Mangata Finance’s Polkadot-based Efficient, MEV-Free DEX Coming June 6th

13 May 2022 - 4:01AM

NEWSBTC

Mangata Finance, the Polkadot-based DEX, is all set for launch on

June 6th. Recently, it had a successful crowdloan that was closed

in just under an hour that secured it a slot on Polkadot’s

innovation network Kusama. Over $2 million in value was bonded

through the crowdloan, a process of staking Polkadot (DOT) tokens

to support a specific project in the Polkadot Slot Auction, in

return for which participants receive rewards from the projects.

The project also raised $4.2 million in equity, which came shortly

after the launch of its first blockchain on the Kusama network,

which raised the Polkadot startup’s valuation to $60 million. New

investors including Signum Capital, IVC, Figment, ZMT Capital,

AngelDAO, and Paribu Ventures joined the returning investors

Altonomy, Polychain, and TRGC in this strategic round. “Altonomy

believes in Mangata’s efforts around connecting major blockchains,

improving security for traders, and helping reduce fees by

eliminating gas from the equation, which is why we returned for a

second round of funding,” said Altonomy Director Ricky Li. Olaf

Carlson-Wee, the founder and CEO of investment firm Polychain

Capital, was actually the first one to fund Mangata’s vision of

efficient DEXes without MEV. Leveraging Polkadot Interoperability

The Slovakia-based Mangata is both a blockchain and DEX that will

be connected as a parachain in the Polkadot ecosystem. By choosing

Polkadot for its multi-purpose DEX, Mangata wants to leverage the

key value proposition of Polkadot, which is interoperability.

Polkadot is a layer 1 blockchain network designed to support

various interconnected, application-specific chains called

parachains. Each chain built within its network uses the Substrate

modular framework of Parity Technologies, allowing developers to

select specific components that suit their chain the best and

optimize their chains for specific use-cases This entire ecosystem

of parachains plugs into a single base platform called Relay Chain.

This base platform is responsible for providing security to the

network’s parachains and contains Polkadot’s consensus and voting

logic. Mangata is a one-stop-shop for easy and secure trading of

Polkadot (DOT) assets while serving as a bridge between Ethereum

and Polkadot so that assets can be seamlessly migrated on-demand

between the two ecosystems. It is actually the first parachain to

build a specialized ETH <> Polkadot trading UI. Besides

connecting these two significant blockchains, Magnata connects

other popular layer 1 blockchains; Cosmos, Solana, and Avalanche.

Novel Proof of Liquidity Mechanism Founded in 2020 by Peter Kris,

who previously founded European web3 studio Block Unison, and CTO

Gleb Urvanov, a computer scientist, Mangata aims to solve some of

the biggest problems in terms of insider trading and institutional

adoption that DeFi and the crypto market faces at large. Other

barriers to mainstream DEX adoption involve complex structure,

price oracle manipulation, and flash loan attacks. With a team of

14 people, which includes software engineers, product designers,

blockchain experts, and business strategists, Mangata believes it

is uniquely positioned to deliver on its goal of eliminating these

problems. To advance the adoption of DeFi and crypto, Mangata will

be using its funding to offer low fixed fees per operation, capital

efficiency via on-chain limit orders, and MEV prevention while

providing the first UI to trade ERC20 tokens with native Polkadot

assets. This community-driven DEX is secured through its unique

Proof of Liquidity mechanism, which reuses liquidity to ensure

chain security. This helps create deeper liquidity pools, increases

capital efficiency, and allows stakers to be rewarded twice.

“Mangata’s unique Proof-of-Liquidity mechanism raises the bar on

chain security and staking rewards, and our no-gas economy does

away with slow, expensive settlements rampant on other blockchains.

This latest round of funding will enable us to continue our mission

to create a better crypto market for everybody within the Polkadot

ecosystem and beyond,” said CEO Kris. Moreover, the project

deliberately does not support smart contracts, self-executing

contracts directly written into lines of code, to further shield

itself from exploitation by malicious actors or bots. The first

production-ready Layer-1 DEX blockchain also prevents dominant

forms of price manipulation and maximal extractable value (MEV).

While other blockchains are vulnerable to frontrunning bots,

Mangata DEX stops them on the consensus layer with a new block

production method, Themis architecture, which makes frontrunning

next to impossible. On top of all these benefits, Mangata’s design

eliminates gas from the swaps equation entirely, while other

blockchains like Ethereum charge extremely high gas fees, pricing

out small users. This allows for faster settlements at no

additional cost, as well as new strategies like dollar-cost

averaging. Algorithmic buy & Burn The way the DEX is designed

ensures fixed fees while providing greater control over trading

costs and increased opportunities for arbitrage. Besides addressing

the limitations of DeFi, Mangata has also implemented a novel

algorithmic buy and burn mechanism that will reflect the protocol’s

success in the price of its native token MGX. The way this

mechanism works is 0.05% of the 0.3% commission charged by Mangata

X will be used for this algorithmic buy and burn. Meanwhile, 0.2%

will go to liquidity providers as LP fees and 0.05% to the

Treasury. MGX is hard-capped at 4 billion, and right at the launch,

1 billion MGX will be released to allow for deep liquidity. Eighty

percent of MGX tokens’ supply will actually be distributed to the

community, out of which 30% is set aside for validation rewards,

and 37.5% is for LP rewards. Now, ahead of its launch, Mangata is

partnering with other DeFi protocols like Acala, Oak Network,

Bifrost and Moonriver as it moves forward to make the cross-chain

future happen and allow tokens to flow freely from one blockchain

to the other. All in all, Magnata aims to create a high-quality

trading system that facilitates community access to early-stage

Polkadot projects.

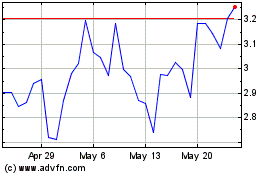

BOND (COIN:BONDDUSD)

Historical Stock Chart

From May 2024 to Jun 2024

BOND (COIN:BONDDUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024