

Replay Passcode: 51461

About Zedge

Zedge empowers

tens of millions of consumers and creators each month with its suite of interconnected platforms that enable creativity, self-expression

and e-commerce and foster community through fun competitions. Zedge’s ecosystem of product offerings includes the Zedge Marketplace,

a freemium marketplace offering mobile phone wallpapers, video wallpapers, ringtones, notification sounds, and pAInt, a generative AI

image maker; GuruShots, “The World’s Greatest Photography Game,” a skill-based photo challenge game; and Emojipedia,

the #1 trusted source for ‘all things emoji.’ For more information please visit: investor.zedge.net

Follow us on X: @Zedge

Follow us on LinkedIn

Forward-Looking Statements

All statements above that are not purely about historical

facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,”

“plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current

judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements

due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks and should be consulted

along with this release. To the extent permitted under applicable law, we assume no obligation to update any forward-looking statements.

Contact:

Brian Siegel,

IRC, MBA

Senior Managing

Director

Hayden IR

(346) 396-8696

ir@zedge.net

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value data)

| July 31, | |

2024 | | |

2023 | |

| | |

| | |

| |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 19,998 | | |

$ | 18,125 | |

| Trade accounts receivable | |

| 3,406 | | |

| 2,883 | |

| Prepaid expenses and other receivables | |

| 593 | | |

| 569 | |

| Total current assets | |

| 23,997 | | |

| 21,577 | |

| Property and equipment, net | |

| 2,306 | | |

| 2,186 | |

| Intangible assets, net | |

| 5,369 | | |

| 18,709 | |

| Goodwill | |

| 1,824 | | |

| 1,961 | |

| Deferred tax assets, net | |

| 4,344 | | |

| 1,842 | |

| Other assets | |

| 355 | | |

| 556 | |

| Total assets | |

$ | 38,195 | | |

$ | 46,831 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Trade accounts payable | |

$ | 1,113 | | |

$ | 669 | |

| Accrued expenses and other current liabilities | |

| 2,969 | | |

| 2,676 | |

| Deferred revenues | |

| 2,168 | | |

| 2,414 | |

| Total current liabilities | |

| 6,250 | | |

| 5,759 | |

| Term loan, net of deferred financing costs | |

| - | | |

| 1,985 | |

| Deferred revenues--non-current | |

| 931 | | |

| - | |

| Other liabilities | |

| 118 | | |

| 223 | |

| Total liabilities | |

| 7,299 | | |

| 7,967 | |

| Commitments and contingencies (Note 10) | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $.01 par value; authorized shares—2,400; no shares issued and outstanding | |

| - | | |

| - | |

| Class A common stock, $.01 par value; authorized shares—2,600; 525 shares issued and outstanding at July 31, 2024 and 2023 | |

| 5 | | |

| 5 | |

| Class B common stock, $.01 par value; authorized shares—40,000; 14,866 shares issued and 13,815 shares outstanding at July 31, 2024, and 14,634 shares issued and 13,801 outstanding at July 31, 2023 | |

| 149 | | |

| 146 | |

| Additional paid-in capital | |

| 48,263 | | |

| 46,122 | |

| Accumulated other comprehensive loss | |

| (1,832 | ) | |

| (1,537 | ) |

| Accumulated deficit | |

| (13,113 | ) | |

| (3,942 | ) |

| Treasury stock,1,051 shares at July 31, 2024 and 833 shares at July 31, 2023, at cost | |

| (2,576 | ) | |

| (1,930 | ) |

| Total stockholders’ equity | |

| 30,896 | | |

| 38,864 | |

| Total liabilities and stockholders’ equity | |

$ | 38,195 | | |

$ | 46,831 | |

ZEDGE,

INC.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except

per share data)

| | |

Three Months Ended | | |

Fiscal Year Ended | |

| | |

July 31, | | |

July 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

$ | 7,581 | | |

$ | 6,632 | | |

$ | 30,091 | | |

$ | 27,241 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Direct cost of revenues (excluding amortization of capitalized software and technology development costs which is included below) | |

