Cardano Might See A Massive Pump Around November 18 – Analyst Exposes 2020 Similarities

30 October 2024 - 5:00AM

NEWSBTC

The crypto market is heating up, with Bitcoin on the brink of

all-time highs and anticipating a major breakout across assets.

Cardano (ADA) is also at a critical juncture, showing striking

similarities to its price action in 2020—a year that saw ADA

skyrocket by over 4,000% in under 12 months. Related Reading:

If Dogecoin Breaks Above Key Resistance ‘We Could See A 25% Rally’

– Top Analyst Renowned analyst Ali Martinez recently shared a

technical analysis comparing ADA’s current market structure to

November 2020. According to Martinez, ADA’s recent consolidation

around key levels could set the stage for a significant upward

surge, particularly following the upcoming U.S. election.

Martinez’s analysis highlights Cardano’s pattern of explosive

growth after periods of accumulation and points to the potential

for a strong rally if Bitcoin breaks new highs. Investors are now

closely watching ADA’s price movement, eager to see if it can

replicate its historic bull run. As the market prepares for a

possible shift, Cardano’s performance in the coming weeks could

offer insight into broader altcoin momentum in this cycle. The next

moves could be decisive, making ADA one to watch in the rapidly

evolving crypto landscape. Cardano Following 2020 Bullish

Pattern Cardano has captured the attention of analysts and

investors who see its current consolidation as a possible signal of

accumulation, hinting at a strong move up ahead. Well-known analyst

Ali Martinez recently shared a technical analysis on X, comparing

Cardano’s current price behavior and its pattern in 2020—a year in

which ADA experienced an extraordinary 4,000% surge.

According to Martinez, Cardano’s price action is displaying a

similar setup, suggesting the possibility of a breakout around

November 18, roughly two weeks after the U.S. elections. This

timeline aligns with historical patterns, where ADA consolidates

before explosive upward moves. Martinez’s analysis points to a

long-term bullish target of $6.30, representing a potential 2,000%

increase from current levels. He anticipates that if it

materializes, this rally could lead to a market top for Cardano

around September 2025. This prediction is based on ADA’s cyclical

price trends, where significant rallies have historically followed

periods of low volatility and accumulation, driven by market

sentiment and broader crypto adoption. Related Reading: GOAT

Outpaces PEPE Growing To $900M Market Cap In 2 Weeks – Details Many

investors are now watching ADA closely, as such a rally would not

only be significant for Cardano but could signal a broader bullish

momentum across altcoins. Cardano’s current price level has

attracted a mix of institutional and retail investors seeking

opportunities before what could be a substantial move. With

both on-chain data and technical indicators supporting a bullish

outlook, ADA’s upcoming price action may set the tone for the

altcoin market in the coming months. If history repeats, Cardano

could be primed for one of its most powerful surges, attracting new

interest and capital into the ecosystem. ADA Technical Levels

Cardano is trading at $0.346 after experiencing a clear rejection

from the 4-hour 200 exponential moving average (EMA) at $0.351.

This key level has been pivotal, as a break above it and holding it

as support would signal a potential shift toward a short-term

uptrend. For bulls aiming to regain control over ADA’s price

action, establishing a firm foothold above the 200 EMA is

essential, as it would likely attract buying interest and

strengthen upward momentum. Additionally, the $0.37 supply zone

presents another significant hurdle for ADA, as bulls have

struggled to reclaim this level since early October. This

resistance zone has repeatedly capped price action, indicating that

substantial buying pressure is necessary to break through and

sustain gains beyond this mark. A bullish trend could gain traction

if ADA breaches the 200 EMA and the $0.37 supply zone. Related

Reading: Bitcoin Short Positions Face Serious Risk Above $68,500 –

Details However, if these levels remain unclaimed, ADA’s price is

likely to continue consolidating sideways in the near term. Such a

pattern would allow the market to stabilize and potentially attract

fresh demand before attempting another breakout, though it may

delay any significant upward movement for ADA. Featured image from

Dall-E, chart from TradingView

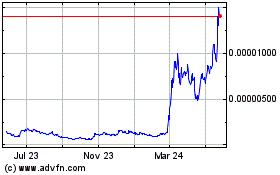

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Oct 2024 to Oct 2024

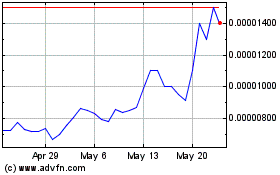

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024