Worldline FY 2024 RESULTS

FY 2024 RESULTS

Refocus and rebound underway

FY24 results

€4,632m revenue, +0.5% organic growth, of which +1.9% in

Merchant Services

€1,070m adjusted EBITDA

€201m free cash-flow, or 19% adjusted EBITDA conversion

rate

€434m Normalized Net Income group share

€(297)m reported Net Income group

share1

2025: leveraging Worldline’s

repositioning to start the rebound

New product developments to accelerate in

H2’25

with renewed leadership team in MS

Strict focus on cost control while leveraging Power24 to

improve unlevered free cash flow

Portfolio pruning well underway

Solid balance sheet and liquidity

profile

Active management of debt maturity profile while

maintaining strong liquidity

(successful issuance of a €500m 5-year bond and RCF

maturity extended)

Worldline appoints Pierre-Antoine

Vacheron as Chief Executive Officer

30 years of extensive experience in

international

and transformative contexts including 15 in the payments

industry

Strong focus on product innovation, technology and customer

excellence

to shape a highly competitive and modern payments

player

Effective March

1st, 2025

2025 Outlook

Similar revenue growth rate in 2025 vs. 2024

Growth in unlevered Free Cash Flow vs.

20242

Further details regarding the 2025 trajectory will be

provided during the Q1 2025 publication

to take place on April

23rd,

2025

The new CEO will be working on Worldline’s next strategic

plan to be presented in the Autumn

Paris, La Défense, February 26, 2025 –

Worldline [Euronext: WLN], a global leader in payment services,

today announces its 2024 annual results.

Grégory Lambertie, CFO of Worldline,

said: "Thanks to our teams’ efforts to tackle specific

challenges faced during the summer, we managed to deliver our 2024

financial results despite a slowdown in Europe. We remained focused

on cost control across the organization as demonstrated by our free

cash flow performance.

In 2024, we successfully executed the

Power24 plan to reorganize the company and adapt it to the evolving

competitive landscape. In 2025, we will continue to reposition

Worldline on a sustainable growth trajectory so as to accelerate by

the end of this year.

We will also continue to manage operating

costs, capital expenditure and working capital tightly in order to

deliver steady growth in unlevered free cash flow in 2025 and

beyond.

Furthermore, following a decade of market

consolidation, we have started our portfolio pruning so as to

refocus on our core activity and drive value creation for all

stakeholders in the medium term.”

FY 2024 KEY HIGHLIGHTS

New products and partnerships to support

activity rebound in H2’25

Throughout 2024, Worldline teams worked hard to

sow the seeds of the Group’s rebound by signing a number of

high-value partnerships, launching new innovative products and

strengthening banking distribution networks. Among others:

New product releases:

- Leveraging the

partnership with OPP, Worldline launched an innovative Embedded

Payments solution in Europe for ISVs and marketplaces, covering the

full revenue ecosystem from global online acceptance to full

acquiring capabilities, with already 165 partners onboarded

- Relevance of our

SoftPos solution: more than 6,300 micro-merchants already onboarded

and counting

- Partnership with

Visa to launch a virtual card issuing solution for Online Travel

Agencies

- In Financial

Services,

- onboarding of a

bank on its new cloud-based instant payments solution leveraging

the strategic partnership signed with Google

- launch of “Bank

Transfer by Worldline”, a new account-to-account payment method

available in 14 European countries, marking a successful

collaboration between Merchant Solutions and Financial

Services

- DNB, the

largest financial services group in Norway, will leverage

Worldline's Swift Instant Connectivity to TIPS (TARGET Instant

Payment Settlement) to enhance its payment infrastructure and

provide seamless, reliable real-time payment services to its

clients. Likewise, Worldline signed a contract with GarantiBBVA

International N.V. to implement its cloud-based instant payments

solution.

On the distribution front:

- Worldline

reinforced its footprint in the fast-food industry with Tabesto,

the order-taking and payment specialist. This ISV partnership

encompasses 36 countries, promoting SoftPos Worldline Tap on Mobile

technology to enhance the ordering and payment kiosk experience.

- Through its

partnership with Wix, Worldline will expand payment solutions

online for businesses in Europe and Asia Pacific thanks to its

integrated payment acceptance powered by localised acquiring

capabilities to offer merchants an all-in-one solution

- Worldline

signed a long-term strategic agreement with RCH, Italy's leading

technology company for the management of electronic cash systems

with around 350,000 clients, to offer integrated payment solutions

for the point of sale.

