Amazon.com, Inc. (NASDAQ: AMZN) today announced financial

results for its fourth quarter ended December 31, 2024.

Fourth Quarter 2024

- Net sales increased 10% to $187.8 billion in the fourth

quarter, compared with $170.0 billion in fourth quarter 2023.

Excluding the $0.9 billion unfavorable impact from year-over-year

changes in foreign exchange rates throughout the quarter, net sales

increased 11% compared with fourth quarter 2023.

- North America segment sales increased 10% year-over-year to

$115.6 billion.

- International segment sales increased 8% year-over-year to

$43.4 billion, or increased 9% excluding changes in foreign

exchange rates.

- AWS segment sales increased 19% year-over-year to $28.8

billion.

- Operating income increased to $21.2 billion in the

fourth quarter, compared with $13.2 billion in fourth quarter 2023.

- North America segment operating income was $9.3 billion,

compared with operating income of $6.5 billion in fourth quarter

2023.

- International segment operating income was $1.3 billion,

compared with an operating loss of $0.4 billion in fourth quarter

2023.

- AWS segment operating income was $10.6 billion, compared with

operating income of $7.2 billion in fourth quarter 2023.

- Net income increased to $20.0 billion in the fourth

quarter, or $1.86 per diluted share, compared with $10.6 billion,

or $1.00 per diluted share, in fourth quarter 2023.

Full Year 2024

- Net sales increased 11% to $638.0 billion in 2024,

compared with $574.8 billion in 2023. Excluding the $2.3 billion

unfavorable impact from year-over-year changes in foreign exchange

rates throughout the year, net sales increased 11% compared with

2023.

- North America segment sales increased 10% year-over-year to

$387.5 billion.

- International segment sales increased 9% year-over-year to

$142.9 billion, or increased 10% excluding changes in foreign

exchange rates.

- AWS segment sales increased 19% year-over-year to $107.6

billion.

- Operating income increased to $68.6 billion in 2024,

compared with $36.9 billion in 2023.

- North America segment operating income was $25.0 billion,

compared with operating income of $14.9 billion in 2023.

- International segment operating income was $3.8 billion,

compared with an operating loss of $2.7 billion in 2023.

- AWS segment operating income was $39.8 billion, compared with

operating income of $24.6 billion in 2023.

- Net income increased to $59.2 billion in 2024, or $5.53

per diluted share, compared with $30.4 billion, or $2.90 per

diluted share, in 2023.

- Operating cash flow increased 36% to $115.9 billion for

the trailing twelve months, compared with $84.9 billion for the

trailing twelve months ended December 31, 2023.

- Free cash flow increased to $38.2 billion for the

trailing twelve months, compared with $36.8 billion for the

trailing twelve months ended December 31, 2023.

- Free cash flow less principal repayments of finance leases

and financing obligations increased to $35.5 billion for the

trailing twelve months, compared with $32.2 billion for the

trailing twelve months ended December 31, 2023.

- Free cash flow less equipment finance leases and principal

repayments of all other finance leases and financing

obligations increased to $36.2 billion for the trailing twelve

months, compared with $35.5 billion for the trailing twelve months

ended December 31, 2023.

“The holiday shopping season was the most successful yet for

Amazon and we appreciate the support of our customers, selling

partners, and employees who helped make it so,” said Andy Jassy,

President and CEO, Amazon. “When we look back on this quarter

several years from now, I suspect what we’ll most remember is the

remarkable innovation delivered across all of our businesses, none

more so than in AWS where we introduced our new Trainium2 AI chip,

our own foundation models in Amazon Nova, a plethora of new models

and features in Amazon Bedrock that give customers flexibility and

cost savings, liberating transformations in Amazon Q to migrate

from old platforms, and the next edition of Amazon SageMaker to

pull data, analytics, and AI together more concertedly. These

benefits are often realized by customers (and the business) several

months down the road, but these are substantial enablers in this

emerging technology environment and we’re excited to see what

customers build.”

Some other highlights since the company’s last earnings

announcement include that Amazon:

- Delivered at its fastest speeds ever for Prime members in

2024.

- Delivered over 65% more items to U.S. Prime members the same

day or overnight than in Q4 2023.

- Held a record-breaking Black Friday Week and Cyber Monday deal

event that was also the largest ever for independent sellers in

Amazon’s store.

- Was named lowest-priced U.S. retailer by Profitero for the

eighth year in a row. The study found Amazon’s online prices were

an average of 14% less than other major U.S. retailers.

- Launched Amazon Haul, a new shopping experience in Amazon’s

U.S. shopping app and mobile site, with ultra-low prices.

