TIDMARBB

RNS Number : 5892Q

Arbuthnot Banking Group PLC

19 October 2023

19 October 202 3

Arbuthnot Banking Group PLC

Third Quarter 202 3 Trading Update

The Board of Arbuthnot Banking Group PLC ("Arbuthnot", the

"Company" or the "Group") provides the following update regarding

the trading performance of the Group for the three months to 30

September 202 3 .

Highlights

-- Bank of England base rate rises continue to contribute to increased revenue

-- Deposit pricing increases expected to stabilise in 2024 as maturing deposits are renewed

-- Customer dep o sit balance growth of 7% over the period to GBP3.5 bn

-- Specialist divisions generating planned balance sheet growth

-- Completion of lease for new Head Office premises

Group Performance

During the third quarter, the Group continued to make good

progress towards achieving its long-term objectives set out in the

Group's "Future State 2" plan.

Once again, rises in the Bank of England base rate contributed

to increased revenues from our repricing assets. As previously

guided, the cost of deposits will be subject to the lag effect

caused by fixed term deposits ("fixed deposits") maturing over the

next year and subsequently repricing to higher rates. However,

during the quarter, as clients increasingly expect the interest

rate cycle to have peaked, we saw a switch out of call or current

accounts into fixed products. During the third quarter, this saw

fixed deposits increase by GBP179m, with fixed deposits at 30

September 2023 equating to 40% of the overall deposit book compared

to 37% at 30 June 2023. As a result, the average cost of deposits

increased to 291bps at 30 September 2023 and we expect the rate to

ultimately rise just above 310 bps during 2024.

Given the robust position in which the Group finds itself and

its predicted future growth prospects, the Group is pleased to have

secured a new long-term solution for its office premises. On 7

September the Group completed on a new 15-year lease to occupy the

entire office space at 20 Finsbury Circus. This building has

approximately 75,000 square feet, an increase of 45% compared to

our current London offices.

The planned fit-out, due to be completed in the second quarter

of 2024, will provide both high specification working space and

also new client meeting and entertainment suites, which will help

to deepen the relationship banking offering that is proving

successful in both our Private and Commercial banking

businesses.

The increased footprint and depreciation of the fit-out costs

will increase the annual expenditure on premises by approximately

GBP5.0m on a steady state basis. During 2024 the Group will incur

the additional cost of running both premises until the lease on our

current office ends in October 2024.

Business Division Highlights

Banking

Growth in the Bank's client base has continued in the third

quarter, from the existing franchise as well as from new segments,

with deposit growth of GBP218m, to GBP3.5bn as at 30 September

2023. Within the deposit book there are a number of

non-relationship deposits which are expected to exit by the year

end, with the result that the full year deposit growth rate is

expected to slow in the fourth quarter. However, this is not

expected to materially affect the Bank's significant liquidity

surplus against its regulatory requirement.

The cost of deposits has increased steadily throughout the year

and into the third quarter, ultimately narrowing the Bank's net

interest margin, as the lag effect caused by fixed term pricing

unwinds. Further increases in the net cost of deposits are expected

in the fourth quarter but are expected to stabilise in 2024 after

the majority of term deposits are repriced and renewed at current

market rates. The Bank's relationship banking model combined with

competitive pricing supports the strategy to grow relationship

deposits rather than rely on more expensive best buy table deposit

rates. Over the long term, this will provide material value to the

Group in a higher interest rate environment.

The 25bps increase in the Bank of England Base Rate ("base

rate") in the quarter has contributed to higher lending income,

although interest rates have showed signs of stabilising with the

most recent decision to hold the base rate at 5.25% comparing with

a rate of 2.25% twelve months prior.

The loan book is unchanged over the quarter, closing at GBP1.4bn

and continues to perform robustly despite the increased credit risk

inherent in the current environment. This was a result of a

conservative credit appetite, which was tightened over a year ago,

as well as the pressures of a higher interest rate environment on

customers, which have resulted in reduced debt levels that

businesses can raise and sustain, as well as clients paying down

debt from cashflows. Over the next 12 months the Bank's credit

appetite will remain conservative, and capital will only be

deployed where disciplined risk and return hurdles are met, which

is likely to result in a contraction in the Banking loan book.

