Aptos Outperforms Broader Market By 18% – Here’s Why

14 October 2024 - 1:00AM

NEWSBTC

With the market correction still felt by most of the altcoin

market, Aptos rose through the ranks clutching a win for investors

and traders. APT bulls pulled through, with the latest market data

marking an 18% uptick in value since last week, a sign that the

token might continue to push through the bearish onslaught plaguing

the broader market. Related Reading: Whales Hoard $90 Million In

Bitcoin: A Sign Of What’s To Come? Although APT’s movement has

garnered much-deserved attention, it remains to be seen whether the

sudden flip in sentiment is a solid move toward a better position.

Recent developments have shown that Aptos’s recent price move is

the start of an upward trajectory that will place the token at the

forefront of investors’ and traders’ attention. Aptos Q2

Performance Boosts Retail Interest Recently, Messari released an

ecosystem review on Aptos. The quarter posted excellent growth

across almost every metric on the platform. DeFi numbers have also

been up on Aptos. TVL on the platform has risen by 123% QoQ. As of

writing, Aptos stands proud with $716 million in TVL and increased

more than 11% in the last 24 hours. This growth was primarily due

to the gradually growing user base of the platform. Average daily

new addresses have been recorded to have grown by 43% QoQ, which

indicates a considerable level of growth in users since the launch.

Over 20 million addresses in less than 2 years. Big math, and big

moves only. Hear from @AptosLabs‘ CEO & Co-Founder, @moshaikhs,

for more on the rapid growth of the Aptos ecosystem 🌐🙌

https://t.co/klIMVqcQFg — Aptos (@Aptos) October 11, 2024 In a

recent interview, Aptos CEO and Co-founder Mo Shaikh revealed that

the platform is operating for over 20 million addresses in only

under two years. The growth experienced by the platform is largely

due to an emphasis on user experience with Aptos capable of

handling over 10,000 transactions per second, being one of the

fastest L1s available in the market. Rejection On $10.41

Inevitable, Swings Momentum To Short Positions Despite APT’s

astonishing movement in the past 24 hours, APT bulls are in the

middle of a breakthrough attempt on the $10.41 resistance level

that will inevitably reject the current attempt before the token

stabilizes above $9.31 in the medium term. Related Reading: Helium

(HNT) Falters 15% As Crypto Market Tries To Bounce Back With the

token’s relative strength index (RSI) maxed out, APT’s short-term

trajectory can only point downward. As it currently stands, the

token will remain at its current $9.31-$10.41 trading range with

the bulls targeting $10.41 in the medium term. However, investors

and traders should still exercise caution as the token’s RSI

signals that the token’s value will fall. As of writing, the bears

aim to flip the $9.31 support to resistance with a long-term target

of $7.90. If APT does fall below $9.31 in the medium term, investor

sentiment will take a hit possibly leading to a deeper fall.

Featured image from Asia Crypto Today, chart from TradingView

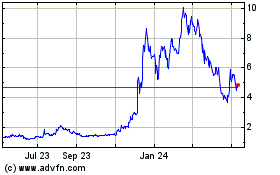

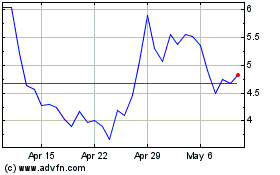

Helium (COIN:HNTUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Helium (COIN:HNTUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025