Rogue Baron Plc Audited Annual Accounts to 30 September 2022

01 April 2023 - 3:11AM

UK Regulatory

TIDMSHNJ

For Immediate Release

31 March 2023

ROGUE BARON PLC

("Rogue Baron", "Rogue", "The Group" or "The Company")

Audited Annual Accounts to 30 September 2022

Rogue Baron PLC (AQSE: SHNJ), a leading company in the premium spirit sector is

pleased to announce its audited results for the year ended 30 September 2022.

The Company's annual report and accounts will be dispatched to shareholders

shortly and will be available on the website at https://roguebaron.com/.

Rogue Baron PLC

DIRECTOR'S STATEMENT & STRATEGIC REPORT

For the year ended September 2022

Rogue Baron plc has made substantial progress towards the goals it set out for

2022. In spite of significant global challenges continuing from the Covid

pandemic, not least the lingering disruptions on international shipping in the

early part of the year and high-cost inflation, the Company has been successful

in increasing its global distribution.

2022 remained a difficult time for the bar/restaurant industry. The ability to

hire labour in the industry became extremely hard even at premium pay rates.

This led to the decision to close De Rhum Spot Bar. The sale will have no

effect on Rogue Baron's revenue as the investment was a non-controlling stake.

It will allow management to fully concentrate on its flagship Shinju whisky.

Bars, particularly in a post

covid world, rather than facing inflationary cost pressure, sourcing staff and

spending time and cost on accounting.

From the beginning of 2022 to date, Rogue has placed Shinju in a number of new

markets in the U.S. and has now officially launched the Shinju brand with the

second-largest distributor in the U.S. in November. Starting in only one

market, the plan is to roll out Shinju across the U.S. in 2023 through the

distributor's national footprint. The effect of the new distributor is already

evident despite sales initially in only the Maryland / Washington DC market

with that particular distributor.

The Shinju brand also saw a strong start to sales in the UK, with the launch of

the 8-year-old 'Black Pearl' extension leading the way. The UK distribution

has expanded not least with the availability of Shinju on both Amazon and the

Whisky Exchange. In addition, the UK based brand manager has made good headway

in getting Shinju listed in a number of trade locations in the UK, a majority

in London, as well as pushing additional sales in multiple EU countries where a

number of distribution agreements have also been signed ie Spain, Switzerland

and Austria.

Included in the UK launch was one of the most exciting pieces for the Company,

the introduction of Shinju's first aged extension. Very few of the newer

Japanese whiskies have multiple expressions, especially aged expressions. Aged

Japanese whisky has been in very limited capacity, with many brands having to

pull their aged expressions due to the lack of supply. Rogue feels it is a

perfect time to launch its 8-year old whiskey as aged expressions are in high

demand from customers. The 8-year old whiskey should open many new accounts for

the Company. Part of the sales strategy the Company will employ is requiring

accounts that want the 8-year to also carry the original. This will continue to

increase the sales of the original Shinju expression as well. The 8-year will

carry a premium which will increase the revenues and margins for the Company.

Sales in the period to September 2022 were impacted by not having stock

available in Q1 due to shipping delays, and an intentional slowdown in sales

while we transitioned to our new distributor. Once the transition to the new

distributor was finalized the Company recommenced full sales in October and

sold approximately 930 cases of Shinju in Q4 2022 globally, which was an

increase of approximately 100% compared to the same period in 2021, resulting

in revenues of approximately USD 124,000.

The Company has a positive outlook on 2023 for sales and margins due to

subsiding shipping issues, that the Company has dealt with over the past couple

years. Delays in finding space on ships is starting to ease. This will allow

the Company to maintain consistent supply to meet Shinju's market demand. In

2022, due to shipping delays, the Company went nearly five months without

product available to sell.

