Company expects to repurchase up to $275.0

million of its common stock beginning in Q4'24

- Q3'24 total revenues of $977.9 million, increased 1.8%

year-over-year, and Q3'24 diluted net income per share was $1.55,

or $2.35 on a non-GAAP diluted basis

- Q3'24 total revenues were unfavorably impacted by foreign

exchange by approximately $14.6 million year-over-year(1), and were

not significantly impacted sequentially

- Q3'24 operating income of $162.3 million and operating margin

of 16.6%, non-GAAP operating margin of 22.1%

- Q3'24 GAAP operating margin was unfavorably impacted by foreign

exchange by approximately 0.8 points year-over-year(1), and was not

significantly impacted sequentially

- Q3'24 Clear Aligner revenues of $786.8 million decreased 5.4%

sequentially, and decreased 1.0% year-over-year

- Q3'24 Clear Aligner volume of 617.2 thousand cases decreased

4.0% sequentially, and increased 2.5% year-over-year

- Q3'24 Clear Aligner volume for teens increased 6.7%

year-over-year and 9.1% sequentially to 236.3 thousand cases

- Q3'24 Imaging Systems and CAD/CAM Services revenues of $191.0

million, increased 15.6% year-over-year

- Cash and cash equivalents was $1.0 billion as of Q3'24 compared

to $761.4 million as of Q2'24

Align Technology, Inc. (Nasdaq: ALGN), a leading global medical

device company that designs, manufactures, and sells the

Invisalign® System of clear aligners, iTero™ intraoral scanners,

and exocad™ CAD/CAM software for digital orthodontics and

restorative dentistry, today reported financial results for the

third quarter ("Q3'24"). Q3'24 total revenues were $977.9 million,

down 4.9% sequentially and up 1.8% year-over-year. Q3'24 total

revenues were not significantly impacted by foreign exchange

sequentially and unfavorably impacted by approximately $14.6

million or 1.5% year-over-year.(1) Q3'24 Clear Aligner revenues

were $786.8 million, down 5.4% sequentially and down 1.0%

year-over-year. Q3'24 Clear Aligner revenues were not significantly

impacted by foreign exchange sequentially, and unfavorably impacted

by approximately $11.7 million or 1.5% year-over-year.(1) Q3'24

Clear Aligner volume was down 4.0% sequentially and up 2.5%

year-over-year. Q3'24 Imaging Systems and CAD/CAM Services revenues

were $191.0 million, down 2.9% sequentially and up 15.6%

year-over-year. Q3'24 Imaging Systems and CAD/CAM Services revenues

were not significantly impacted by foreign exchange sequentially

and unfavorably impacted by approximately $2.9 million or 1.5%

year-over-year.(1)

Q3'24 operating income was $162.3 million resulting in an

operating margin of 16.6%, up 2.3 points sequentially, and down 0.7

points year-over-year. Q3'24 operating margin was not significantly

impacted by foreign exchange sequentially and was unfavorably

impacted by approximately 0.8 points year-over-year.(1) On a

non-GAAP basis, Q3'24 operating income was $215.9 million resulting

in an operating margin of 22.1%, down 0.2 points sequentially, and

up 0.3 points year-over-year. Q3'24 net income was $116.0 million,

or $1.55 per diluted share. On a non-GAAP basis, Q3'24 net income

was $175.6 million, or $2.35 per diluted share.

Commenting on Align's Q3'24 results, Align Technology President

and CEO Joe Hogan said, “Overall, Q3’24 results were mixed and

reflect strong Systems and Services year-over-year revenue growth,

as well as good Clear Aligner volume in the Asia Pacific, EMEA and

Latin America regions, partially offset by declines in the U.S. As

recently reported by many analysts and third-party research firms,

the underlying dental market in the U.S. remains sluggish and our

doctor customers cite similar trends. Q3’24 revenues of

approximately $978 million increased 1.8% year-over-year and Clear

Aligner volume of 617.2 thousand were up 2.5% year-over-year.

