Virbac: Strong annual revenue growth of +13.6% supported by dynamic organic growth (+7.5%) and the strategic contribution of our acquisitions (+6.1%)

17 January 2025 - 3:45AM

UK Regulatory

Virbac: Strong annual revenue growth of +13.6% supported by dynamic

organic growth (+7.5%) and the strategic contribution of our

acquisitions (+6.1%)

Strong annual revenue growth of +13.6%

supported by dynamic organic growth (+7.5%) and the strategic

contribution of our acquisitions (+6.1%)

Press release issued on January 16, 2025

after market close at 5:45pm CET

|

KEY FIGURES |

Annual

Revenue 2024

€1,397.5 million |

Growth at constant exchange rates

and scope1

+7.5% of which

companion animals +10.7%

farm animals +2.4% |

Growth at constant

exchange rates2

+13.6%

|

Overall

change

+12.1%

|

1growth at

constant exchange rates and scope corresponds to organic growth of

revenue, excluding exchange rate variations and changes in scope.

At constant exchange rates: based on the exchange rates of the

previous year. At constant scope: based on a consolidation

scope excluding recent acquisitions (Globion

and Sasaeah). Note that the impact on revenue

growth resulting from the integration of Mopsan

(acquisition of our distributor in Türkiye

completed in December 2024) is considered non-material

therefore consolidation scope was not restated

2this indicator is calculated on the

current scope, including the impact of acquisitions

(Globion &

Sasaeah), using the exchange rate from the

previous year

Quarterly consolidated

revenue

In the fourth quarter, our revenue reached €355.4 million, showing

an increase of +10.5% at actual exchange rates. At constant

exchange rates, activity grew by +12.3% compared to the same period

in 2023. Recent external growth operations (acquisition of Globion

in India and Sasaeah in Japan) contributed +8.2 percentage points

of growth over the period. Thus, at constant exchange rates and

scope, revenue growth reached +4.1%. In a market environment with

favorable global trends, all regions are growing. After four

consecutive quarters of double-digit growth, Europe maintains a

positive dynamic (+3.9% at constant exchange rates and scope),

supported by sales of vaccines for dogs and cats as well as the pet

food range. In the United States, growth momentum has resumed

(+4.0% at constant exchange rates and scope) after a third quarter

penalized by a temporary destocking effect at one of our

distributors. Growth in Latin America stands at +2.5% at constant

exchange rates and scope, marking a slight slowdown compared to

previous quarters, mainly due to an unfavorable base effect on the

aquaculture segment in Chile. Mexico is showing growth of +12.8% at

constant exchange rates and scope. The India-Middle East-Africa

region (IMEA, +4.2% at constant exchange rates and scope) is

benefiting from good momentum on our products for bovine, avian,

and porcine species. The East Asia region is accelerating its

growth dynamic (+7.6% at constant exchange rates and scope), mainly

driven by China which recorded a growth of 20.6%. Finally, activity

in the Pacific region is regaining momentum (+5.9% at constant

exchange rates and scope) after a year strongly impacted by

unfavorable market conditions for livestock in Australia.

Annual consolidated revenue

At the end of December 2024, our annual revenue reached €1,397.5

million compared to €1,246,9 million, representing an overall

increase of +12,1% compared to 2023 and +13.6% at constant exchange

rates. This significant growth is the result of an organic

performance of +7.5% and a contribution of +6.1% linked to the

acquisitions of Globion (acquisition in India in November 2023) and

Sasaeah (acquisition in Japan completed in April 2024). Supported

by a globally positive market dynamic, growth (in volume and value)

is observed in all regions, with the exception of the Pacific, as

well as across all our categories. The Europe area (+10.0% at

constant exchange rates and scope) contributes to more than half of

the Group's organic growth, benefiting from a strong rebound in the

dog and cat vaccine range but also from increased demand for our

petfood/pet care ranges. The performance of the North America area

(+10.2% at constant exchange rates and scope) benefits from a

sustained sales dynamic, particularly for our specialty and dental

care products for companion animals.

The Latin America area (+7.4% at constant exchange rates and scope)

shows strong growth supported by the performances of Chile, which

is experiencing a favorable rebound in the aquaculture segment this

year, and a strong performance from Mexico (companion & farm

animals). Despite a temporary slowdown in sales of vaccines for

ruminants, Brazil recorded positive growth (+3.7% at constant

exchange rates and scope), driven in particular by the successful

launch of Cortotic for companion animals.

The IMEA area maintains a solid performance (+6.7% at constant

exchange rates and scope), particularly in its key segments of

ruminants and poultry. The successful integration of Globion (avian

vaccines) in November 2023 accelerates this dynamic, with a total

increase of +15.1% at actual scope and constant exchange rates. The

East Asia area grew by +7.0% at constant exchange rates and scope,

mainly driven by China with a growth of 11.7% at constant exchange

rates and scope (specialty products and pet food) and sustained

growth in Thailand and Japan. The integration of Sasaeah

significantly strengthens our size in this area, which is recording

a revenue change of +83.0% at actual scope and constant exchange

rates. T

he Pacific area is down (-5.9% at constant exchange rates and

scope), affected by a trend reversal in the livestock market after

a year of strong growth in 2023.

