false

--12-31

Q2

0001014763

0001014763

2024-01-01

2024-06-30

0001014763

AIMD:CommonStockParValue0.01PerShareMember

2024-01-01

2024-06-30

0001014763

AIMD:WarrantsToPurchaseCommonStockMember

2024-01-01

2024-06-30

0001014763

2024-08-02

0001014763

2024-06-30

0001014763

2023-12-31

0001014763

us-gaap:RelatedPartyMember

2024-06-30

0001014763

us-gaap:RelatedPartyMember

2023-12-31

0001014763

2024-04-01

2024-06-30

0001014763

2023-04-01

2023-06-30

0001014763

2023-01-01

2023-06-30

0001014763

us-gaap:RelatedPartyMember

2024-04-01

2024-06-30

0001014763

us-gaap:RelatedPartyMember

2023-04-01

2023-06-30

0001014763

us-gaap:RelatedPartyMember

2024-01-01

2024-06-30

0001014763

us-gaap:RelatedPartyMember

2023-01-01

2023-06-30

0001014763

us-gaap:PreferredStockMember

2024-03-31

0001014763

us-gaap:CommonStockMember

2024-03-31

0001014763

AIMD:CommonStockToBeIssuedMember

2024-03-31

0001014763

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001014763

us-gaap:RetainedEarningsMember

2024-03-31

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001014763

2024-03-31

0001014763

us-gaap:PreferredStockMember

2023-03-31

0001014763

us-gaap:CommonStockMember

2023-03-31

0001014763

AIMD:CommonStockToBeIssuedMember

2023-03-31

0001014763

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001014763

us-gaap:RetainedEarningsMember

2023-03-31

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001014763

2023-03-31

0001014763

us-gaap:PreferredStockMember

2023-12-31

0001014763

us-gaap:CommonStockMember

2023-12-31

0001014763

AIMD:CommonStockToBeIssuedMember

2023-12-31

0001014763

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001014763

us-gaap:RetainedEarningsMember

2023-12-31

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001014763

us-gaap:PreferredStockMember

2022-12-31

0001014763

us-gaap:CommonStockMember

2022-12-31

0001014763

AIMD:CommonStockToBeIssuedMember

2022-12-31

0001014763

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001014763

us-gaap:RetainedEarningsMember

2022-12-31

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001014763

2022-12-31

0001014763

us-gaap:PreferredStockMember

2024-04-01

2024-06-30

0001014763

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0001014763

AIMD:CommonStockToBeIssuedMember

2024-04-01

2024-06-30

0001014763

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0001014763

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-04-01

2024-06-30

0001014763

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001014763

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001014763

AIMD:CommonStockToBeIssuedMember

2023-04-01

2023-06-30

0001014763

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001014763

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001014763

us-gaap:PreferredStockMember

2024-01-01

2024-06-30

0001014763

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001014763

AIMD:CommonStockToBeIssuedMember

2024-01-01

2024-06-30

0001014763

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-06-30

0001014763

us-gaap:RetainedEarningsMember

2024-01-01

2024-06-30

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-06-30

0001014763

us-gaap:PreferredStockMember

2023-01-01

2023-06-30

0001014763

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001014763

AIMD:CommonStockToBeIssuedMember

2023-01-01

2023-06-30

0001014763

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001014763

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-06-30

0001014763

us-gaap:PreferredStockMember

2024-06-30

0001014763

us-gaap:CommonStockMember

2024-06-30

0001014763

AIMD:CommonStockToBeIssuedMember

2024-06-30

0001014763

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001014763

us-gaap:RetainedEarningsMember

2024-06-30

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-06-30

0001014763

us-gaap:PreferredStockMember

2023-06-30

0001014763

us-gaap:CommonStockMember

2023-06-30

0001014763

AIMD:CommonStockToBeIssuedMember

2023-06-30

0001014763

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001014763

us-gaap:RetainedEarningsMember

2023-06-30

0001014763

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001014763

2023-06-30

0001014763

us-gaap:CommonStockMember

2022-05-16

2022-05-16

0001014763

us-gaap:CommonStockMember

2023-12-14

2023-12-14

0001014763

us-gaap:RelatedPartyMember

AIMD:MarchTwoThousandTwentyFiveConvertibleNotesMember

2024-06-30

0001014763

us-gaap:RelatedPartyMember

AIMD:MarchTwoThousandTwentyFiveConvertibleNotesMember

2023-12-31

0001014763

us-gaap:NonrelatedPartyMember

AIMD:MarchTwoThousandTwentyFiveConvertibleNotesOneMember

2024-06-30

0001014763

us-gaap:NonrelatedPartyMember

AIMD:MarchTwoThousandTwentyFiveConvertibleNotesOneMember

2023-12-31

0001014763

AIMD:SeniorSecuredConvertibleNotesMember

2024-06-30

0001014763

AIMD:SeniorSecuredConvertibleNotesMember

2023-12-31

0001014763

us-gaap:RelatedPartyMember

AIMD:TwoThousandTwentySevenConvertibleNotesMember

2024-06-30

0001014763

us-gaap:RelatedPartyMember

AIMD:TwoThousandTwentySevenConvertibleNotesMember

2023-12-31

0001014763

AIMD:KYNoteMember

2022-03-01

2022-03-31

0001014763

AIMD:KYNoteMember

2023-01-01

2023-12-31

0001014763

AIMD:ITwoChinaNoteMember

2024-06-30

0001014763

AIMD:KYNoteMember

2023-08-17

2023-08-17

0001014763

AIMD:ITwoChinaNoteMember

2023-08-17

2023-08-17

0001014763

AIMD:ConvertibleNoteAndWarrantPurchaseAgreementMember

2024-05-03

2024-05-03

0001014763

AIMD:ConvertibleNoteAndWarrantPurchaseAgreementMember

2024-05-03

0001014763

AIMD:ConvertibleNoteAndWarrantPurchaseAgreementMember

us-gaap:CommonStockMember

srt:MaximumMember

2024-05-03

0001014763

AIMD:ConvertibleNoteAndWarrantPurchaseAgreementMember

us-gaap:CommonStockMember

2024-05-03

0001014763

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

AIMD:MarchTwoThousandTwentyFiveConvertibleNotesMember

2023-03-13

0001014763

AIMD:ASENoteMember

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

2023-03-13

0001014763

AIMD:LeeNoteMember

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

2023-03-13

0001014763

AIMD:LeeNoteMember

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

2023-03-13

2023-03-13

0001014763

AIMD:LeeNoteMember

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

2024-04-01

2024-06-30

0001014763

AIMD:LeeNoteMember

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

2024-01-01

2024-06-30

0001014763

AIMD:LeeNoteMember

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

2023-04-01

2023-06-30

0001014763

AIMD:LeeNoteMember

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

2023-01-01

2023-06-30

0001014763

AIMD:LeeNoteMember

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

2024-06-30

0001014763

AIMD:LeeNoteMember