- Drew 50 million worldwide viewers to Red One in its first four

days, making it Amazon MGM Studios’ most-watched film debut ever on

Prime Video.

- Finished third season of Thursday Night Football on Prime Video

with a full-season average of 13.2 million viewers according to

Nielsen—an 11% increase over 2023—and a peak of 24.7 million during

the Wild Card playoff game between the Steelers and Ravens.

- Had the biggest Q4 for Kindle device sales in over a decade,

with a new lineup of Kindles driving a 30% year-over-year increase

in devices sold.

- Held 13th AWS re:Invent, with 55,000+ in-person attendees and

1.8 million livestream viewers.

- Announced a plethora of new AWS capabilities, including:

- Amazon Nova: Amazon’s own family of foundation models that

compare favorably in intelligence against the leading models in the

world, but offer lower latency, lower price, and integration with

key Bedrock features like fine-tuning, model distillation,

knowledge bases, and agentic capabilities. Thousands of customers

are already using Nova, including Deloitte, SAP, Robinhood,

Palantir Technologies, Dentsu Digital, AppFolio, Fortinet, Trellix,

123RF, Envato, Pattern, and Ativion.

- General Availability of Trainium2: EC2 Trn2 instances, powered

by Trainium2 AI chips, offer 30-40% better price-performance than

current generations of GPU-based instances.

- Trainium2 UltraServers: A new type of EC2 Trn2 offering using

ultra-fast networking to connect four Trn2 servers into an extra

large server, enabling even faster training and inference on

AWS.

- Project Rainier: A collaboration with Anthropic using hundreds

of thousands of Trainium2 chips to build the world’s largest AI

compute cluster.

- New leading foundation models in Amazon Bedrock from DeepSeek,

Luma AI, and poolside.

- Amazon Bedrock Marketplace, where customers can choose from

over 100 popular models.

- New features for Amazon Bedrock, including Prompt Caching,

Intelligent Prompt Routing, and Model Distillation, all of which

help customers achieve lower cost and latency in their

inference.

- New Amazon SageMaker AI features, including the ability to

manage costs and prioritize which workloads should receive capacity

when budgets are reached.

- New Amazon Q Transformations that make it easy to move from

Windows .NET applications to Linux, VMware to EC2, and accelerates

mainframe migrations from multi-year to multi-quarter efforts.

- Amazon Aurora DSQL: The fastest distributed database with

99.999% multi-Region availability, virtually unlimited scalability,

strong consistency, zero infrastructure management, PostgreSQL

compatibility, and 4x faster reads and writes vs. other popular

distributed SQL databases.

- S3 Tables, making S3 the first cloud object store with

fully-managed support for Apache Iceberg.

- S3 Metadata, automatically generating queryable metadata,

simplifying data discovery, business analytics, and real-time

inference to help customers unlock the value of their data in

S3.

- The next generation of Amazon SageMaker, which brings together

all of the data, analytics services and AI services into one

interface to do analytics and AI more easily at scale.

- Signed new AWS agreements with the U.S. Army, Intuit, PayPal,

Norwegian Cruise Line Holdings Ltd., Northrop Grumman, Medtronic,

The Guardian Life Insurance Company of America, Reddit, Japan

Airlines, Baker Hughes, The Hertz Corporation, Redfin, Chime, and

Asana.

- Announced GROW with SAP on AWS to help customers rapidly deploy

SAP’s enterprise resource planning.

- Launched AWS Asia Pacific (Thailand) and AWS Mexico (Central)

Regions.

- Supported California wildfire relief efforts with over 500,000

essential items delivered through Disaster Relief by Amazon, AWS

cloud technology to help emergency responders, and $10 million in

donations.

- Supported communities hit by flooding in southern Spain by

donating and delivering more than 265,000 essential items.

- Ranked No. 3 on Fortune magazine’s World’s Most Admired

Companies list.

- Won awards for advancement in workplace health and safety from

Brandon Hall Group, the Network of Employers for Traffic Safety,

and Verdantix.

- Was named the world’s largest corporate purchaser of renewable

energy by Bloomberg NEF for the fifth straight year, with more than

600 wind and solar projects globally.

Visit

aboutamazon.com/news/company-news/amazon-earnings-q4-2024-report.

Financial Guidance The following forward-looking

statements reflect Amazon.com’s expectations as of February 6,

2025, and are subject to substantial uncertainty. Our results are

inherently unpredictable and may be materially affected by many

factors, such as fluctuations in foreign exchange rates, changes in

global economic and geopolitical conditions and customer demand and

spending (including the impact of recessionary fears), inflation,

interest rates, regional labor market constraints, world events,

the rate of growth of the internet, online commerce, cloud

services, and new and emerging technologies, and the various

factors detailed below.

