Adeia Inc. (Nasdaq: ADEA) (the “Company” or “Adeia”) today

announced financial results for the fourth quarter and full year

ended December 31, 2022.

“The results of the fourth quarter are demonstrative of the

success of our continued investment in innovation and portfolio

development that shapes the future of digital entertainment. In the

fourth quarter we closed ten renewals and new license agreements

with customers across multiple verticals including consumer

electronics, Pay-TV, social media and semiconductor. This strong

momentum continued into 2023, signing a significant early renewal

with Altice, a leading provider of broadband and video. The volume

of new deals and renewals demonstrates the strength of our IP

portfolio and our collaborative approach to working with

customers,” said Paul E. Davis, chief executive officer of Adeia.

“Our investment in new technologies will further expand our

customer base as well as enable our existing customers to continue

to leverage the value of our growing portfolio. I would like to

commend our talented team for their strong execution in 2022 and I

look forward to continued success in 2023.”

Fourth Quarter and Full Year Financial

Highlights1

- Total revenue for the fourth quarter

was $103.3 million, an increase of 15% from $89.7 million in the

same period last year

- Total revenue for the full year 2022

was $438.9 million, an increase of 12% from $391.2 million in

2021

- GAAP diluted earnings per share (EPS)

of $0.65 and non-GAAP diluted EPS of $0.41 for the fourth

quarter

- Net income from continuing operations

was $73.7 million and adjusted EBITDA was $74.9 million for the

fourth quarter

- Cash flows from operating activities

for the fourth quarter was $41.0 million

Business Highlights

Our deal momentum across multiple verticals included:

- Samsung signed a long-term license

renewal to the Company’s media patent portfolio for its Smart TVs

and related offerings

- Two leading social media companies

signed multi-year license agreements to the Company’s media patent

portfolio

- Altice signed an early renewal to

extend their license, which supports their Optimum services,

including their cable TV and over-the-top (OTT) streaming

services

- Qorvo, a leading provider of

radio-frequency (RF) solutions, signed a new semiconductor license

agreement relating to our hybrid bonding technology

- Additionally, we signed renewals and

new agreements across multiple media verticals and geographical

regions with Fetch TV, SONIFI Solutions and Naver

Capital Allocation

On December 21, 2022, the Company distributed $5.3 million to

stockholders of record on November 30, 2022, for a quarterly cash

dividend of $0.05 per share of common stock.

On February 9, 2023, the Board of Directors declared a dividend

of $0.05 per share, payable on March 29, 2023, to stockholders of

record on March 15, 2023.

During the fourth quarter, the Company made a $10.1 million

payment toward its outstanding term loan, bringing the outstanding

balance to $749.3 million as of December 31, 2022.

Subsequent to the end of the year, the Company elected to make

an additional payment of $50.0 million towards its outstanding term

loan.

________________________________

1The results of operations of Adeia presented herein pertain to

continuing operations. As the accounting requirements for reporting

the separation of Xperi Inc. as a discontinued operation were met

when the separation was completed on October 1, 2022, the financial

results of Xperi Inc. for the year ended December 31, 2022 are

presented as discontinued operations on the Consolidated Statements

of Operations.

Financial Outlook

The Company's full year 2023 outlook is as follows:

|

Category (in millions, except for tax

rate) |

|

2023 GAAP Outlook |

|

2023 Non-GAAP Outlook |

|

Revenue |

|

$385.0 - 415.0 |

|

$385.0 - 415.0 |

| Operating expenses1 |

|

$253.0 - 267.0 |

|

$135.0 - 145.0 |

| Interest expense |

|

$64.0 - 67.0 |

|

$64.0 - 67.0 |

| Other income |

|

$2.5 - 3.0 |

|

$2.5 - 3.0 |

| Tax rate |

|

23% - 25% |

|

23% |

| Net income2 |

|

$52.5 - 64.0 |

|

$145.0 - 159.0 |

| Adjusted EBITDA2 |

|

N/A |

|

$252.3 - 272.3 |

| Cash from operations |

|

$185.0 - 215.0 |

|

$185.0 - 215.0 |

| Diluted shares outstanding |

|

116.0 |

|

116.0 |

1 See tables for reconciliation of GAAP to Non-GAAP operating

expenses

2 See tables for reconciliation of GAAP net income to (i)

non-GAAP net income and (ii) adjusted earnings before interest

expense, income taxes, depreciation and amortization (adjusted

EBITDA)

