Pasinex Announces First Quarter 2021 Financial Results

29 May 2021 - 7:30AM

Pasinex Resources Limited (CSE: PSE) (FSE: PNX) (The “Company” or

“Pasinex”) today reports the Company’s financial and operating

results for the three months ended March 31, 2021.

Andrew Gottwald, Chief Financial Officer of

Pasinex, commented, “The first quarter of 2021 was a continuation

of the building that occurred in 2020. The dewatering of the fourth

adit, although not complete, has allowed for access to sulphide

product located at the 625-metre level. There should be sufficient

sulphide product at the 625-metre level to mine until the fourth

adit development is complete, to make up for the originally

forecasted sulphide product production. With zinc prices having

rebounded together with increased tonnage available for sale, this

should lead to improved sales metrics and cash flow in 2021.”

Highlights – First Quarter

2021

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2021 |

|

|

2020 |

|

|

Financial: |

|

|

|

|

Equity gain from Horzum AS |

|

$ |

32,232 |

|

$ |

3,298 |

|

|

Adjusted equity gain from Horzum AS (1) |

|

$ |

598,869 |

|

$ |

25,435 |

|

|

Dividend received from investment in Horzum AS |

|

$ |

32,232 |

|

$ |

3,298 |

|

|

Consolidated net loss |

|

$ |

(209,646) |

|

$ |

(396,448) |

|

|

Adjusted consolidated net income (loss) (1) |

|

$ |

341,923 |

|

$ |

(340,389) |

|

|

Basic and diluted net loss per share |

|

$ |

0.00 |

|

$ |

0.00 |

|

|

Net cash (used in) provided by operating activities |

|

$ |

(234,543) |

|

$ |

(183,652) |

|

|

Weighted average shares outstanding |

|

|

144,554,371 |

|

|

144,554,371 |

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2021 |

|

|

2020 |

|

|

Horzum AS operational data (100% basis): |

|

|

|

|

Zinc product mined (wet) tonnes |

|

|

2,580 |

|

|

3,797 |

|

|

Zinc product sold (wet) tonnes |

|

|

2,372 |

|

|

1,932 |

|

|

Zinc product sold grade |

|

|

31% |

|

|

30% |

|

|

Gross margin (1) |

|

|

18% |

|

|

13% |

|

|

CAD cost per tonne mined (1) |

|

$ |

429 |

|

$ |

306 |

|

|

USD cash cost per pound of zinc mined (1) |

|

$ |

0.53 |

|

$ |

0.37 |

|

(1) Refer to

Note 1

Financial and Operational

- For the three months ended March

31, 2021, Pasinex incurred a net loss of approximately $210,000

compared with a net loss of approximately $400,000 for the three

months ended March 31, 2020. The year over year decrease of

approximately $200,000 is the result of lower general and

administrative costs, a larger dividend received in 2021 compared

with 2020 and a small recovery of the Horzum AS receivable compared

with a small impairment in 2020.

- The adjusted consolidated net gain

(see note 1) was approximately $340,000 for the three months ended

March 31, 2021, compared with an adjusted consolidated net loss for

the same period in 2020. The adjusted equity gain (see note 1) was

approximately $600,000 for the three months ended March 31, 2021,

compared with approximately $25,000 for the three months ended

March 31, 2020. These non-GAAP measures reflect the Company’s

results without recording the impairment charges and foreign

currency impact related to the Akmetal receivable.

- The operating income in Horzum AS

decreased slightly in the three months ended March 31, 2021,

compared with the prior period, although when adjusting for prior

period adjustments the results in 2021 are improved compared to

2020. The cost of goods sold in 2021 also includes costs related to

the development of the fourth adit, from which no ore product was

mined in the first quarter of 2021. The gross margin (see note 1)

for the three months ended March 31, 2021, increased to 18% from

13% for the same period in 2020.

- Development of the fourth adit was

stopped after reaching approximately 370 metres in the first

quarter of 2021 due to safety concerns after encountering large

volumes of groundwater. As previously disclosed, this was expected

and Horzum AS had started to dewater the area to be able to

continue the adit development. The dewatering process has been

slowed with spring rains having increased the volume of

groundwater. The Company had originally expected to be completed by

the end of May 2021. As of the date of this report, the dewatering

process is continuing. Due to the continued large volumes of ground

water being discharged, the Company is considering completing

additional geoelectrical and hydrogeological studies to help

determine the source of the water. It is now anticipated that the

dewatering process could take an additional six to eight weeks.

