false

Q2

--12-31

0001086745

0001086745

2024-01-01

2024-06-30

0001086745

2024-08-13

0001086745

2024-06-30

0001086745

2023-12-31

0001086745

AYRO:ConvertiblePreferredStockSeriesHMember

2024-06-30

0001086745

AYRO:ConvertiblePreferredStockSeriesHMember

2023-12-31

0001086745

AYRO:ConvertiblePreferredStockSeriesHThreeMember

2024-06-30

0001086745

AYRO:ConvertiblePreferredStockSeriesHThreeMember

2023-12-31

0001086745

AYRO:ConvertiblePreferredStockSeriesHSixMember

2024-06-30

0001086745

AYRO:ConvertiblePreferredStockSeriesHSixMember

2023-12-31

0001086745

AYRO:SeriesHSevenConvertiblePreferredStockMember

2024-06-30

0001086745

AYRO:SeriesHSevenConvertiblePreferredStockMember

2023-12-31

0001086745

2024-04-01

2024-06-30

0001086745

2023-04-01

2023-06-30

0001086745

2023-01-01

2023-06-30

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001086745

us-gaap:CommonStockMember

2023-12-31

0001086745

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001086745

us-gaap:RetainedEarningsMember

2023-12-31

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2024-03-31

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2024-03-31

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2024-03-31

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2024-03-31

0001086745

us-gaap:CommonStockMember

2024-03-31

0001086745

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001086745

us-gaap:RetainedEarningsMember

2024-03-31

0001086745

2024-03-31

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001086745

us-gaap:CommonStockMember

2022-12-31

0001086745

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001086745

us-gaap:RetainedEarningsMember

2022-12-31

0001086745

2022-12-31

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2023-03-31

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2023-03-31

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2023-03-31

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2023-03-31

0001086745

us-gaap:CommonStockMember

2023-03-31

0001086745

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001086745

us-gaap:RetainedEarningsMember

2023-03-31

0001086745

2023-03-31

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001086745

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001086745

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001086745

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001086745

2024-01-01

2024-03-31

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2024-04-01

2024-06-30

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2024-04-01

2024-06-30

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2024-04-01

2024-06-30

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2024-04-01

2024-06-30

0001086745

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0001086745

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0001086745

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0001086745

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001086745

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001086745

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001086745

2023-01-01

2023-03-31

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001086745

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001086745

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001086745

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2024-06-30

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2024-06-30

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2024-06-30

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2024-06-30

0001086745

us-gaap:CommonStockMember

2024-06-30

0001086745

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001086745

us-gaap:RetainedEarningsMember

2024-06-30

0001086745

AYRO:SeriesHSevenPreferredStockMember

us-gaap:PreferredStockMember

2023-06-30

0001086745

us-gaap:SeriesHPreferredStockMember

us-gaap:PreferredStockMember

2023-06-30

0001086745

AYRO:SeriesHThreePreferredStockMember

us-gaap:PreferredStockMember

2023-06-30

0001086745

AYRO:SeriesHSixPreferredStockMember

us-gaap:PreferredStockMember

2023-06-30

0001086745

us-gaap:CommonStockMember

2023-06-30

0001086745

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001086745

us-gaap:RetainedEarningsMember

2023-06-30

0001086745

2023-06-30

0001086745

us-gaap:SubsequentEventMember

2024-07-18

0001086745

AYRO:SecuritiesPurchaseAgreementMember

AYRO:SeriesHSevenConvertiblePreferredStockMember

2023-08-07

0001086745

AYRO:SecuritiesPurchaseAgreementMember

AYRO:SeriesHSevenConvertiblePreferredStockMember

2023-08-10

2023-08-10

0001086745

AYRO:SecuritiesPurchaseAgreementMember

2023-08-10

2023-08-10

0001086745

us-gaap:ProductMember

2024-04-01

2024-06-30

0001086745

us-gaap:ProductMember

2023-04-01

2023-06-30

0001086745

us-gaap:ProductMember

2024-01-01

2024-06-30

0001086745

us-gaap:ProductMember

2023-01-01

2023-06-30

0001086745

us-gaap:ServiceMember

2024-04-01

2024-06-30

0001086745

us-gaap:ServiceMember

2023-04-01

2023-06-30

0001086745

us-gaap:ServiceMember

2024-01-01

2024-06-30

0001086745

us-gaap:ServiceMember

2023-01-01

2023-06-30

0001086745

AYRO:MiscellaneousIncomeMember

2024-04-01

2024-06-30

0001086745

AYRO:MiscellaneousIncomeMember

2023-04-01

2023-06-30

0001086745

AYRO:MiscellaneousIncomeMember

2024-01-01

2024-06-30

0001086745

AYRO:MiscellaneousIncomeMember

2023-01-01

2023-06-30

0001086745

us-gaap:ShippingAndHandlingMember

2024-04-01

2024-06-30

0001086745

us-gaap:ShippingAndHandlingMember

2023-04-01

2023-06-30

0001086745

us-gaap:ShippingAndHandlingMember

2024-01-01

2024-06-30

0001086745

us-gaap:ShippingAndHandlingMember

2023-01-01

2023-06-30

0001086745

us-gaap:VehiclesMember

2024-04-01

2024-06-30

0001086745

us-gaap:VehiclesMember

2024-01-01

2024-06-30

