Coface : 2024 results: net income at €261.1m, up 8.6%, and proposed

dividend at €1.40

2024 results: net income at €261.1m, up

8.6%, and proposed dividend at €1.40

Paris, 20 February 2025 –

17.35

- Turnover: €1,845m, down

-0.6% at constant FX and perimeter and down -1.3% on a reported

basis

- Trade credit insurance revenue

decreased by -2.2% at constant exchange rates, with slightly

positive customer activity in Q4-24

- Client retention is still high at

92.3% but down slightly from 2023 records; pricing remained

negative at -1.4%, in line with historical trends

- Business information once again

recorded double-digit growth (+16.3% at constant FX); factoring

stabilised at +0.3% with solid growth in Q4-24

- Net loss ratio at 35.2%,

improved by 2.5 ppts; net combined ratio at 65.5%, up

1.2 ppt

- Gross loss ratio at 33.4%, improved

by 2.4 ppts with still high opening year reserving and high reserve

releases

- Net cost ratio increased by

3.6 ppts to 30.2%, reflecting slightly lower revenues and

continued investment, in line with our strategy

- Net combined ratio in Q4-24 at

68.7%, up 9.7 ppts due to a higher net cost ratio and a very low

combined ratio in Q4-23 (59.0%)

- Net income (group share) of

€261.1m, up +8.6%, of which €53.4m in Q4-24, the highest annual

figure since the adoption of IFRS 17. Annualised

RoATE1 at

13.9%

- Coface continues to be

backed by a solid balance sheet:

- Estimated solvency ratio at

~196%2, above the upper end of target range (155% to

175%)

- Proposal to distribute3

a dividend per share of €1.40 representing an 80% pay-out

ratio

- Earnings per share reached

€1.75

- Coface signed the

acquisition of Cedar Rose, strengthening its capabilities in

information services in the Middle East and Africa

- Gonzague Noël has been

appointed as Group Chief Operating Officer (COO)

Unless otherwise indicated, change comparisons

refer to the results as at 31 December 2023

Xavier Durand, Coface’s Chief Executive

Officer, commented:

“2024 was marked by the launch of our Power the Core

strategic plan which is deliberately focused on

innovation.

In an environment characterised by weak economic growth, a

decrease of our clients’ activity and an increase in the number of

bankruptcies, the discipline of our underwriting enabled us to

contain the increase in the combined ratio, which rose moderately

to 65.5%. Finally, we benefited from the repositioning of our

investment portfolio to achieve a return on average tangible equity

of 13.9%, above our mid-cycle targets. The net income of €261m

marked the highest level since the transition to

IFRS 17.

All these achievements would not have been possible without the

engagement of our employees.

These good results and solid solvency ratio of 196% allow us to

propose the payment of a dividend of €1.40 per share to the

Shareholders’ meeting.”

Key figures at 31 December

2024

The Board of Directors

of COFACE SA approved the consolidated financial statements at 31

December 2024 at its meeting of 20 February 2025. The Audit

Committee at its meeting on 18 February 2025 also previously

reviewed them. Accounts are non-audited, certification is in

progress.