| 460 | | |

| 480 | | |

| 1,859 | | |

| 2,242 | |

| Selling, general and administrative | |

| 6,852 | | |

| 5,144 | | |

| 25,625 | | |

| 21,857 | |

| Depreciation and amortization | |

| 334 | | |

| 763 | | |

| 2,454 | | |

| 3,269 | |

| Impairment of intangible assets | |

| - | | |

| - | | |

| 11,958 | | |

| - | |

| Impairment of goodwill | |

| - | | |

| - | | |

| - | | |

| 8,727 | |

| Change in fair value of contingent consideration | |

| - | | |

| - | | |

| - | | |

| (1,943 | ) |

| Loss (income) from operations | |

| (65 | ) | |

| 245 | | |

| (11,805 | ) | |

| (6,911 | ) |

| Interest and other income, net | |

| 192 | | |

| 115 | | |

| 626 | | |

| 311 | |

| Net income (loss) resulting from foreign exchange transactions | |

| 33 | | |

| 36 | | |

| (190 | ) | |

| 36 | |

| Income (loss) before income taxes | |

| 160 | | |

| 396 | | |

| (11,369 | ) | |

| (6,564 | ) |

| Provision for (benefit from) income taxes | |

| 199 | | |

| 240 | | |

| (2,198 | ) | |

| (462 | ) |

| Net (loss) income | |

$ | (39 | ) | |

$ | 156 | | |

$ | (9,171 | ) | |

$ | (6,102 | ) |

| Other comprehensive gain (loss): | |

| | | |

| | | |

| | | |

| | |

| Changes in foreign currency translation adjustment | |

| 46 | | |

| 175 | | |

| (295 | ) | |

| (146 | ) |

| Total other comprehensive gain (loss) | |

| 46 | | |

| 175 | | |

| (295 | ) | |

| (146 | ) |

| Total comprehensive gain (loss) | |

$ | 7 | | |

$ | 331 | | |

$ | (9,466 | ) | |

$ | (6,248 | ) |

| Income (loss) per share attributable to Zedge, Inc. common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | - | | |

$ | 0.01 | | |

$ | (0.65 | ) | |

$ | (0.43 | ) |

| Diluted | |

$ | - | | |

$ | 0.01 | | |

$ | (0.65 | ) | |

$ | (0.43 | ) |

| Weighted-average number of shares used in calculation of income (loss) per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 14,141 | | |

| 13,928 | | |

| 14,092 | | |

| 14,096 | |

| Diluted | |

| 14,495 | | |

| 13,928 | | |

| 14,092 | | |

| 14,096 | |

ZEDGE, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(in thousands)

| Year Ended July 31, | |

2024 | | |

2023 | |

| | |

| | |

| |

| Operating activities | |

| | |

| |

| Net loss | |

$ | (9,171 | ) | |

$ | (6,102 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation | |

| 56 | | |

| 60 | |

| Amortization of intangible assets | |

| 1,382 | | |

| 2,316 | |

| Amortization of capitalized software and technology development costs | |

| 1,016 | | |

| 893 | |

| Amortization of deferred financing costs | |

| 15 | | |

| 3 | |

| Stock-based compensation | |

| 2,141 | | |

| 2,519 | |

| Impairment charge of intangible assets | |

| 11,958 | | |

| - | |

| Impairment of investment in privately-held company | |

| 50 | | |

| - | |

| Deferred income taxes | |

| (2,502 | ) | |

| (981 | ) |

| Impairment charge of goodwill | |

| - | | |

| 8,727 | |

| Change in fair value of contingent consideration | |

| - | | |

| (1,943 | ) |

| | |

| | | |

| | |

| Change in assets and liabilities: | |

| | | |

| | |

| Trade accounts receivable | |

| (523 | ) | |

| (472 | ) |

| Prepaid expenses and other current assets | |

| (24 | ) | |

| (173 | ) |

| Other assets | |

| 45 | | |

| 14 | |

| Trade accounts payable and accrued expenses | |

| 722 | | |

| (711 | ) |

| Deferred revenue | |

| 685 | | |

| (988 | ) |

| Net cash provided by operating activities | |

| 5,850 | | |

| 3,162 | |

| Investing activities | |

| | | |

| | |

| Final payment for asset acquisitions | |

| - | | |

| (962 | ) |

| Capitalized software and technology development costs | |

| (1,147 | ) | |

| (1,406 | ) |

| Purchase of property and equipment | |

| (47 | ) | |

| (54 | ) |

| Net cash used in investing activities | |

| (1,194 | ) | |

| (2,422 | ) |

| Financing activities | |

| | | |

| | |

| Prepayment of term loan | |

| (2,000 | ) | |

| - | |

| Purchase of treasury stock in connection with share buyback program and stock awards vesting | |