First Quarter 2025 Guidance

- Net sales are expected to be between $151.0 billion and $155.5

billion, or to grow between 5% and 9% compared with first quarter

2024. This guidance anticipates an unusually large, unfavorable

impact of approximately $2.1 billion, or 150 basis points, from

foreign exchange rates. Also, as a reminder, in first quarter 2024

the impact from Leap Year added approximately $1.5 billion in net

sales.

- Operating income is expected to be between $14.0 billion and

$18.0 billion, compared with $15.3 billion in first quarter

2024.

- This guidance assumes, among other things, that no additional

business acquisitions, restructurings, or legal settlements are

concluded.

Conference Call Information A conference call will be

webcast live today at 2:00 p.m. PT/5:00 p.m. ET, and will be

available for at least three months at amazon.com/ir. This call

will contain forward-looking statements and other material

information regarding the Company’s financial and operating

results.

Forward-Looking Statements These forward-looking

statements are inherently difficult to predict. Actual results and

outcomes could differ materially for a variety of reasons,

including, in addition to the factors discussed above, the amount

that Amazon.com invests in new business opportunities and the

timing of those investments, the mix of products and services sold

to customers, the mix of net sales derived from products as

compared with services, the extent to which we owe income or other

taxes, competition, management of growth, potential fluctuations in

operating results, international growth and expansion, the outcomes

of claims, litigation, government investigations, and other

proceedings, fulfillment, sortation, delivery, and data center

optimization, risks of inventory management, variability in demand,

the degree to which the Company enters into, maintains, and

develops commercial agreements, proposed and completed acquisitions

and strategic transactions, payments risks, and risks of

fulfillment throughput and productivity. Other risks and

uncertainties include, among others, risks related to new products,

services, and technologies, security incidents, system

interruptions, government regulation and taxation, and fraud. In

addition, global economic and geopolitical conditions and

additional or unforeseen circumstances, developments, or events may

give rise to or amplify many of these risks. More information about

factors that potentially could affect Amazon.com’s financial

results is included in Amazon.com’s filings with the Securities and

Exchange Commission (“SEC”), including its most recent Annual

Report on Form 10-K and subsequent filings.

Additional Information Our investor relations website is

amazon.com/ir and we encourage investors to use it as a way of

easily finding information about us. We promptly make available on

this website, free of charge, the reports that we file or furnish

with the SEC, corporate governance information (including our Code

of Business Conduct and Ethics), and select press releases, which

may contain material information about us, and you may subscribe to

be notified of new information posted to this site.

About Amazon Amazon is guided by four principles:

customer obsession rather than competitor focus, passion for

invention, commitment to operational excellence, and long-term

thinking. Amazon strives to be Earth’s Most Customer-Centric

Company, Earth’s Best Employer, and Earth’s Safest Place to Work.

Customer reviews, 1-Click shopping, personalized recommendations,

Prime, Fulfillment by Amazon, AWS, Kindle Direct Publishing,

Kindle, Career Choice, Fire tablets, Fire TV, Amazon Echo, Alexa,

Just Walk Out technology, Amazon Studios, and The Climate Pledge

are some of the things pioneered by Amazon. For more information,

visit amazon.com/about and follow @AmazonNews.

AMAZON.COM, INC.

Consolidated Statements of

Cash Flows

(in millions)

(unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2024

2023

2024

CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH, BEGINNING OF PERIOD

$

50,081

$

78,677

$

54,253

$

73,890

OPERATING ACTIVITIES:

Net income

10,624

20,004

30,425

59,248

Adjustments to reconcile net income to net

cash from operating activities:

Depreciation and amortization of property

and equipment and capitalized content costs, operating lease

assets, and other

13,820

15,631

48,663

52,795

Stock-based compensation

6,319

4,995

24,023

22,011

Non-operating expense (income), net

(339

)

(486

)

(748

)

2,012

Deferred income taxes

(1,464

)

(1,608

)

(5,876

)

(4,648

)

Changes in operating assets and

liabilities:

Inventories

2,643

934

1,449

(1,884

)

Accounts receivable, net and other

(7,447

)

(4,023

)

(8,348

)

(3,249

)

Other assets

(2,802

)

(4,190

)

(12,265

)

(14,483

)

Accounts payable

10,888

8,726

5,473

2,972

Accrued expenses and other

6,594

4,042

(2,428

)

(2,904

)

Unearned revenue

3,629

1,611

4,578

4,007

Net cash provided by (used in) operating

activities

42,465

45,636

84,946

115,877

INVESTING ACTIVITIES:

Purchases of property and equipment

(14,588

)

(27,834

)

(52,729

)

