UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment No. 8)*

Ainos,

Inc.

(Name

of Issuer)

Common

Stock, par value $0.01 per share

(Title

of Class of Securities)

00902F303

(CUSIP

Number)

Chun-Hsien

Tsai

Chief

Executive Officer

Ainos,

Inc.

14F.,

No. 61, Sec. 4, New Taipei Boulevard, Xinzhuang District

New

Taipei City 242, Taiwan F5

886-37-581999

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

August 15, 2024

(Date of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

| 1 |

NAME OF REPORTING PERSON:

Ainos Inc. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS): |

| |

(a) |

☒ |

| |

(b) |

☐ |

| 3 |

SEC USE ONLY:

|

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS):

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e): ☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE VOTING POWER:

10,904,1841 |

| 8 |

SHARED VOTING POWER:

0 |

| 9 |

SOLE DISPOSITIVE POWER:

2,456,3192 |

| 10 |

SHARED DISPOSITIVE POWER:

8,447,865 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

2,456,3192 |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

17.97

2, 3 |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

CO |

1, Includes

(1) 2,456,319 shares of common stock, $0.01 par value, of Ainos, Inc., a Texas corporation (the “Issuer”), owned

directly by Ainos Inc., a Cayman Islands company (“Ainos KY”), (ii) 538,868 shares pursuant to a Voting Agreement dated

January 26, 2024 (the “2024 Voting Agreement”), by and among the Issuer, Ainos Inc., and Chun-Hsien Tsai, Ting Chuan

Lee, Chun-Jung Tsai, and Chung-Yi Tsai (the “Tsai Group”); (iii) 96,920 shares of common stock pursuant to a Voting

Agreement dated March 7, 2024 (the “2024 Voting Agreement II”) with Chih-Heng Lu; (iv) 2,312,077 shares pursuant to a

Voting Agreement dated May 3, 2024 between Ainos KY and ASE Test, Inc. (“ASE Test” and the “ASE Voting

Agreement”) (with the 2,312,077 ASE Test shares consisting of the following (a) 29,411 shares owned by ASE Test, (b) 282,666

shares issuable to ASE Test upon conversion of outstanding convertible notes of the Issuer and (c) 2,000,000 shares issuable to ASE

Test upon conversion of a convertible note of the Issuer issuable within 60 days), and (v) 5,500,000 shares pursuant to a Voting

Agreement dated August 15, 2024 between Ainos KY and Taiwan Carbon Nano Technology Corporation.

2

Represents beneficial ownership of 2,456,319

shares of common stock of the Issuer, consisting of 2,456,319 shares owned directly by Ainos KY and excludes (i) 538,868 shares

pursuant to the 2024 Voting Agreement; (ii) 96,920 shares of common stock pursuant to the 2024 Voting Agreement II; (iii)

2,312,077 shares pursuant to the ASE Voting Agreement as detailed in Note 1, and (iv) 5,500,000 shares pursuant to a Voting

Agreement dated August 15, 2024 between Ainos KY and Taiwan Carbon Nano Technology Corporation.

3

Based on the sum of (i) 7,663,022 shares of

Common Stock outstanding as of August 2, 2024 as set forth in the Quarterly Report on Form 10-Q of the Issuer filed with the SEC on August

5, 2024, (ii) 382,384 shares of Common Stock issued to an institutional investor upon conversion of certain convertible notes on August

5, 2024, (iii) 5,500,000 shares of Common Stock issued to TCNT pursuant to the patent license agreement (the “License Agreement”)

by and between the Issuer and TCNT, dated August 15, 2024, and (iv) 126,060 restricted stock units (“RSUs”) that vested

on August 15, 2024 under the Ainos, Inc. 2023 Stock Incentive Plan with the underlying shares of the RSUs issued on August 16th.

This

Amendment No. 8 to Schedule 13D (“Amendment No. 8”) amends and supplements the Schedule 13D dated April 28, 2021 (the “Original

Statement”), as amended and restated by Amendment No. 1 dated December 13, 2023, as amended by Amendment No. 2 dated March 8, 2022,

as amended by Amendment No. 3 dated September 2, 2022, as amended by Amendment No. 4 dated August 15, 2023, as amended by Amendment No.

5 dated January 29, 2024, as amended by Amendment No. 6 dated March 11, 2024, as amended by Amendment 7 dated May 6, 2024 (the Original

Statement, as so amended shall be known as the “Statement”), with respect to the (i) the common stock, par value $0.01 per

share (the “Common Stock”), of the Issuer. Unless otherwise indicated, all capitalized terms used herein shall have the same

meaning as set forth in the Statement.

Except

as set forth below, there are no changes to the information set forth in the Statement.