Despite strong growth from Systems and Services revenues, a record

87.4 thousand doctor submitters, a record 236 thousand teens

starting treatment—driven by a record teen case starts in China,

and a record 25K+ of DSP Invisalign® Touch-Up cases, total revenues

for Q3 were slightly below our Q3 revenue outlook in part due to

more pronounced seasonality for clear aligners than expected, as

well as continued weak consumer sentiment and a soft dental market

in the U.S. Q3’24 non-GAAP operating margin of 22.1% was better

than expected and increased year-over-year compared to 21.8% in

Q3’23.”

Financial Summary - Third Quarter

Fiscal 2024

Q3'24

Q2'24

Q3'23

Q/Q Change

Y/Y Change

Clear Aligner Shipments*

617,220

642,725

602,335

(4.0)%

+2.5%

GAAP

Net Revenues

$977.9M

$1,028.5M

$960.2M

(4.9)%

+1.8%

Clear Aligner

$786.8M

$831.7M

$794.9M

(5.4)%

(1.0)%

Imaging Systems and CAD/CAM Services

$191.0M

$196.8M

$165.3M

(2.9)%

+15.6%

Net Income

$116.0M

$96.6M

$121.4M

+20.1%

(4.5)%

Diluted EPS

$1.55

$1.28

$1.58

+$0.27

($0.03)

Non-GAAP

Net Income

$175.6M

$181.0M

$164.3M

(3.0)%

+6.9%

Diluted EPS

$2.35

$2.41

$2.14

($0.06)

+$0.21

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding.

*Clear Aligner shipments include Doctor

Subscription Program Touch-Up cases.

As of September 30, 2024, we had over $1,041.9 million in cash

and cash equivalents, compared to over $761.4 million as of June

30, 2024. As of September 30, 2024, we had $300.0 million available

under a revolving line of credit.

Align also announced today a global organizational restructuring

plan that eliminates or transfers identified positions to other

locations. There are impacted employees in every region and they

will receive severance and other benefits based on applicable laws,

severance plans, or contracts governing their position and country

of employment. As part of the restructuring plan, Raj Pudipeddi’s

position as executive vice president and managing director of the

Americas region and chief marketing officer has been eliminated and

he will leave Align in the fourth quarter of 2024. As a result of

the restructuring plan, we anticipate incurring restructuring

charges in the fourth quarter related to severance of approximately

$30 million or 3% points impact on operating margin.

Commenting on Align’s restructuring actions today, Align

Technology CFO and EVP Global Finance, John Morici said, “We

continually evaluate and evolve our business to provide doctors

with the best tools and resources that they deserve, while managing

our operations responsibly. Today’s restructuring action was

designed to adjust our operations to more closely align with the

existing business environment. We expect the restructuring actions

we announced today to be margin accretive in 2025, even as we scale

our next generation direct 3D printing fabrication

manufacturing.”

Announcement Highlights

- On October 23, 2024, Align announced that Frank Quinn, formerly

Align vice president and general manager of the United States, will

rejoin the company as executive vice president and managing

director of the Americas region, reporting to Joe Hogan, Align

president and CEO.

- On August 22, 2024, Align announced the pilot of a new U.S.

Invisalign treatment promotional program for Costco members on

Costco.com. Costco members in the in the U.S. can purchase an

Invisalign treatment e-card and Invisalign™ Essentials Bundle+ on

Costco.com for $99.99 to receive a $400 discount off Invisalign

treatment with participating U.S. Invisalign providers.

Q4'24 Stock Repurchase

- As of September 30, 2024, $500.0 million remains available for

repurchases of our common stock under our stock repurchase program

approved in January 2023.

- Beginning in Q4'24 and continuing into the first quarter of

2025, we expect to repurchase up to $275.0 million of our common

stock through either, or a combination of, open market repurchases

or an accelerated stock repurchase agreement.