Reinforcing banking networks:

- In Italy, CCB’s

migration of circa 60,000 merchants’ portfolio started end 2024

with a full ramp-up expected in 2025 the Worldline platform

- Roll-out of

Worldline’s payment solutions with the migration of Credem’s

25,000+ merchants in Italy

- The partnership

between Worldline and Crédit Agricole is progressing well with the

initial launch of products destined for small and medium-sized

businesses, before a progressive roll-out of the offering for the

enterprise segment later in 2025.

Strong focus on cost control

In 2024, Worldline successfully implemented its

Power24 program and raised its target for total cash cost savings

to €220 million, and full run rate by the end of 2025.

Management actions have also been focused on

reducing rationalization and integration costs and strictly

managing capital expenditure and working capital.

- Cash

rationalization & integration costs excluding Power24 thus

declined in 2024 to €112 million versus €165 million in 2023

and should decline further to represent around 1% of revenue in the

medium term

- Capex declined

to €281.5 million in 2024 from €332.9 million in 2023

- Working capital,

while still representing an outflow in 2024, is expected to

progressively trend towards a neutral cash contribution in the

medium term.

All of these efforts underpin the Group’s

ambition to significantly improve free cash flow generation in the

coming years, supported also by the significantly lower cash cost

of Power24 implementation in 2025.

Governance update

On June 13, Worldline hosted its Shareholders’

General Meeting chaired by Mr. Georges Pauget, Interim Chairman of

the Board of Directors. Following the Shareholders’ Meeting and as

announced on March 21, 2024, the Board of Directors decided, upon

recommendation of the Nomination Committee, to appoint Mr. Wilfried

Verstraete as Chairman of the Board of Directors. All resolutions

submitted by the Board of Directors were adopted, in

particular:

- the Company and

consolidated accounts for the financial year ended on December

31st, 2023

- the renewal of

the term of office as director of Mrs. Nazan Somer Özelgin and Mr.

Daniel Schmucki, for a period of three years

- the ratification

of the co-optation of Mr. Wilfried Verstraete as director and its

re-appointment for a new term of office of three years; and

- the appointment of three new

directors, Mrs. Agnès Park, Mrs. Sylvia Steinmann and

Mr. Olivier Gavalda for a period of three

years.

As previously announced, the Board of Directors

is now composed of 13 directors, including two employee directors.

The renewed Board showcases strong diversity with Directors being

64% independent directors, 46% women and 64% directors of foreign

nationality (other than the employee directors).

Worldline appoints Pierre-Antoine

Vacheron as Chief Executive Officer

Worldline announced yesterday the appointment of

Mr. Pierre-Antoine Vacheron as Chief Executive Officer, effective

March 1st, 2025. The Board of Directors determined that

the company required a new external profile. and is confident that

Pierre-Antoine will bring a fresh perspective to Worldline. His

priorities will include transforming the company's performance,

enhancing the client experience, and strengthening the talent pool

and the company’s culture. The Board of Directors extends its

heartfelt thanks to Marc-Henri for his contributions to the

development of Worldline during his tenure as Deputy CEO and ad

interim CEO. His steady leadership since October 2024

has been invaluable and reflecting his unwavering commitment

to the company’s success, he will ensure a seamless transition

to Pierre-Antoine.

Pierre-Antoine brings over 30 years of extensive

international and transformational experience as CEO and CFO in the

payments, retail and banking industries, most recently as CEO of

Payments of Group BPCE and CEO of Natixis Payments. During his

tenure at BPCE, Pierre-Antoine focused on product innovation,

simplifying the technology and providing excellent customer service

to shape a highly competitive and modern payments player in card

and account-to-account processing, omnichannel commerce and

bank-as-a-service. Before his role at BPCE,

Pierre-Antoine headed the Global Merchant Services and Acquiring

division of the Ingenico Group. During this period, he oversaw the

diversification of Ingenico from a hardware-oriented payments

processor to a leading payment services provider.

Strong balance sheet and liquidity

profile

Worldline is committed to maintaining a solid

financial structure including a strong liquidity profile.

Structural actions were implemented to achieve this

objective:

- July 4, 2024,

Worldline signed a €1.125bn Revolving Credit Facility (RCF)

maturing in July 2029. The RCF includes two one-year extension

options at the lenders’ discretion. The RCF replaces and upsizes

the existing €450m and €600m RCFs maturing in December 2025. It is

supported by a pool of 17 international banks including new

lenders

- November 21,

2024, Worldline issued a new €500 million bond under the existing

EMTN program, maturing on November 27, 2029, and paying interest of

5.25% per annum on the outstanding principal amount. These bonds

are rated BBB- by S&P Global Ratings, in line with the latest

corporate credit rating of the Company confirmed on September 24,

2024

- November

21, 2024, Worldline repurchased outstanding OCEANEs due July 2025

and OCEANEs due July 2026 for a total consideration of

approximately €250 million. The repurchased bonds were cancelled

after the repurchase in accordance with their respective terms and

conditions.