AIMD:ConvertiblePromissoryNotePurchaseAgreementsMember

2023-12-31

0001014763

AIMD:SecuritiesPurchaseAgreementMember

AIMD:LindGlobalFundTwoLPMember

AIMD:SeniorSecuredConvertibleNotesPayableMember

2023-09-25

0001014763

AIMD:SecuritiesPurchaseAgreementMember

AIMD:LindGlobalFundTwoLPMember

AIMD:SeniorSecuredConvertibleNotesPayableMember

2023-09-25

2023-09-25

0001014763

AIMD:SecuritiesPurchaseAgreementMember

AIMD:LindGlobalFundTwoLPMember

AIMD:SeniorSecuredConvertibleNotesPayableMember

2023-12-31

0001014763

AIMD:SecuritiesPurchaseAgreementMember

AIMD:LindGlobalFundTwoLPMember

AIMD:SeniorSecuredConvertibleNotesPayableMember

2023-12-31

2023-12-31

0001014763

AIMD:SecuritiesPurchaseAgreementMember

AIMD:LindGlobalFundTwoLPMember

AIMD:SeniorSecuredConvertibleNotesPayableMember

2024-01-23

2024-01-23

0001014763

AIMD:SecuritiesPurchaseAgreementMember

AIMD:LindGlobalFundTwoLPMember

AIMD:SeniorSecuredConvertibleNotesPayableMember

2024-01-23

0001014763

AIMD:SecuritiesPurchaseAgreementMember

AIMD:LindGlobalFundTwoLPMember

AIMD:AmendedInitialNoteMember

2024-01-23

0001014763

AIMD:LindGlobalFundTwoLPMember

2023-03-13

0001014763

AIMD:SecuritiesPurchaseAgreementMember

AIMD:LindGlobalFundTwoLPMember

AIMD:SeniorSecuredConvertibleNotesPayableMember

2024-06-30

0001014763

2023-11-26

0001014763

2023-11-27

0001014763

AIMD:PlacementAgentWarrantMember

2024-06-30

0001014763

AIMD:PlacementAgentWarrantMember

2024-01-01

2024-06-30

0001014763

AIMD:PrivateWarrantMember

2024-06-30

0001014763

AIMD:ASEWarrantMember

2024-06-30

0001014763

AIMD:ASEWarrantMember

2023-12-31

0001014763

AIMD:LindWarrantMember

2024-06-30

0001014763

AIMD:LindWarrantMember

2023-12-31

0001014763

AIMD:PublicWarrantMember

2024-06-30

0001014763

AIMD:PublicWarrantMember

2023-12-31

0001014763

AIMD:RepresentativeWarrantMember

2024-06-30

0001014763

AIMD:RepresentativeWarrantMember

2023-12-31

0001014763

AIMD:PlacementAgentWarrantMember

2023-12-31

0001014763

AIMD:LindWarrantMember

srt:MinimumMember

2024-06-30

0001014763

AIMD:LindWarrantMember

srt:MaximumMember

2024-06-30

0001014763

2023-06-14

0001014763

AIMD:TwoThousandTwentyThreeStockIncentivePlanMember

2024-06-30

0001014763

us-gaap:WarrantMember

2024-06-30

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2023-12-31

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2022-12-31

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-03-31

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-03-31

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2024-03-31

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2023-03-31

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2024-04-01

2024-06-30

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2023-04-01

2023-06-30

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2024-06-30

0001014763

us-gaap:RestrictedStockUnitsRSUMember

2023-06-30

0001014763

AIMD:StockOptionsAndRestrictedStockUnitsMember

2024-04-01

2024-06-30

0001014763

AIMD:StockOptionsAndRestrictedStockUnitsMember

2023-04-01

2023-06-30

0001014763

AIMD:StockOptionsAndRestrictedStockUnitsMember

2024-01-01

2024-06-30

0001014763

AIMD:StockOptionsAndRestrictedStockUnitsMember

2023-01-01

2023-06-30

0001014763

us-gaap:WarrantMember

2024-04-01

2024-06-30

0001014763

us-gaap:WarrantMember

2023-04-01

2023-06-30

0001014763

us-gaap:WarrantMember

2024-01-01

2024-06-30

0001014763

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001014763

us-gaap:ConvertibleDebtSecuritiesMember

2024-04-01

2024-06-30

0001014763

us-gaap:ConvertibleDebtSecuritiesMember

2023-04-01

2023-06-30

0001014763

us-gaap:ConvertibleDebtSecuritiesMember

2024-01-01

2024-06-30

0001014763

us-gaap:ConvertibleDebtSecuritiesMember

2023-01-01

2023-06-30

0001014763

AIMD:RelatedParyMember

2024-04-01

2024-06-30

0001014763

AIMD:RelatedParyMember

2024-01-01

2024-06-30

0001014763

AIMD:RelatedParyMember

2023-04-01

2023-06-30

0001014763

AIMD:RelatedParyMember

2023-01-01

2023-06-30

0001014763

us-gaap:RelatedPartyMember

AIMD:SalesAndMarketingAgreementMember

2024-04-01

2024-06-30

0001014763

us-gaap:RelatedPartyMember

AIMD:SalesAndMarketingAgreementMember

2024-01-01

2024-06-30

0001014763

us-gaap:RelatedPartyMember

AIMD:SalesAndMarketingAgreementMember

2023-04-01

2023-06-30

0001014763

us-gaap:RelatedPartyMember

AIMD:SalesAndMarketingAgreementMember

2023-01-01

2023-06-30

0001014763

AIMD:ManufacturingServiceAgreementMember

2024-04-01

2024-06-30

0001014763

AIMD:ManufacturingServiceAgreementMember

2024-01-01

2024-06-30

0001014763

AIMD:COVID19AntigenRapidTestKitsSalesMember

AIMD:ManufacturingServiceAgreementMember

2024-06-30

0001014763

AIMD:COVID19AntigenRapidTestKitsSalesMember

AIMD:ManufacturingServiceAgreementMember

2023-12-31

0001014763

AIMD:COVID19AntigenRapidTestKitsSalesMember

2024-04-01

2024-06-30

0001014763

AIMD:COVID19AntigenRapidTestKitsSalesMember

2024-01-01

2024-06-30

0001014763

AIMD:COVID19AntigenRapidTestKitsSalesMember

2023-04-01

2023-06-30

0001014763

AIMD:COVID19AntigenRapidTestKitsSalesMember

2023-01-01

2023-06-30

0001014763

AIMD:ProductCoDevelopmentAgreementMember

2024-04-01

2024-06-30

0001014763

AIMD:ProductCoDevelopmentAgreementMember

2024-01-01

2024-06-30

0001014763

AIMD:ProductCoDevelopmentAgreementMember

2023-04-01

2023-06-30

0001014763

AIMD:ProductCoDevelopmentAgreementMember

2023-01-01

2023-06-30

0001014763

AIMD:ProductCoDevelopmentAgreementMember

us-gaap:PatentsMember

2024-04-01

2024-06-30

0001014763

AIMD:ProductCoDevelopmentAgreementMember

us-gaap:PatentsMember

2024-01-01

2024-06-30

0001014763

AIMD:ProductCoDevelopmentAgreementMember

us-gaap:PatentsMember

2023-04-01

2023-06-30

0001014763

AIMD:ProductCoDevelopmentAgreementMember

us-gaap:PatentsMember

2023-01-01

2023-06-30

0001014763

AIMD:ProductCoDevelopmentAgreementMember

2023-01-01

2023-12-31

0001014763

AIMD:VocAndPoctTechnologiesMember

us-gaap:SubsequentEventMember

us-gaap:PatentsMember

2024-07-08

2024-07-08

0001014763

us-gaap:SubsequentEventMember

AIMD:VocAndPoctTechnologiesMember

us-gaap:PatentsMember

2024-07-08

0001014763

AIMD:LindFinancingMember

us-gaap:SubsequentEventMember

2024-07-03

2024-07-03

0001014763

AIMD:LindFinancingMember

us-gaap:SubsequentEventMember

2024-07-03

0001014763

AIMD:LindFinancingMember

us-gaap:SubsequentEventMember

srt:DirectorMember

2024-08-02

0001014763

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2024-07-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:TWD

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| |

For

the quarterly period ended June 30, 2024 |

| |

|

| |

or |

| |

|

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| |

For

the transition period from____to____ |

| |

|

| |

Commission

File No. 001-41461 |

AINOS,

INC.

