Whitefort Capital Sends Letter to Arbutus Biopharma Board of Directors

04 December 2024 - 12:00AM

Business Wire

Believes Now Is the Logical Time for Arbutus to

Pursue a License and Collaboration Agreement With a Strategic

Partner and Explore All Options for HBV Portfolio

Urges Arbutus to Commit to No Dilutive Equity

Issuances or ATM Use for Another Year

Whitefort Formally Requests Meeting With the

Board to Ensure Alignment of Views on Path Forward

Whitefort Capital Management, LP (together with its affiliates,

“Whitefort Capital,” “us” or “we”), which is a long-term investor

and the third largest shareholder of Arbutus Biopharma Corp.

(NASDAQ: ABUS) (“Arbutus” or the “Company”) with an ownership

interest of approximately 6.8% of the Company’s outstanding shares,

today published a letter to the Company’s Board of Directors (the

“Board”) outlining its views on the actions Arbutus must take in

order to preserve and maximize shareholder value.

The full text of the letter is below:

Arbutus Biopharma Corporation 701 Veterans Circle Warminster, PA

18974 Attn: Board of Directors

Re: Company’s Direction Following

Announcement of a Functional Cure for Hepatitis B

(HBV)

Dear Members of the Board,

Whitefort Capital Management, LP (together with its affiliates,

“Whitefort Capital” or “we”) is a significant shareholder of

Arbutus Biopharma Corporation (“Arbutus” or the “Company”) with

ownership of approximately 6.8% of the Company’s outstanding

shares. In our public letter to fellow shareholders dated May 17,

2024, and reiterated in our private letter to the Company’s Board

of Directors (the “Board”) dated July 16, 2024, we expressed our

view that, provided the data from the Company’s IM-PROVE I Phase 2a

clinical trial remained confirmatory, the Company would be well

positioned to pursue a license and collaboration agreement with a

strategic partner and should explore all strategic options for its

HBV portfolio at that time. Following the confirmatory results

presented by the Company at AASLD – The Liver Meeting® on November

18, 2024 (pre-announced to the market on November 15), which

reported that in Cohort A1 of the IM-PROVE I trial, 50% of patients

who had baseline HBsAg levels less than 1000 IU/mL and 25% of

patients overall achieved functional cure, we believe that time has

now come.

It is noteworthy that the Company’s share price did not react

positively to the announcement of the trial results on November 15,

2024, and was down over 5% in the following days. We previously

expressed our view that Phase 2b and Phase 3 trials for a

combination therapy enrolling many additional patients will be

large, expensive and complicated such that to maximize the

probability of success of its HBV program, the Company should

partner with a larger biopharmaceutical company with an existing

hepatitis franchise that has the clinical expertise, commercial

infrastructure and capital necessary to commercialize a complex

combination therapy. We believe that the market’s negative, or at

best muted, reaction to the positive data from the IM-PROVE I trial

reflects investors’ concerns over a possible self-funding of the

Phase 2b trial, resulting in further shareholder dilution. While

the Company may have sufficient cash to fund substantially all of

Phase 2b, with cash balances affording it runway to the end of

2026, we reiterate our view that the Board must avoid further

diluting shareholders and should clearly communicate to the market

that it will not pursue further dilution by self-funding a Phase 2b

trial.

To the extent the Board has any doubt as to what the Company’s

shareholders want, we would encourage you to review the stock

performance on November 7, 2024, the day immediately after the

Company filed its shelf registration statement for up to $300

million, including a prospectus supplement for up to $100 million

common shares pursuant to an at-the-market (ATM) offering,

incremental to the approximately $25 million remaining availability

under the Company’s existing ATM program. That day alone the

Company’s stock was down 5%, and since that announcement, the

Company’s share price has declined over 10% despite the positive

IM-PROVE I trial data. Since the prior shelf registration statement

would have expired on November 18, 2024, the $300 million shelf

seems like reasonable housekeeping, but the $100 million ATM

prospectus supplement rubbed salt in an unhealed wound. Arbutus

shareholders freshly recollect that the number of shares

outstanding increased by more than 3.4 times since 2018. While we

were encouraged to hear Interim CEO Michael McElhaugh’s public

statement at an investor conference in May 2024 that, given the

Company’s substantial cash balance and sufficient liquidity, the

Company does not “anticipate the need to further utilize the ATM

this year,” it is now necessary to extend this commitment for

another year, particularly given the importance of preserving the

value of the Company’s lipid nanoparticle (LNP) patent estate.

We continue to believe that Arbutus’ economic stake in the

patent infringement claims against Moderna, Inc. (“Moderna”) and

Pfizer Inc. (“Pfizer”)/BioNTech SE (“BioNTech”) potentially

represents significant value worth multiples of the Company’s

current market capitalization. We await the upcoming

Pfizer/BioNTech claim construction hearing on December 18, 2024

with great interest. The Company should publicly commit to

preserving the value of its LNP patent estate by avoiding any

further share dilution. Furthermore, as the Company evaluates

internally and engages regulator feedback on the Phase 2b trial

design, now is the time to engage with potential strategic

partners. Indeed, at the recent Jefferies London Healthcare

Conference, Mr. McElhaugh commented that with “functional cure

rates to meaningful numbers, which we have now… there are plenty of

[pharma] players out there who may become interested in the [HBV]

space.”

We look forward to the Company engaging now and over the next

few quarters in strategic partnership discussions regarding its HBV

program and urge the Company to make a public announcement

committing to no dilutive equity issuances or ATM use for another

year. Additionally, we hereby formally request a meeting with the

full Board in the coming weeks to ensure that there is full

alignment of views regarding the path forward for the Company.

Sincerely, David Salanic Co-Managing Partner Whitefort Capital

Management, LP

About Whitefort Capital

Founded in 2017, Whitefort Capital is an investment firm that

pursues a value event-driven approach across the capital structure

globally, including stressed/distressed credit and legal/process

oriented special situations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203497675/en/

Investors

Whitefort Capital Management, LP info@whitefortcapital.com

Media

Longacre Square Partners Dan Zacchei

Whitefort-LSP@longacresquare.com

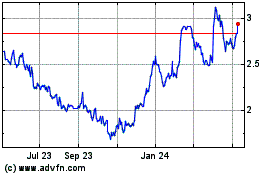

Arbutus Biopharma (NASDAQ:ABUS)

Historical Stock Chart

From Nov 2024 to Dec 2024

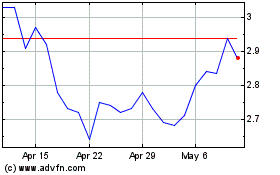

Arbutus Biopharma (NASDAQ:ABUS)

Historical Stock Chart

From Dec 2023 to Dec 2024