Arbutus Biopharma Corporation (Nasdaq: ABUS) (“Arbutus” or the

“Company”), a clinical-stage biopharmaceutical company leveraging

its extensive virology expertise to develop a functional cure for

people with chronic hepatitis B virus (cHBV) infection, today

reports third quarter 2024 financial results and provides a

corporate update.

“We are making significant progress in advancing

the development of imdusiran to bring hope to millions of cHBV

patients globally,” said Michael J. McElhaugh, Interim President

and Chief Executive Officer of Arbutus Biopharma. “In June, we

shared promising data from our IM-PROVE I Phase 2a clinical trial,

showing that some patients treated with imdusiran and interferon

were trending towards a functional cure. We look forward to

presenting follow-up data from this trial, as well as

end-of-treatment data from patients that received nivolumab in

addition to imdusiran and VTP-300 in our IM-PROVE II Phase 2a

trial, at the upcoming AASLD meeting. Assuming continued positive

data, and with a projected cash runway extending into the fourth

quarter of 2026, we are well-positioned to advance imdusiran into a

Phase 2b clinical trial as a cornerstone in a treatment regimen

aimed at functionally curing cHBV.”

Mr. McElhaugh continued, “Our proprietary oral

PD-L1 checkpoint inhibitor, AB-101, is progressing well, as we

continue to see dose-dependent receptor occupancy and have now

advanced into dosing cHBV patients in our Phase 1a/1b clinical

trial. We look forward to providing updates as this trial

progresses.”

Clinical Development Update

Imdusiran (AB-729, RNAi

Therapeutic)

- End-of-treatment

data from the IM-PROVE I Phase 2a clinical trial evaluating the

safety, tolerability and antiviral activity of the combination of

imdusiran (4 or 6 doses over 24 or 48 weeks, respectively),

nucleos(t)ide analogue (NA) therapy and a short course of pegylated

interferon alfa-2a (IFN, 12 or 24 weeks) in patients with cHBV was

presented at the EASL Congress in June. The data showed that 33.3%

(n=4/12) of patients in Cohort A1 receiving 48 weeks (6 doses) of

imdusiran combined with 24 weeks of IFN and NA therapy achieved

HBsAg loss at the end-of-treatment that was maintained in 100% of

these patients 24 weeks after completing imdusiran and IFN

treatment. HBsAg loss was achieved and maintained in 67% of those

patients with HBsAg less than 1000 IU/mL at baseline. A total

of six patients from Cohort A1 (n=4) and Cohort A2 (n=2)

seroconverted with HBsAg loss. At the time the data was reported,

all six of those patients had stopped all therapy, with two of

those patients reaching 12 weeks off all therapy with sustained

HBsAg and HBV DNA loss. The combination of imdusiran and IFN in

this clinical trial was generally safe and well-tolerated. The

Company will present a late-breaker poster with additional

follow-up data at the upcoming AASLD-The Liver Meeting 2024 later

this month.

- End-of treatment

data from the IM-PROVE II Phase 2a clinical trial evaluating the

safety and immunogenicity of imdusiran, NA therapy and Barinthus

Bio’s VTP-300, an HBV antigen-specific immunotherapy was presented

at the EASL Congress in June. The data showed that the

combination of imdusiran and VTP-300 was generally safe and

well-tolerated. At 24-weeks post-end of treatment, statistical

significance (p<0.05) was achieved in HBsAg levels between the

VTP-300 arm (n=5) and placebo (n=6). IM-PROVE II includes an

additional cohort of patients who received 4 doses of imdusiran

plus NA therapy for 24 weeks followed by VTP-300 plus up to two low

doses of nivolumab, an approved anti-PD-1 monoclonal antibody. The

Company will present a late-breaker poster with preliminary

end-of-treatment data from this additional cohort at the upcoming

AASLD - The Liver Meeting 2024 in November.

AB-101 (Oral PD-L1

Inhibitor)

- AB-101-001 is a

Phase 1a/1b double-blind, randomized, placebo-controlled clinical

trial designed to investigate the safety, tolerability,

pharmacokinetics (PK), and pharmacodynamics (PD) of single- and

multiple-ascending oral doses of AB-101 in healthy subjects and

patients with cHBV.