(Exact

name of registrant as specified in its charter)

| texas |

|

75-1974352 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(IRS

Employer

Identification

No.) |

8880

Rio San Diego Drive, Ste. 800, San Diego, CA 92108 (858) 869-2986

(Address

and telephone number, including area code, of registrant’s principal executive offices)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 per share |

|

AIMD |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Common Stock |

|

AIMDW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ☐ Yes ☒ No

7,663,022

shares of common stock, par value $0.01 per share, outstanding as of August 2, 2024

AINOS,

INC.

INDEX

PART

I - FINANCIAL INFORMATION

ITEM

1. Financial Statements

Ainos,

Inc.

Condensed

Balance Sheets

(Unaudited)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 8,014,098 | | |

$ | 1,885,628 | |

| Accounts receivable | |

| 9 | | |

| 455 | |

| Inventory, net | |

| 166,322 | | |

| 167,593 | |

| Other current assets | |

| 291,166 | | |

| 419,521 | |

| Total current assets | |

| 8,471,595 | | |

| 2,473,197 | |

| Intangible assets, net | |

| 26,028,058 | | |

| 28,283,208 | |

| Property and equipment, net | |

| 691,100 | | |

| 876,572 | |

| Other assets | |

| 348,634 | | |

| 208,827 | |

| Total assets | |

$ | 35,539,387 | | |

$ | 31,841,804 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Contract liabilities | |

$ | 106,502 | | |

$ | 112,555 | |

| Convertible notes payable, (including amounts of related party of $ 2,000,000 and nil as of June 30, 2024 and December 31, 2023, respectively) | |

| 3,000,000 | | |

| - | |

| Convertible notes payable | |

| 3,000,000 | | |

| - | |

| Senior secured convertible notes measured at fair value - Current | |

| 1,585,761 | | |

| - | |

| Other notes payable, related party | |

| 312,000 | | |

| 42,000 | |

| Accrued expenses and others current liabilities | |

| 738,936 | | |

| 1,182,283 | |

| Total current liabilities | |

| 5,743,199 | | |

| 1,336,838 | |

| Senior secured convertible notes measured at fair value | |

| - | | |

| 2,651,556 | |

| Convertible notes payable - noncurrent (including amounts of related party of $9,000,000 and $2,000,000 as of June 30, 2024 and December 31, 2023, respectively) | |

| 9,000,000 | | |

| 3,000,000 | |

| Convertible notes payable | |

| 9,000,000 | | |

| 3,000,000 | |

| Other notes payable, related party - noncurrent | |

| - | | |

| 270,000 | |

| Other long-term liabilities | |

| 83,912 | | |

| 135,829 | |

| Total liabilities | |

| 14,827,111 | | |

| 7,394,223 | |

| Commitments and contingencies | |

| - | | |

| - | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.01 par value; 50,000,000 shares authorized; none issued and outstanding as of June

30, 2024 and December 31,2023, respectively | |

| - | | |

| - | |

| Common stock, $0.01 par value; 300,000,000 shares authorized as of June 30, 2024 and December 31, 2023, 7,388,674 and 4,677,787 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 73,887 | | |

| 46,778 | |

| Common stock to be issued 270 shares and 162,337 shares as of June 30, 2024 and December 31, 2023, respectively | |

| 3 | | |

| 1,623 | |

| Additional paid-in capital | |

| 65,414,761 | | |

| 62,555,808 | |

| Accumulated deficit | |

| (44,395,987 | ) | |

| (37,886,155 | ) |

| Accumulated other comprehensive loss - translation adjustment | |

| (380,388 | ) | |

| (270,473 | ) |

| Total stockholders’ equity | |

| 20,712,276 | | |

| 24,447,581 | |

| Total liabilities and stockholders’ equity | |

$ | 35,539,387 | | |

$ | 31,841,804 | |

See

accompanying notes to condensed financial statements.

Ainos,

Inc.

Condensed

Statements of Operations

(Unaudited)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

$ | - | | |

$ | 28,555 | | |

$ | 20,729 | | |

$ | 77,719 | |

| Cost of revenues (including amounts of related party of nil for the three months ended June 30, 2024 and 2023, and nil and $46,635 for the six months ended June 30, 2024 and 2023, respectively) | |

| (25,373 | ) | |

| (55,817 | ) | |

| (52,127 | ) | |

| (156,665 | ) |

| Gross loss | |

| (25,373 | ) | |

| (27,262 | ) | |

| (31,398 | ) | |

| (78,946 | ) |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses (including amounts of related party of $386,507 and $761,700 for the three and six months ended June 30, 2024, and $74,733 and $152,196 for the three and six months ended June 30, 2023, respectively) | |

| 1,978,756 | | |

| 1,671,187 | | |

| 4,063,404 | | |

| 3,370,070 | |

| Selling, general and administrative expenses | |

| 1,044,880 | | |

| 618,149 | | |

| 2,074,298 | | |

| 1,380,614 | |

| Total operating expenses | |

| 3,023,636 | | |

| 2,289,336 | | |

| 6,137,702 | | |

| 4,750,684 | |

| Loss from operations | |

| (3,049,009 | ) | |

| (2,316,598 | ) | |

| (6,169,100 | ) | |

| (4,829,630 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-operating (expenses) income, net: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (118,759 | ) | |

| (40,311 | ) | |

| (167,455 | ) | |

| (49,585 | ) |

| Issuance cost of senior secured convertible note measured at fair value | |

| - | | |

| - | | |

| (138,992 | ) | |

| - | |

| Fair value change for senior secured convertible note | |

| (66,844 | ) | |

| - | | |

| (98,412 | ) | |

| - | |

| Other income, net | |

| 39,590 | | |

| 7,182 | | |

| 64,127 | | |

| 9,013 | |

| Total non-operating expenses, net | |

| (146,013 | ) | |

| (33,129 | ) | |

| (340,732 | ) | |

| (40,572 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| Net loss | |

$ | (3,195,022 | ) | |

$ | (2,349,727 | ) | |

$ | (6,509,832 | ) | |

$ | (4,870,202 | ) |

| Net loss per common share - basic and diluted | |

$ | (0.49 | ) | |

$ | (0.58 | ) | |

$ | (1.06 | ) | |

$ | (1.21 | ) |

| Weighted-average shares used in computing net loss per common share-basic and diluted | |

| 6,519,014 | | |

| 4,019,030 | | |

| 6,145,148 | | |

| 4,010,666 | |

See

accompanying notes to condensed financial statements.

Ainos,

Inc.

Condensed

Statements of Comprehensive Loss

(Unaudited)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net loss | |

$ | (3,195,022 | ) | |

$ | (2,349,727 | ) | |

$ | (6,509,832 | ) | |

$ | (4,870,202 | ) |

| Other comprehensive (loss) income: | |

| | | |

| | | |

| | | |

| | |

| Translation adjustment | |

| (44,646 | ) | |

| (53,867 | ) | |

| (109,915 | ) | |

| (43,806 | ) |

| Comprehensive loss | |

$ | (3,239,668 | ) | |

$ | (2,403,594 | ) | |

$ | (6,619,747 | ) | |

$ | (4,914,008 | ) |

See

accompanying notes to condensed financial statements.

Ainos,

Inc.