(82,999

)

Proceeds from property and equipment sales

and incentives

1,235

1,782

4,596

5,341

Acquisitions, net of cash acquired,

non-marketable investments, and other

(381

)

(2,535

)

(5,839

)

(7,082

)

Sales and maturities of marketable

securities

1,568

3,677

5,627

16,403

Purchases of marketable securities

(435

)

(12,533

)

(1,488

)

(26,005

)

Net cash provided by (used in) investing

activities

(12,601

)

(37,443

)

(49,833

)

(94,342

)

FINANCING ACTIVITIES:

Proceeds from short-term debt, and

other

734

2,554

18,129

5,142

Repayments of short-term debt, and

other

(6,338

)

(2,607

)

(25,677

)

(5,060

)

Repayments of long-term debt

(290

)

(2,500

)

(3,676

)

(9,182

)

Principal repayments of finance leases

(779

)

(333

)

(4,384

)

(2,043

)

Principal repayments of financing

obligations

(73

)

(422

)

(271

)

(669

)

Net cash provided by (used in) financing

activities

(6,746

)

(3,308

)

(15,879

)

(11,812

)

Foreign currency effect on cash, cash

equivalents, and restricted cash

691

(1,250

)

403

(1,301

)

Net increase (decrease) in cash, cash

equivalents, and restricted cash

23,809

3,635

19,637

8,422

CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH, END OF PERIOD

$

73,890

$

82,312

$

73,890

$

82,312

SUPPLEMENTAL CASH FLOW INFORMATION:

Cash paid for interest on debt, net of

capitalized interest

$

787

$

643

$

2,608

$

1,858

Cash paid for operating leases

2,766

3,225

10,453

12,341

Cash paid for interest on finance

leases

74

70

308

287

Cash paid for interest on financing

obligations

46

58

196

219

Cash paid for income taxes, net of

refunds

4,197

4,146

11,179

12,308

Assets acquired under operating leases

2,977

4,189

14,052

15,424

Property and equipment acquired under

finance leases, net of remeasurements and modifications

211

445

642

854

Property and equipment recognized during

the construction period of build-to-suit lease arrangements

49

8

357

97

Property and equipment derecognized after

the construction period of build-to-suit lease arrangements, with

the associated leases recognized as operating

162

—

1,374

—

AMAZON.COM, INC.

Consolidated Statements of

Operations

(in millions, except per share

data)

(unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2024

2023

2024

Net product sales

$

76,703

$

82,226

$

255,887

$

272,311

Net service sales

93,258

105,566

318,898

365,648

Total net sales

169,961

187,792

574,785

637,959

Operating expenses:

Cost of sales

92,553

98,893

304,739

326,288

Fulfillment

26,095

27,962

90,619

98,505

Technology and infrastructure

22,038

23,571

85,622

88,544

Sales and marketing

12,902

13,124

44,370

43,907

General and administrative

3,010

2,863

11,816

11,359

Other operating expense (income), net

154

176

767

763

Total operating expenses

156,752

166,589

537,933

569,366

Operating income

13,209

21,203

36,852

68,593

Interest income

901

1,248

2,949

4,677

Interest expense

(713

)

(570

)

(3,182

)

(2,406

)

Other income (expense), net

289

468

938

(2,250

)

Total non-operating income

477

1,146

705

21

Income before income taxes

13,686

22,349

37,557

68,614

Provision for income taxes

(3,062

)

(2,325

)

(7,120

)

(9,265

)

Equity-method investment activity, net of

tax

—

(20

)

(12

)

(101

)

Net income

$

10,624

$

20,004

$

30,425

$

59,248

Basic earnings per share

$

1.03

$

1.90

$

2.95

$

5.66

Diluted earnings per share

$

1.00

$

1.86

$

2.90

$

5.53

Weighted-average shares used in

computation of earnings per share:

Basic

10,356

10,552

10,304

10,473

Diluted

10,610

10,771

10,492

10,721

AMAZON.COM, INC.

Consolidated Statements of

Comprehensive Income

(in millions)

(unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2024

2023

2024

Net income

$

10,624

$

20,004

$

30,425

$

59,248

Other comprehensive income (loss):

Foreign currency translation adjustments,

net of tax of $(59), $183, $(55), and $226

1,765

(3,511

)

1,027

(3,333

)

Available-for-sale debt securities:

Change in net unrealized gains (losses),

net of tax of $(58), $(1,804), $(110), and $(2,086)

192

5,395

366

6,339

Less: reclassification adjustment for

losses (gains) included in “Other income (expense), net,” net of

tax of $0, $(1), $(15), and $(2)

2

1

50

5

Net change

194

5,396

416

6,344

Other, net of tax of $(1), $0, $(1), and

$1

4

(1

)

4

(5

)

Total other comprehensive income

(loss)

1,963

1,884

1,447

3,006

Comprehensive income

$

12,587

$

21,888

$

31,872

$

62,254

AMAZON.COM, INC.

