0001655759FALSE00016557592024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

FORM 8-K

__________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

__________________

Arvinas, Inc.

(Exact name of registrant as specified in its charter)

__________________

| | | | | | | | |

| Delaware | 001-38672 | 47-2566120 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

5 Science Park 395 Winchester Ave. New Haven, Connecticut | 06511 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (203) 535-1456

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

__________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | | ARVN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On October 30, 2024, Arvinas, Inc. announced its financial results for the quarter ended September 30, 2024 and provided a corporate update. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ARVINAS, INC. |

| | |

Date: October 30, 2024 | By: | /s/ Andrew Saik |

| | Andrew Saik Chief Financial Officer |

Arvinas Reports Third Quarter 2024 Financial Results and Provides Corporate Update

– On track to report topline data from Phase 3 VERITAC-2 trial in 4Q24 or 1Q25 –

– Initial clinical data from Phase 1/2 TACTIVE-U sub-study of abemaciclib in combination with vepdegestrant to be presented at San Antonio Breast Cancer Symposium in December 2024 –

– Recently presented new preclinical data for the PROTAC LRRK2 degrader ARV-102 demonstrating that LRRK2 degradation affects biomarkers in the CSF –

- $1.1 billion in cash, cash equivalents and marketable securities as of Sept. 30, 2024 -

– Company to host conference call today at 8:00 a.m. ET –

NEW HAVEN, Conn., October 30, 2024 -- Arvinas, Inc. (Nasdaq: ARVN), a clinical-stage biotechnology company creating a new class of drugs based on targeted protein degradation, today reported financial results for the third quarter ended September 30, 2024, and provided a corporate update.

“We maintained strong momentum across our portfolio in the third quarter and remain on track to report topline data from VERITAC-2, our Phase 3 clinical trial in metastatic breast cancer, in the fourth quarter of 2024 or the first quarter of 2025,” said John Houston, Ph.D., Chairperson, Chief Executive Officer and President at Arvinas. “In partnership with our colleagues at Pfizer, we are excited by the possibility of changing the treatment paradigm for ER+/HER2- breast cancer and look forward to sharing results from VERITAC-2 in the coming months.”

“Our path to reaching our goal of becoming a multi-product, commercial-stage organization with a robust pipeline across several indications is clearly defined, and our novel PROTAC platform technology has the potential to enable opportunities across multiple therapeutic areas,” continued Dr. Houston. “We look forward to completing the multiple ascending dose portion of our Phase 1 clinical trial with ARV-102, our first PROTAC degrader with the potential to treat neurodegenerative diseases, and sharing data in 2025. We are also encouraged by the preclinical profile of ARV-393, our BCL6 PROTAC degrader currently being evaluated in a first-in-human Phase 1 clinical trial in patients with B-cell lymphomas. We look forward to sharing more about these programs in the coming months.”

3Q 2024 Business Highlights and Recent Developments

Vepdegestrant

•Continued enrollment globally in multiple clinical studies of vepdegestrant in ER+/HER2- metastatic breast cancer.

◦VERITAC-2: Phase 3 monotherapy clinical trial in patients with metastatic breast cancer (ClinicalTrials.gov Identifier: NCT05654623)

◦TACTIVE-U: Phase 1b/2 combination umbrella trial evaluating combinations of vepdegestrant with abemaciclib, ribociclib, or samuraciclib (ClinicalTrials.gov Identifiers: NCT05548127, NCT05573555, and NCT06125522).

◦TACTIVE-K: Phase 1/2 clinical trial with vepdegestrant plus Pfizer’s novel CDK4 inhibitor atirmociclib (ClinicalTrials.gov Identifier: NCT06206837)

ARV-102: Oral PROTAC LRRK2 degrader

•In October, presented preclinical data at the 2024 Michael J. Fox Foundation Parkinson’s Disease Conference further supporting the potential of PROTAC-induced leucine-rich repeat kinase 2 (LRRK2)

degradation as a potential treatment for patients with neurodegenerative diseases. New findings presented included data demonstrating:

◦Orally delivered ARV-102 crosses the blood-brain barriers and degrades LRRK2 in the cerebrospinal fluid (CSF) of non-human primates (NHPs).