0001086745

AYRO:ComputerAndEquipmentMember

2024-06-30

0001086745

AYRO:ComputerAndEquipmentMember

2023-12-31

0001086745

us-gaap:LeaseholdImprovementsMember

2024-06-30

0001086745

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001086745

AYRO:ComputerSoftwareMember

2024-06-30

0001086745

AYRO:ComputerSoftwareMember

2023-12-31

0001086745

us-gaap:FurnitureAndFixturesMember

2024-06-30

0001086745

us-gaap:FurnitureAndFixturesMember

2023-12-31

0001086745

us-gaap:RestrictedStockMember

2024-04-01

2024-06-30

0001086745

us-gaap:RestrictedStockMember

2023-04-01

2023-06-30

0001086745

us-gaap:RestrictedStockMember

2024-01-01

2024-06-30

0001086745

us-gaap:RestrictedStockMember

2023-01-01

2023-06-30

0001086745

AYRO:SecuritiesPurchaseAgreementMember

AYRO:SeriesHSevenConvertiblePreferredStockMember

2024-02-09

2024-02-09

0001086745

AYRO:SeriesHSevenConvertiblePreferredStockMember

2023-09-15

2023-09-15

0001086745

AYRO:SecuritiesPurchaseAgreementMember

AYRO:SeriesHSevenConvertiblePreferredStockMember

2023-08-07

2023-08-07

0001086745

AYRO:InvestorsMember

2024-06-30

0001086745

AYRO:InvestorsMember

AYRO:SeriesHSevenPreferredStockMember

2024-06-30

0001086745

AYRO:InvestorsMember

AYRO:AccruedDividendsPayableMember

2024-06-30

0001086745

AYRO:InvestorsMember

AYRO:DeemedDividendsMember

2024-06-30

0001086745

AYRO:SeriesHSevenPreferredStockMember

2024-01-01

2024-06-30

0001086745

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001086745

2023-01-01

2023-12-31

0001086745

us-gaap:ResearchAndDevelopmentExpenseMember

2024-04-01

2024-06-30

0001086745

us-gaap:ResearchAndDevelopmentExpenseMember

2023-04-01

2023-06-30

0001086745

us-gaap:ResearchAndDevelopmentExpenseMember

2024-01-01

2024-06-30

0001086745

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-06-30

0001086745

us-gaap:SellingAndMarketingExpenseMember

2024-04-01

2024-06-30

0001086745

us-gaap:SellingAndMarketingExpenseMember

2023-04-01

2023-06-30

0001086745

us-gaap:SellingAndMarketingExpenseMember

2024-01-01

2024-06-30

0001086745

us-gaap:SellingAndMarketingExpenseMember

2023-01-01

2023-06-30

0001086745

us-gaap:GeneralAndAdministrativeExpenseMember

2024-04-01

2024-06-30

0001086745

us-gaap:GeneralAndAdministrativeExpenseMember

2023-04-01

2023-06-30

0001086745

us-gaap:GeneralAndAdministrativeExpenseMember

2024-01-01

2024-06-30

0001086745

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-06-30

0001086745

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-06-30

0001086745

us-gaap:EmployeeStockOptionMember

2024-06-30

0001086745

us-gaap:EmployeeStockOptionMember

2024-04-01

2024-06-30

0001086745

us-gaap:EmployeeStockOptionMember

2023-04-01

2023-06-30

0001086745

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-06-30

0001086745

us-gaap:RestrictedStockUnitsRSUMember

2023-12-31

0001086745

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-06-30

0001086745

us-gaap:RestrictedStockUnitsRSUMember

2024-06-30

0001086745

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

AYRO:OneCustomersMember

2023-04-01

2023-06-30

0001086745

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

AYRO:TwoCustomersMember

2023-04-01

2023-06-30

0001086745

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

AYRO:OneCustomersMember

2023-01-01

2023-06-30

0001086745

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

AYRO:TwoCustomersMember

2023-01-01

2023-06-30

0001086745

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

AYRO:ThreeCustomersMember

2023-01-01

2023-06-30

0001086745

AYRO:OneCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001086745

AYRO:TwoCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001086745

AYRO:ThreeCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001086745

AYRO:FourCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-12-31

0001086745

AYRO:SupplierOneMember

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

2023-04-01

2023-06-30

0001086745

AYRO:SupplierOneMember

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

2023-01-01

2023-06-30

0001086745

AYRO:SupplierTwoMember

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

2023-01-01

2023-06-30

0001086745

us-gaap:FairValueInputsLevel1Member

2024-06-30

0001086745

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001086745

us-gaap:FairValueInputsLevel3Member

2024-06-30

0001086745

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001086745

us-gaap:FairValueInputsLevel3Member

2024-01-01

2024-06-30

0001086745

us-gaap:BlackScholesMertonModelMember

us-gaap:MeasurementInputSharePriceMember

2024-06-30

0001086745

us-gaap:BlackScholesMertonModelMember

us-gaap:MeasurementInputExercisePriceMember

2024-06-30

0001086745

us-gaap:BlackScholesMertonModelMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-06-30

0001086745

us-gaap:BlackScholesMertonModelMember

us-gaap:MeasurementInputExpectedTermMember

2024-06-30

0001086745

us-gaap:BlackScholesMertonModelMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-06-30

0001086745

us-gaap:BlackScholesMertonModelMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-06-30

0001086745

us-gaap:MonteCarloModelMember

us-gaap:MeasurementInputPriceVolatilityMember

2024-06-30

0001086745

us-gaap:MonteCarloModelMember

us-gaap:MeasurementInputExpectedTermMember

2024-06-30

0001086745

us-gaap:MonteCarloModelMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-06-30

0001086745

us-gaap:MonteCarloModelMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-06-30

0001086745

us-gaap:MonteCarloModelMember

us-gaap:MeasurementInputExpectedDividendPaymentMember

2024-06-30

0001086745

us-gaap:MonteCarloModelMember

us-gaap:MeasurementInputDefaultRateMember

2024-06-30

0001086745

AYRO:DerivativeLiabilityMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001086745