Segment Information

(in millions)

(unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2023

2024

2023

2024

North America

Net sales

$

105,514

$

115,586

$

352,828

$

387,497

Operating expenses

99,053

106,330

337,951

362,530

Operating income

$

6,461

$

9,256

$

14,877

$

24,967

International

Net sales

$

40,243

$

43,420

$

131,200

$

142,906

Operating expenses

40,662

42,105

133,856

139,114

Operating income (loss)

$

(419

)

$

1,315

$

(2,656

)

$

3,792

AWS

Net sales

$

24,204

$

28,786

$

90,757

$

107,556

Operating expenses

17,037

18,154

66,126

67,722

Operating income

$

7,167

$

10,632

$

24,631

$

39,834

Consolidated

Net sales

$

169,961

$

187,792

$

574,785

$

637,959

Operating expenses

156,752

166,589

537,933

569,366

Operating income

13,209

21,203

36,852

68,593

Total non-operating income

477

1,146

705

21

Provision for income taxes

(3,062

)

(2,325

)

(7,120

)

(9,265

)

Equity-method investment activity, net of

tax

—

(20

)

(12

)

(101

)

Net income

$

10,624

$

20,004

$

30,425

$

59,248

Segment Highlights:

Y/Y net sales growth:

North America

13

%

10

%

12

%

10

%

International

17

8

11

9

AWS

13

19

13

19

Consolidated

14

10

12

11

Net sales mix:

North America

62

%

62

%

61

%

61

%

International

24

23

23

22

AWS

14

15

16

17

Consolidated

100

%

100

%

100

%

100

%

AMAZON.COM, INC.

Consolidated Balance

Sheets

(in millions, except per share

data)

(unaudited)

December 31, 2023

December 31, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

73,387

$

78,779

Marketable securities

13,393

22,423

Inventories

33,318

34,214

Accounts receivable, net and other

52,253

55,451

Total current assets

172,351

190,867

Property and equipment, net

204,177

252,665

Operating leases

72,513

76,141

Goodwill

22,789

23,074

Other assets

56,024

82,147

Total assets

$

527,854

$

624,894

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable

$

84,981

$

94,363

Accrued expenses and other

64,709

66,965

Unearned revenue

15,227

18,103

Total current liabilities

164,917

179,431

Long-term lease liabilities

77,297

78,277

Long-term debt

58,314

52,623

Other long-term liabilities

25,451

28,593

Commitments and contingencies

Stockholders’ equity:

Preferred stock ($0.01 par value; 500

shares authorized; no shares issued or outstanding)

—

—

Common stock ($0.01 par value; 100,000

shares authorized; 10,898 and 11,108 shares issued; 10,383 and

10,593 shares outstanding)

109

111

Treasury stock, at cost

(7,837

)

(7,837

)

Additional paid-in capital

99,025

120,864

Accumulated other comprehensive income

(loss)

(3,040

)

(34

)

Retained earnings

113,618

172,866

Total stockholders’ equity

201,875

285,970

Total liabilities and stockholders’

equity

$

527,854

$

624,894

AMAZON.COM, INC.

Supplemental Financial

Information and Business Metrics

(in millions, except per share

data)

(unaudited)

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Q4 2024

Y/Y %

Change

Cash Flows and Shares

Operating cash flow -- trailing twelve

months (TTM)

$

71,654

$

84,946

$

99,147

$

107,952

$

112,706

$

115,877

36

%

Operating cash flow -- TTM Y/Y growth

81

%

82

%

82

%

75

%

57

%

36

%

N/A

Purchases of property and equipment, net

of proceeds from sales and incentives -- TTM

$

50,220

$

48,133

$

48,998

$

54,979

$

64,959

$

77,658

61

%

Principal repayments of finance leases --

TTM

$

5,245

$

4,384

$

3,774

$

3,092

$

2,489

$

2,043

(53

)%

Principal repayments of financing

obligations -- TTM

$

260

$

271

$

304

$

306

$

320

$

669

147

%

Equipment acquired under finance leases --

TTM (1)

$

239

$

310

$

306

$

425

$

492

$

572

84

%

Principal repayments of all other finance

leases -- TTM (2)

$

694

$

683

$

761

$

794

$

785

$

767

12

%

Free cash flow -- TTM (3)

$

21,434

$

36,813

$

50,149

$

52,973

$

47,747

$

38,219

4

%

Free cash flow less principal repayments

of finance leases and financing obligations -- TTM (4)