Condensed

Statements of Stockholders’ Equity

For

the three months ended June 30, 2024 and 2023

(Unaudited)

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

| |

Loss | | |

Equity | |

| | |

| | |

| | |

Common Stock | | |

Additional | | |

| | |

Accumulated

Other | | |

Total | |

| | |

Preferred Stock | | |

Common Stock | | |

- to be issued | | |

Paid-in | | |

Accumulated | | |

Comprehensive | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Loss | | |

Equity | |

| Balance at March 31, 2024 | |

| - | | |

$ | - | | |

| 6,144,506 | | |

$ | 61,445 | | |

| 270 | | |

$ | 3 | | |

$ | 64,154,052 | | |

$ | (41,200,965 | ) | |

$ | (335,742 | ) | |

$ | 22,678,793 | |

| Conversion of convertible notes into common stock | |

| - | | |

| - | | |

| 1,244,168 | | |

| 12,442 | | |

| - | | |

| - | | |

| 838,335 | | |

| - | | |

| - | | |

| 850,777 | |

| Share-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 422,374 | | |

| - | | |

| - | | |

| 422,374 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,195,022 | ) | |

| - | | |

| (3,195,022 | ) |

| Translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (44,646 | ) | |

| (44,646 | ) |

| Balance at June 30, 2024 | |

| - | | |

$ | - | | |

| 7,388,674 | | |

$ | 73,887 | | |

| 270 | | |

$ | 3 | | |

$ | 65,414,761 | | |

$ | (44,395,987 | ) | |

$ | (380,388 | ) | |

$ | 20,712,276 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at March 31, 2023 | |

| - | | |

$ | - | | |

| 4,002,320 | | |

$ | 40,023 | | |

| - | | |

$ | - | | |

$ | 59,126,074 | | |

$ | (26,636,081 | ) | |

$ | (191,592 | ) | |

$ | 32,338,424 | |

| Issuance of stock to settle vested RSUs | |

| - | | |

| - | | |

| 25,306 | | |

| 253 | | |

| - | | |

| - | | |

| (253 | ) | |

| - | | |

| - | | |

| - | |

| Issuance of stock in exchange of vehicle | |

| - | | |

| - | | |

| 12,231 | | |

| 122 | | |

| - | | |

| - | | |

| 48,437 | | |

| - | | |

| - | | |

| 48,559 | |

| Conversion of convertible notes payable to common stock | |

| - | | |

| - | | |

| 18,666 | | |

| 187 | | |

| - | | |

| - | | |

| 274,602 | | |

| - | | |

| - | | |

| 274,789 | |

| Share-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 137,159 | | |

| - | | |

| - | | |

| 137,159 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,349,727 | ) | |

| - | | |

| (2,349,727 | ) |

| Translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (53,867 | ) | |

| (53,867 | ) |

| Balance at June 30, 2023 | |

| - | | |

$ | - | | |

| 4,058,523 | | |

$ | 40,585 | | |

| - | | |

$ | - | | |

$ | 59,586,019 | | |

$ | (28,985,808 | ) | |

$ | (245,459 | ) | |

$ | 30,395,337 | |

See

accompanying notes to condensed financial statements.

Ainos,

Inc.

Condensed

Statements of Stockholders’ Equity

For

the six months ended June 30, 2024 and 2023

(Unaudited)

| | |

| | |

| | |

| | |

| | |

Common Stock | | |

Additional | | |

| | |

Accumulated

Other | | |

Total | |

| | |

Preferred Stock | | |

Common Stock | | |

- to be issued | | |

Paid-in | | |

Accumulated | | |

Comprehensive | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Loss | | |

Equity | |

| Balance at December 31, 2023 | |

| - | | |

$ | - | | |

| 4,677,787 | | |

$ | 46,778 | | |

| 162,337 | | |

$ | 1,623 | | |

$ | 62,555,808 | | |

$ | (37,886,155 | ) | |

$ | (270,473 | ) | |

$ | 24,447,581 | |

| Issuance of stock to settle vested RSUs | |

| - | | |

| - | | |

| 133,964 | | |

| 1,340 | | |

| 270 | | |

| 3 | | |

| (1,343 | ) | |

| - | | |

| - | | |

| - | |

| Conversion of senior secured convertible note payable to common stock | |

| - | | |

| - | | |

| 2,414,586 | | |

| 24,146 | | |

| - | | |

| - | | |

| 2,015,061 | | |

| - | | |

| - | | |

| 2,039,207 | |

| Related party used computer equipment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,428 | ) | |

| - | | |

| - | | |

| (4,428 | ) |

| Warrants issued in connection with senior secured convertible note payable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,586 | | |

| - | | |

| - | | |

| 1,586 | |

| Issuance of common stock | |

| - | | |

| - | | |

| 162,337 | | |

| 1,623 | | |

| (162,337 | ) | |

| (1,623 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Share-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 848,077 | | |

| - | | |

| - | | |

| 848,077 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,509,832 | ) | |

| - | | |

| (6,509,832 | ) |

| Translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (109,915 | ) | |

| (109,915 | ) |

| Balance at June 30, 2024 | |

| - | | |

$ | - | | |

| 7,388,674 | | |

$ | 73,887 | | |

| 270 | | |

$ | 3 | | |

$ | 65,414,761 | | |

$ | (44,395,987 | ) | |

$ | (380,388 | ) | |

$ | 20,712,276 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at December 31, 2022 | |

| - | | |

$ | - | | |

| 4,002,320 | | |

$ | 40,023 | | |

| - | | |

$ | - | | |

$ | 58,905,242 | | |

$ | (24,115,606 | ) | |

$ | (201,653 | ) | |

$ | 34,628,006 | |

| Balance | |

| - | | |

$ | - | | |

| 4,002,320 | | |

$ | 40,023 | | |

| - | | |

$ | - | | |

$ | 58,905,242 | | |

$ | (24,115,606 | ) | |

$ | (201,653 | ) | |

$ | 34,628,006 | |

| Issuance of stock to settle vested RSUs | |

| - | | |

| - | | |

| 25,306 | | |

| 253 | | |

| - | | |

| - | | |

| (253 | ) | |

| - | | |

| - | | |

| - | |

| Issuance of stock in exchange of vehicle | |

| - | | |

| - | | |

| 12,231 | | |

| 122 | | |

| - | | |

| - | | |

| 48,437 | | |

| - | | |

| - | | |

| 48,559 | |

| Conversion of convertible notes payable to common stock | |

| - | | |

| - | | |

| 18,666 | | |

| 187 | | |

| - | | |

| - | | |

| 274,602 | | |

| - | | |

| - | | |

| 274,789 | |

| Share-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 357,991 | | |

| - | | |

| - | | |

| 357,991 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,870,202 | ) | |

| - | | |

| (4,870,202 | ) |

| Translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (43,806 | ) | |

| (43,806 | ) |

| Balance at June 30, 2023 | |

| - | | |

$ | - | | |

| 4,058,523 | | |

$ | 40,585 | | |

| - | | |

$ | - | | |

$ | 59,586,019 | | |

$ | (28,985,808 | ) | |

$ | (245,459 | ) | |

$ | 30,395,337 | |

| Balance | |

| - | | |

$ | - | | |

| 4,058,523 | | |

$ | 40,585 | | |

| - | | |

$ | - | | |

$ | 59,586,019 | | |

$ | (28,985,808 | ) | |

$ | (245,459 | ) | |

$ | 30,395,337 | |

See

accompanying notes to condensed financial statements.

Ainos,

Inc.