- Part 2 of this

clinical trial has enrolled to date two sequential cohorts of ten

healthy subjects each receiving 10 mg or 25 mg of AB-101 (n=8) or

placebo (n=2) daily for 7 days. AB-101 was generally well-tolerated

with evidence of dose-dependent receptor occupancy. In the 25 mg

cohort, all subjects showed evidence of receptor occupancy, with

seven of the eight subjects demonstrating receptor occupancy

greater than 70% during the 7-day dosing period.

- Arbutus has moved

into Part 3 of this clinical trial which evaluates repeat dosing of

AB-101 for 28 days in patients with cHBV and expects to report

preliminary data in the first half of next year.

LNP Litigation Update

- Expert reports and

expert depositions continue in the Moderna lawsuit. A trial date

has been set for September 24, 2025, and is subject to the Court’s

availability.

- The lawsuit against

Pfizer/BioNTech is ongoing and a date for the claim construction

hearing has been set for December 18, 2024.

Arbutus continues to protect and defend its

intellectual property, which is the subject of the on-going

lawsuits against Moderna and Pfizer/BioNTech. The Company is

seeking fair compensation for Moderna’s and Pfizer/BioNTech’s use

of its patented LNP technology that was developed with great effort

and at a great expense, without which Moderna’s and

Pfizer/BioNTech’s COVID-19 vaccines would not have been

successful.

Financial Results

Cash, Cash Equivalents and

Investments

As of September 30, 2024, the Company had cash,

cash equivalents and investments in marketable securities of $130.8

million compared to $132.3 million as of December 31, 2023.

During the nine months ended September 30, 2024, the Company used

$54.5 million in operating activities, which was partially offset

by $44.1 million of net proceeds from the issuance of common shares

under its “at-the-market” offering program (ATM Program) and $6.1

million of proceeds from the exercise of stock options. The Company

did not issue any common shares under its ATM program in the third

quarter of 2024. The Company expects its 2024 cash burn to range

from $63 million to $67 million. With the organizational

changes in the third quarter, the Company believes its cash, cash

equivalents and investments in marketable securities will be

sufficient to fund its operations into the fourth quarter of

2026.

Revenue

Total revenue was $1.3 million for the three

months ended September 30, 2024 compared to $4.7 million for the

same period in 2023. The decrease of $3.4 million was due primarily

to: i) a decrease in license revenue recognized under the Company’s

licensing agreement with Qilu Pharmaceutical; and ii) a decrease in

license royalty revenue from Alnylam due to lower sales of ONPATTRO

in 2024 compared to 2023.

Operating Expenses

Research and development expenses were $14.3

million for the three months ended September 30, 2024 compared to

$20.2 million for the same period in 2023. The decrease of $5.9

million was due primarily to the discontinuation of the Company’s

coronavirus and AB-161 programs in September 2023, along with

related headcount reductions. General and administrative expenses

were $4.5 million for the three months ended September 30, 2024

compared to $5.8 million for the same period in 2023. The decrease

of $1.3 million was due primarily to decreased employee

compensation and non-cash stock-based compensation expenses due to

headcount reductions. The Company also incurred a $3.6 million

one-time restructuring charge in the third quarter of 2024 related

to its decision to cease all discovery efforts, discontinue its

IM-PROVE III clinical trial, and reduce headcount to streamline the

organization with a focus on advancing the clinical development of

imdusiran and AB-101.

Net Loss

The Company’s net loss was $19.7 million for the

three months ended September 30, 2024 and $20.1 million for the

same period in 2023, with a loss per basic and diluted common share

of $0.10 and $0.12, respectively.

Outstanding Shares

As of September 30, 2024, the Company had

approximately 189.4 million common shares issued and outstanding.

In addition, the Company had approximately 18.7 million stock

options and unvested restricted stock units outstanding as of

September 30, 2024. Roivant Sciences Ltd. owned approximately 21%

of the Company’s outstanding common shares as of September 30,

2024.