In terms of species, the

companion animal segment shows a strong progression of +10.7% at

constant exchange rates and scope, driven by a double-digit growth

dynamic of our dog and cat vaccines (thanks to the increase in our

production capacities), our specialty products, petfood and our

dermatology range. The farm animal segment shows growth of +2.4% at

constant exchange rates and scope. The positive momentum in the

ruminant segment in Latam and IMEA, as well as the strong growth of

aquaculture in Chile driven by sales of parasiticides products,

offset the downturn in the Pacific area.

Outlook

In 2024, in accordance with our July 8 press release, we anticipate

a ratio of “current operating income before amortization of assets

resulting from acquisitions” (Ebit adjusted) to “revenue” of around

16% at constant exchange rates and scope. The recent external

growth operations will have a slightly accretive impact. Excluding

acquisitions our net cash position should improve by around €100

million compared to the end of December 2023.

In 2025, we currently anticipate revenue growth at constant scope

and exchange rates between 4% and 6%.The impact of the Sasaeah

acquisition is expected to represent an additional 1 point of

growth in 2025. The ratio of “current operating income before

amortization of assets resulting from acquisitions” (Ebit adjusted)

to “revenue”, is expected to consolidate at the 2024 level. This

forecast takes into account the continued voluntary increase in our

R&D investments relative to revenue, which will represent

approximately +0.3 percentage points in 2025 compared to 2024.

We reaffirm our ambition to achieve an Ebit adjusted ratio of 20%

by 2030: in this respect, we plan over the next few years to

gradually restore our R&D investments to the Group's normative

and historical level.

Consolidated revenue by

quarter

CONSOLIDATED FIGURES

Non-audited figures

in € million |

2024 |

2023 |

Growth |

Growth

at constant exchange rates2 |

Growth

at constant exchange rates and scope1 |

|

First quarter revenue |

345.7 |

314.8 |

+9.8% |

+10.8% |

+9.7% |

|

Second-quarter revenue |

357.2 |

295.7 |

+20.8% |

+21.8% |

+13.1% |

|

Third-quarter revenue |

339.2 |

314.8 |

+7.7% |

+9.9% |

+3.4% |

|

Fourth-quarter revenue |

355.4 |

321.6 |

+10.5% |

+12.3% |

+4.1% |

|

Annual revenue |

1,397.5 |

1,246.9 |

+12.1% |

+13.6% |

+7.5% |

Cumulated consolidated revenue at the end of December by

region

CONSOLIDATED FIGURES

Non-audited figures

in € million |

2024 |

2023 |

Growth |

Growth

at constant exchange rates2 |

Growth

at constant exchange rates and scope1 |

|

Europe |

560.4 |

510.4 |

+9.8% |

+10.0% |

+10.0% |

|

North America |

181.6 |

164.9 |

+10,1% |

+10,2% |

+10.2% |

|

Latin America |

222.3 |

213.6 |

+4.1% |

+7.4% |

+7.4% |

|

Far East Asia |

143.9 |

82.6 |

+74.3% |

+83.0% |

+7.0% |

|

Pacific |

107.6 |

115.7 |

-7,0% |

-5.9% |

-5.9% |

|

IMEA5 |

181.8 |

159.8 |

+13.8% |

+15.1% |

+6.7% |

|

Revenue at the end of December |

1,397.5 |

1,246.9 |

+12,1% |

+13.6% |

+7.5% |

1growth at

constant exchange rates and scope corresponds to organic growth of

revenue, excluding exchange rate variations and changes in scope.

At constant exchange rates: based on the exchange rates of the

previous year. At constant scope: based on a consolidation

scope excluding recent acquisitions (Globion

and Sasaeah). Note that the impact on revenue

growth resulting from the integration of Mopsan

(acquisition of our distributor in Türkiye

completed in December 2024) is considered non-material

therefore consolidation scope was not restated

2this indicator is calculated on the

current scope, including the impact of acquisitions

(Globion &

Sasaeah), using the exchange rate from the

previous year

Focusing on animal health, from the

beginning

At Virbac, we provide innovative solutions to veterinarians,

farmers and animal owners in more than 100 countries around the

world. Covering more than 50 species, our range of products and

services enables to diagnose, prevent and treat the majority of

pathologies. Every day, we are committed to improving animals’

quality of life and to shaping together the future of animal

health.

Virbac: Euronext Paris - subfund A - ISIN code:

FR0000031577/MNEMO: VIRP

Financial Affairs department: tel. +33 4 92 08 71 32 - email:

finances@virbac.com - Website: corporate.virbac.com

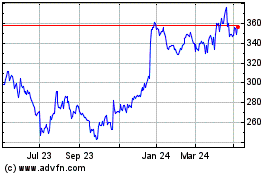

Virbac (EU:VIRP)

Historical Stock Chart

From Jan 2025 to Feb 2025

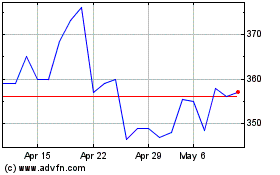

Virbac (EU:VIRP)

Historical Stock Chart

From Feb 2024 to Feb 2025