| Income

statements items in €m |

2023 |

2024 |

Variation |

% ex. FX* |

|

Insurance revenue |

1,559.1 |

1,512.9 |

(3.0)% |

(2.2)% |

| Services

revenue |

309.2 |

331.9 |

+7.4% |

+7.4% |

|

REVENUE |

1,868.2 |

1,844.8 |

(1.3)% |

(0.6)% |

|

UNDERWRITING INCOME/LOSS AFTER REINSURANCE |

395.4 |

368.7 |

(6.8)% |

(5.3)% |

| Investment

income, net of management expenses, excluding finance costs |

12.4 |

91.7 |

638.0% |

595.7% |

|

Insurance Finance Expenses |

(40.0) |

(42.5) |

6.4% |

12.9% |

|

CURRENT OPERATING INCOME |

367.9 |

417.9 |

+13.6% |

+12.8% |

| Other

operating income / expenses |

(5.0) |

(8.6) |

74.5% |

74.2% |

|

OPERATING INCOME |

362.9 |

409.2 |

+12.8% |

+12.0% |

|

NET INCOME (GROUP SHARE) |

240.5 |

261.1 |

+8.6% |

+6.3% |

| |

|

|

|

|

| Key

ratios |

2023 |

2024 |

Variation |

|

Loss ratio net of reinsurance |

37.7% |

35.2% |

(2.5)% |

ppts |

| Cost ratio net

of reinsurance |

26.6% |

30.2% |

3.6% |

ppts |

|

COMBINED RATIO NET OF REINSURANCE |

64.3% |

65.5% |

1.2% |

ppt |

| |

|

|

|

|

|

Balance sheet items in €m |

2023 |

2024 |

Variation |

|

Total equity (group share) |

2,050.8 |

2,193.6 |

+7.0% |

|

Solvency ratio |

199% |

196%1 |

-3 ppt |

* Also excludes scope impact

1 This estimated

solvency ratio constitutes a preliminary calculation made according

to Coface’s interpretation of Solvency II regulations and using the

Partial Internal Model. The final calculation may differ from this

preliminary calculation. The estimated solvency ratio is not

audited.

1. Turnover

In 2024, Coface recorded a consolidated turnover

of €1,844.8 million, down by -0.6% at constant FX and

perimeter compared to 2023. As reported (at current FX and

perimeter), turnover was down -1.3%.

Revenue from insurance activities (including

bonding and Single Risk) fell -2.2% at constant FX and perimeter,

although the year ended on a slightly more positive note (Q4-24

revenue from insurance activities rose +3.7% and total revenue

increased +4.3%). Client retention remains high at 92.3% (but down

from the record level in 2023), in a competitive market where

Coface implemented risk mitigation plans that impacted renewals at

the beginning of the year. New business rose to €126m, up €9m

compared to 2023 driven by an increase in demand and the positive

effects of investments for growth, mainly in the mid-market

segment.

Client activity grew modestly at 0.5%, below the

historical average with an improvement in Q4-24 (+0.4%). Over the

year, the decline in activity in the metals sector, with lower

prices, partially offset the positive trend in the agri-food

sector. The price effect remained negative at -1.4% in 2024 (vs.

-1.9% in 2023), in line with long-term trends.

Turnover from non-insurance activities was up

+8.2% compared to 2023. Factoring turnover stabilised at +0.3% with

a positive Q4-24 that reversed the full-year trend. Information

services turnover rose +16.3%. Fee and commission income (debt

collection commissions) increased by +19.6%, from a low base, due

to the increase in claims to be collected and investments made in

third-party debt collection. Commissions were up +6.6%.

Total revenue - in €m

(by country of invoicing) |

2023 |

2024 |

Variation |

% ex. FX4 |

|

Northern Europe |

379.6 |

362.2 |

(4.6)% |

(4.6)% |

|

Western Europe |

380.1 |

391.8 |

+3.1% |

+0.4% |

|

Central & Eastern Europe |

177.1 |

173.8 |

(1.9)% |

(3.2)% |

|

Mediterranean & Africa |

526.3 |

538.5 |

+2.3% |

+5.6% |

|

North America |

171.8 |

176.6 |

+2.7% |

(6.4)% |

|

Latin America |

100.3 |

77.7 |

(22.5)% |

+4.0% |

|

Asia-Pacific |

133.1 |

124.3 |

(6.6)% |

(7.1)% |

|

Total Group |

1,868.2 |

1,844.8 |

(1.3)% |

(0.6)% |

In Northern Europe, turnover was down by -4.6%

at constant and current FX, due to the selective non-renewal of

some loss-making policies at the beginning of the year, despite the

stabilisation of client activity in Q4-24.

