Antipodean Currencies Slide On Trump Tariff Threat

04 March 2025 - 1:20PM

RTTF2

The Antipodean currencies such as the Australia and the New

Zealand dollars weakened against their major currencies in the

Asian session on Tuesday, amid concerns about the economic impact

after U.S. President Donald Trump confirmed the 25% tariffs on

Canada and Mexico as well as the additional 10 percent tariff on

China will take effect Tuesday. The reciprocal tariffs on other

U.S. trade partners will be imposed on April 2.

U.S. President Donald Trump paused all military aid for Ukraine

to ensure that it will contribute to a solution.

Meanwhile, Canada responded by imposing a 25 percent tax on $155

billion worth of American goods, Beijing has warned that it would

take countermeasures.

Weakness across most sectors led by mining and technology

stocks, after US President Donald Trump confirmed he will move

forward with higher tariffs on major trading partners, also led to

the downturn of the commodity linked currencies such as the AUD and

NZD.

Crude oil prices fell sharply to a near three-month low, weighed

down by concerns about possible excess supply in the market after

reports said OPEC and allies would go ahead with a plan of oil

output increase in April. West Texas Intermediate Crude oil futures

for March settled lower by $1.39 or nearly 2 percent, at $68.37 a

barrel.

The Reserve Bank of Australia's (RBA) February meeting minutes

emphasized the economy's negative risks, as the Board believed

there was more evidence to support rate cuts.

In economic news, retail sales in Australia increased by 0.3

percent month-on-month in January 2025, after a 0.1 percent decline

in the previous month and matching market expectations.

Meanwhile, Australia's current account deficit declined to

A$12.5 billion in the fourth quarter of 2024 from a downwardly

revised A$19.9 billion shortfall in the third quarter, indicating

the seventh consecutive quarter of deficit despite missing market

expectations of an A$11.9 billion gap.

In the Asian trading today, the Australian dollar fell to near

7-month lows of 92.26 against the yen and 1.6929 against the euro,

from yesterday's closing quotes of 92.80 and 1.6870, respectively.

If the aussie extends its downtrend, it is likely to find support

around 91.00 against the yen and 1.70 against the euro.

Against the U.S. and the New Zealand dollars, the aussie slid to

a 1-month low of 0.6187 and an 8-day low of 1.1055 from Monday's

closing quotes of 0.6216 and 1.1075, respectively. The aussie may

test support near 0.60 against the greenback and 1.09 against the

kiwi.

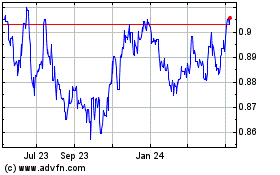

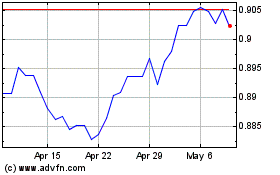

The aussie edged down to 0.8978 against the Canadian dollar,

from yesterday's closing value of 0.9009. On the downside, 0.88 is

seen as the next support level for the aussie.

The NZ dollar slid to a 5-year low of 1.8718 against the euro

and nearly a 7-month low of 83.44 against the yen, from yesterday's

closing quotes of 1.8684 and 83.79, respectively. If the kiwi

extends its downtrend, it is likely to find support around 1.89

against the euro and 81.00 against the yen.

Against the U.S. dollar, the kiwi edged down to 0.5596 from

Monday's closing value of 0.5612. The kiwi is likely to find

support around the 0.54 region.

Looking ahead, Eurozone unemployment data for January is due to

be released at 5:00 am ET in the European session. The jobless rate

is seen at 6.3 percent in January, unchanged from December.

In the New York session, U.S. Redbook report and U.S. RCM/TIPP

economic optimism index for March are slated for release.

AUD vs CAD (FX:AUDCAD)

Forex Chart

From Feb 2025 to Mar 2025

AUD vs CAD (FX:AUDCAD)

Forex Chart

From Mar 2024 to Mar 2025