Worldline will continue to actively manage its

debt maturity profile, while maintaining its strong financial

liquidity.

FY 2024 PERFORMANCE

FY 2024 key figures

|

In € million |

FY 2024 |

FY 2023 |

change |

|

|

|

|

|

|

Published Revenue* |

4,632 |

4,609 |

+0.5% |

|

|

|

|

|

|

Net Net Revenue** |

3,729 |

3,777 |

-1.3% |

|

|

|

|

|

|

Adjusted EBITDA* |

1,070 |

1,112 |

-3.7% |

|

% of Published revenue |

23.1% |

24.1% |

(101) bps |

|

% of Net Net Revenue |

28.7% |

29.4% |

(72) bps |

|

|

|

|

|

|

EBITDA |

750 |

905 |

-17.1% |

|

% of Published revenue |

16.2% |

19.6% |

|

|

% of Net Net Revenue |

20.1% |

24.0% |

|

|

|

|

|

|

|

Net income Group share |

(297) |

(817) |

|

|

|

|

|

|

|

Normalized net income Group share |

434 |

521 |

-16.8% |

|

% of published revenue |

9.4% |

11.3% |

|

|

|

|

|

|

|

Free cash flow (FCF) |

201 |

355 |

-43.4% |

|

Adjusted EBITDA to FCF conversion rate*** |

18.8% |

32.0% |

|

|

|

|

|

|

|

Closing net debt including lease liability

(IFRS16) |

2,012 |

2,156 |

-6.7% |

|

Group leverage ratio |

1.9x |

1.9x |

|

|

*at constant scope and exchange rates |

|

|

|

|

** Revenue excluding schemes and partner fees |

|

|

|

|

*** FY 2023 conversion rate calculated on FY 2023 adjusted

EBITDA reported |

|

|

|

Worldline’s FY 2024 revenue

reached €4,632 million, representing +0.5%

organic revenue growth, with a slowdown in the second half

of the year driven by an overall soft consumption context, the

re-insourcing process of a large customer in Financial Services and

some specific challenges in Merchant Services over the summer.

The Group’s adjusted EBITDA

reached €1,070 million in FY 2024, representing

23.1% of revenue, in a challenging context in

Merchant Services and Financial Services.

Net income Group share from continued

operations was €-297 million, mainly

impacted by the €349 million change in fair value of TSS preferred

shares. On a normalized basis (excluding unusual

and infrequent items, Group share, net of tax) reached €434

million, (versus €521 million in 2023), equating to

normalized basic and diluted EPS of €1.53 in FY

2024.

Free cash flow came to

€201 million or 19% adjusted EBITDA

conversion rate (free cash flow divided by adjusted

EBITDA), mainly impacted by the Power24 plan which

represented €139 million. The main parameters of free cash flow

were:

- The reduction in

capital expenditures as a percentage of revenue at 6.1% (versus

7.2% in 2023)

- A working

capital outflow of €72 million, as expected and in line with the

Group’s planned trajectory for working capital to progressively

have a neutral cash impact in the coming years

- The further

reduction in Integration and Rationalization costs excluding

strategic projects to €112 million, an amount that will continue to

decline in the coming years.

Group Net debt amounted to

€2,012 million at the end of 2024 including IFRS16

leases, down by around €150 million compared with 2023,

representing a net debt to adjusted EBITDA ratio of 1.9x including

IFRS16 leases.

Q4 revenue figures by Global Business

Lines:

|

In € million |

Q4

2024 |

Q4

2023* |

Organic growth (Published) |

Organic growth (NNR) |

|

Merchant Services |

864 |

855 |

+1.2% |

-3.3% |

|

Financial Services |

224 |

246 |

-8.9% |

-9.2% |

|

Mobility & e-Transactional Services |

92 |

90 |

+1.6% |

+1.6% |

|

Worldline |

1,180 |

1,191 |

-0.9% |

-4.3% |

|

*at constant scope and exchange rates |

|

|

|

|

Worldline’s Q4 2024 revenue

reached €1,180 million, representing -0.9%

organic growth. In a soft macro-economic environment in

Europe and despite the impact of merchant terminations and delays

in the delivery of next-generation hardware products, the Merchant

Services division delivered positive growth thanks notably to

continued favorable momentum in Southern Europe. The Financial

Services division was impacted by the re-insourcing process of a

large customer, as in Q3, while Issuing and Instant Payments were

still well oriented. Mobility & e-Transactional Services

achieved growth across all segments, driven in particular by

Worldline’s Contact solutions in France.