$

15,929

$

32,158

$

46,071

$

49,575

$

44,938

$

35,507

10

%

Free cash flow less equipment finance

leases and principal repayments of all other finance leases and

financing obligations -- TTM (5)

$

20,241

$

35,549

$

48,778

$

51,448

$

46,150

$

36,211

2

%

Common shares and stock-based awards

outstanding

10,792

10,788

10,788

10,871

10,872

10,876

1

%

Common shares outstanding

10,330

10,383

10,403

10,490

10,511

10,593

2

%

Stock-based awards outstanding

462

406

385

381

361

283

(30

)%

Stock-based awards outstanding -- % of

common shares outstanding

4.5

%

3.9

%

3.7

%

3.6

%

3.4

%

2.7

%

N/A

Results of Operations

Worldwide (WW) net sales

$

143,083

$

169,961

$

143,313

$

147,977

$

158,877

$

187,792

10

%

WW net sales -- Y/Y growth, excluding

F/X

11

%

13

%

13

%

11

%

11

%

11

%

N/A

WW net sales -- TTM

$

554,028

$

574,785

$

590,740

$

604,334

$

620,128

$

637,959

11

%

WW net sales -- TTM Y/Y growth, excluding

F/X

12

%

12

%

12

%

12

%

12

%

11

%

N/A

Operating income

$

11,188

$

13,209

$

15,307

$

14,672

$

17,411

$

21,203

61

%

F/X impact -- favorable

$

132

$

85

$

72

$

29

$

16

$

14

N/A

Operating income -- Y/Y growth, excluding

F/X

338

%

379

%

219

%

91

%

55

%

60

%

N/A

Operating margin -- % of WW net sales

7.8

%

7.8

%

10.7

%

9.9

%

11.0

%

11.3

%

N/A

Operating income -- TTM

$

26,380

$

36,852

$

47,385

$

54,376

$

60,599

$

68,593

86

%

Operating income -- TTM Y/Y growth,

excluding F/X

99

%

197

%

252

%

205

%

129

%

86

%

N/A

Operating margin -- TTM % of WW net

sales

4.8

%

6.4

%

8.0

%

9.0

%

9.8

%

10.8

%

N/A

Net income

$

9,879

$

10,624

$

10,431

$

13,485

$

15,328

$

20,004

88

%

Net income per diluted share

$

0.94

$

1.00

$

0.98

$

1.26

$

1.43

$

1.86

85

%

Net income -- TTM

$

20,079

$

30,425

$

37,684

$

44,419

$

49,868

$

59,248

95

%

Net income per diluted share -- TTM

$

1.93

$

2.90

$

3.56

$

4.18

$

4.67

$

5.53

91

%

(1)

For the twelve months ended December 31,

2023 and 2024, this amount relates to equipment included in

“Property and equipment acquired under finance leases, net of

remeasurements and modifications” of $642 million and $854

million.

(2)

For the twelve months ended December 31,

2023 and 2024, this amount relates to property included in

“Principal repayments of finance leases” of $4,384 million and

$2,043 million.

(3)

Free cash flow is cash flow from

operations reduced by “Purchases of property and equipment, net of

proceeds from sales and incentives.”

(4)

Free cash flow less principal repayments

of finance leases and financing obligations is free cash flow

reduced by “Principal repayments of finance leases” and “Principal

repayments of financing obligations.”

(5)

Free cash flow less equipment finance

leases and principal repayments of all other finance leases and

financing obligations is free cash flow reduced by equipment

acquired under finance leases, which is included in “Property and

equipment acquired under finance leases, net of remeasurements and

modifications,” principal repayments of all other finance lease

liabilities, which is included in “Principal repayments of finance

leases,” and “Principal repayments of financing obligations.”

AMAZON.COM, INC.

Supplemental Financial

Information and Business Metrics

(in millions)

(unaudited)

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Q4 2024

Y/Y %

Change

Segments

North America Segment:

Net sales

$

87,887

$

105,514

$

86,341

$

90,033

$

95,537

$

115,586

10

%

Net sales -- Y/Y growth, excluding F/X

11

%

13

%

12

%

9

%

9

%

10

%

N/A

Net sales -- TTM

$

340,677

$

352,828

$

362,288

$

369,775

$

377,425

$

387,497

10

%

Operating income

$

4,307

$

6,461

$

4,983

$

5,065

$

5,663

$

9,256

43

%

F/X impact -- favorable (unfavorable)

$

(27

)

$

(13

)

$

8

$

8

$

(28

)

$

(49

)

