Theta Network Leads Crypto Rally With 60% Price Explosion: Here’s Why

28 February 2024 - 3:00AM

NEWSBTC

Theta Network (THETA), a platform for decentralized video delivery

and edge computing, has seen its price skyrocket by 60% in the past

24 hours. This surge has propelled THETA to become the top gainer

across the entire spectrum of the top 100 cryptocurrencies. The

rally can be attributed to a confluence of factors, notably the

anticipation surrounding the upcoming launch of Theta EdgeCloud in

the next quarter, a broader crypto market uplift led by Bitcoin and

a bullish chart setup for THETA. EdgeCloud Launch Sparks Growth

Catalyst At the heart of Theta Network’s bullish trajectory is the

Theta EdgeCloud project, an ambitious endeavor to establish a

global peer-to-peer cloud computing network. This initiative is

poised to harness the power of user devices to scale blockchain

applications to new heights. The excitement around this development

was heightened by a tweet from Theta developers yesterday, which

stated, “Theta EdgeCloud Phase 1 is coming in Q2! Check out the

preview blog on how Theta EdgeCloud is ushering in a new era of AI

computing.” Theta EdgeCloud Phase 1 is coming in Q2! Check out the

preview blog on how Theta EdgeCloud is ushering in a new era of AI

Computing:https://t.co/kNMYib48RJ — Theta Network (@Theta_Network)

February 26, 2024 Theta’s foray into AI computing aligns with the

current market enthusiasm for AI-related tokens, as evidenced by

the impressive gains of projects like Render Network (RNDR) and

Fetch.Ai (FET). This alignment suggests that Theta’s price surge is

not only a result of its intrinsic value proposition but also its

strategic positioning within the booming AI narrative in the crypto

space. In the newly released blog post, the Theta team elaborated

on EdgeCloud’s mission to democratize access to GPU processing

power for AI and video tasks, offering a cost-effective and

decentralized alternative to traditional cloud computing. This

initiative leverages the Theta Edge Network’s substantial

distributed GPU computing power, which ranks among the world’s

largest, to support a wide range of AI applications, from language

models to text-to-image and text-to-video models. Related Reading:

THETA Breaches $1 Level Courtesy Of Solid On-Chain Developments The

blog further elaborates on the technical prowess of the Theta Edge

Network, highlighting its capacity to support a wide array of AI

applications, thereby democratizing access to GPU processing power.

“This vast processing power […] can deliver upwards of 2500

equivalent NVIDIA A100s, enough to train and serve some of the

largest language models,” the post reads, illustrating the

network’s potential to significantly impact the AI computing

landscape. Theta’s approach to innovation is also reflected in its

patented technology for an edge computing platform supported by a

blockchain network, enabling a new era of hybrid computing

architectures. “This set in motion the capability to build a next

generation hybrid computing architecture,” the team noted.

Technical Analysis Of THETA/USD The Theta token (THETA/USD) has

charted a significant bullish breakout on its 1-week timeframe

chart. Over the past week, the price has surged with an impressive

gain, reflecting a newfound vigor in the buying sentiment. However,

the rally has reached a formidable resistance at $2.28 level, which

acted as a crucial support in early 2022. At press time, THETA was

trading at approximately $2.01, after a massive move from its

recent lows of around $0.55, representing an increase of over 365%

in just 20 weeks. Before the breakout, the 100-week and 200-week

exponential moving averages (EMAs) served as crucial resistance

while the 20-week and 50-week EMAs marked strong support levels.

The breakout above the 100- and 200-week EMA (blue line) can be

seen as a major catalyst. Notably, the relative strength index

(RSI) is currently positioned at approximately 62.6, which is

comfortably below the overbought threshold of 70. This suggests

that there may still be room for upward movement before the market

is considered overextended. Related Reading: Crypto Analyst Sounds

Warning Alarm: Last Chance To Buy Bitcoin And Ethereum Before Bull

Run This thesis is supported by the Fibonacci retracement levels,

drawn from the all-time high to the significant low, which shows

that the Theta price is still in somewhat bearish territory. It

would take a further doubling of the price for THETA to reach the

0.236 level at $4.31911099, which can be seen as major resistance.

However, for this to happen, the $2.28 resistance needs to be

cleared. A decisive weekly close above this level could pave the

way for a test of the 0.382 level at $6.64707545, followed by the

0.5 and 0.618 levels at $8.5285097 and $10.41008649, respectively.

Conversely, a rejection at the current level could see a retest of

the 200-week EMA. The volume indicator shows a modest increase in

trading volume accompanying the recent price spike, which lends

credence to the breakout. However, traders and investors will be

closely monitoring this metric to confirm whether the momentum has

the conviction to break through the current resistance zone.

Featured image from Binance US Blog, chart from TradingView.com

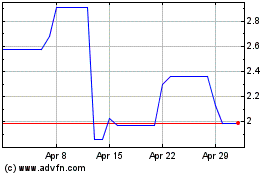

Theta (COIN:THETAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Theta (COIN:THETAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024