In Western Europe, turnover increased by +0.4%

at constant FX (+3.1% at current FX and perimeter following the

integration of certain African countries in the first half of the

year) thanks to a sharp increase in information services sales

(+30.3%) combined with a better Q4-24 in credit insurance under the

effect of significant business catch-up.

In Central and Eastern Europe, turnover fell

-3.2% at constant FX (-1.9% at current FX) due to the decline in

client activity, which weighed on credit insurance, despite a high

client retention rate. Factoring was down -1.0% at constant

exchange rates.

In the Mediterranean and Africa region, which is

driven by Italy and Spain, turnover rose +5.6% at constant FX and

+2.3% at current FX driven by robust sales in credit insurance and

services and a stronger economic environment.

In North America, turnover was down -6.4% at

constant FX but increased by +2.7% at current FX due to the

integration of Mexico in this scope. The region saw a slowdown in

client activity despite higher retention and a fairly strong

economic environment.

In Latin America, turnover rose +4.0% at

constant FX but fell -22.5% at current FX. The region is benefiting

from a recovery in client activity after 2023 was dominated by risk

prevention actions. However, the transfer of Mexico to the North

America region had a negative impact.

In Asia-Pacific, turnover decreased by -7.1% at

constant FX and -6.6% at current FX. This lower turnover was due to

a slowdown in client activity that robust sales were unable to

offset and selective non-renewal of certain policies.

2. Result

The annual combined ratio net of reinsurance was

65.5% in 2024, up 1.2 ppt year on year.

(i) Loss ratio

The gross loss ratio stood at 33.4%, a 2.4 ppts

improvement on the previous year. This improvement reflects both

the gradual normalisation of the loss experience, offset by rising

reserve releases. The amount of claims recorded is now higher than

in 2019. The total number of claims decreased, offset by an

increase in the number of mid-sized claims.

The Group’s provisioning policy remained

unchanged. The amount of provisions related to the underwriting

year, although discounted, reflects the increase in the claims

frequency. Strict management of past claims enabled the Group to

record 51.9 ppts of recoveries.

The net loss ratio improved to 35.2%, down 2.5

ppts compared to 2023.

(ii) Cost ratio

Coface is pursuing a strict cost management

policy and is continuing to invest, in line with its Power the Core

strategic plan. As a result, over the full year 2024, costs rose by

+5.5% at constant FX and perimeter, and by +5.3% at current FX.

The cost ratio before reinsurance was 33.7%, up

2.2 ppts year on year. This rise was mainly due to the decline

in revenues (1.0 ppt), embedded cost inflation (1.5 ppt)

and ongoing investments (1.5 ppt). In contrast, the improved

product mix (information services, debt collection and fee and

commission income) had a positive effect. High reinsurance

commissions explain the remainder of the variation.

Net financial income for 2024 was €91.7m, up

sharply compared to 2023. This figure includes capital gains of

+€11.4m, which more than offset negative market value adjustments

on investments of -€2.9m. The FX effect remained slightly negative

at -€2.7m but improved significantly compared to 2023, which was

marked by the accounting effect of IAS 29 (hyperinflation) in

Turkey and Argentina as well as the sharp devaluation of the

Argentine peso.

The portfolio’s current yield (i.e. excluding

capital gains, depreciation and FX impact) was €96.6m, of which

€25.7m in Q4-24. The accounting yield5, excluding

capital gains and fair value effect, was 2.9% for 2024. The yield

on new investments made year-to-date was 4.1% and fell in Q4-24 in

line with the trend in market rates.

Insurance Finance Expenses (IFE) stood at €42.5m

(€40.0m in 2023).

- Operating income

and net income

Operating income amounted to €409.2m in 2024, up

+12.0% at constant FX.

The effective tax rate was 29% for the year (vs.

27% in 2023), including the impact of Pillar 2 (global minimum

tax).

In total, net income (group share) was €261.1m,

up +8.6% compared to 2023.