N/A

Operating income -- Y/Y growth, excluding

F/X

N/A

N/A

454

%

58

%

32

%

44

%

N/A

Operating margin -- % of North America net

sales

4.9

%

6.1

%

5.8

%

5.6

%

5.9

%

8.0

%

N/A

Operating income -- TTM

$

8,176

$

14,877

$

18,962

$

20,816

$

22,172

$

24,967

68

%

Operating margin -- TTM % of North America

net sales

2.4

%

4.2

%

5.2

%

5.6

%

5.9

%

6.4

%

N/A

International Segment:

Net sales

$

32,137

$

40,243

$

31,935

$

31,663

$

35,888

$

43,420

8

%

Net sales -- Y/Y growth, excluding F/X

11

%

13

%

11

%

10

%

12

%

9

%

N/A

Net sales -- TTM

$

125,420

$

131,200

$

134,012

$

135,978

$

139,729

$

142,906

9

%

Operating income (loss)

$

(95

)

$

(419

)

$

903

$

273

$

1,301

$

1,315

N/A

F/X impact -- favorable (unfavorable)

$

228

$

160

$

(3

)

$

(94

)

$

43

$

6

N/A

Operating income (loss) -- Y/Y growth

(decline), excluding F/X

(87

)%

(74

)%

N/A

N/A

N/A

N/A

N/A

Operating margin -- % of International net

sales

(0.3

)%

(1.0

)%

2.8

%

0.9

%

3.6

%

3.0

%

N/A

Operating income (loss) -- TTM

$

(4,465

)

$

(2,656

)

$

(506

)

$

662

$

2,058

$

3,792

N/A

Operating margin -- TTM % of International

net sales

(3.6

)%

(2.0

)%

(0.4

)%

0.5

%

1.5

%

2.7

%

N/A

AWS Segment:

Net sales

$

23,059

$

24,204

$

25,037

$

26,281

$

27,452

$

28,786

19

%

Net sales -- Y/Y growth, excluding F/X

12

%

13

%

17

%

19

%

19

%

19

%

N/A

Net sales -- TTM

$

87,931

$

90,757

$

94,440

$

98,581

$

102,974

$

107,556

19

%

Operating income

$

6,976

$

7,167

$

9,421

$

9,334

$

10,447

$

10,632

48

%

F/X impact -- favorable (unfavorable)

$

(69

)

$

(62

)

$

67

$

115

$

1

$

57

N/A

Operating income -- Y/Y growth, excluding

F/X

30

%

39

%

83

%

72

%

50

%

48

%

N/A

Operating margin -- % of AWS net sales

30.3

%

29.6

%

37.6

%

35.5

%

38.1

%

36.9

%

N/A

Operating income -- TTM

$

22,669

$

24,631

$

28,929

$

32,898

$

36,369

$

39,834

62

%

Operating margin -- TTM % of AWS net

sales

25.8

%

27.1

%

30.6

%

33.4

%

35.3

%

37.0

%

N/A

AMAZON.COM, INC.

Supplemental Financial

Information and Business Metrics

(in millions, except employee

data)

(unaudited)

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Q4 2024

Y/Y %

Change

Net Sales

Online stores (1)

$

57,267

$

70,543

$

54,670

$

55,392

$

61,411

$

75,556

7

%

Online stores -- Y/Y growth, excluding

F/X

6

%

8

%

7

%

6

%

8

%

8

%

N/A

Physical stores (2)

$

4,959

$

5,152

$

5,202

$

5,206

$

5,228

$

5,579

8

%

Physical stores -- Y/Y growth, excluding

F/X

6

%

4

%

6

%

4

%

5

%

8

%

N/A

Third-party seller services (3)

$

34,342

$

43,559

$

34,596

$

36,201

$

37,864

$

47,485

9

%

Third-party seller services -- Y/Y growth,

excluding F/X

18

%

19

%

16

%

13

%

10

%

9

%

N/A

Advertising services (4)

$

12,060

$

14,654

$

11,824

$

12,771

$

14,331

$

17,288

18

%

Advertising services -- Y/Y growth,

excluding F/X

25

%

26

%

24

%

20

%

19

%

18

%

N/A

Subscription services (5)

$

10,170

$

10,488

$

10,722

$

10,866

$

11,278

$

11,508

10

%

Subscription services -- Y/Y growth,

excluding F/X

13

%

13

%

11

%

11

%

11

%

10

%

N/A

AWS

$

23,059

$

24,204

$

25,037

$

26,281

$

27,452

$

28,786

19

%

AWS -- Y/Y growth, excluding F/X

12

%

13

%

17

%

19

%

19

%

19

%

N/A

Other (6)

