Ascent Solar Technologies Announces Reverse Stock Split

14 August 2024 - 1:45AM

Ascent Solar Technologies, Inc. (“Ascent” or the “Company”)

(Nasdaq: ASTI), the leading U.S. innovator in the design and

manufacturing of featherweight, flexible thin-film photovoltaic

(PV) solutions, today announced that effective before market open

on August 15, 2024, it will complete a 1-for-100 reverse stock

split of its common stock.

At Ascent’s 2024 Annual Stockholders Meeting on August 7, 2024,

stockholders approved an amendment to the Company’s Amended and

Restated Certificate of Incorporation to affect a reverse stock

split with the exact ratio to be set by its Board of Directors. The

Board resolved to set the reverse stock split at the ratio of

1-for-100. Ascent filed an amendment to its Certificate of

Incorporation with the Secretary of State in Delaware effective

August 14, 2024, at 5:00 p.m. Eastern Time. As a result, every

hundred issued shares of common stock will automatically be

combined into one share of common stock.

As explained in Ascent’s Proxy Statement filed June 20, 2024,

the Company believes that affecting the reverse stock split will

assist in its efforts to meet the Nasdaq continued listing

standards and to continue to have its common stock remain listed

and traded on Nasdaq. In particular, Ascent expects the reverse

stock split to increase the per share price and bid price of its

common stock above the $1.00 required by Nasdaq’s Minimum Bid Price

Rule.

Shares of the Company’s common stock will be assigned a new

CUSIP number (043635804) and are expected to begin trading on a

split-adjusted basis on Thursday, August 15, 2024.

The reverse stock split will not change the authorized number of

shares of the Company’s common stock. No fractional shares will be

issued and any fractional shares resulting from the reverse stock

split will be rounded up to the nearest whole share. Therefore,

stockholders with less than 100 shares will receive one share of

stock.

The reverse stock split will also apply to Ascent’s common stock

issuable upon the exercise of its outstanding warrants, stock

options and restricted stock units, with proportionate adjustments

to be made to the exercise prices thereof and under the Company’s

equity incentive plans.

Once the reverse stock split becomes effective, stockholders

holding shares through a brokerage account will have their shares

automatically adjusted to reflect the 1-for-100 reverse stock

split. Existing stockholders holding common stock certificates will

receive a letter of transmittal from Ascent's transfer agent,

Computershare, with specific instructions regarding the exchange of

shares.

Ascent expects to have its issued and outstanding common shares

decrease from approximately 102 million pre-split shares to

approximately 1.02 million post-split shares outstanding as a

result of the reverse stock split.

About Ascent Solar Technologies, Inc.

Backed by 40 years of R&D, 15 years of manufacturing

experience, numerous awards, and a comprehensive IP and patent

portfolio, Ascent Solar Technologies, Inc. is a leading provider of

innovative, high-performance, flexible thin-film solar panels for

use in environments where mass, performance, reliability, and

resilience matter. Ascent’s photovoltaic (PV) modules have been

deployed on space missions, multiple airborne vehicles, agrivoltaic

installations, in industrial/commercial construction as well as an

extensive range of consumer goods, revolutionizing the use cases

and environments for solar power. Ascent Solar’s research and

development center and 5-MW nameplate production facility is in

Thornton, Colorado. To learn more, visit

https://www.ascentsolar.com

Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact constitute "forward-looking statements"

including statements about the financing transaction, our business

strategy, and the potential uses of the proceeds from the

transaction. Such forward-looking statements involve known and

unknown risks, uncertainties and other unknown factors that could

cause the company's actual operating results to be materially

different from any historical results or from any future results

expressed or implied by such forward-looking statements. We have

based these forward-looking statements on our current assumptions,

expectations, and projections about future events. In addition to

statements that explicitly describe these risks and uncertainties,

readers are urged to consider statements that contain terms such as

“will,” "believes," "belief," "expects," "expect," "intends,"

"intend," "anticipate," "anticipates," "plans," "plan," to be

uncertain and forward-looking. No information in this press release

should be construed as any indication whatsoever of our future

revenues, stock price, or results of operations. The

forward-looking statements contained herein are also subject

generally to other risks and uncertainties that are described from

time to time in the company's filings with the Securities and

Exchange Commission including those discussed under the heading

“Risk Factors” in our most recently filed reports on Forms 10-K and

10-Q.

Media Contact

Spencer HerrmannFischTank PRascent@fischtankpr.com

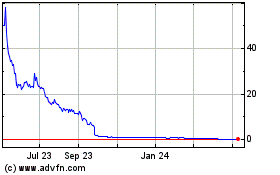

Ascent Solar Technologies (NASDAQ:ASTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

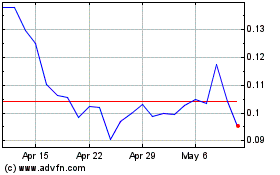

Ascent Solar Technologies (NASDAQ:ASTI)

Historical Stock Chart

From Dec 2023 to Dec 2024