3. Shareholders’

equity

At 31 December 2024, Group shareholders’ equity

stood at €2,193.6m, up €142.8m or +7.0% (€2,050.8m at

31 December 2023).

These changes are mainly due to the positive net

income of €261.1m and the dividend payment of -€194.3m. Other items

include changes in unrealised capital gains for €72.0m.

The annualised return on average tangible equity

(RoATE) was 13.9%, up 0.5 ppt mainly due to the improvement in

financial income, which more than offset the decrease in

underwriting income (decline in net premiums and slight increase in

the combined ratio).

The solvency ratio reached 196%6,

representing a decrease of 3 ppts compared to FY-23. It remains

well above the upper end of the target range (155%-175%).

Coface will propose €1.40 dividend per share at

the Shareholders’ meeting, corresponding to a payout ratio of

80%7, in line with its capital management policy.

4. Outlook

Once again, the global economy experienced

modest growth in 2024 (2.7%), in line with Coface’s forecasts and

still driven being by the United States. The electoral calendar,

which involved an unprecedented number of countries, delivered

generally unsurprising outcomes, with some exceptions.

For 2025, Coface is forecasting growth identical

to that of 2024 at 2.7%. Further downgrades to European growth are

likely to be offset by the good performance of the United States,

while political risk remains. Donald Trump’s return to power seems

to have been welcomed by economic circles so far, raising hopes of

deregulation, which is stimulating in the short term but often

carries longer-term risks. The announced introduction of tariffs

for many countries is also a destabilising factor for global

trade.

Against this backdrop, Coface is anticipating a

continued rise in bankruptcies, as businesses are caught between

depleted levels of cheap financing and sluggish growth. Coface and

its teams will continue to support their clients in this still

uncertain environment.

At the end of 2024, client activity finally

posted a slightly positive performance after several quarters of

decline. This slight rebound may give hope that the post-Covid

decline in client activity has come to an end. In 2025, Coface will

continue to implement its Power the Core strategic plan, which aims

to develop a leading global ecosystem in credit risk

management.

5. Governance

evolution

In the Executive Committee:

- As of February

1st, 2025, Carole Lytton leads the Specialties

Businesses, in addition to her role as General Secretary. She takes

over from Antonio Marchitelli who decided to leave and take another

appointment outside Coface after many years of dedication to the

Group.

- As of February

3rd, Gonzague Noël has been appointed as Group Chief

Operating Officer (COO). He takes over Declan Daly, joins the Group

executive committee and reports to Xavier Durand, Coface CEO.

Conference call for financial

analysts

Coface’s results for FY-2024 will be discussed

with financial analysts during the conference call on Thursday, 20

February 2025 at 18.00 (Paris time). Dial one of the following

numbers:

- By webcast:

Coface FY-2024 results - Webcast

- By telephone

(for sell-side analysts): Coface FY-2024 - conference call

The presentation will be available (in English

only) at the following address:

http://www.coface.com/Investors/financial-results-and-reports

Income

statements items in €m

Quarterly figures |

Q1-23 |

Q2-23 |

Q3-23 |

Q4-23 |

Q1-24 |

Q2-24 |

Q3-24 |

Q4-24 |

|

% |

%

ex. FX* |

|

Insurance revenue |

395.3 |

407.8 |

384.7 |

371.3 |

378.6 |

375.6 |

375.9 |

382.7 |

|

+3.1% |

+3.7% |

| Other

revenue |

79.8 |

76.8 |

73.4 |

79.2 |

85.0 |

83.4 |

78.0 |

85.5 |

|

+8.0% |

+7.6% |

|

REVENUE |

475.1 |

484.5 |

458.1 |

450.4 |

463.7 |

459.1 |

453.8 |

468.3 |

|

+4.0% |

+4.3% |

UNDERWRITING INCOME (LOSS)