Conference Call Information

The Company will hold its fourth quarter and full year 2022

earnings conference call at 2:00 PM Pacific Time (5:00 PM Eastern

Time) on Wednesday, February 22, 2023. To access the call in the

U.S., please dial +1 877-451-6152, and for international callers,

dial +1 201-389-0879. All participants should dial in 15 minutes

prior to the start of the conference call. The Company also

suggests utilizing the webcast link to access the call at Q4 FY2022

Earnings Call Webcast.

Safe Harbor Statement

This press release contains "forward-looking statements" within

the meaning of the federal securities laws, including Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements are based on information available to the Company as of

the date hereof, as well as the Company’s current expectations,

assumptions, estimates and projections that involve risks and

uncertainties. In this context, forward-looking statements often

address expected future business, financial performance and

financial condition, and often contain words such as "expect,"

"anticipate," "intend," "plan," "believe," "could," "seek," "see,"

"will," "may," "would," "might," "potentially," "estimate,"

"continue," "expect," "target," similar expressions or the

negatives of these words or other comparable terminology that

convey uncertainty of future events or outcomes. All

forward-looking statements by their nature address matters that

involve risks and uncertainties, many of which are beyond the

Company’s control, and are not guarantees of future results. These

and other forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results to

differ materially from those expressed in any forward-looking

statements. Accordingly, there are or will be important factors

that could cause actual results to differ materially from those

indicated in such statements and, therefore, you should not place

undue reliance on any such statements and caution must be exercised

in relying on forward-looking statements. Important risk factors

that may cause such a difference include, but are not limited to:

the Company’s ability to implement its business strategy; the

Company’s ability to enter into new and renewal license agreements

with customers on favorable terms; the Company’s ability to retain

and hire key personnel; uncertainty as to the long-term value of

the Company’s common stock; legislative, regulatory and economic

developments affecting the Company’s business; general economic and

market developments and conditions; the Company’s ability to grow

and expand its patent portfolios; changes in technology and

development of competing technology in the industries in which in

which the Company operates; the evolving legal, regulatory and tax

regimes under which the Company operates; unforeseen liabilities

and expenses; risks associated with the Company’s indebtedness; the

Company’s ability to achieve the intended benefits of, and its

ability to recognize the anticipated tax treatment of, the recent

spin-off of its product business; unpredictability and severity of

catastrophic events, including, but not limited to, acts of

terrorism or outbreak of war or hostilities, including Russia’s

invasion of Ukraine, and natural disasters; and the extent to which

the COVID-19 pandemic continues to have an adverse impact on the

Company’s business, results of operations, and financial condition

will depend on future developments, including measures taken in

response to the pandemic, which are highly uncertain and cannot be

predicted. These risks, as well as other risks associated with the

business, are more fully discussed in the Company’s filings with

the U.S. Securities and Exchange Commission ("SEC"), including the

Company’s Annual Report on Form 10-K and Quarterly Reports on Form

10-Q. While the list of factors presented here is, and the list of

factors presented in the Company’s filings with the SEC are,

considered representative, no such list should be considered to be

a complete statement of all potential risks and uncertainties.

Unlisted factors may present significant additional obstacles to

the realization of forward-looking statements.

Consequences of material differences in results as compared with

those anticipated in the forward-looking statements could include,

among other things, business disruption, operational problems,

financial loss, legal liability to third parties and similar risks,

any of which could have a material adverse effect on the Company’s

consolidated financial condition, results of operations, liquidity

or trading price of common stock. The Company does not assume any

obligation to publicly provide revisions or updates to any

forward-looking statements, whether as a result of new information,

future developments or otherwise, should circumstances change,

except as otherwise required by securities and other applicable

laws.

