Auddia Provides Corporate Update as it Executes Two Non-Binding LOI’s With Its Buyside M&A Strategy

21 June 2023 - 9:30PM

via NewMediaWire –

Auddia Inc. (NASDAQ:AUUD)

(NASDAQ:AUUDW) ("Auddia" or the "Company"), developer of a

proprietary AI platform for audio and innovative technologies for

podcasts that is reinventing how consumers engage with audio, today

provided an expanded corporate update following the execution of

two non-binding letters of intent as part of its buy-side M&A

strategy and recent closing on approximately $3.1 million in new

financing.

“Given current market conditions, we are very pleased to have

closed a financing at a premium according to the Nasdaq definition,

while protecting our cap table by not offering warrants of any

kind. The additional cash, along with the progress we have made on

the release of faidr 3.0 and our buyside M&A strategy,

positions us well to meet or exceed the user and revenue targets we

established for 2023,” said Jeff Thramann, Executive Chairman of

Auddia.

Earlier this week the Company announced completion of the faidr

3.0 upgrade on the iOS platform and projected the release of faidr

3.0 on the Android platform in early July. Completion of the faidr

3.0 product is a significant catalyst as it represents the key

milestone required to increase marketing spend in the second half

of the year to begin reporting key user metrics and revenue

growth.

The Company continues to make great progress with respect to its

previously announced buyside M&A strategy. The strategy is

focused on acquiring high margin AM/FM streaming aggregators that

deliver both cash flow to reduce burn and an installed user base of

retained AM/FM streaming listeners on a free tier that can be

offered the opportunity to purchase a subscription to the

commercial-free premium AM/FM listening experience that is the

hallmark of faidr.

Auddia CEO Michael Lawless added, “We have now entered into

non-binding LOIs with our first two acquisition partners and are

well into the due diligence phase. As previously announced, the

initial targets, if successfully closed, would significantly change

the trajectory of the Company going forward. Not only will the

anticipated $3M plus in cash flow from the initial acquisitions

reduce our current burn by over 60%, the acquired user base of

approximately 1 million monthly active users in the U.S. offers a

fertile base of retained AM/FM streaming listeners that can be

offered the faidr upgrade. Because of our uniquely high margins in

the audio streaming space, a conversion rate of 3% off the acquired

U.S. based listeners, if achieved, would eliminate the rest of our

current cash burn rate. For perspective, we announced early

subscription conversion rates on our faidr 2.0 product earlier this

year of 10%. It is important to note that we would reach this

position of sustainability just from (i) the acquired revenue and

cash flow and (ii) achieving a successful subsequent conversion of

the U.S. based acquired users. The high margin revenue generated

from our core strategy of putting marketing dollars behind faidr

3.0 is additive. You can see why we are so excited about the runway

provided by the current financing and the opportunities we are

creating for the second half of the

year.”

The Company will provide updates on the M&A strategy as

definitive purchase agreements are executed. The closing of any

proposed acquisitions will be contingent on securing additional

financing. The Company will also begin to release key user metrics

as well as de novo MAU growth data for both the free and

subscription tiers in Q3 of this year.

Visit faidr.com for more information.

About Auddia Inc.

Auddia, through its proprietary AI platforms for audio, is

reinventing how consumers engage with AM/FM radio, podcasts, music,

and other audio content. Auddia’s flagship audio superapp, called

faidr, brings three industry firsts to the audio-streaming

landscape: subscription-based, ad-free listening on any AM/FM radio

station; podcasts with interactive digital feeds that support

deeper stories and create new revenue streams for podcasters; and a

proprietary chat interface for music. faidr also delivers exclusive

content and playlists, and showcases exciting new artists,

hand-picked by curators and DJs. All differentiated offerings

address large and rapidly growing audiences.

For more information visit: www.auddia.com

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934 about the Company's current

expectations about future results, performance, prospects and

opportunities. Statements that are not historical facts, such as

"anticipates," "believes" and "expects" or similar expressions, are

forward-looking statements. These forward-looking statements are

based on the current plans and expectations of management and are

subject to a number of uncertainties and risks that could

significantly affect the Company's current plans and expectations,

as well as future results of operations and financial condition.

These and other risks and uncertainties are discussed more fully in

our filings with the Securities and Exchange Commission. Readers

are encouraged to review the section titled "Risk Factors" in the

Company's Annual Report on Form 10-K for the year ended December

31, 2022, as well as other disclosures contained in the Annual

Report and subsequent filings made with the Securities and Exchange

Commission. Forward-looking statements contained in this

announcement are made as of this date and the Company undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Investor Relations:Kirin Smith, PresidentPCG

Advisory, Inc.ksmith@pcgadvisory.comwww.pcgadvisory.com

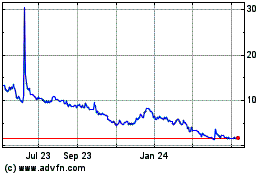

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Dec 2024 to Jan 2025

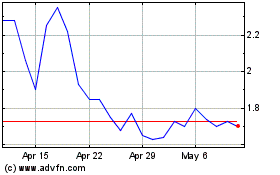

Auddia (NASDAQ:AUUD)

Historical Stock Chart

From Jan 2024 to Jan 2025