Merchant Services

Merchant Services’ revenue in

Q4 2024 reached €864 million, representing an

organic growth of +1.2%. In a soft macro-economic

context, activity in the quarter was held back by the termination

of merchant contracts, with the impact of the latter coming to an

end in H1’25, as well as delays in the delivery of next-generation

hardware products. The specific issues encountered in Q3’24 were

resolved as planned, with Australia back to accretive growth and a

strong improvement in the online verticals which had declined in

the summer. By division, the performance was the following:

- Commercial Acquiring: Good

growth driven by market share gains in Southern Europe and solid

activity levels in Central Europe, partially offset by some online

contract terminations and a soft performance in Northern

Europe.

- Payment Acceptance: Solid

growth driven by the recovery of some online verticals.

- Digital

Services: Decline as a result of hardware delivery delays

offsetting good activity in Turkey.

During the fourth quarter, Merchant Services

benefited from robust commercial activity with a number of

contracts signed, for example with Fortech, myWorld, Wix, RCH and

various airlines including Qatar Airways.

In parallel, Worldline renewed its contract with

PayPal to provide gateway services to branded and unbranded

businesses in the Mexican and Brazilian markets, demonstrating the

Group’s ability to navigate complex partnerships and deliver

innovative solutions.

Financial Services

Q4 2024 revenue reached

€224 million, a -8.9% organic

growth, largely affected by the re-insourcing process of a

significant client which had already impacted Q3’24 revenue. The

performance by division was the following:

- Card-based payment processing

activities (Issuing Processing and Acquiring

Processing): good growth driven by new projects and greater

demand, notably in Finland.

- Digital Banking: sales

lower year-on-year as greater activity in Sanctions Securities and

Monitoring solutions was more than offset by lower volumes

overall.

- Account

Payments: the one-off re-insourcing of a large client drove a

significant decline in sales, as expected, while the dynamic was

good in the Netherlands.

In the 4th quarter, Financial

Services maintained a positive commercial momentum and recorded new

wins including with Argenta in issuing, Dimoco in open banking and

Garanti Bank in instant payments. This should support a return to

growth for this division in H2’25, supported by the end of the

impact of the one-off re-insourcing process.

Mobility & e-Transactional Services

Revenue in Mobility &

e-Transactional Services grew +1.6% to €92

million, driven by new business developments in France.

The performance by division was the following:

- Trusted Services: slight

growth thanks to increased activity in France, notably with ANCV

(Chèques Vacances) and Caisse Nationale d’Assurance Maladie.

- Transport & Mobility:

moderately higher sales driven by ticketing solutions in France

which more than offset lower activity in the UK.

- Omnichannel

interactions: Good growth thanks to increased Contact volumes

in France more than offsetting slightly lower sales in Iberia.

In the fourth quarter, Mobility &

e-Transactional Services signed a new 5-year contract with

Transport for Wales Rail Limited, and notably won contracts in

France with Pays de la Loire to improve mobility services and with

the Ministère des Transports linked to the experimentation of a

unique, national transport ticket.

2024 performance per Global Business

Line

|

|

Revenue |

|

Adjusted EBITDA |

|

Adjusted EBITDA % |

|

NNR |

|

NNR Adjusted EBITDA % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

FY

2024 |

FY

2023* |

Organic change |

|

FY

2024 |

FY

2023* |

Organic change |

|

FY

2024 |

FY

2023* |

Organic change |

|

FY

2024 |

FY

2023* |

|

FY

2024 |

FY

2023* |

Organic change |

|

Merchant Services |

3,390 |

3,326 |

+1.9% |

|

815 |

850 |

-4.1% |

|

24.0% |

25.5% |

(150) bps |

|

2,496 |

2,504 |

|

32.7% |

33.9% |

(126) bps |

|

Financial Services |

891 |

940 |

-5.1% |

|

242 |

274 |

-11.7% |

|

27.1% |

29.1% |

(201) bps |

|

882 |

929 |

|

27.4% |

29.4% |

(205) bps |

|

Mobility & e-Transactional Services |

351 |

344 |

+2.1% |

|

68 |

48 |

+41.6% |

|

19.4% |

14.0% |

+541 bps |

|

351 |

344 |

|

19.4% |

14.0% |

+541 bps |

|

Corporate |

|

|

|

|

(54) |

(59) |

-8.7% |

|

-1.2% |

-1.3% |

+12 bps |

|

|

|

|

-1.2% |

-1.3% |

+12 bps |

|

Worldline |

4,632 |

4,609 |

+0.5% |

|

1,070 |

1,112 |

-3.7% |

|

23.1% |

24.1% |

(101) bps |

|

3,729 |

3,777 |

|

28.7% |

29.4% |

(72) bps |

* at constant scope and exchange

rates

Merchant Services revenue in FY

2024 reached €3,390 million, representing an

organic growth of +1.9%. Despite

a good momentum in our core geographies such as Central Europe and

strong activity driven by market share gains in Italy, Merchant

Services' performance was impacted by softer macroeconomic

conditions during the year, the termination of some of our online

merchants as planned, specific performance issues in our

Asia-Pacific business and in some global online verticals over the

summer which were resolved in Q4’24, as well as delays in the

delivery of next-generation hardware products. Adjusted

EBITDA amounted to €815 million,

24.0% of revenue, impacted by a soft revenue

performance, as well as by an unfavorable country mix linked to the

outperformance of Southern European markets relative to Central

Europe.