About Adeia Inc.

Adeia invents, develops and licenses fundamental innovations

that shape the way millions of people explore and experience

entertainment in an increasingly connected world. From TVs to

smartphones, and across all types of entertainment experiences,

Adeia’s technologies allow users to manage content and connections

in a way that is smart, immersive and personal. For more

information, please visit adeia.com.

Non-GAAP Financial Measures

In addition to disclosing financial results calculated in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP), the Company’s earnings release contains non-GAAP financial

measures adjusted, where applicable, for either one-time or ongoing

non-cash acquired intangibles amortization charges; costs related

to actual or planned business combinations including transaction

fees, integration costs, severance payments, facility closures, and

retention bonuses; separation costs from the separation of Xperi

Inc.; all forms of stock-based compensation; loss on debt

extinguishment; expensed debt refinancing costs; impairment of

intangible assets; impact of certain foreign currency adjustments;

discontinued operations and related tax effects. In addition,

adjusted EBITDA adjusts for recurring charges of interest expense,

income taxes, depreciation and amortization. Management believes

that the non-GAAP measures used in this release provide investors

with important perspectives into the Company’s ongoing business and

financial performance and provide a better understanding of our

core operating results reflecting our normal business operations.

The non-GAAP financial measures disclosed by the Company should not

be considered a substitute for, or superior to, financial measures

calculated in accordance with GAAP. Our use of non-GAAP financial

measures has certain limitations in that the non-GAAP financial

measures we use may not be directly comparable to those reported by

other companies. For example, the terms used in this press release,

such as adjusted EBITDA, non-GAAP operating expenses, non-GAAP net

income, non-GAAP diluted earnings per share (EPS), do not have a

standardized meaning. Other companies may use the same or similarly

named measures, but exclude different items, which may not provide

investors with a comparable view of our performance in relation to

other companies. We seek to compensate for the limitation of our

non-GAAP presentation by providing a detailed reconciliation of the

non-GAAP financial measures to the most directly comparable GAAP

measures in the tables attached hereto. Investors are encouraged to

review the related GAAP financial measures and the reconciliation

of these non-GAAP financial measures to their most directly

comparable GAAP financial measures. All financial data is presented

on a GAAP basis except where the Company indicates its presentation

is on a non-GAAP basis.

Set forth below are reconciliations of the Company’s reported

and forecasted GAAP to non-GAAP financial metrics.

Investor Contact:Ned MitchellIR@adeia.com

– Tables Follow –

SOURCE: ADEIA

INC.ADEA

ADEIA INC.CONSOLIDATED

STATEMENTS OF OPERATIONS(in thousands, except per

share amounts)(unaudited)

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

December 31,2022 |

|

|

December 31,2021 |

|

|

December 31,2022 |

|

|

December 31,2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

103,290 |

|

|

$ |

89,705 |

|

|

$ |

438,933 |

|

|

$ |

391,212 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

12,041 |

|

|

|

13,953 |

|

|

|

44,579 |

|

|

|

39,608 |

|

|

Selling, general and administrative |

|

32,546 |

|

|

|

33,003 |

|

|

|

135,630 |

|

|

|

129,214 |

|

|

Amortization expense |

|

23,950 |

|

|

|

24,531 |

|

|

|

97,077 |

|

|

|

98,090 |

|

|

Litigation expense |

|

1,510 |

|

|

|

1,250 |

|

|

|

8,587 |

|

|

|

5,272 |

|

|

Total operating expenses |

|

70,047 |

|

|

|

72,737 |

|

|

|

285,873 |

|

|

|

272,184 |

|

|

Operating income from continuing operations |

|

33,243 |

|

|

|

16,968 |

|

|

|

153,060 |

|

|

|

119,028 |

|

| Interest expense |

|

(15,023 |

) |

|

|

(8,573 |

) |

|

|

(45,335 |

) |

|

|

(38,973 |

) |

| Other income and expense,

net |

|

420 |

|

|

|

(1,040 |

) |

|

|

2,047 |

|

|

|

768 |

|

| Loss on debt extinguishment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8,012 |