AYRO:DerivativeLiabilityMember

us-gaap:FairValueInputsLevel3Member

2024-01-01

2024-06-30

0001086745

AYRO:DerivativeLiabilityMember

us-gaap:FairValueInputsLevel3Member

2024-06-30

0001086745

us-gaap:EmployeeStockOptionMember

2024-04-01

2024-06-30

0001086745

us-gaap:EmployeeStockOptionMember

2023-04-01

2023-06-30

0001086745

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-06-30

0001086745

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-06-30

0001086745

us-gaap:RestrictedStockMember

2024-04-01

2024-06-30

0001086745

us-gaap:RestrictedStockMember

2023-04-01

2023-06-30

0001086745

us-gaap:RestrictedStockMember

2024-01-01

2024-06-30

0001086745

us-gaap:RestrictedStockMember

2023-01-01

2023-06-30

0001086745

AYRO:RestrictedStockVestedMember

2024-04-01

2024-06-30

0001086745

AYRO:RestrictedStockVestedMember

2023-04-01

2023-06-30

0001086745

AYRO:RestrictedStockVestedMember

2024-01-01

2024-06-30

0001086745

AYRO:RestrictedStockVestedMember

2023-01-01

2023-06-30

0001086745

us-gaap:WarrantMember

2024-04-01

2024-06-30

0001086745

us-gaap:WarrantMember

2023-04-01

2023-06-30

0001086745

us-gaap:WarrantMember

2024-01-01

2024-06-30

0001086745

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001086745

us-gaap:PreferredStockMember

2024-04-01

2024-06-30

0001086745

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0001086745

us-gaap:PreferredStockMember

2024-01-01

2024-06-30

0001086745

us-gaap:PreferredStockMember

2023-01-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended June 30, 2024

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ___________ to __________

Commission

file number: 001-34643

AYRO,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

98-0204758 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

900

E. Old Settlers Boulevard, Suite 100

Round

Rock, Texas |

|

78664 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(512)

994-4917

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

AYRO |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of August 13, 2024, the registrant had 6,878,618

shares of common stock outstanding.

AYRO,

Inc.

Quarter

Ended June 30, 2024

Table

of Contents

PART

I - FINANCIAL INFORMATION

ITEM

1. Financial Statements (Unaudited)

AYRO,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 14,091,100 | | |

$ | 33,440,867 | |

| Restricted cash | |

| — | | |

| 10,000,000 | |

| Marketable securities | |

| 22,872,151 | | |

| — | |

| Accounts receivable, net of allowance for credit losses of $130,515 and $53,696 at June 30, 2024, and December 31, 2023, respectively | |

| 129,302 | | |

| 219,000 | |

| Inventory | |

| 3,314,008 | | |

| 3,431,982 | |

| Prepaid expenses and other current assets | |

| 1,587,261 | | |

| 1,887,782 | |

| Total current assets | |

| 41,993,822 | | |

| 48,979,631 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 2,351,061 | | |

| 3,117,164 | |

| Operating lease – right-of-use asset | |

| 569,346 | | |

| 671,451 | |

| Deposits and other assets | |

| 82,564 | | |

| 95,532 | |

| Total assets | |

$ | 44,996,793 | | |

$ | 52,863,778 | |

| | |

| | | |

| | |

| LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 3,500,916 | | |

$ | 2,456,258 | |

| Accrued expenses and other current liabilities | |

| 1,509,201 | | |

| 1,656,541 | |

| Accrued preferred stock redemption payable (H-7) | |

| 1,329,047 | | |

| — | |

| Current portion lease obligation – operating lease | |

| 206,112 | | |

| 196,682 | |

| Total current liabilities | |

| 6,545,276 | | |

| 4,309,481 | |

| | |

| | | |

| | |

| Derivative liability | |

| 6,773,000 | | |

| 9,400,000 | |

| Warrant liability | |

| 4,309,500 | | |

| 13,319,800 | |

| Lease obligation - operating lease, net of current portion | |

| 396,712 | | |

| 502,831 | |

| Total liabilities | |

| 18,024,488 | | |

| 27,532,112 | |

| | |

| | | |

| | |

| MEZZANINE EQUITY | |

| | | |

| | |

| Redeemable Series H-7 Convertible Preferred Stock, ($0.0001 par value per share and $1,000 face value

per share; authorized - 22,000 shares; issued and outstanding – 19,333 and 22,000 shares, at June 30, 2024, and December 31,

2023, respectively). Liquidation preference of $ $22,044,550, as of June 30, 2024 | |

| 14,140,756 | | |

| 11,193,939 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred Stock, (authorized – 20,000,000 shares) | |

| — | | |

| — | |

Series H Convertible Preferred Stock, ($0.0001 par value per share; authorized – 8,500 shares; issued and outstanding – 8 shares as of June 30, 2024, and December 31, 2023, respectively)

Liquidation preference of $1 as of June 30, 2024 | |

| — | | |

| — | |

Convertible Preferred Stock Series H-3, ($0.0001 par value; authorized – 8,461 shares; issued and outstanding – 1,234 shares as of June 30, 2024, and December 31, 2023, respectively)

Liquidation preference of $101 as of June 30, 2024 | |

| — | | |

| — | |

Series H-6 Convertible Preferred Stock, ($0.0001 par value per share; authorized – 50,000 shares; issued and outstanding – 50 shares as of June 30, 2024, and December 31, 2023, respectively)