Fiscal 2024 Business

Outlook

Turning to our outlook, assuming no circumstances occur beyond

our control, including foreign exchange, we provide the following

business outlook:

- For Q4'24, we expect worldwide revenues to be in the range of

$995M to $1,015M

- For Q4'24, we expect Clear Aligner volume and ASP to be

slightly up sequentially

- We also expect Systems and Services revenue to be up in Q4'24

sequentially consistent with typical Q4 seasonality

- We expect Q4’24 GAAP operating margin to be slightly lower than

14.0% primarily due to restructuring charges related to severance

as we adjust headcount for the existing business environment. We

estimate these restructuring charges to impact Q4’24 GAAP operating

margin by approximately 3 points

- We anticipate Q4’24 non-GAAP operating margin to be slightly up

sequentially

- For fiscal 2024, we expect investments in capital expenditures

to be above $100M. Capital expenditures primarily relate to

building construction and improvements as well as manufacturing

capacity in support of continued expansion

Align Webcast and Conference

Call

We will host a conference call today, October 23, 2024, at 4:30

p.m. ET, 1:30 p.m. PT, to review our Q3'24 results, discuss future

operating trends, and our business outlook. The conference call

will also be webcast live via the Internet. To access the webcast,

go to the "Events & Presentations" section under "Company

Information" on Align's Investor Relations website at

http://investor.aligntech.com. To access the conference call,

participants may register for the call at

https://edge.media-server.com/mmc/p/fyw8ag8t/. An archived audio

webcast will be available 2 hours after the call's conclusion and

will remain available for one month.

About Non-GAAP Financial

Measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with generally

accepted accounting principles ("GAAP") in the United States, we

use the following non-GAAP financial measures: constant currency

net revenues, constant currency gross profit, constant currency

gross margin, constant currency income from operations, constant

currency operating margin, non-GAAP gross profit, non-GAAP gross

margin, non-GAAP total operating expenses, non-GAAP income from

operations, non-GAAP operating margin, non-GAAP net income before

provision for income taxes, non-GAAP provision for income taxes,

non-GAAP effective tax rate, non-GAAP net income and non-GAAP

diluted net income per share.

These non-GAAP financial measures exclude certain items that may

not be indicative of our fundamental operating performance,

including foreign currency exchange rate impacts, the effects of

stock-based compensation, amortization of intangible assets related

to certain acquisitions, restructuring and other charges,

acquisition-related costs, associated tax impacts and discrete cash

and non-cash charges or gains that are included in the most

directly comparable GAAP financial measure.

Our management believes that the use of certain non-GAAP

financial measures provides meaningful supplemental information

regarding our recurring core operating performance. We believe that

both management and investors benefit from referring to these

non-GAAP financial measures in assessing our performance and when

planning, forecasting, and analyzing future periods. We believe

these non-GAAP financial measures are useful to investors both

because (1) they allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision-making and (2) they are used by our institutional

investors and the analyst community to help them analyze the

performance of our business.

There are material limitations to using non-GAAP financial

measures as they are not prepared in accordance with GAAP and may

be different from similarly titled non-GAAP financial measures used

by other companies. Non-GAAP financial measures exclude certain

items that may have a material impact upon our reported financial

results, which can limit their usefulness for comparison purposes.

In addition, they are subject to inherent limitations as they

reflect the exercise of judgments by management about which charges

are excluded from the non-GAAP financial measures. We compensate

for these limitations by analyzing current and future results on

both a GAAP and non-GAAP basis and by providing specific

information regarding the GAAP amounts excluded from these non-GAAP

financial measures in our public disclosures. The presentation of

non-GAAP financial information is meant to be considered in

addition to, not as a substitute for, superior to, or in isolation

from, the directly comparable financial measures prepared in

accordance with GAAP. We urge investors to review the

reconciliation of our GAAP financial measures to the comparable

non-GAAP financial measures included herein and not to rely on any

single financial measure to evaluate our business. For more

information on these non-GAAP financial measures and a

reconciliation of GAAP to non-GAAP measures, please see the tables

captioned "Unaudited GAAP to Non-GAAP Reconciliation."

About Align Technology,

Inc.

Align Technology designs and manufactures the Invisalign®

System, the most advanced clear aligner system in the world, iTero™

intraoral scanners and services, and exocad™ CAD/CAM software.

