Form 8-K - Current report

18 June 2024 - 2:30AM

Edgar (US Regulatory)

0000824142false00008241422024-06-172024-06-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 17, 2024

AAON, INC.

(Exact name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

| Nevada | 0-18953 | 87-0448736 |

| (State or Other Jurisdiction | (Commission File Number: ) | (IRS Employer Identification No.) |

| of Incorporation) | | |

| | | | |

| 2425 South Yukon Ave., | Tulsa, | Oklahoma | | 74107 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(Registrant's telephone number, including area code): (918) 583-2266

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | AAON | NASDAQ |

Item 8.01 Other Events.

The Company provided an update to the previously disclosed share repurchase programs authorized by our Board of Directors. The share repurchase program was financed through a combination of the Company's cash reserves and available credit facility.

As of June 17, 2024, the Company's repurchase activity under the programs is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Effective

Date | | | | Shares

Repurchased | | Authorized and

Repurchased $ | | Average Price

Per Share $ | | Completion

Date |

| February 27, 2024 | | | | 671,230 | | $50.0 million1 | | $74.49 | | June 4, 2024 |

| June 4, 2024 | | | | 682,334 | | $50.0 million2 | | $73.28 | | June 14, 2024 |

1 Repurchases made in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934, as amended. |

2 Repurchases made in accordance with Rule 10b-18 of the Securities Exchange Act of 1934, as amended. |

A copy of the Company's press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | | | | | | | |

| Exhibit Number | | Description |

| | | | |

| | Press Release Share Repurchase Program Updates |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | AAON, INC. |

| | | |

| Date: | June 17, 2024 | By: | /s/ Luke A. Bomer |

| | | Luke A. Bomer, Secretary |

AAON Announces Share Repurchase Program Updates

TULSA, OK, June 17, 2024 – AAON, Inc. (NASDAQ: AAON) (“AAON” or the “Company”), provided an update to the previously disclosed share repurchase programs authorized by our Board of Directors. As of June 17, 2024, our repurchase activity under the programs is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Effective

Date | | | | Shares

Repurchased | | Authorized and

Repurchased $ | | Average Price

Per Share $ | | Completion

Date |

| February 27, 2024 | | | | 671,230 | | $50.0 million1 | | $74.49 | | June 4, 2024 |

| June 4, 2024 | | | | 682,334 | | $50.0 million2 | | $73.28 | | June 14, 2024 |

1 Repurchases made in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934, as amended. |

2 Repurchases made in accordance with Rule 10b-18 of the Securities Exchange Act of 1934, as amended. |

"We are pleased to announce the completion of our second share repurchase program," said Gary Fields, CEO. "This initiative reflects our confidence in the long-term growth prospects of AAON and our ongoing commitment to delivering value to our shareholders. By reducing the number of shares outstanding, we believe we have positioned the Company for increased earnings per share and an enhanced return on equity."

The share repurchase program was financed through a combination of the Company's cash reserves and available credit facility, without compromising our ability to invest in strategic growth opportunities and maintain a strong balance sheet.

About AAON

Founded in 1988, AAON is a world leader in HVAC solutions for commercial and industrial indoor environments. The Company's industry-leading approach to designing and manufacturing highly configurable equipment to meet exact needs creates a premier ownership experience with greater efficiency, performance and long-term value. AAON is headquartered in Tulsa, Oklahoma, where its world-class innovation center and testing lab allows AAON engineers to continuously push boundaries and advance the industry. For more information, please visit www.AAON.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, “should”, “will”, and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligations to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Important factors that could cause results to differ materially from those in the forward-looking statements include (1) the timing and extent of changes in raw material and component prices, (2) the effects of fluctuations in the commercial/industrial new construction market, (3) the timing and extent of changes in interest rates, as well as other competitive factors during the year, and (4) general economic, market or business conditions.

Contact Information

Joseph Mondillo

Director of Investor Relations

Phone (617) 877-6346

Email: joseph.mondillo@aaon.com

v3.24.1.1.u2

Cover Page

|

Jun. 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 17, 2024

|

| Entity Registrant Name |

AAON, INC.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

0-18953

|

| Entity Tax Identification Number |

87-0448736

|

| Entity Address, Address Line One |

2425 South Yukon Ave.,

|

| Entity Address, City or Town |

Tulsa,

|

| Entity Address, State or Province |

OK

|

| Entity Address, Postal Zip Code |

74107

|

| City Area Code |

918

|

| Local Phone Number |

583-2266

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AAON

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000824142

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

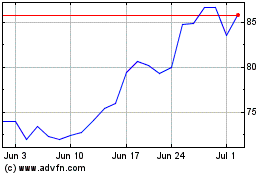

AAON (NASDAQ:AAON)

Historical Stock Chart

From May 2024 to Jun 2024

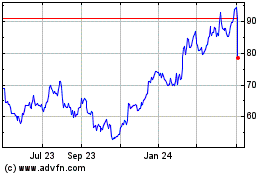

AAON (NASDAQ:AAON)

Historical Stock Chart

From Jun 2023 to Jun 2024