Liquidation preference of $487 as of June 30, 2024 | |

| — | | |

| — | |

| Preferred Stock, value | |

| — | | |

| — | |

| | |

| | | |

| | |

| Common Stock, ($0.0001 par value; authorized – 200,000,000 shares; issued and outstanding – 6,572,618 and 4,913,907 shares as of June 30, 2024, and December 31, 2023, respectively) | |

| 657 | | |

| 492 | |

| Additional paid-in capital | |

| 124,885,063 | | |

| 129,467,274 | |

| Accumulated deficit | |

| (112,054,171 | ) | |

| (115,330,039 | ) |

| Total stockholders’ equity | |

| 12,831,549 | | |

| 14,137,727 | |

| Total liabilities, mezzanine equity and stockholders’ equity | |

$ | 44,996,793 | | |

$ | 52,863,778 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

AYRO,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

$ | — | | |

$ | 139,544 | | |

$ | 58,351 | | |

$ | 252,628 | |

| Cost of goods sold | |

| 1,074,896 | | |

| 332,027 | | |

| 2,258,103 | | |

| 551,820 | |

| Gross loss | |

| (1,074,896 | ) | |

| (192,483 | ) | |

| (2,199,752 | ) | |

| (299,192 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 622,567 | | |

| 2,405,398 | | |

| 1,382,984 | | |

| 4,535,388 | |

| Sales and marketing | |

| 285,035 | | |

| 420,861 | | |

| 553,390 | | |

| 1,138,953 | |

| General and administrative | |

| 1,977,358 | | |

| 3,247,731 | | |

| 5,039,684 | | |

| 6,091,047 | |

| Total operating expenses | |

| 2,884,960 | | |

| 6,073,990 | | |

| 6,976,058 | | |

| 11,765,388 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (3,959,856 | ) | |

| (6,266,473 | ) | |

| (9,175,810 | ) | |

| (12,064,580 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 140,567 | | |

| 117,278 | | |

| 293,865 | | |

| 261,638 | |

| Change in fair value - warrant liability | |

| 7,937,500 | | |

| — | | |

| 9,010,300 | | |

| — | |

| Change in fair value - derivative liability | |

| 2,618,000 | | |

| — | | |

| 2,627,000 | | |

| — | |

| Unrealized gain on marketable securities | |

| 301,921 | | |

| 146,935 | | |

| 266,902 | | |

| 198,215 | |

| Realized gain on marketable securities | |

| 74,998 | | |

| 8,193 | | |

| 452,121 | | |

| 73,193 | |

| Other income (expense), net | |

| (198,510 | ) | |

| (9,166 | ) | |

| (198,510 | ) | |

| 52,532 | |

| Total other income (expense), net | |

| 10,874,476 | | |

| 263,240 | | |

| 12,451,678 | | |

| 585,578 | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 6,914,620 | | |

$ | (6,003,233 | ) | |

$ | 3,275,868 | | |

$ | (11,479,002 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Dividends earned on H-7 convertible preferred stock | |

| (546,648 | ) | |

| — | | |

| (998,734 | ) | |

| — | |

| Accretion of discounts to redemption value of H-7 convertible preferred stock | |

| (1,999,136 | ) | |

| — | | |

| (5,094,609 | ) | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to common stockholders | |

| 4,368,836 | | |

| (6,003,233 | ) | |

| (2,817,475 | ) | |

| (11,479,002 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) per share, basic | |

$ | 0.78 | | |

$ | (1.28 | ) | |

$ | (0.53 | ) | |

$ | (2.46 | ) |

| Net income (loss) per share, diluted (NOTE

14) | |

$ | 0.14 | | |

$ | (1.28 | ) | |

$ | (0.53 | ) | |

$ | (2.46 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic weighted average Common Stock outstanding | |

| 5,615,725 | | |

| 4,684,606 | | |

| 5,270,757 | | |

| 4,674,819 | |

| Diluted weighted average Common Stock outstanding (NOTE 14) | |

| 16,638,755 | | |

| 4,684,606 | | |

| 5,270,757 | | |

| 4,674,819 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

AYRO,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENT OF CHANGES IN MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY

(UNAUDITED)

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| | |

Three

and Six Months Ended June 30, 2024 | |

| | |

Series

H-7 | | |

Series

H | | |

Series

H-3 | | |

Series

H-6 | | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Preferred

Stock | | |

Preferred

Stock | | |

Preferred Stock | | |

Preferred

Stock | | |

Common

Stock | | |

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| Balance,

January 1, 2024 | |

| 22,000 | | |

$ | 11,193,939 | | |

| 8 | | |

$ | — | | |

| 1,234 | | |

$ | — | | |

| 50 | | |

$ | — | | |

| 4,913,907 | | |

$ | 492 | | |

$ | 129,467,274 | | |

$ | (115,330,039 | ) | |

$ | 14,137,727 | |

| Stock

based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 12,398 | | |

| — | | |

| 12,398 | |

| Vested

restricted stock | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 23,771 | | |

| 2 | | |

| 48,312 | | |

| — | | |

| 48,314 | |

| Dividends

(Accrued Series H-7 Preferred) | |

| — | | |

| 452,086 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (452,086 | ) | |

| — | | |

| (452,086 | ) |

| Accretion

of discounts to redemption value of H-7 convertible preferred stock | |

| — | | |

| 3,095,473 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (3,095,473 | ) | |

| — | | |

| (3,095,473 | ) |

| Net

Loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (3,638,752 | ) | |

| (3,638,752 | ) |

| Balance,

March 31, 2024 | |

| 22,000 | | |

$ | 14,741,498 | | |

| 8 | | |

$ | - | | |

| 1,234 | | |

$ | - | | |

| 50 | | |

$ | - | | |

| 4,937,678 | | |

$ | 494 | | |

$ | 125,980,425 | | |

$ | (118,968,791 | ) | |

$ | 7,012,128 | |

| Stock

based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (4,319 | ) | |

| — | | |

| (4,319 | ) |

| Preferred

stock redemptions and conversions including cash premium | |

| (2,667 | ) | |

| (3,065,973 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,634,940 | | |

| 163 | | |

| 1,454,741 | | |

| — | | |

| 1,454,904 | |

| Deemed

dividend | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (80,553 | ) | |

| — | | |

| (80,553 | ) |

| Preferred

stock dividends | |

| — | | |

| 466,095 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (466,095 | ) | |

| — | | |

| (466,095 | ) |

| Accretion

of discounts to redemption value of H-7 convertible preferred stock | |

| — | | |

| 1,999,136 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,999,136 | ) | |