◦Degradation of LRRK2 by ARV-102 induces changes in pathway (lysosomal and inflammation) biomarkers in the CSF of NHPs, which has not previously been demonstrated by kinase inhibitors of LRRK2.

◦In murine tauopathy models, oral PROTAC LRRK2 degrader treatment led to ~50% pathologic tau reduction.

•Initiated the multiple ascending dose portion of the ongoing Phase 1 clinical trial in healthy volunteers.

ARV-393: Oral PROTAC BCL6 degrader

•Continued recruiting patients in the first-in-human Phase 1 clinical trial in patients with B-cell lymphomas.

Anticipated Upcoming Milestones and Expectations

Vepdegestrant

As part of Arvinas global collaboration with Pfizer, the companies plan to:

•Complete enrollment (4Q24) and announce topline data (4Q24/1Q25) for the VERITAC-2 Phase 3 monotherapy clinical trial in patients with metastatic breast cancer.

•Present initial safety and pharmacokinetic data from the TACTIVE-U sub-study (NCT05548127) of abemaciclib in combination with vepdegestrant at the San Antonio Breast Cancer Symposium (SABCS) in December 2024.

•Present data from the Phase 1 healthy volunteer pharmacokinetic trial of vepdegestrant in combination with midazolam to assess potential for drug-drug interaction at SABCS in December 2024 (NCT06256510).

•Continue enrollment of the ongoing Phase 1b/2 combination umbrella trial evaluating combinations of vepdegestrant with abemaciclib, ribociclib, or samuraciclib (TACTIVE-U; ClinicalTrials.gov Identifiers: NCT05548127, NCT05573555, and NCT06125522).

•Evaluate data from the study lead-in of the VERITAC-3 Phase 3 trial (NCT05909397) in patients with ER+/HER2- locally advanced or metastatic breast cancer (2H24).

•Continue enrollment and evaluate preliminary data from the ongoing clinical trial with vepdegestrant plus Pfizer’s novel CDK4 inhibitor atirmociclib (TACTIVE-K).

•Start Phase 3 combination trials in the first- and second-line settings (anticipated in 2025; pending emerging data and regulatory feedback).

◦First-line setting with vepdegestrant plus atirmociclib or palbociclib.

◦Second-line setting with vepdegestrant plus palbociclib and/or another CDK4/6 inhibitor.

ARV-102: Oral PROTAC LRRK2 degrader

•Complete enrollment in the ongoing multiple ascending dose portion of a Phase 1 trial evaluating ARV-102 in healthy volunteers

•Present data from the Phase 1 trial in 2025.

ARV-393: Oral PROTAC BCL6 degrader

•Continue recruiting patients in the first-in-human Phase 1 clinical trial evaluating ARV-393 in patients with B-cell lymphomas.

Novel PROTAC KRAS G12D degrader

•File an Investigational New Drug (IND) application in 2025.

Financial Guidance

Based on its current operating plan, Arvinas believes its cash, cash equivalents, and marketable securities as of September 30, 2024, is sufficient to fund planned operating expenses and capital expenditure requirements into 2027.

Third Quarter Financial Results

Cash, Cash Equivalents, and Marketable Securities Position: As of September 30, 2024, cash, cash equivalents and marketable securities were $1,121.6 million as compared with cash, cash equivalents, restricted cash and marketable securities of $1,266.5 million as of December 31, 2023. The decrease in cash, cash equivalents and marketable securities of $144.9 million for the nine months ended September 30, 2024 was primarily related to cash used in operations of $158.1 million (net of $150.0 million received from the Novartis agreements), inclusive of a one-time cash termination fee in the amount of $41.5 million related to the termination of our laboratory and office space lease with 101 College Street LLC in August 2024 and the purchase of lab equipment and leasehold improvements of $1.5 million, partially offset by proceeds from the exercise of stock options of $7.7 million and unrealized gains on marketable securities of $7.2 million.