Financial Services revenues in

2024 reached €891 million, down by

5.1% compared with FY 2023. The continued positive

momentum in acquiring and issuing processing was more than offset

by the large one-off re-insourcing process that started in the

second quarter of 2024 in the Account Payments activity.

Adjusted EBITDA reached €242

million, representing 27.1% of revenue.

The division was affected by the soft revenue performance which was

not offset by cost-based mitigation actions launched at the end of

the first half.

Mobility & e-Transactional Services

revenue reached €351 million, up

2.1% organically, mainly driven by increased

activity in France in Trusted Services and new projects won in the

second half of 2024 in the Omnichannel interactions division.

Adjusted EBITDA reached €68

million, representing 19.4% of revenue

driven by the strong productivity improvement in project

roll-outs.

Corporate costs amounted to

€54 million in FY 2024, representing 1.2%

of total Group revenue compared with €59 million in

FY 2023, benefitting from the implementation of rigorous cost

control in support functions.

2025 OUTLOOK

- Similar

revenue growth rate in 2025 vs. 2024

with progressive acceleration in H2’25 after an H1’25 performance

slightly below Q4’24 growth rate

- Growth in

unlevered Free Cash Flow vs. 2024

- Further

details regarding the 2025 trajectory will be provided during the

Q1 2025 publication to take place on April

23rd, 2025

- The new CEO

will be working on Worldline’s next strategic plan to be presented

in the Autumn

The audit procedures on the consolidated

accounts have been carried out, and the certification report will

be issued after the completion of the verification of the

management report and the due diligence related to the electronic

ESEF format of the 2024 accounts.

Appendices

RECONCILIATION OF Q4 2023 STATUTORY

REVENUE WITH Q4 2023 REVENUE AT CONSTANT SCOPE AND EXCHANGE

RATES

For the analysis of the Group’s performance, revenue for Q4 2024 is

compared to Q4 2023 revenue at constant scope and exchange rates as

presented below per Global Business Lines:

|

|

|

Revenue |

|

|

|

|

|

|

|

|

In € million |

|

Q4 2023 |

Scope effects** |

Exchange rates effects |

Q4 2023* |

|

Merchant Services |

|

849 |

-0.4 |

+5.8 |

855 |

|

Financial Services |

|

248 |

-2.8 |

+0.8 |

246 |

|

Mobility & e-Transactional Services |

|

89 |

+0.0 |

+0.8 |

90 |

|

Worldline |

|

1,187 |

-3.2 |

7.5 |

1,191 |

|

* At constant scope and December 2024 YTD average exchange

rates |

|

|

|

|

|

|

** At December 2023 YTD average exchange rates |

|

|

|

|

|

Exchange rates effect in Q4 were mainly due to

appreciation of the Turkish Lira and Swiss Franc, while scope

effects are mainly related to the divestment of ePay in Merchant

Services and internal scope adjustments (in particular the disposal

of Consulting & Services entity in Germany).

RECONCILIATION OF FY 2023 STATUTORY

REVENUE AND ADJUSTED EBITDA WITH FY 2023 REVENUE AND ADJUSTED

EBITDA AT CONSTANT SCOPE AND EXCHANGE RATES

For the analysis of the Group’s performance,

revenue and Adjusted EBITDA for FY 2024 are compared with FY 2023

revenue and Adj. EBITDA at constant scope and exchange rates.

Reconciliation between the FY 2023 reported revenue and Adj. EBITDA

and the FY 2023 revenue and Adjusted EBITDA at constant scope and

foreign exchange rates is presented below per Global Business

Lines:

|

|

|

Revenue |

|

|

|

|

|

|

|

|

In € million |

|

FY 2023 |

Scope effects** |

Exchange rates effects |

FY 2023* |

|

Merchant Services |

|

3,325 |

+2.7 |

-1.8 |

3,326 |

|

Financial Services |

|

944 |

-5.6 |

+1.0 |

940 |

|

Mobility & e-Transactional Services |

|

342 |

+0.0 |

+2.0 |

344 |

|

Worldline |

|

4,610 |

-2.9 |

+1.2 |

4,609 |

|

* At constant scope and December 2024 YTD average exchange

rates |

|

|

|

|

|

|

** At December 2023 YTD average exchange rates |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

In € million |

|

FY 2023 |

Scope effects** |

Exchange rates effects |

FY 2023* |

|

Merchant Services |

|

847 |

+0.6 |

+2.0 |

850 |

|

Financial Services |

|

275 |

-1.8 |

+0.7 |

274 |

|

Mobility & e-Transactional Services |

|

48 |

-0.8 |

+0.5 |

48 |

|

Corporate |

|

-59 |

+0.0 |

-0.0 |

-59 |

|

Worldline |

|

1,110 |

-2.4 |

+3.2 |

1,112 |

|

* At constant scope and December 2024 YTD average exchange

rates |

|

|

|

|

|

|

** At December 2023 YTD average exchange rates |

|

|

|

|

|

Exchanges rates effect in FY were mainly due to

the appreciation of the Swiss Franc and the British Pound, largely

offset by the depreciation of the Turkish Lira, Czech Koruna or

Indian Rupee, while scope effects are mainly related to the

integration of Banco Desio and the divestment of ePay within

Merchant Services and internal scope adjustments (in particular the

disposal of Consulting & Services entity in Germany).

2023 ESTIMATED PRO FORMA

For the analysis of the Group’s organic performance, revenue and

Adj. EBITDA in 2024 are compared with 2023 revenue and Adj. EBITDA

at constant scope and exchange rates. FY 2023 estimated pro forma

is presented below (per Global Business Lines):

|

|

|

2023 estimated proforma |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1* |

|

Q2** |

|

H1** |

|

Q3*** |

|

Q4**** |

|

H2**** |

|

FY**** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Merchant Services |

|

757 |

|

849 |

|

1 606 |

|

865 |

|

855 |

|

1 719 |

|

3 326 |

|

Financial Services |

|

229 |

|

235 |

|

464 |

|

230 |

|

246 |

|

476 |

|

940 |

|

Mobility & e-Transactional Services |

|

84 |

|

88 |

|

172 |

|

81 |

|

90 |

|

172 |

|

344 |

|

Worldline |

|

1,070 |

|

1,172 |

|

2,242 |

|

1,176 |

|

1,191 |

|

2,367 |

|

4,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

|

|

|

|

|

Adj. EBITDA** |

|

|

|

|

|

Adj. EBITDA*** |

|

Adj. EBITDA |

|

Merchant Services |

|

|

|

|

|

400 |

|

|

|

|

|

450 |

|

850 |

|

Financial Services |

|

|

|

|

|

125 |

|

|

|

|

|

149 |

|

274 |

|

Mobility & e-Transactional Services |

|

|

|

|

|

24 |

|

|

|

|

|

24 |

|

48 |

|

Corporate costs |

|

|

|

|

|

-30 |

|

|

|

|

|

-29 |

|

-59 |

|

Worldline |

|

|

|

|

|

518 |

|

|

|

|

|

593 |

|

1,112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In % |

|

|

|

|

|

Adj. EBITDA% |

|

|

|

|

|

Adj. EBITDA% |

|

Adj. EBITDA |

|

Merchant Services |

|

|

|

|

|

24.9% |

|

|

|

|

|

26.2% |

|

25.5% |

|

Financial Services |

|

|

|

|

|

26.9% |

|

|

|

|

|

31.3% |

|

29.1% |

|

Mobility & e-Transactional Services |

|

|

|

|

|

13.7% |

|

|

|

|

|

14.2% |

|

14.0% |

|

Corporate costs |

|

|

|

|

|

-1.3% |

|

|

|

|

|

-1.2% |

|

-1.3% |

|

Worldline |

|

|

|

|

|

23.1% |

|

|

|

|

|

25.1% |

|

24.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*at March 2024 YTD average exchange rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

**at June 2024 YTD average exchange rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

***at September 2024 YTD average exchange rates |

|

|

|

|

|

|

|

|

|

|

|

***at december 2024 YTD average exchange rates |

|

|

|

|

|

|

|

|

|

|

|

Main components of the scope effects on 2023

estimated pro forma:

- Contribution of Banco Desio for 9

months (integrated for 9 months in 2023 reported)

- Divestment of ePay

- Internal scope adjustments (in

particular the disposal of Consulting & Services entity in

Germany)

RECONCILIATION TABLES

To enhance the comparability of our reporting

metrics, we will now provide added non-GAAP reporting

information

1. Published Revenue to

Net Net Revenue reconciliation and impacts on adjusted EBITDA

margin

Net Net Revenue information excluding schemes and partners fees,

showing growth and margin levels from an NNR perspective to enable

better comparison with peers.