AFTER REINSURANCE |

95.3 |

103.5 |

91.2 |

105.4 |

100.3 |

94.7 |

88.8 |

84.9 |

|

(19.5)% |

(17.9)% |

|

Investment income, net of management expenses, excluding finance

costs |

(2.6) |

4.0 |

13.0 |

(2.0) |

17.9 |

22.8 |

19.0 |

31.9 |

|

(1667)% |

(1568)% |

|

Insurance Finance Expenses |

(2.4) |

(12.3) |

(15.4) |

(9.9) |

(11.4) |

(6.7) |

(7.3) |

(17.1) |

|

+73.3% |

+77.9% |

|

CURRENT OPERATING INCOME |

90.4 |

95.2 |

88.9 |

93.5 |

106.8 |

110.9 |

100.5 |

99.7 |

|

+6.7% |

+7.9% |

| Other

operating income / expenses |

(0.3) |

(0.4) |

(0.2) |

(4.0) |

(0.1) |

(0.5) |

(2.6) |

(5.5) |

|

+38.3% |

+36.4% |

|

OPERATING INCOME |

90.0 |

94.8 |

88.6 |

89.5 |

106.8 |

110.4 |

97.9 |

94.2 |

|

+5.2% |

+6.6% |

|

NET INCOME (GROUP SHARE) |

61.2 |

67.7 |

60.9 |

50.8 |

68.4 |

73.8 |

65.4 |

53.4 |

|

+5.1% |

+4.9% |

| Income tax

rate |

25.5% |

21.9% |

24.2% |

36.0% |

27.2% |

26.8% |

25.5% |

36.2% |

|

+0.2 ppt |

Appendices

Quarterly results

Cumulated results*

Income

statements items in €m

Cumulated figures |

Q1-23 |

H1-23 |

9M-23 |

2023 |

Q1-24 |

H1-24 |

9M-24 |

2024 |

|

% |

%

ex. FX* |

|

Insurance revenue |

395.3 |

803.1 |

1,187.8 |

1,559.1 |

378.6 |

754.3 |

1,130.2 |

1,512.9 |

|

(3.0)% |

(2.2)% |

| Other

revenue |

79.8 |

156.6 |

230.0 |

309.2 |

85.0 |

168.5 |

246.4 |

331.9 |

|

+7.4% |

+7.4% |

|

REVENUE |

475.1 |

959.7 |

1,417.8 |

1,868.2 |

463.7 |

922.7 |

1,376.6 |

1,844.8 |

|

(1.3)% |

(0.6)% |

UNDERWRITING INCOME (LOSS)

AFTER REINSURANCE |

95.3 |

198.8 |

290.0 |

395.4 |

100.3 |

195.0 |

283.8 |

368.7 |

|

(6.8)% |

(5.3)% |

|

Investment income, net of management expenses, excluding finance

costs |

(2.6) |

1.4 |

14.5 |

12.4 |

17.9 |

40.8 |

59.8 |

91.7 |

|

+638.0% |

+595.7% |

|

Insurance Finance Expenses |

(2.4) |

(14.7) |

(30.1) |

(40.0) |

(11.4) |

(18.1) |

(25.4) |

(42.5) |

|

+6.4% |

+12.9% |

|

CURRENT OPERATING INCOME |

90.4 |

185.5 |

274.4 |

367.9 |

106.8 |

217.7 |

318.2 |

417.9 |

|

+13.6% |

+12.8% |

| Other

operating income / expenses |

(0.3) |

(0.7) |

(0.9) |

(5.0) |

(0.1) |

(0.5) |

(3.1) |

(8.6) |

|

+74.5% |

+74.2% |

|

OPERATING INCOME |

90.0 |

184.8 |

273.4 |

362.9 |

106.8 |

217.2 |

315.1 |

409.2 |

|

+12.8% |

+12.0% |

|

NET INCOME (GROUP SHARE) |

61.2 |

128.8 |

189.7 |

240.5 |

68.4 |

142.3 |

207.7 |

261.1 |

|

+8.6% |

+6.3% |

| Income tax

rate |

25.5% |

23.7% |

23.8% |

26.8% |

27.2% |

27.0% |

26.5% |

28.7% |

|

+1.9 ppt |

|

* Also excludes scope impact

CONTACTS

ANALYSTS / INVESTORS

Thomas JACQUET: +33 1 49 02 12 58 – thomas.jacquet@coface.com

Rina ANDRIAMIADANTSOA: +33 1 49 02 15 85 –

rina.andriamiadantsoa@coface.com

MEDIA RELATIONS

Saphia GAOUAOUI: +33 1 49 02 14 91 – saphia.gaouaoui@coface.com

Adrien BILLET: +33 1 49 02 23 63 – adrien.billet@coface.com

FINANCIAL CALENDAR 2025

(subject to change)