These technology building blocks enable enhanced digital

orthodontic and restorative workflows to improve patient outcomes

and practice efficiencies for over 271 thousand doctor customers

and are key to accessing Align’s 600 million consumer market

opportunity worldwide. Over the past 27 years, Align has helped

doctors treat approximately 18.9 million patients with the

Invisalign System and is driving the evolution in digital dentistry

through the Align™ Digital Platform, our integrated suite of

unique, proprietary technologies and services delivered as a

seamless, end-to-end solution for patients and consumers,

orthodontists and GP dentists, and lab/partners. Visit

www.aligntech.com for more information.

For additional information about the Invisalign System or to

find an Invisalign doctor in your area, please visit

www.invisalign.com. For additional information about the iTero

digital scanning system, please visit www.itero.com. For additional

information about exocad dental CAD/CAM offerings and a list of

exocad reseller partners, please visit www.exocad.com.

Invisalign, iTero, exocad, Align, Align Digital Platform and

iTero Lumina are trademarks of Align Technology, Inc.

Forward-Looking

Statements

This news release, including the tables below, contains

forward-looking statements, including statements of beliefs and

expectations regarding our ability to successfully control our

business and operations and pursue our strategic growth drivers,

our expectations regarding our stock repurchase programs, our

expectations for market opportunities, our expectations for the

restructuring actions and their impact, our expectations for Q4'24

worldwide revenues, Clear Aligner volume, Clear Aligner ASP,

Systems and Services revenues and GAAP and non-GAAP operating

margin, and 2024 capital expenditures. Forward-looking statements

contained in this press release relating to expectations about

future events or results are based upon information available to

Align as of the date hereof. Readers are cautioned that these

forward-looking statements reflect our best judgments based on

currently known facts and circumstances and are subject to risks,

uncertainties, and assumptions that are difficult to predict. As a

result, actual results may differ materially and adversely from

those expressed in any forward-looking statement.

Factors that might cause such a difference include, but are not

limited to:

- macroeconomic conditions, including inflation, fluctuations in

currency exchange rates, higher interest rates, market volatility,

weakness in general economic conditions and recessions and the

impact of efforts by central banks and federal, state and local

governments to combat inflation and recession;

- customer and consumer purchasing behavior and changes in

consumer spending habits as a result of, among other things,

prevailing macroeconomic conditions, levels of employment, salaries

and wages, debt obligations, discretionary income, inflationary

pressure, declining consumer confidence, and the military conflicts

in the Middle East and Ukraine;

- variations in our geographic, channel and product mix, product

adoption, and selling prices regionally and globally, including

product mix shifts to lower priced products or to products with a

higher percentage of deferred revenue;

- competition from existing and new competitors;

- declines in, or the slowing of the growth of, sales of our

clear aligners and intraoral scanners domestically and/or

internationally and the impact either would have on the adoption of

Invisalign products;

- the economic and geopolitical ramifications of the military

conflicts in the Middle East and Ukraine, including supply chain

and trade disruptions, tariffs, trade sanctions, customs inquiries

or restrictions, boycotts, retaliatory sanctions, nationalism, and

other consequences, any of which could adversely impact our

operations and assets;

- the possibility that the development and release of new

products or enhancements to existing products do not proceed in

accordance with the anticipated timeline or may themselves contain

bugs, errors, or defects in software or hardware requiring

remediation and that the market for the sale of these new or

enhanced products may not develop as expected;

- the timing and availability and cost of raw materials,

components, products and other shipping and supply chain

constraints and disruptions;

- unexpected or rapid changes in the growth or decline of our

domestic and/or international markets;

- rapidly evolving and groundbreaking advances that fundamentally

alter the dental industry or the way new and existing customers

market and provide products and services to consumers;

- our ability to protect our intellectual property rights;

- continued compliance with regulatory requirements;

- the willingness and ability of our customers to maintain and/or

increase product utilization in sufficient numbers;

- our ability to sustain or increase profitability or revenue

growth in future periods (or minimize declines) while controlling

expenses;

- expansion of our business and products;

- the impact of excess or constrained capacity at our

manufacturing and treat operations facilities and pressure on our

internal systems and personnel;

- the compromise of our systems or networks, including any

customer and/or patient data contained therein, for any

reason;

- the timing of case submissions from our doctor customers within

a quarter as well as an increased manufacturing costs per case;

and

- the loss of key personnel, labor shortages, or work stoppages

for us or our suppliers.