| — | | |

| (1,999,136 | ) |

| Net

Income | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| - | | |

| 6,914,620 | | |

| 6,914,620 | |

| Balance,

June 30, 2024 | |

| 19,333 | | |

$ | 14,140,756 | | |

| 8 | | |

$ | - | | |

| 1,234 | | |

$ | - | | |

| 50 | | |

$ | - | | |

| 6,572,618 | | |

$ | 657 | | |

$ | 124,885,063 | | |

$ | (112,054,171 | ) | |

$ | 12,831,549 | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| | |

Three and Six Months Ended June 30, 2023 | |

| | |

Series H-7 | | |

Series H | | |

Series H-3 | | |

Series H-6 | | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Preferred Stock | | |

Preferred Stock | | |

Preferred Stock | | |

Preferred Stock | | |

Common Stock | | |

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| Balance, January 1, 2023 | |

| — | | |

$ | — | | |

| 8 | | |

$ | — | | |

| 1,234 | | |

$ | — | | |

| 50 | | |

$ | - | | |

| 4,655,205 | | |

$ | 466 | | |

$ | 133,227,507 | | |

$ | (81,169,584 | ) | |

$ | 52,058,389 | |

| Balance value | |

| — | | |

$ | — | | |

| 8 | | |

$ | — | | |

| 1,234 | | |

$ | — | | |

| 50 | | |

$ | - | | |

| 4,655,205 | | |

$ | 466 | | |

$ | 133,227,507 | | |

$ | (81,169,584 | ) | |

$ | 52,058,389 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 20,116 | | |

| — | | |

| 20,116 | |

| Vested Restricted Stock | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 13,858 | | |

| 1 | | |

| 246,624 | | |

| — | | |

| 246,625 | |

| Net Loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (5,475,769 | ) | |

| (5,475,769 | ) |

| Balance, March 31, 2023 | |

| - | | |

$ | - | | |

| 8 | | |

$ | - | | |

| 1,234 | | |

$ | - | | |

| 50 | | |

$ | - | | |

| 4,669,063 | | |

$ | 467 | | |

$ | 133,494,247 | | |

$ | (86,645,353 | ) | |

$ | 46,849,361 | |

| Stock based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 11,417 | | |

| — | | |

| 11,417 | |

| Vested Restricted Stock | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 23,568 | | |

| 2 | | |

| 230,711 | | |

| — | | |

| 230,713 | |

| Net Loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (6,003,233 | ) | |

| (6,003,233 | ) |

| Balance, June 30, 2023 | |

| - | | |

$ | - | | |

| 8 | | |

$ | - | | |

| 1,234 | | |

$ | - | | |

| 50 | | |

$ | - | | |

| 4,692,632 | | |

$ | 469 | | |

$ | 133,736,375 | | |

$ | (92,648,586 | ) | |

$ | 41,088,258 | |

| Balance value | |

| - | | |

$ | - | | |

| 8 | | |

$ | - | | |

| 1,234 | | |

$ | - | | |

| 50 | | |

$ | - | | |

| 4,692,632 | | |

$ | 469 | | |

$ | 133,736,375 | | |

$ | (92,648,586 | ) | |

$ | 41,088,258 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

AYRO,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

2024 | | |

2023 | |

| | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net income (loss) | |

$ | 3,275,868 | | |

$ | (11,479,002 | ) |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 895,627 | | |

| 452,848 | |

| Loss on disposal of fixed asset | |

| — | | |

| 11,666 | |

| Stock-based compensation | |

| 56,393 | | |

| 508,869 | |

| Change in fair value - derivative liability | |

| (2,627,000 | ) | |

| — | |

| Change in fair value - warrant liability | |

| (9,010,300 | ) | |

| — | |

| Amortization of right-of-use asset | |

| 102,105 | | |

| 81,524 | |

| Bad debt expense | |

| 76,819 | | |

| 292,010 | |

| Unrealized gain on marketable securities | |

| (266,902 | ) | |

| (198,215 | ) |

| Realized gain on marketable securities | |

| (452,121 | ) | |

| (73,193 | ) |

| Impairment of inventory | |

| 1,622,609 | | |

| — | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 12,879 | | |

| 113,906 | |

| Inventory | |

| (1,704,756 | ) | |

| (2,079,590 | ) |

| Prepaid expenses and other assets | |

| 587,476 | | |

| (1,790,987 | ) |

| Deposits and other assets | |

| 12,967 | | |

| — | |

| Accounts payable | |

| 1,115,255 | | |

| (405,979 | ) |

| Accrued expenses and other current liabilities | |

| (434,295 | ) | |

| (234,155 | ) |

| Lease obligations - operating leases | |

| (96,690 | ) | |

| (93,181 | ) |

| Net cash used in operating activities | |

| (6,834,066 | ) | |

| (14,893,479 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

| — | | |

| (1,271,311 | ) |

| Change in marketable securities | |

| (22,153,128 | ) | |

| (9,343,804 | ) |

| Purchase of intangible assets | |

| — | | |

| (18,703 | ) |

| Net cash used in investing activities | |

| (22,153,128 | ) | |

| (10,633,818 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Payment of preferred stock redemption (H-7) | |

| (362,573 | ) | |

| — | |

| Net cash used in financing activities | |

| (362,573 | ) | |

| — | |

| | |

| | | |

| | |

| Net change in cash, cash equivalents and restricted cash | |

| (29,349,767 | ) | |

| (25,527,297 | ) |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash, beginning of the period | |

| 43,440,867 | | |

| 39,096,562 | |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash, end of the period | |