Items

2, 3, 4, 5 and 6 of the Statement are hereby amended as follows:

Item

2. Identity and Background

(a-b)

This Schedule is being filed by Ainos Inc., a Cayman Islands corporation (“Ainos KY”). The principal business and office

address of Ainos KY is P. O. Box 31119 Grand Pavilion, Hibiscus Way, 802 West Bay Road, Grand Cayman, KY1 - 1205 Cayman Islands.

Ainos

KY is controlled by Taiwan Carbon Nano Technology Corporation, a Taiwanese corporation (“TCNT” and together with the Issuer,

the “Parties”). The principal business and office address of TCNT is 10F-2, No. 66, Shengyi 5th Rd., Zhubei City, Hsinchu

County 30261, Taiwan (R.O.C.).

(c)

The principal business of Ainos KY is a holding company of the Issuer’s securities. The principal business of TCNT is the development

of advanced materials for industrial and medical device applications.

See

Schedules A and B for information about the directors and executive officers of the Parties.

(d-e)

During the last five years, the reporting person and respective executive officers and directors, as applicable, have not (i) been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) been a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding

any violation with respect to such laws.

Item

3. Source and Amount of Funds or Other Consideration

Since

the filing of Amendment No.7, Chun-Hsien Tsai, Ting Chuan Lee, Chun-Jung Tsai, and Chih-Heng Lu were awarded 26,100, 14,400, 16,200,

and 6,000 restricted stock units (“RSUs”), respectively, under the Ainos, Inc. 2023 Stock Incentive Plan. Additionally, 1,920

RSUs will vest to Chih-Heng Lu under the Ainos, Inc. 2023 Stock Incentive Plan within 60 days of this Statement. Under the 2024 Voting

Agreement and the 2024 Voting Agreement II, Ainos KY has the sole discretion to determine the vote of all the parties’ voting stock

of the Issuer.

Pursuant

a patent license agreement by and between the Issuer and TCNT, the Issuer issued 5,500,000 shares of common stock to TCNT on August 15,

2024. On the same day, TCNT entered into a voting agreement with Ainos KY and, pursuant to such voting agreement, TCNT has agreed to

vote all of the voting stock of the Company that is current owns or will acquire in the future in the manner determined by Ainos KY in

its sole discretion.

The

information requested by this Item 3 is incorporated herein by reference to Item 5 hereof.

Item

4. Purpose of Transaction

Ainos

KY acquired the Common stock in the Issuer for investment purposes.

Except

as disclosed herein, each of the Parties has no plans which relate to or would result in an event described in subparagraphs (a) through

(j) of Item 4 of Schedule 13D. However, each of the Parties may, from time to time, engage in discussions, whether initiated by the Parties

or another party, concerning proposals for transactions or other arrangements that may relate to or, if consummated, result in an event

described in Item 4 of Schedule 13D. Each of the Parties may review and evaluate their respective investments in the Issuer at any time,

whether in light of the discussions described in the immediately preceding sentence or otherwise, which may give rise to plans or proposals

that, if consummated, would result in one or more of the events described in Item 4 of Schedule 13D. Any such discussion or actions may

consider various factors, including, without limitation, the Issuer’s business prospects and other developments concerning the

Issuer, alternative investment opportunities, general economic conditions, financial and stock market conditions and any other facts

and circumstances that may become known to the Parties regarding or related to the matters described in this Statement.

Item

5. Interest in Securities of the Issuer

Items 5 of the Statement are hereby amended and restated as follows:

(a)

- (b) The information requested by these paragraphs are incorporated herein by reference to the cover pages to this Amendment No. 8.

(c)

Since the most recent filing of Amendment No. 7 to Schedule 13D on May 6, 2024, the following transactions have occurred:

(1)

Effective August 15, 2024, Ainos KY and TCNT entered into a voting agreement with respect to the voting

stock of the Issuer held by TCNT as described further in Item 6.

(d)

No other person is known to the Parties to have the right to receive or the power to direct the receipt of dividends or the proceeds

from the sale of the Shares (other than their respective records owner).

(e)

Not applicable.

Item

6. Contracts, Arrangements, Understandings or Relationships With Respect To Securities Of The Issuer

Item

6 of the Statement is hereby amended and supplemented as follows:

Pursuant

a patent license agreement by and between the Issuer and TCNT, the Issuer issued 5,500,000 shares of common stock to TCNT on August 15,

2024. On the same day, TCNT entered into a voting agreement with Ainos KY and, pursuant to such voting agreement, TCNT has agreed to

vote all of the voting stock of the Company that is current owns or will acquire in the future in the manner determined by Ainos KY in

its sole discretion. The Voting Agreement may only be terminated if (i) Ainos KY directly holds less than 10% of the shares of the

Issuer; or (ii) when Ainos KY directly holds shares which have less than 10% of the voting power in the Issuer. This voting agreement

will cease to apply to a particular stockholder when the stockholder holds no shares in the Issuer; or when the stockholder ceases to

be subject to the obligations under Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), if

applicable.