Condensed

Statements of Cash Flows

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

Six months ended June 30 | |

| | |

2024 | | |

2023 | |

| Cash flows from Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (6,509,832 | ) | |

$ | (4,870,202 | ) |

Adjustments to reconcile net loss to net cash

used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 2,398,696 | | |

| 2,423,274 | |

| Loss on inventory write-downs | |

| - | | |

| 57,474 | |

| Share-based compensation expense | |

| 848,077 | | |

| 357,991 | |

| Issuance cost of senior secured convertible note measured at fair value | |

| 138,992 | | |

| - | |

| Change in fair value of senior secured convertible note | |

| 98,412 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 446 | | |

| 192,161 | |

| Inventory | |

| 1,271 | | |

| 10,814 | |

| Other current assets | |

| 128,355 | | |

| (55,990 | ) |

| Accrued expenses and other current and long-term liabilities | |

| (573,309 | ) | |

| (693,975 | ) |

| Net cash used in operating activities | |

| (3,468,892 | ) | |

| (2,578,453 | ) |

| Cash flows from Investing Activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (10,276 | ) | |

| (71,262 | ) |

| Increase in refundable deposits and others | |

| (109,516 | ) | |

| - | |

| Net cash used in investing activities | |

| (119,792 | ) | |

| (71,262 | ) |

| Cash flows from Financing Activities: | |

| | | |

| | |

| Proceeds from convertible notes payable- noncurrent | |

| - | | |

| 1,000,000 | |

| Proceeds from convertible notes payable, related party | |

| 9,000,000 | | |

| 1,500,000 | |

| Proceeds from senior secured convertible notes payable | |

| 875,000 | | |

| - | |

| Repayment of other notes payable, related party | |

| - | | |

| (200,000 | ) |

| Repayment of convertible notes payable, related party | |

| - | | |

| (114,026 | ) |

| Payments of issuance cost of senior secured convertible note measured at fair value | |

| (97,500 | ) | |

| - | |

| Net cash provided by financing activities | |

| 9,777,500 | | |

| 2,185,974 | |

| Effect from foreign currency exchange | |

| (60,346 | ) | |

| (28,651 | ) |

| Net increase (decrease) in cash and cash equivalents | |

| 6,128,470 | | |

| (492,392 | ) |

| Cash and cash equivalents at beginning of year | |

| 1,885,628 | | |

| 1,853,362 | |

| Cash and cash equivalents at end of year | |

$ | 8,014,098 | | |

$ | 1,360,970 | |

| | |

| | | |

| | |

| Supplemental Cash Flow Information | |

| | | |

| | |

| Cash paid for interest | |

$ | 39 | | |

$ | 3,122 | |

| | |

| | | |

| | |

| Noncash financing and investing activities: | |

| | | |

| | |

| Conversion of convertible notes payable to common stock and accrued interest waived by convertible notes holders | |

$ | - | | |

$ | 274,789 | |

| Conversion of senior secured convertible notes to common stock | |

$ | 2,039,207 | | |

$ | - | |

| Issuance of common stocks in exchange of vehicle | |

$ | - | | |

$ | 48,559 | |

| Account payable to purchase equipment | |

$ | - | | |

$ | 5,848 | |

See

accompanying notes to the condensed financial statements.

Ainos,

Inc.

Notes

to Condensed Financial Statements

(Unaudited)

1.

Description of Business

Organization

and Business

Ainos,

Inc. (the “Company”), incorporated in the State of Texas in 1984, is a diversified healthcare company focused on the development

of novel point-of-care testing (the “POCT”), therapeutics based on very low-dose interferon alpha (the “VELDONA”),

and synthetic RNA-driven preventative medicine. Our product pipeline includes commercial-stage VELDONA Pet cytoprotein supplements, clinical-stage

VELDONA human and animal therapeutics and telehealth-friendly POCTs powered by the AI Nose technology platform.

We

have historically involved in the research and development of therapeutics based on VELDONA. Building on our research and development

on VELDONA since inception, we are focused on commercializing a suite of VELDONA-based product candidates.

In

2021 and 2022, we acquired certain types of intellectual property from our controlling shareholder, Ainos Inc., a Cayman Island corporation

(“Ainos KY”), to expand product portfolio into POCTs aimed to provide connected, rapid, and convenient testing for a broad

range of health conditions. Pivoting from the sales of COVID-19 POCT, we aim to commercialize POCTs that detect volatile organic compounds

(the “VOC”) emitted by the body, powered by our AI Nose technology platform. Our lead VOC POCT candidate, Ainos Flora, aims

to test female vaginal health and certain common sexually transmitted infections (the “STIs”) quickly and easily.

Underwritten

Public Offering

The

Company’s registration statement related to its underwritten public offering (the “Offering”) was declared effective

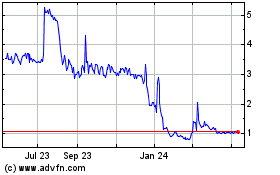

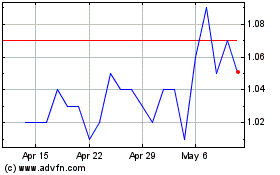

on August 8, 2022, and the Company’s common stock and warrants began trading on the Nasdaq Capital Market (the “Nasdaq”)

on August 9, 2022 under the trading symbols “AIMD” and “AIMDW”, respectively.

Reverse

Stock Splits

In

connection with the Offering, the Company’s board of directors on April 29, 2022 and its shareholders on May 16, 2022 approved

a 1-for-15 reverse stock split of the Company’s common stock that became effective on August 9, 2022. Further, to comply with Nasdaq’s

minimum $1.00 per share continued listing rules, the Company filed a Certificate of Amendment to its Restated Certificate of Formation

on November 27, 2023, to apply for another reverse stock split of the Company’s common stock at a ratio of 1-for-5 which was effectuated

on December 14, 2023 after receiving required approvals.

The

par value of $0.01 and authorized shares of the Company’s common stock remains the same and were not adjusted as a result of the

reverse stock splits. All issued and outstanding common stock, restricted stock units (RSUs), outstanding convertible notes, warrants

and options to purchase common stock and per share amounts contained in the financial statements have been retroactively adjusted to

give effect to the reverse stock splits for all periods presented.

2.

Summary of Significant Accounting Policies

Basis

of Presentation

The

accompanying condensed financial statements have been prepared in accordance with accounting principles generally accepted in the United

States of America (the “GAAP”) and pursuant to the accounting disclosure rules and regulations of the Securities and Exchange

Commission (the “SEC”) regarding interim financial reporting. Certain information and note disclosures normally included

in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. Therefore,

these condensed financial statements should be read in conjunction with the financial statements and notes included in the Company’s

audited financial statements as of and for the year ended December 31, 2023 contained in the Annual Report on Form 10-K filed with the

SEC on March 8, 2024.

In

the opinion of management, the accompanying condensed financial statements reflect all normal recurring adjustments necessary to present

fairly the financial position, results of operations, and cash flows for the interim periods. The results for the three and six months

ended June 30, 2024 are not necessarily indicative of the results to be expected for any subsequent quarter, the year ending December

31, 2024, or any other period.

There

have been no material changes to the Company’s significant accounting policies as described in the audited financial statements

as of December 31, 2023.

Use

of Estimates

The

preparation of condensed financial statements in conformity with GAAP requires management to make certain estimates, judgments, and assumptions

that affect the reported amounts of assets and liabilities and disclosures as of the date of the condensed financial statements and the

reported amounts of revenues and expenses during the reporting period. The Company bases its estimates on various factors, including

historical experience, and on various other assumptions that are believed to be reasonable under the circumstances, when these carrying

values are not readily available from other sources. Significant items subject to estimates and assumptions include useful lives of property

and equipment, valuation of stock option, warrants and convertible notes measured at fair value, and impairment testing of intangible

assets. Actual results may differ from these estimates.

Liquidity

As

of June 30, 2024, the Company had cash and cash equivalents of $8,014,098. The Company plans to finance its operations and development

needs with its existing cash and cash equivalents, additional equity and/or debt financing arrangements, and expected near-term revenue

primarily from the sale of VELDONA Pet cytoprotein supplements to support the Company’s clinical trial activities, largely in connection

with Ainos Flora and human related VELDONA therapeutics. There can be no assurance that the Company will be able to obtain additional

financing on terms acceptable to the Company, on a timely basis, or at all.

For

the six months ended June 30, 2024, the Company generated a net loss of $6,509,832.

