TotalEnergies EP Gabon's Shares Fall After Military Declares Coup

30 August 2023 - 8:34PM

Dow Jones News

By Giulia Petroni

Shares in TotalEnergies EP Gabon fell Wednesday after military

officers declared a coup in the central African nation of Gabon

following President Ali Bongo's win in the elections.

At 0949 GMT, the stock was down 10% lower at EUR166.00.

A group of officers in country--a member of the Organization of

the Petroleum Exporting Countries--said they had seized control of

the government on a national television channel shortly after

Bongo, whose family has ruled the country since 1967, was declared

the winner of Saturday's presidential elections.

The subsidiary of French major TotalEnergies has been active in

the central African country for more than 90 years, with

oil-and-gas exploration and production activities and as a leading

retailer. Crude-oil production from fields operated by the

TotalEnergies EP Gabon was 5.8 million barrels in 2022.

TotalEnergies wasn't immediately available for comment when

contacted by Dow Jones Newswires.

The French company has a 58.28% share in TotalEnergies EP Gabon,

while the Gabonese state holds a 25% stake.

French-listed oil company Maurel & Prom and miner Eramet are

among other companies with operations in the country. Their shares

slump 19% and 18%, respectively, on Wednesday after Gabon officers

claimed they had seized power.

Maurel & Prom's share of oil production from Gabon was

15,779 barrels a day in the first half of 2023, roughly 58% of

total production.

Eramet, whose local subsidiary in Gabon extracts manganese ore

from the Moanda mine, said earlier on Wednesday that it has halted

all operations and rail traffic in the country.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

August 30, 2023 06:19 ET (10:19 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

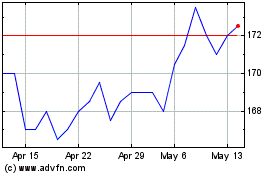

TotalEnergies EP Gabon (EU:EC)

Historical Stock Chart

From Jan 2025 to Feb 2025

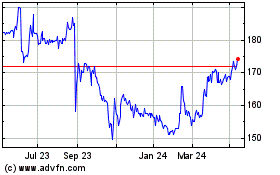

TotalEnergies EP Gabon (EU:EC)

Historical Stock Chart

From Feb 2024 to Feb 2025