) |

|

Income from continuing operations before income taxes |

|

18,640 |

|

|

|

7,355 |

|

|

|

109,772 |

|

|

|

72,811 |

|

| Provision for (benefit from)

income taxes |

|

(55,090 |

) |

|

|

(1,264 |

) |

|

|

(28,620 |

) |

|

|

4,828 |

|

| Net income from continuing

operations |

|

73,730 |

|

|

|

8,619 |

|

|

|

138,392 |

|

|

|

67,983 |

|

| Net loss from discontinued

operations, net of tax |

|

— |

|

|

|

(23,808 |

) |

|

|

(436,978 |

) |

|

|

(126,896 |

) |

| Net income (loss) |

|

73,730 |

|

|

|

(15,189 |

) |

|

|

(298,586 |

) |

|

|

(58,913 |

) |

|

Less: Net loss attributable to non-controlling interest in

discontinued operations |

|

— |

|

|

|

(630 |

) |

|

|

(2,706 |

) |

|

|

(3,456 |

) |

| Net income (loss) attributable to

the Company |

$ |

73,730 |

|

|

$ |

(14,559 |

) |

|

$ |

(295,880 |

) |

|

$ |

(55,457 |

) |

| Income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

$ |

0.70 |

|

|

$ |

0.08 |

|

|

$ |

1.33 |

|

|

$ |

0.65 |

|

|

Discontinued operations |

|

— |

|

|

|

(0.22 |

) |

|

|

(4.16 |

) |

|

|

(1.18 |

) |

|

Net income (loss) |

$ |

0.70 |

|

|

$ |

(0.14 |

) |

|

$ |

(2.84 |

) |

|

$ |

(0.53 |

) |

|

Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

$ |

0.65 |

|

|

$ |

0.08 |

|

|

$ |

1.29 |

|

|

$ |

0.63 |

|

|

Discontinued operations |

|

— |

|

|

|

(0.22 |

) |

|

|

(4.04 |

) |

|

|

(1.15 |

) |

|

Net income (loss) |

$ |

0.65 |

|

|

$ |

(0.14 |

) |

|

$ |

(2.75 |

) |

|

$ |

(0.52 |

) |

|

Weighted average number of shares used in per

sharecalculations-basic |

|

105,135 |

|

|

|

104,249 |

|

|

|

104,336 |

|

|

|

104,735 |

|

|

Weighted average number of shares used in per

sharecalculations-diluted |

|

113,392 |

|

|

|

105,915 |

|

|

|

107,580 |

|

|

|

107,265 |

|

ADEIA INC.CONSOLIDATED

BALANCE SHEETS(in

thousands)(unaudited)

