Fed Officials Want Further Progress On Inflation Before Cutting Rates

20 February 2025 - 1:20AM

RTTF2

Provided the U.S. economy remains near maximum employment, the

minutes of the Federal Reserve's latest monetary policy meeting

revealed officials want to see further progress on inflation before

they consider resuming lowering interest rates.

The minutes of the Fed's January 28-29 meeting also reiterated

officials believe a "careful approach" in considering additional

adjustments to the stance of monetary policy remains appropriate

given the high degree of uncertainty.

Factors mentioned by participants as supporting a "careful

approach" included the reduced downside risks to the outlook for

the labor market and economic activity and increased upside risks

to the outlook for inflation, the Fed said.

While many participants noted the Fed could keep rates at a

restrictive level if the economy remained strong and inflation

remained elevated, several remarked that policy could be eased if

labor market conditions deteriorated, economic activity faltered or

inflation returned to 2 percent more quickly than anticipated.

The minutes also said participants observed that the Fed was

well positioned to take time to assess the evolving outlook for

economic activity, the labor market, and inflation, with the vast

majority pointing to a still-restrictive policy stance.

Following the late-January meeting, the Fed announced its widely

expected decision to leave interest rates unchanged after cutting

interest rates for three straight meetings.

The Fed said it decided to maintain the target range for the

federal funds rate at 4.25 to 4.50 percent in support of its dual

goals of maximum employment and inflation at the rate of 2 percent

over the longer run.

The minutes said participants noted inflation remained somewhat

elevated while also observing that recent indicators suggested

economic activity had continued to expand at a solid pace, the

unemployment rate had stabilized at a low level, and labor market

conditions had remained solid in recent months.

The central bank's next monetary policy meeting is scheduled for

March 18-19, when Fed officials will also provide their latest

projections for rates, inflation and the economy.

CME Group's FedWatch Tool is currently indicating 97.5 percent

chance the Fed will once again leave rates unchanged.

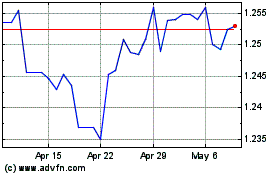

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Jan 2025 to Feb 2025

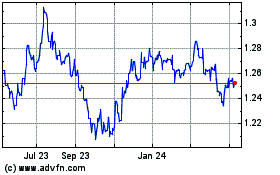

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Feb 2024 to Feb 2025