The Company expects to continue incurring development expenses for the next twelve months as the Company advances Ainos Flora and VELDONA

therapeutics for humans through clinical development until regulatory approval is received and the sales and marketing of the products

is authorized.

The

financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of

liabilities in the normal course of business. The Company has incurred net operating losses since inception and has an accumulated deficit

as of June 30, 2024 of $44,395,987 and expects to incur additional losses and negative operating cash flows for at least the next twelve

months. The Company’s ability to meet its obligations is dependent upon its ability to generate sufficient cash flows from operations

and future financing transactions. Management expects the Company will continue as a going concern for at least one year from the issuance

of these financial statements.

Segments

Operating

segments are defined as components of an entity for which separate financial information is available and that is regularly reviewed

by the chief operating decision maker (the “CODM”) in deciding how to allocate resources to an individual segment and in

assessing performance. The Company’s Chief Executive Officer is the Company’s CODM. The CODM reviews financial information

prepared on the basis of accounting policy disclosed in its annual financial statement for purposes of making operating decisions, allocating

resources, and evaluating financial performance of the Company. As such, the Company has determined that it operates as one operating

segment.

Impairment

of Intangible Assets

The

Company reviews its definite-lived intangibles and other long-lived assets for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset or asset group may not be fully recoverable. When such events occur, management determines

whether there has been impairment by comparing the anticipated undiscounted future net cash flows to the carrying value of the asset

or asset group. If impairment exists, the assets are written down to their estimated fair value. No impairment of definite-lived intangible

and long-lived assets was recorded for the three and six months ended June 30, 2024 and 2023.

Fair

Value Option

ASC

825-10, Financial Instruments, provides a fair value option (the “FVO”) election that allows companies an irrevocable

election to use fair value as the initial and subsequent accounting measurement attribute for certain financial assets and liabilities.

ASC 825-10 permits entities to elect to measure eligible financial assets and liabilities at fair value on an ongoing basis. Unrealized

gains and losses on items for which the FVO has been elected are reported in earnings, except for the effect of changes in own credit,

which are recognized in other comprehensive income/loss. The decision to elect the FVO is determined on an instrument-by-instrument basis,

must be applied to an entire instrument and is irrevocable once elected. Assets and liabilities measured at fair value pursuant to ASC

825-10 are required to be reported separately from those instruments measured using another accounting method.

The

Company elected to account for the senior secured convertible notes issued to Lind Global Fund II LP (the “Lind Note”) using

FVO, which allows for valuing the Lind Note at fair value in its entirety versus bifurcation of the embedded derivatives (see Note 5).

The fair value of the Lind Note is determined using

a binomial lattice valuation model, which is widely used for valuing convertible notes. The significant assumptions used in the model

is volatility of the Company’s common stock. If different assumptions are used, the fair value of the convertible notes and the

change in estimated fair value could be materially different. A significant increase in the volatility of the market price of the Company’s

common stock, in isolation, would result in a significantly higher fair value; and a significant decrease in volatility would result

in a significantly lower fair value.

Recent

Accounting Pronouncements Adopted

On

January 1, 2023, the Company adopted Accounting Standards Update (the “ASU”) 2016-13 (the “ASU 2016-13”), Financial

Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which the Financial Accounting

Standards Board (the “FASB”) issued in June 2016. The new standard changes the accounting for credit losses for financial

assets and certain other instruments, including trade receivables and contract assets that are not measured at fair value through net

income. Under legacy standards, the Company recognizes an impairment of receivables when it was probable that a loss had been incurred.

Under the new standard pursuant to ASU 2016-13, the Company is required to recognize estimated credit losses expected to occur over the

estimated life or remaining contractual life of an asset (which includes losses that may be incurred in future periods) using a broader

range of information including reasonable and supportable forecasts about future economic conditions. The guidance is effective for smaller

reporting companies (the “SRC”) as defined by the SEC for fiscal years beginning after December 15, 2022, including interim

periods within those fiscal years with early adoption permitted. The Company’s adoption of this new guidance did not have a material

impact on the Company’s financial statements and related disclosure.

On

January 1, 2023, the Company early adopted ASU 2020-06 (the “ASU 2020-06”), Debt—Debt

with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts

in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts

in an Entity’s Own Equity, which simplifies accounting for convertible instruments

by removing major separation models required under current GAAP. ASU 2020-06 as issued by FASB in August 2020 removes certain settlement

conditions that are required for equity contracts to qualify for the derivative scope exception, and it also simplifies the diluted earnings

per share calculation in certain areas. ASU 2020-06 is effective for SRC’s fiscal years beginning after December 15, 2023, including

interim periods within those fiscal years, with early adoption permitted. The Company’s early adoption of this new guidance did

not have a material impact on its financial statements and related disclosures.

Accounting

Standards Issued but Not Yet Adopted

No

other new accounting pronouncement issued or effective has had, or is expected to have, a material impact on the Company’s financial

statements.

3.

Cash and Cash Equivalents

As

of June 30, 2024 and December 31, 2023, cash and cash equivalents consisted of cash on hand and cash in bank which is potentially subject

to concentration of credit risk. Such balance is maintained at financial institutions that management determines to be of high-credit

quality. Cash accounts at each institution are insured by the Federal Deposit Insurance Corporation in the U.S.A or Central Deposit Insurance

Corporation in Taiwan up to certain limits. At times, such deposits may be in excess of the insurance limit. Accounts are guaranteed

by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. As of June 30, 2024 and December 31, 2023, the Company had approximately

$4,281,890 and $1,557,487 in excess of FDIC insured limits, respectively. The Company maintains cash in state-owned banks in Taiwan.

In Taiwan, the insurance coverage of each bank is NTD$3,000,000 (approximately USD$93,750). As of June 30, 2024 and December 31, 2023,

the Company had approximately $3,358,000and

$0 cash in excess of the insured amount, respectively. The Company has not experienced any losses in such accounts.

4.

Inventory

Inventory

stated at cost, net of reserve, consisted of the following:

Schedule of Inventory

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Raw materials | |

$ | 87,047 | | |

$ | 92,708 | |

| Work in process | |

| 1,142 | | |

| 1,208 | |

| Finished goods | |

| 78,133 | | |

| 73,677 | |

| Total | |

$ | 166,322 | | |

$ | 167,593 | |

Inventory

write-downs to estimated net realizable values were nil for the three and six months ended June 30, 2024, compared to $14,694 and $57,474

for the three and six months ended June 30, 2023.

5.

Convertible Notes Payable and Other Notes Payable

As

of June 30, 2024 and December 31, 2023, the respective notes payable were as follows:

Schedule of Notes Payable

| | |

June 30,

2024 | | |

December 31,

2023 | |

| Other notes payable, related party – current | |

$ | 312,000 | | |

$ | 42,000 | |

| Other notes payable, related party - noncurrent | |

| - | | |

| 270,000 | |

| March 2025 Convertible Notes, related party – noncurrent (ASE Note) | |

| - | | |

| 2,000,000 | |

| March 2025 Convertible Notes, related party –current (ASE Note) | |

| 2,000,000 | | |

| - | |

| March 2025 Convertible Notes – noncurrent (Lee Note) | |

| - | | |

| 1,000,000 | |

| March 2025 Convertible Notes –current (Lee Note) | |

| 1,000,000 | | |

| - | |

| Senior secured convertible notes payable (Lind Note) - fair value | |

| 1,585,761 | | |

| 2,651,556 | |

| May 2027 Convertible Notes, related party – noncurrent (ASE Note) | |

| 9,000,000 | | |

| - | |

| Notes payable | |

$ | 13,897,761 | | |

$ | 5,963,556 | |

The

other notes payable were issued to Ainos KY, the controlling shareholder of the Company, in exchange for $800,000 in cash to support

working capital of the Company in March 2022 (the “KY Note”). The Company paid off $530,000 of the KY Note during the year

ended December 31, 2023. The Company did not repay the KY Note during the three and six months ended June 30, 2024. Another note payable

was issued to i2China Management Group, LLC (“i2China”) in exchange for consulting services in 2020 (the “i2China Note”)

which remains outstanding for the amount of $42,000 as of June 30, 2024. Both the KY Note and the i2China Note bear an interest rate

of 1.85% per annum. On August 17, 2023, the Company entered into extension agreements with Ainos KY and i2China to extend the maturity

of the KY Note and i2China Note to March 31, 2025 and September 1, 2024, respectively.