Product margins should also increase in 2023 as shipping costs are starting to

come back to pre-Covid levels. In early 2022 the Company shipped a container to

New Jersey and a container to Los Angeles. The cost for just the shipping to

New Jersey was $22,000 and to Los Angeles it was $17,000. Recent container

shipping from Japan is now down to $4,000 - $6,000 per container. This will

make a big difference in the Company's profit margins going forward. The

Company plans to make a big marketing push to increase the velocity and

turnover in its current markets, while also expanding into new markets

Results for the year

The loss before tax for the period amounted to $671,000 (2021: $1,373,000)

which includes staff cost amounting $ 200,000 (2021: $226,000) and professional

and consultancy fees amounting to $201,000 (2021: $233,000).

Net assets have decreased from $4,794,000 to $4,127,000.

Key performance indicators

Due to the size of the Group, the Group currently monitors progress with

particular reference to the following key performance indicators:

Revenue

Revenue from the sales of Shinju has decreased from $236000 to $146,000

reflecting both the shorter trading period and the difficulties experienced

with shipping in the early part of the period.

Loss before taxation

The loss before taxation decreased from $1,339,000 to $676,000 reflecting the

shorter trading period and the non- recurring costs of listing and significant

non-cash loss on the conversion of loan notes in 2021.

Auditors note on Material uncertainty related to going concern

"We draw attention to note 2 in the financial statements, under the heading

'Going concern' concerning the ability of the group and parent company to

continue as a going concern. Based on our discussion with management and our

review of the group and parent company's cash flow forecasts and projections,

it was noted that the Group needs to raise additional funds within twelve

months of the date of the approval of these financial statements.

As stated in note 2, these events or conditions, along with the other matters

as set forth in note 2, indicate that a material uncertainty exists that may

cast significant doubt on the group and company's ability to continue as a

going concern. Our opinion is not modified in respect of this matter.

In auditing the financial statements, we have concluded that the director's use

of the going concern basis of accounting in the preparation of the financial

statements is appropriate. Our evaluation of the directors' assessment of the

group and parent company's ability to continue to adopt the going concern basis

of accounting included;

a. Reviewing management's assessment of going concern.

b. Determining if all relevant information has been included in the assessment

of going concern including completeness of forecasted expenditure.

c. Analysing cash flow forecasts, reviewing the underlying assumptions in

relation to revenue and expenditure and checking mathematical accuracy.

d. Considering the cash position at and after the period end.

e. Reviewing the reasonable worst-case forecast scenario and the financial

resources available to deal with this outcome i.e. ability of the group and

parent company to raise funds.

Our responsibilities and the responsibilities of the directors with respect to

going concern are described in the relevant sections of this report."

Auditors note on Emphasis of Matter - recoverability of inventory

"We draw your attention to Note 3 of the financial statements, which describes

the group's assessment over the inventory balance held in Mexico. The group

have explained their assessment over the recoverability of the inventory in

Mexico of £464,000. within the critical accounting estimates and concluded that

whilst no sales have been recorded to date, the inventory is kept in good

condition and it is the intention of the Directors to commence sales of these

inventories over the medium term. The financial statements do not include any

adjustment that would result if the group was unable to fully recover the

values of the inventories held in Mexico.

Our opinion is not modified in this respect.

Auditors note on Other Matter

"The group and parent company opening balances as at and for the year ended 31

December 2021 had a modified audit report by way of a Disclaimer due to the

fact that we were not able to observe the counting of physical inventories at

the beginning and end of last year.

In addition, management were not able to provide us with all the supporting

documentation to support material receipts and payments relating to one of the

Group's subsidiaries called "1301 Bin" which was a discontinued operation in

the year to 31 December 2021.

However, we were able to resolve these matters during the year, as we have

observed the physical count of inventories as at 30 September 2022 and for the

significant lines of inventory there was no material movement during the

period. Further, Bin 1301 operations were discontinued last year and during the

period Bin 1301 was disposed-of and all balances relating to Bin 1301 are

eliminated from the financial statements of the Group as at 30 September 2022."

The Directors of the Company accept responsibility for the contents of this

announcement.