| (646 | ) | |

| (1,596 | ) |

| Proceeds from exercise of stock options | |

| 3 | | |

| 1 | |

| Proceeds from term loan | |

| - | | |

| 2,000 | |

| Payment of deferred financing costs | |

| - | | |

| (18 | ) |

| Net cash (used in) provided by financing activities | |

| (2,643 | ) | |

| 387 | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (140 | ) | |

| (87 | ) |

| Net increase in cash and cash equivalents | |

| 1,873 | | |

| 1,040 | |

| Cash and cash equivalents at beginning of period | |

| 18,125 | | |

| 17,085 | |

| Cash and cash equivalents at end of period | |

$ | 19,998 | | |

$ | 18,125 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | |

| | | |

| | |

| Cash payments made for income taxes | |

$ | 272 | | |

$ | 795 | |

| Cash payments made for interest expenses | |

$ | 66 | | |

$ | 118 | |

Use of Non-GAAP Measures

Adjusted EBITDA, defined as earnings (loss) before interest,

taxes, depreciation and amortization, stock compensation expense, transaction-related expenses and other non-recurring expenses, Adjusted

EBITDA Margin, and non-GAAP net income and EPS (which adjust out stock compensation expense, transaction-related expenses and other non-recurring

expenses from GAAP net income and EPS), represent measures that we believe are customarily used by investors and analysts to evaluate

the financial performance of companies in addition to the GAAP measures we present. Our management also believes these measures are useful

in evaluating our core operating results. However, these are not measures of financial performance under GAAP and should not be considered

an alternative to net income or operating income/margin as an indicator of our operating performance or to net cash provided by operating

activities as a measure of our liquidity.

| Reconciliation of Adjusted EBITDA to Net (Loss) Income | |

Q123 | | |

Q223 | | |

Q323 | | |

Q423 | | |

Q124 | | |

Q224 | | |

Q324 | | |

Q424 | | |

FY22 | | |

FY23 | | |

FY24 | |

| Net (Loss) Income | |

$ | (0.2 | ) | |

$ | 1.6 | | |

$ | (7.7 | ) | |

$ | 0.2 | | |

$ | (0.0 | ) | |

$ | (9.2 | ) | |

$ | 0.1 | | |

$ | (0.0 | ) | |

$ | 9.7 | | |

$ | (6.1 | ) | |

$ | (9.2 | ) |

| Excluding: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest and other income (expense), net | |

$ | (0.0 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | (0.2 | ) | |

$ | (0.2 | ) | |

$ | (0.2 | ) | |

$ | (0.0 | ) | |

$ | (0.3 | ) | |

$ | (0.6 | ) |

| Provision for (benefit from) income taxes | |

$ | (0.1 | ) | |

$ | 0.1 | | |

$ | (0.7 | ) | |

$ | 0.2 | | |

$ | 0.2 | | |

$ | (2.5 | ) | |

$ | (0.1 | ) | |

$ | 0.2 | | |

$ | 1.9 | | |

$ | (0.5 | ) | |

$ | (2.2 | ) |

| Depreciation and amortization | |

$ | 0.8 | | |

$ | 0.8 | | |

$ | 0.9 | | |

$ | 0.8 | | |

$ | 0.8 | | |

$ | 0.8 | | |

$ | 0.6 | | |

$ | 0.3 | | |

$ | 2.0 | | |

$ | 3.3 | | |

$ | 2.5 | |

| EBITDA | |

$ | 0.5 | | |

$ | 2.4 | | |

$ | (7.6 | ) | |

$ | 1.0 | | |

$ | 0.9 | | |

$ | (11.1 | ) | |

$ | 0.4 | | |

$ | 0.3 | | |

$ | 13.5 | | |

$ | (3.6 | ) | |

$ | (9.5 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquisition related write-offs | |

$ | (0.2 | ) | |

$ | (1.8 | ) | |

$ | 8.7 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 12.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | (4.0 | ) | |

$ | 6.8 | | |

$ | 12.0 | |

| Stock-based compensation | |

$ | 0.6 | | |

$ | 0.8 | | |

$ | 0.6 | | |

$ | 0.6 | | |

$ | 0.5 | | |

$ | 0.7 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 1.9 | | |

$ | 2.5 | | |

$ | 2.1 | |

| Transaction costs related to business combination | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.2 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.9 | | |