$ | 14,091,100 | | |

$ | 13,569,265 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash and non-cash transactions: | |

| | | |

| | |

| Fixed asset additions included in accounts payable and accrued expenses | |

$ | 70,597 | | |

$ | 194,335 | |

| Accrual of Series H-7 Convertible Preferred Stock Dividends | |

$ | 918,181 | | |

$ | — | |

| Accretion of discounts to redemption value of H-7 convertible preferred stock | |

$ | 5,094,609 | | |

$ | — | |

| Accrued Series H-7 preferred stock redemption payable | |

$ | 1,329,047 | | |

$ | — | |

| Non-cash redemption of Series H-7 preferred stock | |

$ | 1,454,904 | | |

$ | — | |

| Prepaid insurance financed through accrued expenses | |

$ | 286,955 | | |

$ | — | |

| | |

| | | |

| | |

| Supplemental disclosure of restricted cash: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 14,091,100 | | |

$ | 13,569,265 | |

| Restricted cash | |

$ | — | | |

$ | — | |

| Total cash, cash equivalents and restricted cash | |

$ | 14,091,100 | | |

$ | 13,569,265 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

AYRO,

INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

1. ORGANIZATION AND NATURE OF OPERATIONS

AYRO,

Inc. (“AYRO” or the “Company”), a Delaware corporation formerly known as DropCar, Inc. (“DropCar”),

a corporation headquartered outside Austin, Texas, is the merger successor of AYRO Operating Company, Inc. (“AYRO Operating”),

which was formed under the laws of the State of Texas on May 17, 2016 as Austin PRT Vehicle, Inc. and subsequently changed its name to

Austin EV, Inc. under an Amended and Restated Certificate of Formation filed with the State of Texas on March 9, 2017. On July 24, 2019,

the Company changed its name to AYRO, Inc. and converted its corporate domicile to Delaware. The Company was founded on the basis of

promoting resource sustainability. The Company, and its wholly-owned subsidiaries, are principally engaged in manufacturing and sales

of environmentally conscious, minimal-footprint electric vehicles. The all-electric vehicles are typically sold both directly to customers

and to dealers in the United States.

Reverse

Stock Split

On

September 15, 2023, the Company effected a one-for-eight reverse stock split of the Company’s common stock (the “Reverse

Stock Split”). Share and per share information for the three and six months ended June 30, 2023, has been retroactively adjusted

to reflect the Reverse Stock Split.

Strategic

Review

For

the past several years, AYRO’s primary supplier for the AYRO 411x has been Cenntro Automotive Group, Ltd. (“Cenntro”),

which operates a large electric vehicle factory in the automotive district in Hangzhou, China. As a result of rising shipping costs,

quality issues with certain components and persistent delays, the Company ceased production of the AYRO 411x from Cenntro in September

2022 in order to focus its resources on the development and launch of the new 411 fleet vehicle model year 2023 refresh, the Vanish (the

“Vanish”).

The

Company began the design and development of the Vanish in December 2021, including updates to its supply chain, the offshoring/onshoring

mix, and its manufacturing strategy. The Company commenced low-rate initial production of the Vanish in the second quarter of 2023 and

commenced initial sales and delivery of the Vanish in the third quarter of 2023.

On

January 31, 2024, the Company began to implement an internal restructuring to achieve greater efficiency in pursuit of its strategic

goals. As part of the restructuring, among other things, the Company eliminated a substantial number of positions at the Company as the

Company re-evaluates its sales, marketing and manufacturing functions. Additionally, in connection with its internal restructuring, the

Company is working closely with third-party consultants to complete a thorough review of the Vanish to achieve the Company’s objective

of lowering the bill of materials (“BOM”) and overall manufacturing expenses, which in turn will reduce the Manufacturer’s

Suggested Retail Price (“MSRP”) of the Vanish. The Company expects to provide additional updates regarding such progress

in the near term.

NOTE

2. LIQUIDITY AND OTHER UNCERTAINTIES

Liquidity

and Other Uncertainties

The

unaudited condensed consolidated financial statements have been prepared in conformity with generally accepted accounting principles

in the United States (“GAAP”), which contemplates continuation of the Company as a going concern. The Company is subject

to a number of risks similar to those of earlier stage commercial companies, including dependence on key individuals and products, the

difficulties inherent in the development of a commercial market, the potential need to obtain additional capital, competition from larger

companies, other technology companies and other technologies. The Company has a limited operating history and the sales and income potential

of its business and market are unproven. The Company incurred net income of $3,275,868, as a result of the non-cash changes in the warrant liability and the

derivative liability, for the six months ended June 30, 2024, and negative

cash flow used in operations of $6,834,066 for the six months ended June 30, 2024. On June 30, 2024, the Company had cash and cash equivalent

balances totaling $14,091,100, restricted cash of $0 and marketable securities of $22,872,151. In addition, overall working capital decreased

by $9,221,604 during the six months ended June 30, 2024. Management believes that the existing cash as of June 30, 2024, will be sufficient

to fund operations for at least the next twelve months following the issuance of these unaudited condensed consolidated financial statements.

