Vopak reports on Q3 2022 results

11 November 2022 - 5:00PM

Vopak reports on Q3 2022 results

The Netherlands, 11 November 2022

Vopak reports improved

EBITDA of EUR 227 million in Q3 2022

and raises its full-year 2022 EBITDA outlook

to around EUR

890

million

Key highlights - excluding

exceptional items

- Improved financial

performance supported by business conditions and currency gains.

2022 outlook for EBITDA and proportional operating cash return

increased.

- Growing our

footprint in industrial terminals in China and increased send-out

capacity in Gate LNG terminal in Rotterdam.

- Accelerating in new

energies by repurposing oil capacity in Los Angeles to

sustainable aviation fuel and renewable diesel and taking a share

in the electricity storage company Elestor.

|

Q3 2022 |

Q2 2022 |

Q3 2021 (restated) |

in EUR millions |

YTD Q3 2022 |

YTD Q3 2021 (restated) |

| |

|

|

|

|

|

|

349.6 |

338.0 |

309.5 |

Revenues |

1,011.7 |

912.7 |

|

|

|

|

|

|

|

|

|

|

|

Results -excluding

exceptional items- |

|

|

|

226.9 |

219.4 |

210.8 |

Group operating profit / (loss) before depreciation and

amortization (EBITDA) |

659.4 |

614.1 |

|

140.3 |

130.9 |

127.9 |

Group operating profit / (loss) (EBIT) |

397.0 |

372.9 |

|

77.7 |

53.5 |

80.6 |

Net profit / (loss) attributable to holders of ordinary shares |

205.9 |

229.2 |

|

0.62 |

0.42 |

0.65 |

Earnings per ordinary share (in EUR) |

1.64 |

1.83 |

|

|

|

|

|

|

|

|

|

|

|

Results -including

exceptional items- |

|

|

|

229.7 |

-245.0 |

201.4 |

Group operating profit / (loss) before depreciation and

amortization (EBITDA) |

197.8 |

535.0 |

|

143.1 |

-333.5 |

118.5 |

Group operating profit / (loss) (EBIT) |

- 64.6 |

293.8 |

|

80.5 |

-410.5 |

71.2 |

Net profit / (loss) attributable to holders of ordinary shares |

- 255.3 |

150.1 |

|

0.64 |

-3.28 |

0.57 |

Earnings per ordinary share (in EUR) |

-2.04 |

1.20 |

|

|

|

|

|

|

|

|

197.9 |

214.0 |

166.0 |

Cash flows from operating activities (gross excluding

derivatives) |

581.0 |

473.1 |

|

191.3 |

189.4 |

166.9 |

Cash flows from operating activities (gross) |

530.9 |

429.0 |

|

- 117.9 |

- 176.0 |

- 160.2 |

Cash flows from investing activities (including derivatives) |

- 388.7 |

- 448.7 |

|

|

|

|

|

|

|

|

|

|

|

Additional performance measures |

|

|

|

277.4 |

267.1 |

257.3 |

Proportional EBITDA -excluding exceptional items- |

798.2 |

749.0 |

|

22.2 |

22.3 |

22.5 |

Proportional capacity end of period (in million cbm) |

22.2 |

22.5 |

|

89% |

87% |

88% |

Proportional occupancy rate |

87% |

88% |

|

36.6 |

36.7 |

36.1 |

Storage capacity end of period (in million cbm) |

36.6 |

36.1 |

|

88% |

87% |

87% |

Subsidiary occupancy rate |

86% |

87% |

|

|

|

|

|

|

|

|

11.2% |

11.1% |

11.0% |

Proportional operating cash return |

11.3% |

11.1% |

|

10.4% |

9.3% |

10.4% |

Return on capital employed (ROCE) |

9.6% |

10.4% |

|

5,344.3 |

5,538.7 |

4,783.4 |

Average capital employed |

5,443.4 |

4,624.4 |

|

3,278.7 |

3,211.4 |

2,979.4 |

Net interest-bearing debt |

3,278.7 |

2,979.4 |

|

2.82 |

2.86 |

2.93 |

Senior net debt : EBITDA |

2.82 |

2.93 |

|

3.02 |

3.06 |

3.16 |

Total net debt : EBITDA |

3.02 |

3.16 |

The prior periods related to financial year 2021 have been

restated, due to mandatory full retrospective application of a

change in accounting policy for the IFRIC agenda decision made in

March 2021 on Cloud Computing Arrangements.