The foregoing and other risks are detailed from time to time in

our periodic reports filed with the Securities and Exchange

Commission ("SEC"), including, but not limited to, our Annual

Report on Form 10-K for the year ended December 31, 2023, which was

filed with the SEC on February 28, 2024 and our latest Quarterly

Report on Form 10-Q for the quarter ended June 30, 2024, which was

filed with the SEC on August 2, 2024. Align undertakes no

obligation to revise or update publicly any forward-looking

statements for any reason.

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net revenues

$

977,872

$

960,214

$

3,003,793

$

2,905,534

Cost of net revenues

296,098

297,138

901,575

868,195

Gross profit

681,774

663,076

2,102,218

2,037,339

Operating expenses:

Selling, general and administrative

434,138

407,992

1,338,222

1,300,876

Research and development

85,272

88,738

269,324

264,670

Legal settlement loss

66

—

31,193

—

Total operating expenses

519,476

496,730

1,638,739

1,565,546

Income from operations

162,298

166,346

463,479

471,793

Interest income and other income

(expense), net:

Interest income

4,003

5,522

11,696

12,280

Other income (expense), net

(371

)

(9,757

)

(6,993

)

(15,749

)

Total interest income and other income

(expense), net

3,632

(4,235

)

4,703

(3,469

)

Net income before provision for income

taxes

165,930

162,111

468,182

468,324

Provision for income taxes

49,967

40,684

150,627

147,285

Net income

$

115,963

$

121,427

$

317,555

$

321,039

Net income per share:

Basic

$

1.55

$

1.59

$

4.23

$

4.19

Diluted

$

1.55

$

1.58

$

4.23

$

4.18

Shares used in computing net income per

share:

Basic

74,736

76,569

75,031

76,670

Diluted

74,757

76,826

75,149

76,849

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

September 30,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,041,935

$

937,438

Marketable securities, short-term

—

35,304

Accounts receivable, net

1,010,601

903,424

Inventories

254,119

296,902

Prepaid expenses and other current

assets

290,732

273,550

Total current assets

2,597,387

2,446,618

Marketable securities, long-term

—

8,022

Property, plant and equipment, net

1,290,427

1,290,863

Operating lease right-of-use assets,

net

121,079

117,999

Goodwill

471,512

419,530

Intangible assets, net

115,905

82,118

Deferred tax assets

1,569,950

1,590,045

Other assets

199,714

128,682

Total assets

$

6,365,974

$

6,083,877

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

109,035

$

113,125

Accrued liabilities

574,556

525,780

Deferred revenues

1,380,022

1,427,706

Total current liabilities

2,063,613

2,066,611

Income tax payable

111,558

116,744

Operating lease liabilities

96,435

96,968

Other long-term liabilities

150,014

173,065

Total liabilities

2,421,620

2,453,388

Total stockholders’ equity

3,944,354

3,630,489

Total liabilities and stockholders’

equity

$

6,365,974

$

6,083,877

ALIGN TECHNOLOGY, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

Nine Months Ended

September 30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net cash provided by operating

activities

$

452,153

$

738,878

CASH FLOWS FROM INVESTING

ACTIVITIES

Net cash used in investing activities

(200,996

)

(182,619

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Net cash used in financing activities

(152,703

)

(248,059

)

Effect of foreign exchange rate changes on

cash, cash equivalents, and restricted cash

6,008

(11,205

)

Net increase in cash, cash equivalents,

and restricted cash

104,462

296,995

Cash, cash equivalents, and restricted

cash at beginning of the period

938,519

942,355

Cash, cash equivalents, and restricted

cash at end of the period

$

1,042,981

$

1,239,350

ALIGN TECHNOLOGY, INC.