Wealth Management

Assets under Management closed at GBP1.43bn compared to

GBP1.38bn at the start of the period, as net inflows continued into

the third quarter and market performance was positive.

Whilst the business saw strong inflows, outflows exceeded

forecasts and are tracking above levels observed in the prior year.

This has been largely as a consequence of rising interest rates as

clients elect to pay down debt or revert to holding cash.

Mortgage Portfolio

The mortgage portfolio continues to amortise in line with

expectation. As expected, the effect of rising inflation and

interest rates has resulted in an increase in arrears, however the

portfolio remains well secured with the impact of losses mitigated

by higher income generated from the portfolio.

Renaissance Asset Finance ("RAF")

RAF finished the period with a loan book of GBP176m compared to

GBP157m at the half year, equating to an increase of 12% in the

quarter to 30 September 2023 and a 33% increase since 31 December

2022.

The business continues to build on the momentum generated in the

first half of the year, delivering month-on-month loan book growth

with consistent positive new business levels on the Broker Flow

business, along with a positive pipeline going into the autumn

period.

RAF's Block Discounting business, launched in the prior year,

continues to grow in line with management's expectations.

Arbuthnot Commercial Asset Based Lending ("ACABL")

ACABL maintained its loan book over the quarter to finish at

GBP244m. Mid-market deal-making continues to suffer as sponsors and

investors find it hard to close deals due to ongoing macro

uncertainty and the business has continued to see fewer

transactions that fit within its risk appetite. Despite this, the

business has continued to develop the book; although, the rate of

attrition has been higher. The established loan book has resulted

in an increase in opportunities to support existing clients with

bolt on opportunities and natural growth, as would be expected in a

higher inflation environment, with clients' invoices being at

higher levels than before.

As a consequence of the challenging economic environment, the

business has experienced a number of exit situations, including

where clients have entered administration. However, the business

model to lend against realisable assets has resulted in any

exposures being managed down to avoid any losses.

Asset Alliance ("AAG")

AAG had Assets Available for Lease of GBP276m at 30 September

2023 compared to GBP259m at 30 June 2023 and GBP172m at 31 December

2022, with growth supported by recent portfolio transactions. The

recent base rate increases have resulted in a slowing in demand for

used trucks, as buyers defer decision making as late as possible,

albeit sales continue to achieve targeted margins.

Whilst the overall economic position within the UK remains

challenging, with increased interest rates having an impact on

commercial confidence, truck manufacturers are now reporting close

to pre-COVID supply capacity.

The Directors of the Company accept responsibility for the

contents of this announcement.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

ENQUIRIES:

Arbuthnot Banking Group 020 7012 2400

Sir Henry Angest, Chairman and Chief Executive

Andrew Salmon, Group Chief Operating Officer

James Cobb, Group Finance Director

Grant Thornton UK LLP (Nominated Adviser and AQSE

Corporate Adviser) 020 7383 5100

Colin Aaronson

Samantha Harrison

Ciara Donnelly

Shore Capital (Broker) 020 7408 4090

Daniel Bush

David Coaten

Tom Knibbs

H/Advisors Maitland (Financial PR) 020 7379 5151

Sam Cartwright

Neil Bennett

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

MSCMPBRTMTTBBAJ

(END) Dow Jones Newswires

October 19, 2023 02:00 ET (06:00 GMT)

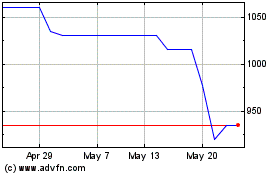

Arbuthnot Banking (AQSE:ARBB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Arbuthnot Banking (AQSE:ARBB)

Historical Stock Chart

From Dec 2023 to Dec 2024