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

LOSS |

|

(in thousands, except share and per share

data) |

| |

| |

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

| |

2024 |

|

2023 |

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

Collaborations and licenses |

$ |

767 |

|

|

|

$ |

3,935 |

|

|

|

$ |

2,861 |

|

|

$ |

13,329 |

|

|

Non-cash royalty revenue |

572 |

|

|

|

723 |

|

|

|

|

1,736 |

|

|

|

2,667 |

|

| Total

revenue |

1,339 |

|

|

|

4,658 |

|

|

|

|

4,597 |

|

|

|

15,996 |

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

Research and development |

14,273 |

|

|

|

20,169 |

|

|

|

|

45,227 |

|

|

|

56,136 |

|

|

General and administrative |

4,537 |

|

|

|

5,842 |

|

|

|

|

17,396 |

|

|

|

17,374 |

|

|

Change in fair value of contingent consideration |

344 |

|

|

|

205 |

|

|

|

|

735 |

|

|

|

(158 |

) |

|

Restructuring |

3,625 |

|

|

|

- |

|

|

|

|

3,625 |

|

|

|

- |

|

| Total operating

expenses |

22,779 |

|

|

|

26,216 |

|

|

|

|

66,983 |

|

|

|

73,352 |

|

| Loss from operations |

(21,440 |

) |

|

|

(21,558 |

) |

|

|

|

(62,386 |

) |

|

|

(57,356 |

) |

| Other income |

|

|

|

|

|

|

|

|

|

|

Interest income |

1,747 |

|

|

|

1,494 |

|

|

|

|

5,121 |

|

|

|

4,223 |

|

|

Interest expense |

(29 |

) |

|

|

(46 |

) |

|

|

|

(107 |

) |

|

|

(415 |

) |

|

Foreign exchange gain / (loss) |

5 |

|

|

|

6 |

|

|

|

|

(16 |

) |

|

|

11 |

|

| Total other income |

1,723 |

|

|

|

1,454 |

|

|

|

|

4,998 |

|

|

|

3,819 |

|

| Net loss |

$ |

(19,717 |

) |

|

|

$ |

(20,104 |

) |

|

|

$ |

(57,388 |

) |

|

$ |

(53,537 |

) |

| Loss per

share |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.10 |

) |

|

|

$ |

(0.12 |

) |

|

|

$ |

(0.31 |

) |

|

$ |

(0.32 |

) |

| Weighted average

number of common shares |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

188,997,194 |

|

|

|

167,512,708 |

|

|

|

|

184,244,819 |

|

|

|

165,085,243 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive

loss |

|

|

|

|

|

|

|

|

|

|

|

| Unrealized gain on

available-for-sale securities |

218 |

|

|

|

584 |

|

|

|

|

331 |

|

|

|

1,604 |

|

|

Comprehensive loss |

$ |

(19,499 |

) |

|

|

$ |

(19,520 |

) |

|

|

$ |

(57,057 |

) |

|

$ |

(51,933 |

) |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(in thousands) |

| |

| |

September 30, 2024 |

|

December 31, 2023 |

|

Cash, cash equivalents and marketable securities, current |

$ |

127,794 |

|

|

$ |

126,003 |

| Accounts receivable and other

current assets |

4,983 |

|

|

6,024 |

|

Total current assets |

132,777 |

|

|

132,027 |

| Property and equipment, net of

accumulated depreciation |

3,556 |

|

|

4,674 |

| Investments in marketable

securities, non-current |

2,964 |

|

|

6,284 |

| Right of use asset |

1,144 |

|

|

1,416 |

|

Total assets |

$ |

140,441 |

|

|

$ |

144,401 |

| Accounts payable and accrued

liabilities |

$ |

7,544 |

|

|

$ |

10,271 |

| Deferred license revenue,

current |

|

10,911 |

|

|

|

11,791 |

| Lease liability, current |

468 |

|

|

425 |

|

Total current liabilities |

18,923 |

|

|

22,487 |

| Liability related to sale of

future royalties |

5,315 |

|

|

6,953 |

| Contingent consideration |

8,335 |

|

|

7,600 |

| Lease liability, non-current |

978 |

|

|

1,343 |

| Total stockholders’ equity |

106,890 |

|

|

106,018 |

|

Total liabilities and stockholders’ equity |

$ |

140,441 |

|

|

$ |

144,401 |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(in thousands) |

| |

| |

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

Net loss |

$ |

(57,388 |

) |

|

$ |

(53,537 |

) |