Research and Development Expenses: Research and development expenses were $86.9 million for the quarter ended September 30, 2024, as compared with $85.9 million for the quarter ended September 30, 2023. The increase in research and development expenses of $1.0 million for the quarter was primarily due to an increase in compensation and related personnel expenses of $2.8 million, which are not allocated by program, partially offset by a decrease in external expenses of $2.2 million. External expenses include program-specific expenses, which decreased by $1.1 million, primarily driven by decreases in our ARV-766 and ARV-110 programs of $3.8 million and $1.6 million, respectively, partially offset by increases in our ARV-102 and ARV-393 programs of $2.5 million and $1.4 million, respectively, and our non-program specific expenses, which decreased by $1.1 million.

General and Administrative Expenses: General and administrative expenses were $75.8 million for the quarter ended September 30, 2024, as compared with $22.6 million for the quarter ended September 30, 2023. The increase in general and administrative expenses of $53.2 million for the quarter was primarily due to a loss on the termination of our laboratory and office space lease with 101 College Street LLC of $43.4 million as well as increases in personnel and infrastructure related costs of $5.0 million, professional fees of $3.4 million and in developing our commercial operations of $1.2 million.

Revenue: Revenue was $102.4 million for the quarter ended September 30, 2024 as compared with $34.6 million for the quarter ended September 30, 2023. Revenue for the quarter is related to the license agreement with Novartis, the Vepdegestrant (ARV-471) Collaboration Agreement with Pfizer, the collaboration and license agreement with Bayer and the collaboration and license agreement with Pfizer. The increase in revenue of $67.8 million was primarily due to revenue from the Novartis license agreement of $76.7 million, offset by a decrease in revenue from the Vepdegestrant (ARV-471) Collaboration Agreement with Pfizer of $7.6 million related to timing differences in clinical trials and program expenses and a decrease in revenue from Bayer of $1.1 million related to the termination of the Bayer Collaboration Agreement in August 2024.

Investor Call & Webcast Details

Arvinas will host a conference call and webcast today, October 30, 2024, at 8:00 a.m. ET to review its third quarter 2024 financial results and discuss recent corporate updates. Participants are invited to listen by going to the Events and Presentation section under the Investors page on the Arvinas website at www.arvinas.com. A replay of the webcast will be available on the Arvinas website following the completion of the event and will be archived for up to 30 days.

About Vepdegestrant

Vepdegestrant is an investigational, orally bioavailable PROTAC protein degrader designed to specifically target and degrade the estrogen receptor (ER) for the treatment of patients with ER positive (ER+)/human epidermal growth factor receptor 2 (HER2) negative (ER+/HER2-) breast cancer. Vepdegestrant is being developed as a potential monotherapy and as part of combination therapy across multiple treatment settings for ER+/HER2- metastatic breast cancer.

In July 2021, Arvinas announced a global collaboration with Pfizer for the co-development and co-commercialization of vepdegestrant; Arvinas and Pfizer will share worldwide development costs, commercialization expenses, and profits.

The U.S. Food and Drug Administration (FDA) has granted vepdegestrant Fast Track designation as a monotherapy in the treatment of adults with ER+/HER2- locally advanced or metastatic breast cancer previously treated with endocrine-based therapy.