|

|

December 31, |

|

|

December 31, |

|

|

|

2022 |

|

|

2021 |

|

| ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

114,555 |

|

|

$ |

80,428 |

|

|

Available-for-sale debt securities |

|

— |

|

|

|

60,534 |

|

|

Accounts receivable, net of allowance for credit losses |

|

58,480 |

|

|

|

64,187 |

|

|

Unbilled contracts receivable, net |

|

73,754 |

|

|

|

26,715 |

|

|

Other current assets |

|

11,924 |

|

|

|

10,490 |

|

|

Current assets of discontinued operations |

|

— |

|

|

|

277,120 |

|

|

Total current assets |

|

258,713 |

|

|

|

519,474 |

|

| Long-term unbilled contracts

receivable |

|

40,705 |

|

|

|

282 |

|

| Property and equipment, net |

|

4,550 |

|

|

|

4,936 |

|

| Operating lease right-of-use

assets |

|

5,993 |

|

|

|

6,640 |

|

| Intangible assets, net |

|

432,476 |

|

|

|

546,982 |

|

| Goodwill |

|

313,660 |

|

|

|

314,576 |

|

| Long-term income tax

receivable |

|

113,679 |

|

|

|

118,059 |

|

| Other long-term assets |

|

40,750 |

|

|

|

9,646 |

|

| Long-term assets of discontinued

operations |

|

— |

|

|

|

949,427 |

|

|

Total assets |

$ |

1,210,526 |

|

|

$ |

2,470,022 |

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

8,546 |

|

|

$ |

448 |

|

|

Accrued legal fees |

|

4,942 |

|

|

|

4,980 |

|

|

Accrued liabilities |

|

26,335 |

|

|

|

21,752 |

|

|

Current portion of long-term debt |

|

103,776 |

|

|

|

36,095 |

|

|

Deferred revenue |

|

17,076 |

|

|

|

6,975 |

|

|

Current liabilities of discontinued operations |

|

— |

|

|

|

119,497 |

|

|

Total current liabilities |

|

160,675 |

|

|

|

189,747 |

|

| Deferred revenue, less current

portion |

|

10,683 |

|

|

|

13,443 |

|

| Long-term deferred tax

liabilities |

|

— |

|

|

|

7,077 |

|

| Long-term debt, net |

|

625,617 |

|

|

|

729,392 |

|

| Noncurrent operating lease

liabilities |

|

4,794 |

|

|

|

5,641 |

|

| Long-term income tax payable |

|

87,302 |

|

|

|

91,445 |

|

| Other long-term liabilities |

|

20,043 |

|

|

|

3,792 |

|

| Long-term liabilities of

discontinued operations |

|

— |

|

|

|

89,057 |

|

|

Total liabilities |

|

909,114 |

|

|

|

1,129,594 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Company stockholders’

equity: |

|

|

|

|

|

|

Preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

117 |

|

|

|

113 |

|

|

Additional paid-in capital |

|

636,266 |

|

|

|

1,340,480 |

|

|

Treasury stock at cost |

|

(211,223 |

) |

|

|

(178,022 |

) |

|

Accumulated other comprehensive loss |

|

(51 |

) |

|

|

(752 |

) |

|

Retained earnings (accumulated deficit) |

|

(123,697 |

) |

|

|

187,814 |

|

|

Total Company stockholders’ equity |

|

301,412 |

|

|

|

1,349,633 |

|

| Noncontrolling interest |

|

— |

|

|

|

(9,205 |

) |

|

Total equity |

|

301,412 |

|

|

|

1,340,428 |

|

|

Total liabilities and equity |

$ |

1,210,526 |

|

|

$ |

2,470,022 |

|

ADEIA INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(in

thousands)(unaudited)