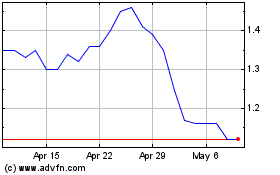

On

July 18, 2024, the Company received a letter from the Listing Qualifications Department of the Nasdaq Stock Market indicating that, based

upon the closing bid price of the Company’s common stock for the 30 consecutive business days between June 3, 2024, to July 17,

2024, the Company did not meet the minimum bid price of $1.00 per share required for continued listing on The Nasdaq Capital Market pursuant

to Nasdaq Listing Rule 5550(a)(2). The letter also indicated that the Company will be provided with a compliance period of 180 calendar

days, or until January 14, 2025, in which to regain compliance pursuant to Nasdaq Listing Rule 5810(c)(3)(A). Delisting could harm the Company’s

ability to raise capital through alternative financing sources on terms acceptable to us, or at all, and may result in the potential

loss of confidence by investors, suppliers, customers and employees and fewer business development opportunities.

On

August 7, 2023, the Company entered into a Securities Purchase Agreement (the “Series H-7 Purchase Agreement”), pursuant

to which it agreed to sell to certain existing investors (the “Series H-7 Investors”) in a private placement (the “Series

H-7 Private Placement”) (i) an aggregate of 22,000 shares of the Company’s newly designated Series H-7 convertible preferred

stock, par value $0.0001 per share, with a stated value of $1,000 per share (“Series H-7 Preferred Shares”), and (ii) warrants

(the “Series H-7 Investor Warrants”) initially exercisable for up to an aggregate of 2,750,000 shares of common stock. The

Company raised gross proceeds of $22,000,000 from the sale, which closed on August 10, 2023 (see Note 9).

The

certificate of designations for the Series H-7 Preferred Shares (the “Series H-7 Certificate of Designations”) contains certain

restrictive provisions, including (i) a requirement to maintain unencumbered, unrestricted cash and cash equivalents on hand in an amount

equal to (a) until December 31, 2023, at least $20,000,000 plus the net proceeds from the sale of the Series H-7 Preferred Shares pursuant

to the Series H-7 Purchase Agreement, and (b) from January 1, 2024 and until an aggregate of eighty percent (80%) of the Series H-7 Preferred

Shares have been converted into shares of common stock, at least $21,000,000, and (ii) a requirement to deposit an amount equal to $10,000,000

from the Private Placement proceeds into a newly established segregated deposit account of the Company (“Segregated Cash”),

and to use such Segregated Cash solely for the purpose of performing the Company’s monetary obligations to the holders of the Series

H-7 Preferred Shares, provided, however, that the Company may use the Segregated Cash for any purpose, including general corporate purposes,

with the prior written consent of holders of at least 75% of the outstanding Series H-7 Preferred Shares. As of June 30, 2024, the Company

was not in compliance with the restrictive provisions discussed above. The Company has regained compliance subsequent to June 30, 2024.

The

Company may experience increases in the cost or a sustained interruption in the supply or shortage of raw materials, including lithium-ion

battery cells, semiconductors, and integrated circuits. Any such increase or supply interruption could materially and negatively impact

the business, prospects, financial condition, and operating results. Certain production-ready components may be delayed in shipment to

Company facilities which has and may continue to cause delays in validation and testing for these components, which would in turn create

a delay in the availability of saleable vehicles.

The

Company uses various raw materials, including aluminum, steel, carbon fiber, non-ferrous metals (such as copper), and cobalt. The prices

for these raw materials fluctuate depending on market conditions, and global demand and could adversely affect business and operating

results. For instance, the Company is exposed to multiple risks relating to price fluctuations for lithium-ion cells. These risks include:

| ● |

the

inability or unwillingness of current battery manufacturers to build or operate battery cell manufacturing plants to supply the numbers

of lithium-ion cells required to support the growth of the electric vehicle industry as demand for such cells increases; |

| |

|

| ● |

disruption

in the supply of cells due to quality issues or recalls by the battery cell manufacturers; and |

| |

|

| ● |

an

increase in the cost of raw materials, such as cobalt, used in lithium-ion cells. |

Any

disruption in the supply of lithium-ion battery cells, semiconductors, or integrated circuits could temporarily disrupt production of

the Company’s vehicles until a different supplier is fully qualified. Moreover, battery cell manufacturers may refuse to supply

electric vehicle manufacturers if they determine that the vehicles are not sufficiently safe. Furthermore, fluctuations or shortages

in petroleum and other economic conditions may cause the Company to experience significant increases in freight charges and raw material

costs. Substantial increases in the prices for raw materials would increase operating costs and could reduce margins if the increased

costs cannot be recouped through increased electric vehicle prices. There can be no assurance that the Company will be able to recoup

the increasing costs of raw materials by increasing vehicle prices.

The

Company has made certain indemnities, under which the Company may be required to make payments to an indemnified party, in relation to

certain transactions. The Company indemnifies their directors and officers to the maximum extent permitted under the laws of the State

of Delaware. In connection with the Company’s facility leases, the Company has indemnified their lessors for certain claims arising

from the use of the facilities. The duration of the indemnities vary and, in many cases, are indefinite. These indemnities do not provide

for any limitation of the maximum potential future payments the Company could be obligated to make. Historically, the Company has not

been obligated to make any payments for these obligations and no liabilities have been recorded for these indemnities.

NOTE

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of Presentation and Principles of Consolidation

The

accompanying unaudited condensed consolidated financial statements have been prepared in accordance with GAAP and in conformity with

the instructions on Form 10-Q and Rule 8-03 of Regulation S-X and the related rules and regulations of the Securities and Exchange Commission

(the “SEC”).

The

unaudited condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All significant

intercompany accounts and transactions have been eliminated in consolidation. The unaudited condensed consolidated financial statements

reflect all adjustments consisting of normal recurring accruals, which are, in the opinion of management, necessary for a fair presentation

of such statements. The results of operations for the three and six months ended June 30, 2024, are not necessarily indicative of the

results that may be expected for the entire year. These unaudited condensed consolidated financial statements should be read in conjunction

with the audited consolidated financial statements and the accompanying notes for the fiscal year ended December 31, 2023, which are

included in the Company’s Annual Report on Form 10-K, filed with the SEC on April 1, 2024, and amended on April 26, 2024.