About Arvinas

Arvinas (Nasdaq: ARVN) is a clinical-stage biotechnology company dedicated to improving the lives of patients suffering from debilitating and life-threatening diseases. Through its PROTAC® (PROteolysis Targeting Chimera) protein degrader platform, the Company is pioneering the development of protein degradation therapies designed to harness the body’s natural protein disposal system to selectively and efficiently degrade and remove disease-causing proteins. Arvinas is currently progressing multiple investigational drugs through clinical development programs, including vepdegestrant, targeting the estrogen receptor for patients with locally advanced or metastatic ER+/HER2- breast cancer; ARV-393, targeting BCL6 for relapsed/refractory non-Hodgkin Lymphoma; and ARV-102, targeting LRRK2 for neurodegenerative disorders. Arvinas is headquartered in New Haven, Connecticut. For more information about Arvinas, visit www.arvinas.com and connect on LinkedIn and X.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties, including statements regarding the expected timing in connection with the completion of enrollment and reporting of topline data from the VERITAC-2 clinical trial; the potential to change the treatment paradigm for ER+/HER2- breast cancer; the goal of becoming a multi-product, commercial-stage organization with a robust pipeline across several indications; novel PROTAC platform technology having the potential to enable opportunities across multiple therapeutic areas; plans to present initial safety and pharmacokinetic data from the TACTIVE-U sub-study of abemaciclib in combination with vepdegestrant at SABCS; plans to present data from the Phase 1 healthy volunteer pharmacokinetic trial of vepdegestrant in combination with midazolam at SABCS; plans to continue enrollment in the TACTIVE-U study and evaluate data from the study lead-in of the VERITAC-3 Phase 3 clinical trial; plans to continue enrollment and evaluate preliminary data from the TACTIVE-K clinical trial; the expected timing of initiation of Phase 3 vepdegestrant combination trials in the first- and second-line settings, pending emerging data and regulatory feedback; expected timing of filing an investigational new drug application for a KRAS

G12D degrader; plans to compete enrollment in the multiple ascending dose portion of the ARV-102 Phase 1 clinical trial, the timing of the presentation of data from such clinical trial, and the timing of sharing additional information about the program; plans to continue recruiting patients in the Phase 1 ARV-393 clinical trial and timing of sharing additional information about the program; and statements regarding Arvinas’ cash, cash equivalents and marketable securities. All statements, other than statements of historical fact, contained in this press release, including statements regarding Arvinas’ strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,” “project,” “target,” “goal,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

Arvinas may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance on such forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements Arvinas makes as a result of various risks and uncertainties, including but not limited to: Arvinas’ and Pfizer’s performance of the respective obligations with respect to Arvinas’ collaboration with Pfizer; whether Arvinas and Pfizer will be able to successfully conduct and complete clinical development for vepdegestrant; whether Arvinas will be able to successfully conduct and complete development for its other product candidates, including whether Arvinas initiates and completes clinical trials for its product candidates and receives results from its clinical trials and preclinical studies on its expected timelines or at all; whether Arvinas and Pfizer, as appropriate, will be able to obtain marketing approval for and commercialize vepdegestrant and other product candidates on current timelines or at all; Arvinas’ ability to protect its intellectual property portfolio; whether Arvinas’ cash and cash equivalent resources will be sufficient to fund its foreseeable and unforeseeable operating expenses and capital expenditure requirements, and other important factors discussed in the “Risk Factors” section of Arvinas’ Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent other reports on file with the U.S. Securities and Exchange Commission. The forward-looking statements contained in this press release reflect Arvinas’ current views with respect to future events, and Arvinas assumes no obligation to update any forward-looking statements, except as required by applicable law. These forward-looking statements should not be relied upon as representing Arvinas’ views as of any date subsequent to the date of this release.

Contacts

Investors:

Jeff Boyle

+1 (347) 247-5089

Jeff.Boyle@arvinas.com

Media:

Kathleen Murphy

+1 (203) 584-0307

Kathleen.Murphy@arvinas.com

Arvinas, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | |

| (dollars and shares in millions, except per share amounts) | September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 85.2 | | | $ | 311.7 | |

| Restricted cash | — | | | 5.5 | |

| Marketable securities | 1,036.4 | | | 949.3 | |

| Accounts receivable | 7.3 | | | — | |

| Other receivables | 7.5 | | | 7.2 | |

| Prepaid expenses and other current assets | 13.1 | | | 6.5 | |

| Total current assets | 1,149.5 | | | 1,280.2 | |

| Property, equipment and leasehold improvements, net | 6.8 | | | 11.5 | |

| Operating lease right of use assets | 1.0 | | | 2.5 | |

| Collaboration contract asset and other assets | 9.8 | | | 10.4 | |

| Total assets | $ | 1,167.1 | | | $ | 1,304.6 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 75.9 | | | $ | 92.2 | |