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

FY 2024 Published |

Schemes & Partners fees |

FY 2024 Net Net |

|

FY 2023 Published* |

Schemes & Partners fees |

FY 2023 Net Net |

|

OG% FY Published |

OG% FY Net Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

Merchant Services |

3,390 |

(894) |

2,496 |

|

3,326 |

(821) |

2,504 |

|

+1.9% |

-0.3% |

|

Financial Services |

891 |

(9) |

882 |

|

940 |

(10) |

929 |

|

-5.1% |

-5.1% |

|

Mobility & e-Transactional Services |

351 |

|

351 |

|

344 |

|

344 |

|

+2.1% |

+2.1% |

|

Revenue |

4,632 |

(903) |

3,729 |

|

4,609 |

(831) |

3,777 |

|

+0.5% |

-1.3% |

|

* at constant scope and exchange rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

FY 2024 Published |

% margin (on Published Revenue) |

% margin (on Net Net Revenue) |

|

FY 2023 Published* |

% margin (on Published Revenue) |

% margin (on Net Net Revenue) |

|

OG% FY Published |

OG% FY Net Net |

|

|

|

|

|

|

|

|

|

|

|

|

|

Merchant Services |

815 |

24.0% |

32.7% |

|

850 |

25.5% |

33.9% |

|

(150) bps |

(126) bps |

|

Financial Services |

242 |

27.1% |

27.4% |

|

274 |

29.1% |

29.4% |

|

(201) bps |

(205) bps |

|

Mobility & e-Transactional Services |

68 |

19.4% |

19.4% |

|

48 |

14.0% |

14.0% |

|

+541 bps |

+541 bps |

|

Corporate |

-54 |

-1.2% |

-1.2% |

|

-59 |

-1.3% |

-1.3% |

|

+12 bps |

+12 bps |

|

Adjusted EBITDA |

1,070 |

23.1% |

28.7% |

|

1,112 |

24.1% |

29.4% |

|

(101) bps |

(72) bps |

|

* at constant scope and exchange rates |

|

|

|

|

|

|

|

|

|

2. Adjusted EBITDA to

EBITDA reconciliation

EBITDA information is equal to the Adjusted EBITDA minus

integration and rationalization costs:

|

(In € million) |

12 months ended December 31, 2024 |

12 months ended December 31, 2023 |

|

Adjusted EBITDA |

1,070 |

1,110 |

|

Rationalization and associated costs (from other operating income

and expense) |

(233) |

(63) |

|

Integration and acquisition costs |

(88) |

(143) |

|

EBITDA |

750 |

905 |

Operating margin to Adjusted EBITDA

reconciliation

|

(In € million) |

12 months ended December 31, 2024 |

12 months ended December 31, 2023 |

|

Operating margin |

687 |

790 |

|

+ Depreciation of fixed assets |

350 |

298 |

|

+ Net book value of assets sold/written off |

7 |

4 |

|

+/- Net charge/(release) of pension provisions |

10 |

(1) |

|

+/- Net charge/(release) of provisions |

17 |

19 |

|

Adjusted EBITDA |

1,070 |

1,110 |

3. Net income to

normalized net income reconciliation

The normalized net income is defined as net income attributable to

continued operations excluding unusual and infrequent items

(attributable to the owners of the parent), net of tax. For 2024,

the amount was €434 million, compared to €521 million

in 2023.

|

(In € million) |

12 months ended December 31, 2024 |

12 months ended December 31, 2023 |

|

Net income - Attributable to owners of the

parent |

(297) |

(817) |

|

Other operating income and expenses (Group share) |

509 |

1 444 |

|

Financial loss on fair value of preferred shares (Group's

share) |

349 |

- |

|

Tax impact on unusual items |

(124) |

(105) |

|

Normalized net income - Attributable to owners of the

parent |

434 |

521 |

4. EPS

calculation

The weighted average number of shares amounts to 282,567,142 shares

for the period. At December 31, 2024, as at December 31, 2023,

there are no potentially dilutive instruments as all equity

instruments are potentially accretive.