$ | 0.0 | | |

$ | 0.2 | |

| Adjusted EBITDA | |

$ | 1.0 | | |

$ | 1.4 | | |

$ | 1.7 | | |

$ | 1.6 | | |

$ | 1.5 | | |

$ | 1.5 | | |

$ | 0.9 | | |

$ | 0.8 | | |

$ | 12.4 | | |

$ | 5.7 | | |

$ | 4.7 | |

| * | numbers may not add due to rounding |

| Reconciliation of GAAP Net (Loss) Income to Non-GAAP Net Income | |

Q123 | | |

Q223 | | |

Q323 | | |

Q423 | | |

Q124 | | |

Q224 | | |

Q324 | | |

Q424 | | |

FY22 | | |

FY23 | | |

FY24 | |

| GAAP Net (Loss) Income | |

$ | (0.2 | ) | |

$ | 1.6 | | |

$ | (7.7 | ) | |

$ | 0.2 | | |

$ | (0.0 | ) | |

$ | (9.2 | ) | |

$ | 0.1 | | |

$ | (0.0 | ) | |

$ | 9.7 | | |

$ | (6.1 | ) | |

$ | (9.2 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Acquisition related write-offs | |

$ | (0.2 | ) | |

$ | (1.8 | ) | |

$ | 8.7 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 12.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | (4.0 | ) | |

$ | 6.8 | | |

$ | 12.0 | |

| Stock-based compensation | |

$ | 0.6 | | |

$ | 0.8 | | |

$ | 0.6 | | |

$ | 0.6 | | |

$ | 0.5 | | |

$ | 0.7 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 1.9 | | |

$ | 2.5 | | |

$ | 2.1 | |

| Transaction costs related to business combination | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.2 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.0 | | |

$ | 0.9 | | |

$ | 0.0 | | |

$ | 0.2 | |

| Income tax effect on non-GAAP items | |

$ | (0.1 | ) | |

$ | 0.2 | | |

$ | (1.3 | ) | |

$ | (0.1 | ) | |

$ | (0.2 | ) | |

$ | (2.9 | ) | |

$ | (0.1 | ) | |

$ | (0.1 | ) | |

$ | 0.3 | | |

$ | (1.3 | ) | |

$ | (3.3 | ) |

| Non-GAAP Net Income | |

$ | 0.2 | | |

$ | 0.8 | | |

$ | 0.3 | | |

$ | 0.6 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.5 | | |

$ | 0.3 | | |

$ | 8.8 | | |

$ | 1.9 | | |

$ | 1.8 | |

| Non-GAAP basic earnings per share | |

$ | 0.01 | | |

$ | 0.06 | | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.03 | | |

$ | 0.02 | | |

$ | 0.62 | | |

$ | 0.13 | | |

$ | 0.13 | |

| Non-GAAP diluted earnings per share | |

$ | 0.01 | | |

$ | 0.06 | | |

$ | 0.02 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.04 | | |

$ | 0.03 | | |

$ | 0.02 | | |

$ | 0.59 | | |

$ | 0.13 | | |

$ | 0.13 | |

| Weighted average shares used to compute Non-GAAP basic earnings per share | |

| 14.3 | | |

| 14.1 | | |

| 14.0 | | |

| 13.9 | | |

| 14.0 | | |

| 14.1 | | |

| 14.2 | | |

| 14.1 | | |

| 14.2 | | |

| 14.1 | | |

| 14.1 | |

| Weighted average shares used to compute Non-GAAP diluted earnings per share | |

| 14.3 | | |

| 14.3 | | |

| 14.0 | | |

| 13.9 | | |

| 14.0 | | |

| 14.1 | | |

| 14.5 | | |

| 14.5 | | |

| 14.9 | | |

| 14.1 | | |

| 14.1 | |

| * | numbers may not add due to rounding |

9

v3.24.3

Cover

|

Oct. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 29, 2024

|

| Entity File Number |

1-37782

|

| Entity Registrant Name |

Zedge, Inc.

|

| Entity Central Index Key |

0001667313

|

| Entity Tax Identification Number |

26-3199071

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1178 Broadway

|

| Entity Address, Address Line Two |

Ste. 1450 (3rd Floor)

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

330

|

| Local Phone Number |

577-3424

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class B common stock, par value $0.01 per share

|

| Trading Symbol |

ZDGE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

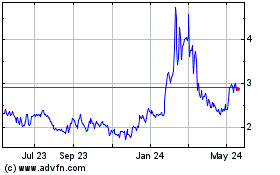

Zedge (AMEX:ZDGE)

Historical Stock Chart

From Jan 2025 to Feb 2025

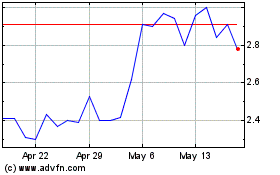

Zedge (AMEX:ZDGE)

Historical Stock Chart

From Feb 2024 to Feb 2025