$

1,226

$

1,361

$

1,262

$

1,260

$

1,313

$

1,590

17

%

Other -- Y/Y growth (decline), excluding

F/X

(3

)%

8

%

23

%

(6

)%

5

%

17

%

N/A

Stock-based Compensation

Expense

Cost of sales

$

193

$

227

$

174

$

266

$

193

$

205

(10

)%

Fulfillment

$

732

$

823

$

636

$

944

$

696

$

697

(15

)%

Technology and infrastructure

$

3,284

$

3,533

$

2,772

$

3,670

$

2,961

$

2,747

(22

)%

Sales and marketing

$

1,111

$

1,216

$

932

$

1,224

$

1,012

$

916

(25

)%

General and administrative

$

509

$

520

$

447

$

618

$

471

$

430

(17

)%

Total stock-based compensation expense

$

5,829

$

6,319

$

4,961

$

6,722

$

5,333

$

4,995

(21

)%

Other

WW shipping costs

$

21,799

$

27,326

$

21,834

$

21,965

$

23,501

$

28,549

4

%

WW shipping costs -- Y/Y growth

9

%

11

%

10

%

8

%

8

%

4

%

N/A

WW paid units -- Y/Y growth (7)

9

%

12

%

12

%

11

%

12

%

11

%

N/A

WW seller unit mix -- % of WW paid units

(7)

60

%

61

%

61

%

61

%

60

%

62

%

N/A

Employees (full-time and part-time;

excludes contractors & temporary personnel)

1,500,000

1,525,000

1,521,000

1,532,000

1,551,000

1,556,000

2

%

Employees (full-time and part-time;

excludes contractors & temporary personnel) -- Y/Y growth

(decline)

(3

)%

(1

)%

4

%

5

%

3

%

2

%

N/A

(1)

Includes product sales and digital media

content where we record revenue gross. We leverage our retail

infrastructure to offer a wide selection of consumable and durable

goods that includes media products available in both a physical and

digital format, such as books, videos, games, music, and software.

These product sales include digital products sold on a

transactional basis. Digital media content subscriptions that

provide unlimited viewing or usage rights are included in

“Subscription services.”

(2)

Includes product sales where our customers

physically select items in a store. Sales to customers who order

goods online for delivery or pickup at our physical stores are

included in “Online stores.”

(3)

Includes commissions and any related

fulfillment and shipping fees, and other third-party seller

services.

(4)

Includes sales of advertising services to

sellers, vendors, publishers, authors, and others, through programs

such as sponsored ads, display, and video advertising.

(5)

Includes annual and monthly fees

associated with Amazon Prime memberships, as well as digital video,

audiobook, digital music, e-book, and other non-AWS subscription

services.

(6)

Includes sales related to various other

offerings, such as healthcare services, certain licensing and

distribution of video content, and shipping services, and our

co-branded credit card agreements.

(7)

Excludes the impact of Whole Foods

Market.

Amazon.com, Inc. Certain

Definitions

Customer Accounts

- References to customers mean customer accounts established when

a customer places an order through one of our stores. Customer

accounts exclude certain customers, including customers associated

with certain of our acquisitions, Amazon Payments customers, AWS

customers, and the customers of select companies with whom we have

a technology alliance or marketing and promotional relationship.

Customers are considered active when they have placed an order

during the preceding twelve-month period.

Seller Accounts

- References to sellers means seller accounts, which are

established when a seller receives an order from a customer

account. Sellers are considered active when they have received an

order from a customer during the preceding twelve-month

period.

AWS Customers

- References to AWS customers mean unique AWS customer accounts,

which are unique customer account IDs that are eligible to use AWS

services. This includes AWS accounts in the AWS free tier. Multiple

users accessing AWS services via one account ID are counted as a

single account. Customers are considered active when they have had

AWS usage activity during the preceding one-month period.

Units

- References to units mean physical and digital units sold (net

of returns and cancellations) by us and sellers in our stores as

well as Amazon-owned items sold in other stores. Units sold are

paid units and do not include units associated with AWS, certain

acquisitions, certain subscriptions, rental businesses, or

advertising businesses, or Amazon gift cards.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205727633/en/

Amazon Investor Relations amazon-ir@amazon.com amazon.com/ir

Amazon Public Relations amazon-pr@amazon.com amazon.com/pr

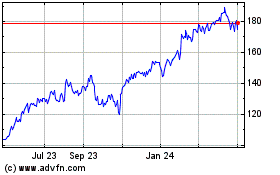

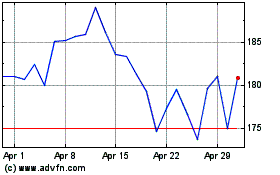

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Feb 2024 to Feb 2025