Why XRP Could Be 10X Bigger Than Apple And Nvidia, According To Wealth Guru

24 December 2024 - 6:00PM

NEWSBTC

Ripple’s XRP has been the subject of recent media attention, and

for good reason. The cryptocurrency has experienced a significant

increase in 2024, with a gain of over 258% since the start of the

year. XRP’s price had risen significantly from its low of $0.22 in

early 2021 to approximately $2.30 as of mid-December. XRP has now

surpassed stablecoin Tether (USDT) to become the third-largest

cryptocurrency by market capitalization, a testament to its

extraordinary growth. Related Reading: XRP Historic Moment Coming

In 2025? This Crypto Exchange Believes So Linda Jones, a well-known

wealth mentor, has just lately delivered her most current

newsletter, which has generated a great deal of excitement among

members of the international crypto community. The Beginning Of A

New Technology Cycle Jones underscores that we are at the inception

of a new technological cycle. She contends that digital assets are

poised to revolutionize asset tokenization and money, much like the

internet transformed communication. An excerpt from my weekly

newsletter today: Digital assets should outperform tech stocks like

the Magnificent 7 (Apple, Alphabet, Google, Tesla, Meta, Amazon and

Nvidia) by possibly as much as 10x, in my opinion. Why? There are

seven reasons I can think of: 1. We are early… — Linda P. Jones

(@LindaPJones) December 19, 2024 Investors who are prepared to

adopt this emergent asset class may capitalize on substantial

growth prospects as a result of this transformation. Jones

emphasizes that digital assets have historically been the most

successful asset class, with Bitcoin experiencing nearly 30,000%

increase over the past decade and XRP following closely behind with

a 35,000% increase during the same period. Unexploited Market

Potential The current low adoption rate of digital assets is one of

Jones’s most compelling arguments. She observes that only 5% of

individuals worldwide have invested in cryptocurrencies, indicating

a vast untapped market that is awaiting development. Retail

investors are currently better positioned than institutional

players since they cannot fully enter the market because of

regulatory barriers. However, Jones expects that institutional

capital will soon flood the market in response to the expected

regulations on crypto and stablecoins by early 2025. The recent

proposal by US President-elect Donald Trump to exempt capital gains

on digital assets situated in the United States from taxation

serves to bolster this optimism. This policy has the potential to

substantially increase the potential of American projects such as

XRP and Cardano (ADA) by redirecting investments toward them if it

is implemented. Related Reading: Can Ethereum Break $3,500 Before

End Of 2024? Analyst Weighs In A Favorable Political Environment

Political change is also favoring digital assets. Jones notes David

Sacks’ appointment as Crypto and AI czar, citing his pro-crypto

stance as PayPal COO. This leadership change shows a commitment to

promoting cryptocurrencies. $XRP gonna make history next year —

Bitstamp (@Bitstamp) December 20, 2024 Moreover, Congress has

lately grown much more pro-crypto, creating an environment fit for

regulatory clarity and expansion. As XRP and other digital assets

gather pace in front of changing rules and more investor trust,

Jones expects 2025 to be a decisive year for them. Other business

leaders share her feelings; they believe that XRP may become

historical in this year. Featured image from DALL-E, chart from

TradingView

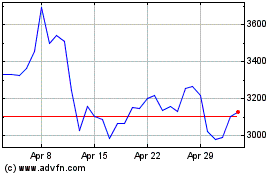

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024