|

|

Twelve Months Ended |

|

|

|

December 31, 2022 |

|

|

December 31, 2021 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

Net income (loss) |

$ |

(298,586 |

) |

|

$ |

(58,913 |

) |

|

Adjustments to reconcile net income (loss) to net cash from

operating activities: |

|

|

|

|

|

|

Depreciation of property and equipment |

|

17,144 |

|

|

|

23,801 |

|

|

Amortization of intangible assets |

|

143,243 |

|

|

|

203,401 |

|

|

Goodwill impairment |

|

354,000 |

|

|

|

— |

|

|

Stock-based compensation expense |

|

52,626 |

|

|

|

58,182 |

|

|

Deferred income tax |

|

(51,030 |

) |

|

|

(978 |

) |

|

Loss on debt extinguishment |

|

— |

|

|

|

8,012 |

|

|

Patent assets received in lieu of cash |

|

— |

|

|

|

(8,787 |

) |

|

Other |

|

5,149 |

|

|

|

5,488 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

24,892 |

|

|

|

(27,615 |

) |

|

Unbilled contracts receivable, net |

|

(86,673 |

) |

|

|

58,496 |

|

|

Other assets |

|

4,504 |

|

|

|

7,497 |

|

|

Accounts payable |

|

18,601 |

|

|

|

(5,234 |

) |

|

Accrued and other liabilities |

|

(632 |

) |

|

|

(27,910 |

) |

|

Deferred revenue |

|

(215 |

) |

|

|

(651 |

) |

|

Net cash from operating activities |

|

183,023 |

|

|

|

234,789 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

(12,576 |

) |

|

|

(13,950 |

) |

|

Proceeds from sale of property and equipment |

|

86 |

|

|

|

19 |

|

|

Net cash received (paid) for mergers and acquisitions |

|

(50,473 |

) |

|

|

(17,400 |

) |

|

Purchases of short-term investments |

|

(4,490 |

) |

|

|

(67,343 |

) |

|

Proceeds from sales of short-term investments |

|

28,254 |

|

|

|

49,768 |

|

|

Proceeds from maturities of short-term investments |

|

36,576 |

|

|

|

42,886 |

|

|

Purchases of intangible assets |

|

(290 |

) |

|

|

(186 |

) |

|

Net cash from investing activities |

|

(2,913 |

) |

|

|

(6,206 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

Repayment of debt |

|

(40,500 |

) |

|

|

(84,048 |

) |

|

Debt refinancing costs |

|

— |

|

|

|

(4,253 |

) |

|

Dividends paid |

|

(20,888 |

) |

|

|

(20,979 |

) |

|

Distribution of Xperi Inc. |

|

(182,928 |

) |

|

|

— |

|

|

Proceeds from employee stock purchase program and exercise of stock

options |

|

14,260 |

|

|

|

13,839 |

|

|

Repurchases of common stock |

|

(33,201 |

) |

|

|

(100,804 |

) |

|

Net cash from financing activities |

|

(263,257 |

) |

|

|

(196,245 |

) |

| Effect of exchange rate changes

on cash and cash equivalents |

|

(3,419 |

) |

|

|

(1,405 |

) |

| Net increase (decrease) in cash

and cash equivalents |

|

(86,566 |

) |

|

|

30,933 |

|

| Cash and cash equivalents at

beginning of period |

|

201,121 |

|

|

|

170,188 |

|

| Cash and cash equivalents at end

of period |

$ |

114,555 |

|

|

$ |

201,121 |

|

Cash flows above are presented on a consolidated basis and

therefore also include $120.7 million of cash and cash equivalents

presented in current assets of discontinued operations in the

Consolidated Balance Sheet as of December 31, 2021.

ADEIA INC.GAAP TO

NON-GAAP RECONCILIATIONS(in thousands, except per

share amounts)(unaudited)