Other

than the foregoing agreements and arrangements, there are no contracts, arrangements, understandings or relationships (legal or otherwise)

among Ainos KY or the Parties and any other person with respect to any securities of the Issuer, including, but not limited to transfer

or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits,

division of profits or loss, or the giving or withholding of proxies.

Item

7. Material to be Filed as Exhibit

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated:

August 20, 2024

| |

AINOS INC. |

| |

|

|

| |

By: |

/s/ Chun-Hsien Tsai |

| |

Name: |

Chun-Hsien Tsai |

| |

Title: |

Director and CEO |

SCHEDULE

A

Officers

and Directors of Ainos KY

| Name |

|

Principal

Occupation (and name/address of employer if not one of the entities listed on this Schedule) |

|

Principal

Business Address |

|

Interest

in Issuer (in shared of Common Stock) |

| Hung-Szu

Tung |

|

Director

of Ainos KY |

|

See

Note 1. |

|

None |

| Chun-Hsien

Tsai |

|

Director

of Ainos KY, Chairman and Chief Executive Officer

of TCNT, and Chairman, President, and CEO of the Issuer |

|

See

Note 1. |

|

397,5502 |

| Chun-Jung

Tsai |

|

Director

of each of Ainos KY and TCNT and employee director

of the Issuer |

|

See

Note 1. |

|

88,3863 |

| Chih-Heng

Lu |

|

Director

of Ainos KY and Director of Corporate Development of the Issuer |

|

See

Note 1. |

|

96,920 |

Note

1: The address of each individual is c/o Ainos, Inc., P. O. Box 31119 Grand Pavilion, Hibiscus Way, 802 West Bay Road, Grand Cayman,

KY1 - 1205 Cayman Islands and each individual is a citizen of Taiwan.

Note

2: Chun-Hsien Tsai’s beneficially owns 302,319 (direct) shares and 95,231 (indirect) shares beneficially owned by his wife, Ting

Chuan Lee, a director of the Issuer.

Note

3: Chun-Jung Tsai beneficially owns 88,386 shares of Common Stock of the Issuer.

SCHEDULE

B

Officers

and Directors of TCNT

| Name |

|

Principal

Occupation (and name/address of employer if not one of the entities listed on this Schedule) |

|

Principal

Business Address |

|

Interest

in Issuer (in shared of Common Stock) |

| Ting-Chuan

Lee |

|

Director of TCNT and employee director of the Issuer |

|

See

Note 1. |

|

95,2312 |

| Chung-Yi

Tsai |

|

Director of TCNT and non-employee director of the Issuer |

|

See

Note 1. |

|

52,9324 |

| Chun-Hsien

Tsai |

|

Director

of Ainos KY, Chairman and Chief Executive Officer of TCNT, and Chairman, President, and CEO of the Issuer |

|

See

Note 1. |

|

302,3192 |

| Chun-Jung

Tsai |

|

Director

of each of Ainos KY and TCNT and employee director of the Issuer |

|

See

Note 1. |

|

88,3863 |

| Ching-Ho

Tsai |

|

Director

of TCNT |

|

See

Note 1. |

|

None |

| A-Wen

Tsai Huang |

|

Supervisor

of TCNT |

|

See

Note 1. |

|

None |

Note

1: The address of each individual is c/o 10F-2, No. 66, Shengyi 5th Rd., Zhubei City, Hsinchu County 30261, Taiwan (R.O.C.) and each

individual is a citizen of Taiwan.

Note

2: The combined beneficial ownership of Chun-Hsien Tsai and Ting Chuan Lee totals 397,550 shares. Chun-Hsien Tsai directly and beneficially

owns 302,319 shares, and his wife, Ting Chuang Lee directly and beneficially owns 95,231 shares.

Note

3: Chun-Jung Tsai beneficially owns 88,386 shares of Common Stock of the Issuer.

Note

4: Chung Yi-Tsai beneficially owns 52,932 shares of Common Stock of the Issuer.

Exhibit

1

VOTING

AGREEMENT

THIS

VOTING AGREEMENT (this “Agreement”) is dated as of August 15, 2024, by and among AINOS INC., a Cayman Islands company

(“Ainos KY”), and the individuals and entities listed on Schedule A hereto (each a “Stockholder”

and together the “Stockholders”).

WHEREAS

each Stockholder is a stockholder of Ainos, Inc., a Texas corporation (the “Company”);

WHEREAS

the Company is currently traded on NASDAQ under the stock symbol “AIMD.”