INVISALIGN BUSINESS METRICS

Q1

Q2

Q3

Q4

Q1

Q2

Q3

2023

2023

2023

2023

2024

2024

2024

Number of Invisalign Trained Doctors

Cases Were Shipped To

82,730

83,440

85,195

83,700

83,510

86,135

87,380

Invisalign Trained Doctor Utilization

Rates*:

North America

9.5

9.8

9.6

9.1

9.5

9.9

9.7

North American Orthodontists

28.7

29.2

28.8

25.9

28.2

28.8

28.3

North American GP Dentists

4.9

5.2

4.9

5.0

4.9

5.3

5.0

International

6.2

6.6

6.1

6.5

6.3

6.7

6.2

Total Utilization Rates**

7.1

7.5

7.1

7.1

7.2

7.5

7.1

Clear Aligner Revenue Per Case

Shipment***:

$

1,335

$

1,335

$

1,320

$

1,320

$

1,350

$

1,295

$

1,275

* # of cases shipped / # of doctors to

whom cases were shipped

** LATAM utilization rate is not

separately disclosed but included in the total utilization

rates

*** Clear Aligner revenues / Case

shipments

ALIGN TECHNOLOGY, INC.

STOCK-BASED COMPENSATION

(in thousands)

Q1

Q2

Q3

Q4

Fiscal

Q1

Q2

Q3

2023

2023

2023

2023

2023

2024

2024

2024

Stock-based Compensation (SBC):

SBC included in Gross Profit

$

1,807

$

1,901

$

1,974

$

1,780

$

7,462

$

2,064

$

2,582

$

3,070

SBC included in Operating Expenses

35,928

35,959

37,628

37,049

146,564

36,724

44,446

45,969

Total SBC

$

37,735

$

37,860

$

39,602

$

38,829

$

154,026

$

38,788

$

47,028

$

49,039

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP

RECONCILIATION+

CONSTANT CURRENCY NET REVENUES

(in thousands, except percentages)

Sequential constant currency analysis:

Three Months Ended

September 30,

2024

June 30, 2024

Impact % of Revenue

GAAP net revenues

$

977,872

$

1,028,490

Constant currency impact (1)

(125

)

0.0

%

Constant currency net revenues

(1)

$

977,747

GAAP Clear Aligner net revenues

$

786,844

$

831,738

Clear Aligner constant currency impact

(1)

(124

)

0.0

%

Clear Aligner constant currency net

revenues (1)

$

786,720

GAAP Imaging Systems and CAD/CAM

Services net revenues

$

191,028

$

196,752

Imaging Systems and CAD/CAM Services

constant currency impact (1)

(1

)

0.0

%

Imaging Systems and CAD/CAM Services

constant currency net revenues (1)

$

191,027

Year-over-year constant currency

analysis:

Three Months Ended

September 30,

2024

2023

Impact % of Revenue

GAAP net revenues

$

977,872

$

960,214

Constant currency impact (1)

14,649

1.5

%

Constant currency net revenues

(1)

$

992,521

GAAP Clear Aligner net revenues

$

786,844

$

794,939

Clear Aligner constant currency impact

(1)

11,700

1.5

%

Clear Aligner constant currency net

revenues (1)

$

798,544

GAAP Imaging Systems and CAD/CAM

Services net revenues

$

191,028

$

165,275

Imaging Systems and CAD/CAM Services

constant currency impact (1)

2,949

1.5

%

Imaging Systems and CAD/CAM Services

constant currency net revenues (1)

$

193,977

Note:

(1)

We define constant currency net revenues

as total net revenues excluding the effect of foreign exchange rate

movements and use it to determine the percentage for the constant

currency impact on net revenues on a sequential and year-over-year

basis. Constant currency impact in dollars is calculated by

translating the current period GAAP net revenues using the foreign

currency exchange rates that were in effect during the previous

comparable period and subtracting it by the current period GAAP net

revenues. The percentage for the constant currency impact on net

revenues is calculated by dividing the constant currency impact in

dollars (numerator) by constant currency net revenues in dollars

(denominator).