|

In € million - attributable to the owner of the

parent |

12 months ended December 31, 2024 |

% revenue |

12 months ended December 31, 2023 |

% revenue |

|

Net income [a] |

(297) |

(6.4)% |

(817) |

(17.7)% |

|

Diluted net income [b] |

(297) |

(6.4)% |

(817) |

(17.7)% |

|

Normalized net income - continued [c] |

434 |

9.4% |

521 |

11.3% |

|

Normalized diluted net income - continued [d] |

434 |

9.4% |

521 |

11.3% |

|

Average number of shares [e] |

282 567 142 |

|

282 110 764 |

|

|

Impact of dilutive instruments |

0 |

|

0 |

|

|

Diluted average number of shares [f] |

282 567 142 |

|

282 110 764 |

|

|

In € |

|

|

|

|

|

Basic EPS [a] / [e] |

(1.05) |

|

(2.90) |

|

|

Diluted EPS [b] / [f] |

(1.05) |

|

(2.90) |

|

|

Normalized basic EPS [c] / [e] |

1.53 |

|

1.85 |

|

|

Normalized diluted EPS [d] / [f] |

1.53 |

|

1.85 |

|

5. Leverage ratio

bridge excluding and including IFRS16

|

In € million |

2022 |

2023 |

2024 |

|

|

|

|

|

|

Net Debt |

2,202 |

1,811 |

1,610 |

|

Lease liability |

326 |

345 |

402 |

|

Net debt including lease liability |

2,528 |

2,156 |

2,012 |

|

Group leverage ratio excluding lease liability |

1,9x |

1,6x |

1,5x |

|

Group leverage ratio including lease liability |

2,2x |

1,9x |

1,9x |

FORTHCOMING EVENTS

- April 23,

2025: Q1 2025

revenue

- June 5,

2025: Annual

General Meeting

- July 30,

2025: H1

2025 results

INVESTOR RELATIONS

Laurent Marie

E laurent.marie@worldline.com

Peter Farren

E peter.farren@worldline.com

Guillaume Delaunay

E guillaume.delaunay@worldline.com

COMMUNICATION

Sandrine van der Ghinst

E sandrine.vanderghinst@worldline.com

Hélène Carlander

E helene.carlander@worldline.com

ABOUT WORLDLINE

Worldline [Euronext: WLN] helps businesses of

all shapes and sizes to accelerate their growth journey – quickly,

simply, and securely. With advanced payments technology, local

expertise and solutions customised for hundreds of markets and

industries, Worldline powers the growth of over one million

businesses around the world. Worldline generated circa €4.6 billion

revenue in 2024. worldline.com

Worldline’s corporate purpose (“raison d’être”)

is to design and operate leading digital payment and transactional

solutions that enable sustainable economic growth and reinforce

trust and security in our societies. Worldline makes them

environmentally friendly, widely accessible, and supports social

transformation.

FOLLOW US

DISCLAIMER

This document contains forward-looking

statements that involve risks and uncertainties, including

references, concerning the Group's expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviors. Any forward-looking

statements made in this document are statements about Worldline’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Worldline’s plans, objectives, strategies, goals, future events,

future revenues or synergies, or performance, and other information

that is not historical information. Actual events or results may

differ from those described in this document due to a number of

risks and uncertainties that are described within the 2023

Universal Registration Document filed with the French Autorité des

marchés financiers (AMF) on April 30, 2024 under the filling

number: D.24-0377 and its Amendment filed on August 2, 2024, under

number D.24-0377-A01.

Revenue organic growth and Adjusted EBITDA

improvement are presented at constant scope and exchange rate.

Adjusted EBITDA is presented as defined in the 2023 Universal

Registration Document. All amounts are presented in € million

without decimal. This may in certain circumstances lead to

non-material differences between the sum of the figures and the

subtotals that appear in the tables. 2024 objectives are expressed

at constant scope and exchange rates and according to Group’s

accounting standards.

Worldline does not undertake, and specifically

disclaims, any obligation or responsibility to update or amend any

of the information above except as otherwise required by law.

This document is disseminated for information

purposes only and does not constitute an offer to purchase, or a

solicitation of an offer to sell, any securities in the United

States or any other jurisdiction. Securities may not be offered or

sold in the United States unless they have been registered under

the U.S. Securities Act of 1933, as amended (the “U.S. Securities

Act”) or the securities laws of any U.S. state, or are exempt from

registration. The securities that may be offered in any transaction

have not been and will not be registered under the U.S. Securities

Act or the securities laws of any U.S. state and Worldline does not

intend to make a public offering of any such securities in the

United States.

1 Impacted by €349 million change in

fair value linked to TSS preferred shares and €203 million

restructuring costs linked notably to Power24.

2 Unlevered FCF: FCF before cash costs of net financial

debt.

- 20250226 - Worldline - FY 2024 annual results - Press

Release

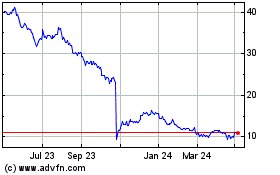

Worldline (EU:WLN)

Historical Stock Chart

From Jan 2025 to Feb 2025

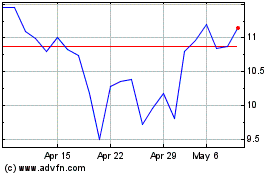

Worldline (EU:WLN)

Historical Stock Chart

From Feb 2024 to Feb 2025