| Net

income |

|

|

|

|

|

| |

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

December 31, 2022 |

|

|

December 31, 2022 |

|

|

GAAP net income from continuing operations |

$ |

73,730 |

|

|

$ |

138,392 |

|

| |

|

|

|

|

|

| Adjustments to GAAP net income

from continuing operations: |

|

|

|

|

|

|

Stock-based compensation expense: |

|

|

|

|

|

|

Research and development |

|

440 |

|

|

|

1,644 |

|

|

Selling, general and administrative |

|

2,903 |

|

|

|

21,201 |

|

| Amortization expense |

|

23,950 |

|

|

|

97,077 |

|

| Other corporate expenses

(1) |

|

— |

|

|

|

37,282 |

|

|

Transaction and separation-related costs: |

|

|

|

|

|

|

Transaction and other related costs recorded in selling, general

and administrative |

|

— |

|

|

|

2,793 |

|

|

Separation and other related costs recorded in selling, general and

administrative (2) |

|

13,697 |

|

|

|

13,697 |

|

|

Severance and retention recorded in selling, general and

administrative |

|

243 |

|

|

|

278 |

|

| Total operating expenses

adjustments |

|

41,233 |

|

|

|

173,972 |

|

| Other income and expense,

net |

|

788 |

|

|

|

788 |

|

| Non-GAAP tax adjustment

(3) |

|

(69,042 |

) |

|

|

(94,063 |

) |

| Non-GAAP net income from

continuing operations |

$ |

46,709 |

|

|

$ |

219,089 |

|

| |

|

|

|

|

|

| Diluted income per

share |

|

|

|

|

|

| |

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

December 31, 2022 |

|

|

December 31, 2022 |

|

| GAAP diluted income per share

from continuing operations |

$ |

0.65 |

|

|

$ |

1.29 |

|

| |

|

|

|

|

|

| Adjustments to GAAP diluted

income per share from continuing operations: |

|

|

|

|

|

|

Stock-based compensation expense: |

|

|

|

|

|

|

Research and development |

|

— |

|

|

|

0.01 |

|

|

Selling, general and administrative |

|

0.03 |

|

|

|

0.20 |

|

| Amortization expense |

|

0.21 |

|

|

|

0.90 |

|

| Other corporate expenses

(1) |

|

— |

|

|

|

0.35 |

|

|

Transaction and separation-related costs: |

|

|

|

|

|

|

Transaction and other related costs recorded in selling, general

and administrative |

|

— |

|

|

|

0.02 |

|

|

Separation and other related costs recorded in selling, general and

administrative (2) |

|

0.12 |

|

|

|

0.13 |

|

|

Severance and retention recorded in selling, general and

administrative |

|

— |

|

|

|

— |

|

| Total operating expenses

adjustments |

|

0.36 |

|

|

|

1.61 |

|

| Other income and expense,

net |

|

0.01 |

|

|

|

0.01 |

|

| Non-GAAP tax adjustment

(3) |

|

(0.61 |

) |

|

|

(0.87 |

) |

| Non-GAAP diluted income per share

from continuing operations |

$ |

0.41 |

|

|

$ |

2.04 |

|

(1) Represents general corporate overhead costs, which were

historically allocated to Xperi Inc., that do not meet the

requirements to be presented in discontinued operations. Such costs

are not reflective of the on-going operations of the Company and

include labor and non-labor costs related to the Company’s

corporate support functions (e.g., administration, human resources,

finance, accounting, tax, information technology, corporate

development, legal, among others) that historically provided

support to Xperi Inc. prior to its separation on October 1,

2022.

(2) Represents separation and related costs that were incurred

subsequent to the separation on October 1, 2022 that will be

accounted for in continuing operations including fees for financial

advisory and other professional services, and expenses incurred on

a transitional basis under a contract shared with Xperi Inc.

(3) The provision for income taxes is adjusted to reflect the

net direct and indirect income tax effects of the various non-GAAP

pretax adjustments

ADEIA INC.GAAP NET

INCOME TO ADJUSTED EBITDA RECONCILIATION

(in thousands)(unaudited)

| |

Three Months Ended |

|

| |

December 31, 2022 |

|

|

GAAP net income from continuing operations |

$ |

73,730 |

|

| |

|

|

| Adjustments to GAAP net income

from continuing operations: |

|

|

| Stock-based compensation

expense: |

|

|

|

Research and development |

|

440 |

|

|

Selling, general and administrative |

|

2,903 |

|

| Transaction and

separation-related costs: |

|

|

|

Separation and other related costs recorded in selling, general and

administrative (1) |

|

13,697 |

|

|

Severance and retention recorded in selling, general and

administrative |

|

243 |

|

| Amortization expense |

|

23,950 |

|

| Depreciation expense |

|

385 |

|

| Interest expense |

|

15,023 |

|

| Interest income |

|

(420 |

) |

| Provision for (benefit from)

income taxes |

|

(55,090 |

) |

| Adjusted EBITDA |

$ |

74,861 |

|

(1) Represents separation and related costs that were incurred

subsequent to the separation on October 1, 2022 that will be

accounted for in continuing operations including expenses incurred

on a transitional basis under a contract shared with Xperi Inc.