(+)

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding. Refer to "About Non-GAAP Financial Measures" section of

press release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED+

CONSTANT CURRENCY GROSS PROFIT AND GROSS

MARGIN

(in thousands, except percentages)

Sequential constant currency analysis:

Three Months Ended

September 30,

2024

June 30, 2024

GAAP gross profit

$

681,774

$

722,628

Constant currency impact on net

revenues

(125

)

Constant currency gross profit

$

681,648

Three Months Ended

September 30,

2024

June 30, 2024

GAAP gross margin

69.7

%

70.3

%

Gross margin constant currency impact

(1)

0.0

Constant currency gross margin

(1)

69.7

%

Year-over-year constant currency

analysis:

Three Months Ended

September 30,

2024

2023

GAAP gross profit

$

681,774

$

663,076

Constant currency impact on net

revenues

14,649

Constant currency gross profit

$

696,422

Three Months Ended

September 30,

2024

2023

GAAP gross margin

69.7

%

69.1

%

Gross margin constant currency impact

(1)

0.4

Constant currency gross margin

(1)

70.2

%

Note:

(1)

We define constant currency gross margin

as constant currency gross profit as a percentage of constant

currency net revenues. Gross margin constant currency impact is the

increase or decrease in constant currency gross margin compared to

the GAAP gross margin.

(+)

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding. Refer to "About Non-GAAP Financial Measures" section of

press release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED+

CONSTANT CURRENCY INCOME FROM OPERATIONS

AND OPERATING MARGIN

(in thousands, except percentages)

Sequential constant currency analysis:

Three Months Ended

September 30,

2024

June 30, 2024

GAAP income from operations

$

162,298

$

147,046

Income from operations constant currency

impact (1)

(1,374

)

Constant currency income from

operations (1)

$

160,924

Three Months Ended

September 30,

2024

June 30, 2024

GAAP operating margin

16.6

%

14.3

%

Operating margin constant currency impact

(2)

(0.1

)

Constant currency operating margin

(2)

16.5

%

Year-over-year constant currency

analysis:

Three Months Ended

September 30,

2024

2023

GAAP income from operations

$

162,298

$

166,346

Income from operations constant currency

impact (1)

9,973

Constant currency income from

operations (1)

$

172,271

Three Months Ended

September 30,

2024

2023

GAAP operating margin

16.6

%

17.3

%

Operating margin constant currency impact

(2)

0.8

Constant currency operating margin

(2)

17.4

%

Notes:

(1)

We define constant currency income from

operations as GAAP income from operations excluding the effect of

foreign exchange rate movements for GAAP net revenues and operating

expenses on a sequential and year-over-year basis. Constant

currency impact in dollars is calculated by translating the current

period GAAP net revenues and operating expenses using the foreign

currency exchange rates that were in effect during the previous

comparable period and subtracting it by the current period GAAP net

revenues and operating expenses.

(2)

We define constant currency operating

margin as constant currency income from operations as a percentage

of constant currency net revenues. Operating margin constant

currency impact is the increase or decrease in constant currency

operating margin compared to the GAAP operating margin.

(+)

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding. Refer to "About Non-GAAP Financial Measures" section of

press release.

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED+

FINANCIAL MEASURES OTHER THAN CONSTANT

CURRENCY

(in thousands, except per share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP gross profit

$

681,774

$

663,076

$

2,102,218

$

2,037,339

Stock-based compensation

3,070

1,974

7,716

5,682

Amortization of intangibles (1)

3,702

2,825

11,104

8,409

Restructuring charges (2)

—

—

—

(8

)

Non-GAAP gross profit

$

688,546

$

667,875

$

2,121,038

$

2,051,422

GAAP gross margin

69.7

%

69.1

%

70.0

%

70.1

%

Non-GAAP gross margin

70.4

%

69.6

%

70.6

%

70.6

%

GAAP total operating expenses

$

519,476

$

496,730

$

1,638,739

$

1,565,546

Stock-based compensation

(45,969

)

(37,628

)

(127,139

)

(109,515

)

Amortization of intangibles (1)

(880

)

(885

)

(2,618

)

(2,631

)

Restructuring and other charges (2)

89

—

446

300

Legal settlement loss

(66

)

—

(31,193

)

—

Non-GAAP total operating

expenses

$

472,650

$

458,217

$

1,478,235

$

1,453,700

GAAP income from operations

$

162,298

$

166,346

$

463,479

$

471,793

Stock-based compensation

49,039

39,602

134,855

115,197

Amortization of intangibles (1)