Q1-2025 results: 5 May 2025 (after market

close)

Annual General Shareholders’ Meeting: 14 May 2025

H1-2025 results: 31 July 2025 (after market close)

9M-2025 results: 3 November 2025 (after market close)

FINANCIAL INFORMATION

This press release, as well as COFACE SA’s integral regulatory

information, can be found on the Group’s website:

http://www.coface.com/Investors

For regulated information on Alternative

Performance Measures (APM), please refer to our Interim Financial

Report for H1-2024 and our 2023 Universal Registration Document

(see part 3.7 “Key financial performance indicators”).

|

|

Regulated

documents posted by COFACE SA have been secured and authenticated

with the blockchain technology by Wiztrust.

You can check the authenticity on the website

www.wiztrust.com. |

COFACE: FOR TRADE

As a global leading player in trade credit risk management for more

than 75 years, Coface helps companies grow and navigate in an

uncertain and volatile environment.

Whatever their size, location or sector, Coface provides 100,000

clients across some 200 markets. with a full range of solutions:

Trade Credit Insurance, Business Information, Debt Collection,

Single Risk insurance, Surety Bonds, Factoring.

Every day, Coface leverages its unique expertise and cutting-edge

technology to make trade happen, in both domestic and export

markets.

In 2024, Coface employed ~5,236 people and registered a turnover of

€1.84 billion.

www.coface.com

COFACE SA is listed in Compartment A of Euronext Paris

ISIN: FR0010667147 / Ticker: COFA

|

DISCLAIMER - Certain declarations featured

in this press release may contain forecasts that notably relate to

future events, trends, projects or targets. By nature, these

forecasts include identified or unidentified risks and

uncertainties, and may be affected by many factors likely to give

rise to a significant discrepancy between the real results and

those stated in these declarations. Please refer to chapter 5 “Main

risk factors and their management within the Group” of the Coface

Group's 2023 Universal Registration Document filed with AMF on 5

April 2024 under the number D.24-0242 in order to obtain a

description of certain major factors, risks and uncertainties

likely to influence the Coface Group's businesses. The Coface Group

disclaims any intention or obligation to publish an update of these

forecasts, or provide new information on future events or any other

circumstance.

1 RoATE =

Return on average tangible equity

2 This estimated solvency ratio is a

preliminary calculation made according to Coface’s interpretation

of Solvency II regulations and using the Partial Internal Model.

The final calculation may differ from this preliminary calculation.

The estimated solvency ratio is not audited.

3 The distribution proposal will be

submitted to the Shareholders’ Meeting to be held on

14 May 2025.

4 Also excludes scope impact

5 Book yield calculated on the average of the investment

portfolio excluding non-consolidated subsidiaries.

6 This estimated solvency ratio is a preliminary calculation

made according to Coface’s interpretation of Solvency II

regulations and using the Partial Internal Model. The final

calculation may differ from this preliminary calculation. The

estimated solvency ratio is not audited.

7 The distribution proposal will be submitted to the

Shareholders’ Meeting to be held on 14 May 2025.

- 2025 02 20 PR results FY-2024 COFACE

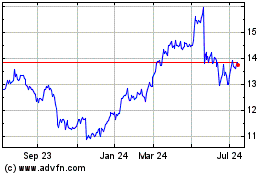

Coface (EU:COFA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Coface (EU:COFA)

Historical Stock Chart

From Feb 2024 to Feb 2025