For further information, please contact:

The Company

Ryan Dolder

rdolder@roguebaron.com

AQSE Corporate Adviser:

Peterhouse Capital Limited

Guy Miller

+44 (0) 20 7469 0936

AQSE Corporate Broker:

Peterhouse Capital Limited

Lucy Williams

+44 (0) 20 7469 0936

GROUP STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 September 2022

Notes Period ended Year ended 31

30 September December 2021

2022

$'000 $'000

Revenue 4 146 299

Cost of sales (103) (236)

Gross Profit 43 63

IPO and related extraordinary costs - (358)

Payments made in shares - (440)

Share based payments 16 (4) -

Other administrative expenses 4 (728) (582)

Exchange differences movement 85 (7)

Total administrative expenses (647) (1,387)

Operating loss (604) (1,324)

Finance cost - (15)

Loss before taxation (604) (1,339)

Tax charge 5 - -

Loss after taxation (604) (1,339)

Profit from assets held for sale 7 (2) 3

Loss for the year (606) (1,336)

Other comprehensive income for the

period / year

(65) (37)

Exchange difference on translating

foreign operations

Total comprehensive loss for the period (671) (1,373)

/ year

Loss attributable to

- Non-controlling shareholders 17 14 36

- Equity holders of the parent (685) (1,372)

(671) (1,336)

Total comprehensive loss attributable

to

- Non-controlling shareholders 17 14 36

- Equity holders of the parent (685) (1,409)

(671) (1,373)

Total earnings per ordinary share

Basic and diluted loss per share 9 (0.67) (1.69)

(cents) from continuing operations

Basic and diluted loss per share 9 (0.00) 0.00

(cents) from operations held for sale

The activities of Legacy Group LLC are classified as held for sale in 2021 (see

Note 7).

As permitted by section 408 of the Companies Act 2006, the parent company's

profit and loss account has not been included in these financial statements.

The loss after taxation for the financial year/period for the parent company

was $471,000 (2021: $1,208,000).

GROUP STATEMENT OF Group Group Company Company

FINANCIAL POSITION

At 30 September 2022

30 September 31 December 30 September 31 December

2022 2021 2022 2021

ASSETS Notes $'000 $'000 $'000 $'000

Non-current assets

Goodwill 10 - -

1,239 1,464

Intangible assets 10 - -

2,352 2,352

Investment in 10 - - 4,353 4,362

subsidiaries

3,591 3,816 4,353 4,362

Current assets

Inventories 11 659 717 - -

Assets held for sale 7 - 75 - -

Receivable on sale of 75 - - -

subsidiaries

Trade and other 12 268 325 522 631

receivables

Cash and cash 43 246 40 233

equivalents

Total current assets

1,045 1,363 562 864

Total assets 4,636 5,179 4,915 5,226

LIABILITIES

Current liabilities

Trade and other 13 342 39 245 35

payables

Loans payable 14 167 156 167 156

Liabilities of assets 7 - 190 - -

held for resale

Total current 509 385 412 191

liabilities and

total liabilities

EQUITY

Share capital 15 119 119 119 119

Share premium 6,627 6,627 6,627 6,627

Share based payment 16 4 - 4 -

reserve

Exchange reserve (242) (177) (242) (177)

Retained deficit (2,353) (1,734) (2,005) (1,534)

Equity attributable to 4,155 4,835 4,503 5,035

the equity holders of

the Company

Non-controlling 17 (27) (41) - -

interest

Total equity 4,128 4,794 4,503 5,035

Total equity and

liabilities 4,636 5,179 4,915 5,226

END

(END) Dow Jones Newswires

March 31, 2023 12:11 ET (16:11 GMT)

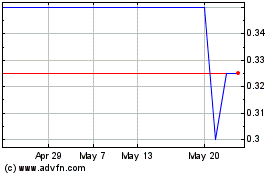

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Nov 2024 to Dec 2024

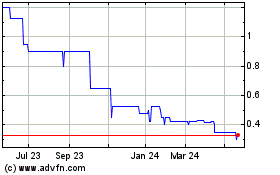

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Dec 2023 to Dec 2024