4,582

3,710

13,722

11,040

Restructuring and other charges (2)

(89

)

—

(446

)

(308

)

Legal settlement loss

66

—

31,193

—

Non-GAAP income from operations

$

215,896

$

209,658

$

642,803

$

597,722

GAAP operating margin

16.6

%

17.3

%

15.4

%

16.2

%

Non-GAAP operating margin

22.1

%

21.8

%

21.4

%

20.6

%

GAAP net income before provision for

income taxes

$

165,930

$

162,111

$

468,182

$

468,324

Stock-based compensation

49,039

39,602

134,855

115,197

Amortization of intangibles (1)

4,582

3,710

13,722

11,040

Restructuring and other charges (2)

(89

)

—

(446

)

(308

)

Legal settlement loss

66

—

31,193

—

Non-GAAP net income before provision

for income taxes

$

219,528

$

205,423

$

647,506

$

594,253

ALIGN TECHNOLOGY, INC.

UNAUDITED GAAP TO NON-GAAP RECONCILIATION

CONTINUED

FINANCIAL MEASURES OTHER THAN CONSTANT

CURRENCY CONTINUED

(in thousands, except per share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP provision for income taxes

$

49,967

$

40,684

$

150,627

147,285

Tax impact on non-GAAP adjustments

(6,061

)

418

(21,156

)

(28,417

)

Non-GAAP provision for income

taxes

$

43,906

$

41,102

$

129,471

$

118,868

GAAP effective tax rate

30.1

%

25.1

%

32.2

%

31.4

%

Non-GAAP effective tax rate

20.0

%

20.0

%

20.0

%

20.0

%

GAAP net income

$

115,963

$

121,427

$

317,555

$

321,039

Stock-based compensation

49,039

39,602

134,855

115,197

Amortization of intangibles (1)

4,582

3,710

13,722

11,040

Restructuring and other charges (2)

(89

)

—

(446

)

(308

)

Legal settlement loss

66

—

31,193

—

Tax impact on non-GAAP adjustments

6,061

(418

)

21,156

28,417

Non-GAAP net income

$

175,622

$

164,321

$

518,035

$

475,385

GAAP diluted net income per

share

$

1.55

$

1.58

$

4.23

$

4.18

Non-GAAP diluted net income per

share

$

2.35

$

2.14

$

6.89

$

6.19

Shares used in computing diluted net

income per share

74,757

76,826

75,149

76,849

Notes:

(1)

Amortization of intangible assets related

to certain acquisitions.

(2)

Restructuring and other charges recorded

in gross profit and operating expenses primarily relate to

severance costs or revisions to initial severance cost

estimates.

(+)

Changes and percentages are based on

actual values. Certain tables may not sum or recalculate due to

rounding. Refer to "About Non-GAAP Financial Measures" section of

press release.

ALIGN TECHNOLOGY, INC.

Q4 2024 OUTLOOK - GAAP TO NON-GAAP

RECONCILIATION

GAAP operating margin

Slightly below 14.0%

Stock-based compensation

~5.0%

Amortization of intangibles (1)

~0.5%

Restructuring charges (2)

~3.0%

Non-GAAP operating margin

Slightly above 22.1%

(1)

Amortization of intangible assets related

to certain acquisitions.

(2)

Restructuring charges primarily related to

severance.

Refer to "About Non-GAAP Financial Measures" section of press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023467147/en/

Align Technology Madelyn Valente

(909) 833-5839 mvalente@aligntech.com

Zeno Group Sarah Johnson (828)

551-4201 sarah.johnson@zenogroup.com

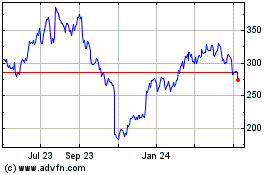

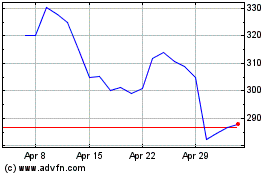

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Align Technology (NASDAQ:ALGN)

Historical Stock Chart

From Feb 2024 to Feb 2025