NOW

THEREFORE, the parties, intending to be legally bound, hereby agree as follows:

1.

Shares Subject to Agreement. Each Stockholder agrees to vote all of its voting shares in the Company in the manner as shall

be determined at the sole discretion of Ainos KY.

2.

Additional Shares. If, after the date hereof, any Stockholder acquires beneficial or record ownership of any additional

shares of capital stock of the Company (any such shares, “Additional Shares”) as a result of acquisition by

any means, or via stock split, stock dividend, recapitalization, or reorganization of the shares in the Company, the provisions of this

Agreement shall thereafter be applicable to such Additional Shares until the end of the term of this Agreement.

3.

Termination. This Agreement shall commence immediately upon execution and continue in force and effect until Ainos KY directly

holds less than ten percent (10%) of the shares of the Company; or when Ainos KY directly holds shares which have less than ten percent

(10%) of the voting power in the Company. This Agreement will cease to apply to a particular Stockholder when the Stockholder holds no

shares in the Company; or when the Stockholder ceases to be subject to the obligations under Section 16 of the Securities Exchange Act

of 1934, if applicable.

4.

Notices. Any notices required or permitted to be sent hereunder shall be delivered either by person, by courier service,

or by electric mail to the following addresses, or such other address as any party hereto designates by written notice to the other party.

| |

If

to the Company: |

Ainos,

Inc. |

| |

|

8880

Rio San Diego Drive, Suite 800 |

| |

|

San

Diego, CA 92108 |

| |

|

Attention:

Chairman and CEO |

| |

|

Email:

|

| |

|

|

| |

If

to Ainos KY: |

Ainos

Inc. |

| |

|

P.O.

Box 31119 Grand Pavilion, Hibiscus Way, |

| |

|

802

West Bay Road |

| |

|

Grand

Cayman, KY1-1205 Cayman Islands |

| |

|

Attention:

Tsai, Chun Hsien, Director |

| |

|

Email:

|

If

to a Stockholder, to the address for such Stockholder set forth on Schedule A hereto.

5.

Governing Law and Submission to Jurisdiction. This Agreement shall be governed by the State of New York. Any legal suit,

action, or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby may be instituted in any United

States federal court or state court located in the state of New York, and each party irrevocably submits to the non-exclusive jurisdiction

of such courts in any such suit, action, or proceeding.

6.

Miscellaneous.

(a)

Amendments; Waivers. No provision of this Agreement may be waived or amended except in a written instrument signed by the

party hereto to whom it is being enforced. Notwithstanding the foregoing, this Agreement may be amended without consent to add any additional

holders of capital stock of the Company by executing and delivering a counterpart signature page to this Agreement, and such party shall

have the rights and obligations of a “Stockholder” hereunder.

(b)

Counterparts; Execution. This Agreement may be executed in any number of counterparts, all of whom taken together shall

constitute one and the same instrument, and any of the parties hereto may execute this Agreement by signing any such counterpart. In

the event that any signature is delivered by facsimile or electronic mail transmission, such signature shall create a valid and binding

obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile

or electronic mail signature page were an original thereof.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed and made and entered into effective as of the date

first set forth above.

| |

AINOS

INC. |

| |

a

Cayman Islands company |

| |

|

|

| |

By: |

/s/

Chun-Hsien Tsai |

| |

Name: |

Chun-Hsien

Tsai |

| |

Title: |

Director |

| |

|

|

| |

STOCKHOLDERS: |

| |

|

| |

SEE

SCHEDULE A ATTACHED HERETO |

Signature

Page to Voting Agreement

SCHEDULE

A

| STOCKHOLDER: |

|

| |

|

| Taiwan

Carbon Nano Technology Corporation |

|

| (Stockholder

name if an entity) |

|

| |

|

| [Company

Stamp] |

|

| (Signature) |

|

| |

|

| |

|

| (Print

Name) |

|

| |

|

| Chairman

and CEO |

|

| (Print

title if signing on behalf of an entity) |

|

| |

|

| |

|

| Address |

|

| |

|

| |

|

| Email |

|

Signature

Page to Voting Agreement

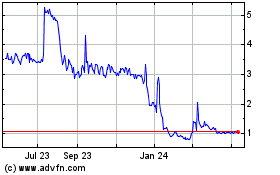

Ainos (NASDAQ:AIMD)

Historical Stock Chart

From Dec 2024 to Jan 2025

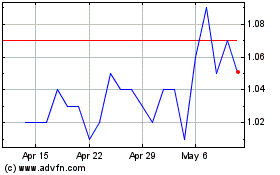

Ainos (NASDAQ:AIMD)

Historical Stock Chart

From Jan 2024 to Jan 2025