| Non-cash items |

5,453 |

|

|

4,613 |

|

| Change in deferred license

revenue |

(880 |

) |

|

(10,349 |

) |

| Other changes in working

capital |

(1,720 |

) |

|

(9,371 |

) |

| Net cash used in

operating activities |

(54,535 |

) |

|

(68,644 |

) |

| Net cash provided by

investing activities |

9,537 |

|

|

28,548 |

|

|

Issuance of common shares pursuant to the Open Market Sale

Agreement |

44,124 |

|

|

26,000 |

|

|

Cash provided by other financing activities |

6,451 |

|

|

840 |

|

| Net cash provided by

financing activities |

50,575 |

|

|

26,840 |

|

| Effect of foreign exchange rate

changes on cash and cash equivalents |

(16 |

) |

|

11 |

|

|

Increase/(decrease) in cash and cash equivalents |

5,561 |

|

|

(13,245 |

) |

| Cash and cash equivalents,

beginning of period |

26,285 |

|

|

30,776 |

|

|

Cash and cash equivalents, end of period |

31,846 |

|

|

17,531 |

|

| Investments in marketable

securities |

98,912 |

|

|

127,145 |

|

|

Cash, cash equivalents and marketable securities, end of

period |

$ |

130,758 |

|

|

$ |

144,676 |

|

|

|

|

|

|

|

|

|

|

Conference Call and Webcast Today

Arbutus will hold a conference call and webcast

today, Wednesday, November 6, 2024, at 8:45 AM Eastern Time to

provide a corporate update. To dial-in for the conference call by

phone, please register using the following link: Registration Link.

A live webcast of the conference call can be accessed through the

Investors section of Arbutus' website at www.arbutusbio.com.

An archived webcast will be available on the

Arbutus website after the event.

About Imdusiran (AB-729)

Imdusiran is an RNA interference (RNAi)

therapeutic specifically designed to reduce all HBV viral proteins

and antigens including hepatitis B surface antigen, which is

thought to be a key prerequisite to enable reawakening of a

patient’s immune system to respond to the virus. Imdusiran targets

hepatocytes using Arbutus’ novel covalently conjugated

N-Acetylgalactosamine (GalNAc) delivery technology enabling

subcutaneous delivery. Clinical data generated thus far has shown

single and multiple doses of imdusiran to be generally safe and

well-tolerated, while also providing meaningful reductions in

hepatitis B surface antigen and hepatitis B DNA. Imdusiran is

currently in multiple Phase 2a clinical trials.

About AB-101

AB-101 is our oral PD-L1 inhibitor candidate

that we believe will allow for controlled checkpoint blockade while

minimizing the systemic safety issues typically seen with

checkpoint antibody therapies. Immune checkpoints such as

PD-1/PD-L1 play an important role in the induction and maintenance

of immune tolerance and in T-cell activation. Preclinical data

generated thus far indicates that AB-101 mediates re-activation of

exhausted HBV-specific T-cells from cHBV patients. We believe

AB-101, when used in combination with other approved and

investigational agents, could potentially lead to a functional cure

in patients chronically infected with HBV. AB-101 is currently

being evaluated in a Phase 1a/1b clinical trial.

About HBV

Hepatitis B is a potentially life-threatening

liver infection caused by the hepatitis B virus (HBV). HBV can

cause chronic infection which leads to a higher risk of death from

cirrhosis and liver cancer. Chronic HBV infection represents a

significant unmet medical need. The World Health Organization

estimates that over 250 million people worldwide suffer from

chronic HBV infection, while other estimates indicate that

approximately 2.4 million people in the United States suffer from

chronic HBV infection. Approximately 820,000 people die every year

from complications related to chronic HBV infection despite the

availability of effective vaccines and current treatment

options.