All

of the aforementioned convertible promissory notes and other notes payable are unsecured and due upon maturity. Holders of convertible

notes have the option to convert some or the entire unpaid principal and accrued interest to common stock of the Company.

May

2027 Convertible Notes and Warrant Purchase Agreement

On

May 03, 2024, The Company entered into Convertible Note and Warrant Purchase Agreement with the ASE Test, Inc. (“ASE”), a

shareholder of Ainos KY, for the issuance of convertible promissory notes with 6% compound interest in the aggregate principal amount

of $9,000,000 (collectively the “Notes”) convertible into shares of common stock, par value $0.01 per share, of the Company,

payable three (3) years from May 03, 2024 as well as the issuance of warrants for the purchase of up to 500,000 shares of Common Stock

at a price per share of $4.50, exercisable until May 03, 2029. As of June 30, 2024, the Company received the full amount of the payment.

March

2025 Convertible Notes

On

March 13, 2023, the Company entered into two convertible promissory note purchase agreements pursuant to Regulation S of the Securities

Act of 1933, as amended, in the total principal amount of $3,000,000 with the following investors (the “March 2025 Convertible

Notes” or “Notes”).

Convertible

Note Issued to ASE Test, Inc. (the “ASE Note”)

Pursuant

to the one of the aforementioned agreements, ASE Test, Inc., a shareholder of Ainos KY, committed to pay a total aggregate amount of

$2,000,000 to the Company in exchange for convertible promissory note(s) in three tranches in the amounts of $1,000,000 (the “First

Tranche”), $500,000 (the “Second Tranche”), and $500,000 (the “Third Tranche”) conditioned, among other

things, on the Company achieving certain business milestones. As of June 30, 2024, the Company received the full amount of the payment.

Convertible

Note Issued to Li-Kuo Lee (the “Lee Note”)

The

Company issued a convertible note in the principal amount of $1,000,000 to an unrelated party, Li-Kuo Lee, in exchange of $1,000,000

in cash. As of June 30, 2024, the Company received the full amount of the payment.

The

March 2025 Convertible Notes will mature in two years from the issuance dates, bearing interest at the rate of 6% compounded interest

per annum. At any time after the issuance and before the maturity date, the Notes are convertible into the common stock of the Company

at the conversion price of $7.50 per share, subject to anti-dilutive adjustment as set forth in the Notes. Unless previously converted,

the Company shall repay the outstanding principal amount plus all accrued and unpaid interest on the maturity date. The Notes shall be

an unsecured general obligation of the Company.

The

total interest expense of convertible notes payable, other notes payable, March 2025 Convertible Notes and May 2027 Convertible Notes

and Warrant Purchase Agreement for the three and six months ended June 30, 2024 were $117,828 and $164,214 compared with the same period

in year 2023 were $37,991and $44,924. As of June 30, 2024 and December 31, 2023, the unpaid accrued interest expense was $303,153 and

$138,939, respectively.

Senior

Secured Convertible Notes Payable

On

September 25, 2023, the Company entered into a securities purchase agreement (the “SPA”) with Lind Global Fund II LP (the

“Lind”). The SPA provides for loans in an aggregate principal amount of up to $10,000,000 under various tranches to fund

clinical trials, commercial product launch and working capital of the Company. The Lind Note does not bear any interest and matures on

March 28, 2025..

In

2023, the Company issued and sold to Lind, in a private placement, (a) a senior secured convertible promissory note in the aggregate

principal amount of $3,540,000 (the “Lind Note”) and (b) warrants to purchase 691,244 shares of common stock at an exercise

price of $4.50 per share of common stock (the “Lind Warrant”) for a cash amount of $3,000,000. As of June 30, 2024, the Company

received the full amount of the funding.

Subject

to the satisfaction of certain conditions, the Company has the right to request additional tranches of funding from Lind in the aggregate

amount not to exceed $7.0 million (the “Increased Funding Amount”). Lind will receive additional warrants to purchase a number

of shares of common stock based on a formula set forth in the Securities Purchase Agreement. Such warrants will expire after five years

from the date of issuance and may be exercised on a cashless basis.

On

January 23, 2024, the Company received an Increased Funding Amount of up to $1.75 million, with $875,000 funded at closing and $875,000

to be funded subject to an effective registration statement and other conditions specified in the Securities Purchase Agreement, and

amended the Initial Note to, among other amendments, increase the principal amount to $4,235,000 (the Initial Note as so amended, the

“Note”). In connection with additional funding, the Company issued Lind a warrant to purchase 1,021,400 shares at an exercise

price of $2.16 per share (the “Second Lind Warrants and together with the First Lind Warrants, the “Lind Warrants”).

Following

the earlier to occur of (i) 90 days from the date of the SPA or (ii) the date the resale Registration Statement is declared effective

by the SEC, the Lind Note is convertible into shares of the Company’s common stock at the option of Lind at any time with the conversion

price at lower of $7.50 per share, subject to adjustment, or 90% of the average of the three lowest daily VWAP of the common stock during

the 20 trading days prior to conversion, subject to certain adjustments.

As

of June 30, 2024, the converted principal amount from the SPA was $2,752,170 and the aggregate principal amount was $1,785,330.

From

an accounting perspective, the Lind Note is considered a debt host instrument embedded with an issuer’s call and investor’s

contingent puts, and is issued at substantial discount. The Company elects the fair value option (the “FVO”) to account for

the Lind Note at fair value and mark to market each quarter. As of June 30, 2024, the fair value of the Lind Note was $1,585,761. For

the three and six months ended June 30, 2024, the change in the fair value of the Lind Note was recorded in the Statements of Operations

in the amount of $66,844 and $98,412 respectively. No portion of the change in fair value was related to changes in credit risk of the

Company which would be charged to other comprehensive loss if any. The Company has granted to Lind a senior security interest in all

of the Company’s right, title, and interest in, to and under all of the Company’s property, subject to certain exceptions

as set forth in the SPA. The issuance cost related to the first amendment of $875,000 of the Lind Note, including a commitment fee charged

by Lind, placement agent fee and warrants, and legal fees is $138,992, which is expensed off due to FVO election. $169,344 of the remaining

insurance cost related to the future funding of $6,125,000 offered by the SPA is deferred as other assets on the balance sheet and will

be expensed upon each closing or when the Company does not expect to complete the remaining funding.

6.

Stockholders’ Equity

Preferred

Stock

The

Company increased authorized shares of preferred stock from 10,000,000 shares to 50,000,000 shares upon the filing of an amendment to

the Company’s Certificate of Formation with the Secretary of State of Texas on November 27, 2023. No shares of preferred stock

were issued and outstanding as of June 30, 2024 and December 31, 2023.

Common

Stock

During

the three months ended June 30, 2024, the Company issued an additional 1,244,168 shares of common stock as a result of delivering conversion

of the Lind’s Note. As of June 30, 2024, there were 7,388,674 shares of common stock legally issued and outstanding.

As

a result of the Lind private placement, the Company reserved up to 3,749,535 shares of common stock to be issued upon exercise of conversion

of the Lind Note and warrants issued in connection with the private placement.