Thereafter, it is expected, that an additional two months of

development will be needed to reach the targeted zinc

sulphide.

- The dewatering process at the

fourth adit has enabled Horzum AS to conduct further exploratory

drilling at the 625-meter level. Horzum AS encountered zinc

sulphide at the 625-metre level and started to successfully mine

zinc sulphide product in that area in the first quarter of 2021.

The zinc sulphide product is expected to contain a grade of between

40% to 60% zinc. The ground between the 625-metre level and the

541-metre level has had little exploration to date with the

potential below the 541-metre level completely unknown. The fourth

adit will allow this area to be drilled from underground and will

enable the depth potential to be better delineated.

- Horzum AS completed a total of

approximately 2,800 metres of underground and surface diamond core

drilling and 500 metres of exploration and development adits during

the first quarter of 2021.

- Horzum AS restructured its tax

liabilities in December 2020 as allowed by the Turkish taxation

department. Horzum AS is scheduled to make instalments of its

various tax debts, with each tax debt under its own schedule of 18

equal instalments. Akmetal has paid on behalf of Horzum AS two sets

of instalments during the first quarter of 2021. The first set of

payments was made on March 1, 2021, with the second set on March

31, 2021. The total amount paid was approximately $720,000 (TRY

4.44 million). The amount paid subsequent to the end of the quarter

was approximately $42,600 (TRY 287,000).

- The Company received $175,000

during the first quarter of 2021 and $115,000 subsequent to the

quarter end from shareholder loans.

Note 1 Please note that all

dollar amounts in this news release are expressed in Canadian

dollars unless otherwise indicated. Refer also to the first quarter

2020 Management’s Discussion and Analysis (MD&A) and Audited

Financial Statements found on SEDAR.com for more information. This

news release includes non-GAAP measures, including adjusted equity

gain from Horzum AS, adjusted consolidated net income, gross

margin, cost per tonne mined and US$ cash cost per pound of zinc

mined. A reconciliation of these non-GAAP measures to the GAAP

financial statements is included in the MD&A.

About Pasinex

Pasinex Resources Limited is a Toronto-based

mining company that owns 50% of the producing Pinargozu high-grade

zinc mine and, under a Direct Shipping Program, sells to zinc

smelters/refiners from its mine site in Turkey. The Company also

holds an option to acquire 80% of the Spur high-grade zinc

exploration project in Nevada. Pasinex has a strong technical

management team with many years of mineral exploration and mining

project development experience. The mission of Pasinex is to build

a mid-tier zinc company based on its mining and exploration

projects in Turkey and Nevada.

Visit our website at www.pasinex.com.

On Behalf of the Board of

DirectorsPASINEX RESOURCES LIMITED

“Andrew Gottwald”

|

Andrew Gottwald |

Evan White |

| Chief Financial Officer |

Manager of Corporate

Communications |

| Phone: +1 416.861.9659 |

Phone: +1 416.906.3498 |

|

Email: info@pasinex.com |

Email:

evan.white@pasinex.com |

The CSE does not accept responsibility for the

adequacy or accuracy of this news release.This news release

includes forward-looking statements that are subject to risks and

uncertainties. Forward-looking statements involve known and unknown

risks, uncertainties, and other factors that could cause the actual

results of the Company to be materially different from the

historical results or any future results expressed or implied by

such forward-looking statements.All statements within, other than

statements of historical fact, are to be considered

forward-looking. Although Pasinex believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not a guarantee of

future performance, and actual results or developments may differ

materially from those in forward-looking statements. Factors that

could cause actual results to differ materially from those in

forward-looking statements include market prices, continued

availability of capital and financing, exploration results, and

general economic, market or business conditions. There can be no

assurances that such statements will prove accurate and, therefore,

readers are advised to rely on their own evaluation of such

uncertainties. We do not assume any obligation to update any

forward-looking statements.

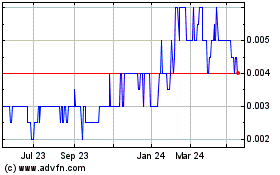

PNX Metals (ASX:PNX)

Historical Stock Chart

From Jan 2025 to Feb 2025

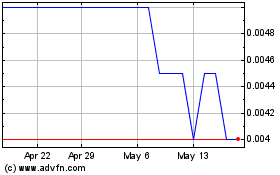

PNX Metals (ASX:PNX)

Historical Stock Chart

From Feb 2024 to Feb 2025