About Arbutus

Arbutus Biopharma Corporation (Nasdaq: ABUS) is

a clinical-stage biopharmaceutical company leveraging its extensive

virology expertise to develop novel therapeutics with distinct

mechanisms of action, which can potentially be combined to provide

a functional cure for patients with chronic hepatitis B virus

(cHBV). We believe the key to success in developing a functional

cure involves suppressing HBV DNA, reducing surface antigen, and

boosting HBV-specific immune responses. Our pipeline of internally

developed, proprietary compounds includes an RNAi therapeutic,

imdusiran (AB-729), and an oral PD-L1 inhibitor, AB-101. Imdusiran

has generated meaningful clinical data demonstrating an impact on

both surface antigen reduction and reawakening of the HBV-specific

immune response. Imdusiran is currently in two Phase 2a combination

clinical trials. AB-101 is currently being evaluated in a Phase

1a/1b clinical trial. For more information, visit

www.arbutusbio.com.

Forward-Looking Statements and

Information

This press release contains forward-looking

statements within the meaning of the Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934,

and forward-looking information within the meaning of Canadian

securities laws (collectively, forward-looking statements).

Forward-looking statements in this press release include statements

about our future development plans for our product candidates; the

expected cost, timing and results of our clinical development plans

and clinical trials with respect to our product candidates; our

expectations with respect to the release of data from our clinical

trials and the expected timing thereof; our expectations and goals

for our collaborations with third parties and any potential

benefits related thereto; our expectations regarding our

organizational changes; the potential for our product candidates to

achieve success in clinical trials; our expectations regarding our

pending litigation matters; and our expected financial condition,

including our anticipated net cash burn, the anticipated duration

of cash runways and timing regarding needs for additional

capital.

With respect to the forward-looking statements

contained in this press release, Arbutus has made numerous

assumptions regarding, among other things: the effectiveness and

timeliness of preclinical studies and clinical trials, and the

usefulness of the data; the timeliness of regulatory approvals; the

continued demand for Arbutus’ assets; and the stability of economic

and market conditions. While Arbutus considers these assumptions to

be reasonable, these assumptions are inherently subject to

significant business, economic, competitive, market and social

uncertainties and contingencies, including uncertainties and

contingencies related to patent litigation matters.

Additionally, there are known and unknown risk

factors which could cause Arbutus’ actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements contained herein. Known risk factors

include, among others: anticipated pre-clinical studies and

clinical trials may be more costly or take longer to complete than

anticipated, and may never be initiated or completed, or may not

generate results that warrant future development of the tested

product candidate; Arbutus may elect to change its strategy

regarding its product candidates and clinical development

activities; Arbutus may not receive the necessary regulatory

approvals for the clinical development of Arbutus’ products;

economic and market conditions may worsen; Arbutus may not realize

the anticipated benefits from the organizational changes; Arbutus

may incur additional unexpected expenses in connection with the

organizational changes; Arbutus may experience additional employee

turnover as a result of the organizational changes; uncertainties

associated with litigation generally and patent litigation

specifically; and Arbutus and its collaborators may never realize

the expected benefits of the collaborations; market shifts may

require a change in strategic focus.

A more complete discussion of the risks and

uncertainties facing Arbutus appears in Arbutus’ Annual Report on

Form 10-K, Arbutus’ Quarterly Reports on Form 10-Q and Arbutus’

continuous and periodic disclosure filings, which are available at

www.sedar.com and at www.sec.gov. All forward-looking statements

herein are qualified in their entirety by this cautionary

statement, and Arbutus disclaims any obligation to revise or update

any such forward-looking statements or to publicly announce the

result of any revisions to any of the forward-looking statements

contained herein to reflect future results, events or developments,

except as required by law.

Contact Information

Investors and Media

Lisa M. CaperelliVice President, Investor RelationsPhone:

215-206-1822Email: lcaperelli@arbutusbio.com

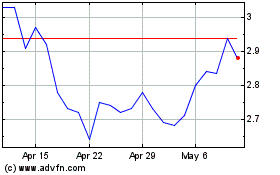

Arbutus Biopharma (NASDAQ:ABUS)

Historical Stock Chart

From Jan 2025 to Feb 2025

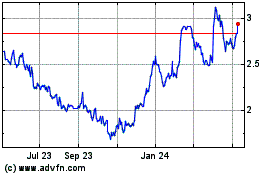

Arbutus Biopharma (NASDAQ:ABUS)

Historical Stock Chart

From Feb 2024 to Feb 2025