Warrants

As

of June 30, 2024 and December 31, 2023, warrants issued and outstanding in connection with financing are summarized as below:

Schedule of Warrants Issued and Outstanding

| | |

June 30, | | |

December 31, | |

| (In number of shares) | |

2024 | | |

2023 | |

| ASE Warrant with exercise price $4.5 | |

| 500,000 | | |

| - | |

| Lind Warrant with exercise price from $2.16 to $4.50 | |

| 1,201,944 | | |

| 691,244 | |

| Public warrant with exercise price of $21.25 | |

| 179,400 | | |

| 179,400 | |

| Representative’s warrant with exercise price of $23.375 | |

| 7,800 | | |

| 7,800 | |

| Placement agent warrant with exercise price of $8.25 | |

| 20,666 | | |

| 16,000 | |

| Total | |

| 1,909,810 | | |

| 894,444 | |

As

mentioned in Note 5, in connection with Convertible Note and Warrant Purchase Agreement with the ASE, the Company issued warrants to

ASE for purchase of up to 500,000 shares of Common Stock at a price per share of $4.50, exercisable until May 03, 2029.

As

discussed in Note 5, the Company issued the Lind Warrants on September 28, 2023 in connection with the private placement of the Lind

Note. The Company further issued 20,666 shares of warrants with an exercise price of $8.25 per share to the placement agent as the agent

fee. Each warrant has a contractual term of 5 years and can be exercised for the purchase of one share of common stock of the Company.

The carrying amount of the Lind Warrant is nil after allocating proceeds to the Lind Note measured at fair value. The fair value of the

placement agent warrant is estimated as $21,479 using the Black-Scholes Model.

As

disclosed in Note 1, the Company issued public warrants together with common stock in connection with its underwritten public offering

effective August 8, 2022. The Company further issued private warrants to Maxim Group LLC, as representative of the underwriter pursuant

to an underwriting agreement. Each warrant has a contractual term of 5 years, expiring on August 8, 2027, and can be exercised for the

purchase of one share of common stock of the Company.

The

Company accounts for warrants as either equity-classified or liability-classified instruments based on an assessment of the instruments’

specific terms and applicable authoritative guidance in ASC 480, Distinguishing Liabilities from Equity (the “ASC480), and

ASC 815, Derivatives and Hedging (the “ASC 815”). The assessment considers whether the instruments are free standing

financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the instruments meet all

of the requirements for equity classification under ASC 815, including whether the instruments are indexed to the Company’s own

common shares and whether the instrument holders could potentially require “net cash settlement” in a circumstance outside

of the Company’s control, among other conditions for equity classification. This assessment, which requires the use of professional

judgment, is conducted at the time of warrant issuance and as of each subsequent period end date while the instruments are outstanding.

Management has concluded that the warrants issued in connection with the underwritten public offering and the private placement of Lind

Note qualify for equity accounting treatment and are recorded as additional paid-in capital.

In

addition, the warrant issued by the Company to i2China in 2020 in exchange for consulting services is accounted for under ASC 718, Compensation

– Stock Compensation (see Note 8).

As

of June 30, 2024, none of the warrants have been exercised nor have expired.

7.

Revenue

Revenue

is recognized upon shipment of products based upon contractually stated pricing at standard payment terms within 30 to 60 days. The revenue

generated by product sales is recognized at point in time.

The

Company generated revenue from sales of COVID-19 Antigen Rapid Test Kits in the Taiwan market for the three and six months ended June

30, 2023. There was no revenue recognized from performance obligation satisfied or partially satisfied in prior periods, nor were there

any unsatisfied performance obligations related to the sales of COVID-19 Test Kits as of June 30, 2024 and December 31, 2023.

The

Company generated revenue from sales of VELDONA Pet cytoprotein supplements in the Taiwan market through on-line platforms that were

recognized after the expiration of right of return which was offered for a limited time. Revenue from sales through off-line distribution

channels was recognized based on the amount of consideration that we expected to receive, reduced

by estimates for return allowances, promotional discounts, and fees. $106,502 of contract liabilities was recorded for the cash

received in advance from distribution channels as of June 30, 2024.

Return

Allowances

Return

allowances, which reduce revenue and cost of sales, are estimated using historical experience. Liabilities for return allowances are

included in “Accrued expenses and others current liabilities”.

Variable

consideration

We

record revenue from customers in an amount that reflects the transaction price we expect to be entitled to after transferring control

of those goods. From time to time, we offer product sales promotions such as discounts. Variable consideration is estimated at contract

inception only to the extent that it is probable that a significant reversal of revenue will not occur.

8.

Share-Based Compensation

2023

Stock Incentive Plan

The

Company effectuated an amendment to its 2021 Stock Incentive Plan, now restated as the Company 2023 Stock Incentive Plan (the “2023

SIP” or “Plan”) which includes, among other things, a change in the number of reserved shares under the Plan. Under

the 2023 SIP, subject to a change in capital structure or a change in control, the aggregate number of shares which may be issued or

transferred pursuant to awards under the Plan will be equal to up to twenty percent (20%) of shares of outstanding common stock of the

Company existing as of December 31st of the previous calendar year (the “Plan Share Reserve”). Upon the effectiveness

of the 2023 SIP on June 14, 2023, the aggregate number of shares which may be issued pursuant to awards under the Plan is 871,075 shares

of common stock, including shares that remained available for grant under the 2021 Stock Incentive Plan. As of June 30, 2024, 870,200

shares have been granted under the 2023 SIP.

2021

Stock Incentive Plan

On

September 28, 2021, the Company’s board of directors, and on May 16, 2022, its shareholders approved the 2021 Stock Incentive Plan

(the “2021 SIP”). During the period from January 1, 2023 up to the date that the prior plan was superseded by the 2023 SIP,

no shares were granted under the 2021 SIP.

2021

Employee Stock Purchase Plan

On

September 28, 2021, the Company’s board of directors, and on May 16, 2022, its shareholders approved the 2021 Employee Stock Purchase

Plan (the “2021 ESPP”). As of June 30, 2024, no shares were issued under the 2021 ESPP.

Restricted

Stock Units (“RSUs”)

RSUs

entitle the recipient to be paid out an equal number of common stock shares upon vesting. The fair value of RSUs is based on market price

of the underlying stock on the date of grant. A summary of the Company’s RSUs activity and related information for the three and

six months ended June 30, 2024 and for the three and six months ended June 30, 2023 were as follows:

Schedule

of Restricted Stock Units

| | |

2024 | | |

2023 | |

| | |

Number of

Shares | | |

Weighted-Average

Grant Date Fair

Value Per Share | | |

Number of

Shares | | |

Weighted-Average

Grant Date Fair

Value Per Share | |

| Unvested balance at January 1 | |

| 954,306 | | |

$ | 4.39 | | |

| 160,000 | | |

$ | 12.08 | |

| RSUs granted | |

| - | | |

$ | - | | |

| - | | |

$ | - | |

| RSUs vested | |

| (133,964 | ) | |

$ | 5.74 | | |

| (5,866 | ) | |

$ | 55.50 | |

| RSUs forfeited | |

| (5,950 | ) | |

$ | 3.46 | | |

| (7,600 | ) | |

$ | 7.15 | |

| Unvested balance at March 31 | |

| 814,392 | | |

$ | 4.18 | | |

| 146,534 | | |

$ | 10.60 | |

| RSUs granted | |

| - | | |

| | | |

| - | | |

| | |

| RSUs vested | |

| - | | |

| | | |

| (20,220 | ) | |

$ | 6.69 | |

| RSUs forfeited | |

| (4,410 | ) | |

$ | 4.16 | | |

| (6,970 | ) | |

$ | 6.38 | |

| Unvested balance at June 30 | |

| 809,982 | | |

$ | 4.18 | | |