Proportional operating cash return is defined as proportional

operating cash flow over average proportional capital employed and

reflects the increased importance of free cash flow and joint

ventures in our portfolio.

Royal Vopak Chief Executive Officer Dick Richelle,

comments on the

results:

“Our strong third quarter performance

demonstrates that our well diversified infrastructure portfolio

uniquely positions Vopak to serve our customers amidst highly

uncertain times. The deployment of growth capex towards our

strategic priorities is going well, with growth in industrial and

gas terminals and acceleration towards new energies. Our improved

financial performance and solid strategy execution allows us to

update our outlook for FY 2022, by increasing our expectation for

EBITDA and proportional operating cash return.”

Financial highlights for YTD Q3 2022 -

excluding exceptional items

- Revenue increased to EUR 1 billion, driven by

a favorable chemical and gas market environment, positive currency

translation effects and growth project contribution.

- Proportional occupancy rate YTD Q3 2022 was

87% (YTD Q3 2021: 88%). Proportional occupancy improved to 89% in

Q3 2022 from Q2 2022 (87%) driven mainly by performance in Asia and

Middle East, New Energy and LNG and Americas.

- Costs increased by EUR 69 million to EUR 522

million (YTD Q3 2021 453 million) mainly due to surging energy

prices (EUR 31 million), currency translation effects (EUR 22

million), personnel expenses (EUR 14 million) and cost of growth

projects and business development.

- EBITDA increased to EUR 659 million (YTD Q3

2021 614 million) supported by business conditions, currency

translation effects (EUR 44 million) and growth projects’

contribution (EUR 20 million) which were partly offset by higher

costs.

- EBIT increased to EUR 397 million (YTD Q3 2021

EUR 373 million), adjusted for EUR 32 million positive currency

translation effects, EBIT decreased by EUR 8 million. Depreciation

charges were higher compared to the same period last year mainly

due to an increase in commissioned growth assets.

- Growth investments in YTD Q3

2022 were EUR 270 million (YTD Q3 2021 226 million), reflecting the

completion of the acquisition of our joint venture in India with

Aegis in Q2 2022. Proportional growth investments in YTD Q3 2022

was EUR 299 million. Operating capex, which includes sustaining and

IT capex, in YTD Q3 2022 was EUR 194 million (YTD Q3 2021 217

million) while proportional operating capex was EUR 211 million

(YTD Q3 2021 245 million).

- Cash flow from operating activities increased

by EUR 108 million to EUR 581 million, driven by good operational

performance and dividend receipts from joint ventures and

associates which increased by EUR 109 million compared to YTD Q3

2021.

- Proportional Operating Cash

flow in YTD Q3 2022 was EUR 514 million.

Proportional operating cash return in YTD Q3 2022 of 11.3% vs 11.1%

in YTD Q3 2021 driven by positive proportional EBITDA performance

and lower operating capex during YTD Q3 2022.

- Net profit attributable to holders of

ordinary shares of EUR 206 million (YTD Q3 2021: EUR 229

million). Tax charges increased as a result of the write off of the

deferred tax assets in the Netherlands in Q2 2022.

- The senior net debt : EBITDA ratio is 2.82 at

the end of YTD Q3 2022, within our previously communicated ambition

to keep senior net debt to EBITDA ratio in the range of around

2.5-3.0x. Average interest rate on total debt at the end of Q3 2022

was 2.9%. Interest coverage ratio at the end of Q3 2022 stood at

8.6x, well above the agreed level of 3.5x.

- During Q3 2022, there was an update on the recognized

exceptional gain realized upon divestment (100%) of two Canadian

entities of EUR 2.8 million, bringing the total gain to EUR 8.5

million.

For Vopak's full press release, please

refer to the attached document.

- Press Release - Vopak reports on Q3 2022

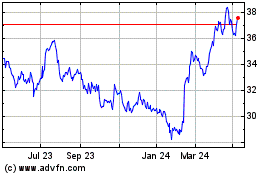

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

From Feb 2025 to Mar 2025

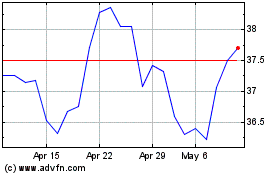

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

From Mar 2024 to Mar 2025