ADEIA INC.RECONCILIATION

FOR GUIDANCE ON OPERATING

EXPENSES(in

millions)(unaudited)

|

|

Year Ended |

|

|

|

December 31, 2023 |

|

|

|

Low |

|

|

High |

|

|

GAAP operating expenses |

$ |

253.0 |

|

|

$ |

267.0 |

|

|

Amortization expense |

|

95.0 |

|

|

|

95.0 |

|

|

Stock-based compensation expense |

|

14.0 |

|

|

|

16.0 |

|

|

Separation and related costs (1) |

|

9.0 |

|

|

|

11.0 |

|

|

Total of non-GAAP adjustments |

|

118.0 |

|

|

|

122.0 |

|

| Non-GAAP operating

expenses |

$ |

135.0 |

|

|

$ |

145.0 |

|

(1) Represents separation and related costs that were incurred

subsequent to the separation on October 1, 2022 that will be

accounted for in continuing operations including expenses incurred

on a transitional basis under a contract shared with Xperi Inc.

ADEIA INC.RECONCILIATION

FOR GUIDANCE ON NET INCOME(in

millions)(unaudited)

|

|

Year Ended |

|

|

|

December 31, 2023 |

|

|

|

Low |

|

|

High |

|

|

GAAP net income |

$ |

52.5 |

|

|

$ |

64.0 |

|

|

Amortization expense |

|

95.0 |

|

|

|

95.0 |

|

|

Stock-based compensation expense |

|

14.0 |

|

|

|

16.0 |

|

|

Separation and related costs (1) |

|

9.0 |

|

|

|

11.0 |

|

|

Total of non-GAAP operating expenses |

|

118.0 |

|

|

|

122.0 |

|

| Non-GAAP tax adjustment |

|

(25.5 |

) |

|

|

(27.0 |

) |

| Non-GAAP net income |

$ |

145.0 |

|

|

$ |

159.0 |

|

(1) Represents separation and related costs that were incurred

subsequent to the separation on October 1, 2022 that will be

accounted for in continuing operations including expenses incurred

on a transitional basis under a contract shared with Xperi Inc.

ADEIA INC.RECONCILIATION

FOR GUIDANCE ONADJUSTED EBITDA

(in millions)(unaudited)

|

|

Year Ended |

|

|

|

December 31, 2023 |

|

|

|

Low |

|

|

High |

|

|

GAAP net income |

$ |

52.5 |

|

|

$ |

64.0 |

|

|

Stock-based compensation expense |

|

14.0 |

|

|

|

16.0 |

|

|

Separation and related costs (1) |

|

9.0 |

|

|

|

11.0 |

|

|

Amortization expense |

|

95.0 |

|

|

|

95.0 |

|

|

Depreciation expense |

|

2.3 |

|

|

|

2.3 |

|

|

Interest expense |

|

64.0 |

|

|

|

67.0 |

|

|

Other income |

|

(2.5 |

) |

|

|

(3.0 |

) |

|

Income tax expense |

|

18.0 |

|

|

|

20.0 |

|

|

Total of non-GAAP adjustments |

|

199.8 |

|

|

|

208.3 |

|

| Adjusted EBITDA |

$ |

252.3 |

|

|

$ |

272.3 |

|

(1) Represents separation and related costs that were incurred

subsequent to the separation on October 1, 2022 that will be

accounted for in continuing operations including expenses incurred

on a transitional basis under a contract shared with Xperi Inc.

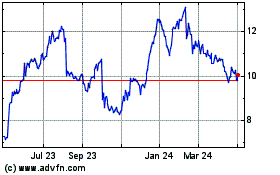

Adeia (NASDAQ:ADEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

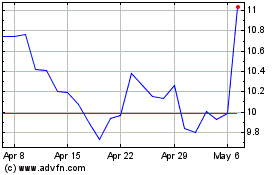

Adeia (NASDAQ:ADEA)

Historical Stock Chart

From Apr 2023 to Apr 2024