| Deferred revenue | 199.2 | | | 163.0 | |

| | | |

| Current portion of operating lease liabilities | 0.8 | | | 1.9 | |

| Total current liabilities | 275.9 | | | 257.1 | |

| Deferred revenue | 304.5 | | | 386.2 | |

| Long-term debt | 0.6 | | | 0.8 | |

| Operating lease liabilities | 0.1 | | | 0.5 | |

| Total liabilities | 581.1 | | | 644.6 | |

| | | |

| Stockholders’ equity: | | | |

Preferred stock, $0.001 par value, zero shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | — | | | — | |

Common stock, $0.001 par value; 68.7 and 68.0 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | 0.1 | | | 0.1 | |

| Accumulated deficit | (1,486.5) | | | (1,332.7) | |

| Additional paid-in capital | 2,068.3 | | | 1,995.7 | |

| Accumulated other comprehensive income (loss) | 4.1 | | | (3.1) | |

| Total stockholders’ equity | 586.0 | | | 660.0 | |

| Total liabilities and stockholders’ equity | $ | 1,167.1 | | | $ | 1,304.6 | |

Arvinas, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, |

| (dollars and shares in millions, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 102.4 | | | $ | 34.6 | | | $ | 204.2 | | | $ | 121.6 | |

| Operating expenses: | | | | | | | |

| Research and development | 86.9 | | | 85.9 | | | 264.9 | | | 284.5 | |

| General and administrative | 75.8 | | | 22.6 | | | 131.3 | | | 73.3 | |

| Total operating expenses | 162.7 | | | 108.5 | | | 396.2 | | | 357.8 | |

| Loss from operations | (60.3) | | | (73.9) | | | (192.0) | | | (236.2) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Interest and other income | 11.7 | | | 10.0 | | | 39.2 | | | 25.5 | |

| Net loss before income taxes and loss from equity method investment | (48.6) | | | (63.9) | | | (152.8) | | | (210.7) | |

| Income tax (expense) benefit | (0.6) | | | — | | | (1.0) | | | 0.7 | |

| Loss from equity method investment | — | | | (0.1) | | | — | | | (2.5) | |

| Net loss | $ | (49.2) | | | $ | (64.0) | | | $ | (153.8) | | | $ | (212.5) | |

| Net loss per common share, basic and diluted | $ | (0.68) | | | $ | (1.18) | | | $ | (2.14) | | | $ | (3.97) | |

Weighted average common shares outstanding, basic and diluted | 72.1 | | | 54.1 | | | 71.9 | | | 53.6 | |

Cover

|

Oct. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 30, 2024

|

| Entity Registrant Name |

Arvinas, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38672

|

| Entity Tax Identification Number |

47-2566120

|

| Entity Address, Address Line One |

5 Science Park

|

| Entity Address, Address Line Two |

395 Winchester Ave.

|

| Entity Address, City or Town |

New Haven

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06511

|

| City Area Code |

203

|

| Local Phone Number |

535-1456

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

ARVN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001655759

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

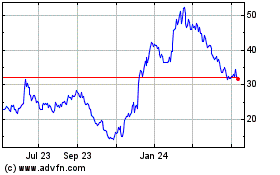

Arvinas (NASDAQ:ARVN)

Historical Stock Chart

From Nov 2024 to Dec 2024

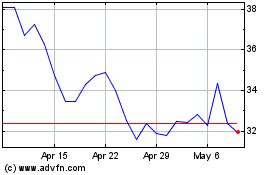

Arvinas (NASDAQ:ARVN)

Historical Stock Chart

From Dec 2023 to Dec 2024