Use

of Estimates

The

preparation of the unaudited condensed consolidated financial statements, in conformity with GAAP, requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the

date of the unaudited consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period.

The

Company’s most significant estimates include marketable securities, revenue recognition, fair value measurements of warrant and

derivative liabilities, accretion of preferred stock and the measurement of stock-based compensation expenses. Actual results could differ

from these estimates.

Restricted

Cash

As

of June 30, 2024, and December 31, 2023, $0 and $10,000,000, respectively, of cash was restricted in accordance with the Series H-7 Certificate

of Designations, see Note 2.

Marketable

Securities

Marketable

securities include investment in fixed income bonds and U.S. Treasury securities that are considered to be highly liquid and easily tradeable.

The marketable securities are considered trading securities and are measured at fair value and are accounted for in accordance with ASC

320 Investments—Debt and Equity Securities. The marketable securities are valued using inputs observable in active markets

for identical securities and are therefore classified as Level 1 within the Company’s fair value hierarchy. The Company held $22,872,151

and $0 in marketable securities as of June 30, 2024, and December 31, 2023, respectively.

Derivative

Financial Instruments

The

Company evaluates all its financial instruments to determine if such instruments contain features that qualify as embedded derivatives.

Embedded derivatives must be separately measured from the host contract if all the requirements for bifurcation are met. The assessment

of the conditions surrounding the bifurcation of embedded derivatives depends on the nature of the host contract. Bifurcated embedded

derivatives are recognized at fair value, with changes in fair value recognized in the statement of operations each period. Bifurcated

embedded derivatives are classified with the related host contract in the Company’s balance sheet. These particular derivatives

are assessed under ASC 480 and ASC 815.

Fair

Value Measurements

In

accordance with ASC 820 (Topic 820, Fair Value Measurements and Disclosures), the Company uses a three-level hierarchy for fair value

measurements of certain assets and liabilities for financial reporting purposes that distinguishes between market participant assumptions

developed from market data obtained from outside sources (observable inputs) and the Company’s own assumptions about market participant

assumptions developed from the best information available to the Company under the circumstances (unobservable inputs). The fair value hierarchy

is divided into three levels based on the source of inputs as follows:

| |

● |

Level

1 – inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets; |

| |

|

|

| |

● |

Level

2 – inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs

that are observable for the asset or liability other than quoted prices, either directly or indirectly including inputs in markets

that are not considered to be active; and |

| |

|

|

| |

● |

Level

3 – inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

Categorization

within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

Warrants

and Preferred Shares

The

accounting treatment of warrants and preferred share series issued is determined pursuant to the guidance provided by ASC 480, Distinguishing

Liabilities from Equity, and ASC 815, Derivatives and Hedging, as applicable. Each feature of a freestanding financial instruments

including, without limitation, any rights relating to subsequent dilutive issuances, dividend issuances, equity sales, rights offerings,

forced conversions, optional redemptions, automatic monthly conversions, dividends, and exercise is assessed with determinations made

regarding the proper classification in the Company’s unaudited condensed consolidated financial statements.

Redeemable

Preferred Stock

Applicable

accounting guidance requires an equity instrument that is redeemable for cash or other assets to be classified outside of permanent equity

if it is redeemable (a) at a fixed or determinable price on a fixed or determinable date, (b) at the option of the holder, or (c) upon

the occurrence of an event that is not solely within the control of the issuer.

Revenue

Recognition

The

Company recognizes revenue in accordance with ASC 606, Revenue from Contracts with Customers, the core principle of which is that

an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration

to which the entity expects to be entitled to receive in exchange for those goods or services.

To

achieve this core principle, five basic criteria must be met before revenue can be recognized: (1) identify the contract with a customer;

(2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to

performance obligations in the contract; and (5) recognize revenue when or as the Company satisfies a performance obligation.

Nature

of goods and services

The

following is a description of the Company’s products and services from which the Company generates revenue, as well as the nature,

timing of satisfaction of performance obligations, and significant payment terms for each:

Inventory

Inventory

consists of purchased chassis, cabs, batteries, truck beds and component parts which includes cost of raw materials, freight, direct

labor, and related production overhead and are stated at the lower of cost or net realizable value, as determined using a first-in, first-out

method. Inventory also includes a fleet of internally manufactured vehicles that serve demonstration and other purposes, the balance

of which is being depreciated over their useful lives. Management compares the cost of inventory with the net realizable value and, if

applicable, an allowance is made for writing down the inventory to its net realizable value, if lower than cost. On an ongoing basis,

inventory is reviewed for potential write-down for estimated obsolescence or unmarketable inventory based upon forecasts for future demand

and market conditions.

Product

revenue

Product

revenue from customer contracts is recognized on the sale of each electric vehicle as vehicles are shipped to customers. The majority

of the Company’s vehicle sales orders generally have only one performance obligation: the sale and delivery of complete vehicles.

Ownership and risk of loss transfers to the customer based on FOB shipping point and freight charges are the responsibility of the customer.

Revenue is typically recognized at the point control transfers or in accordance with payment terms customary to the business. The Company

provides product warranties to assure that the product assembly complies with agreed upon specifications. The Company’s product

warranty is similar in all material respects to the product warranties provided by the Company’s suppliers, therefore minimizing

the warranty liability to the standard labor rates associated with the defective part replacement. Customers do not have the option to

purchase a warranty separately; as such, a warranty is not accounted for as a separate performance obligation. The Company’s policy

is to exclude taxes collected from a customer from the transaction price of automotive contracts.

Shipping

revenue

Amounts

billed to customers related to shipping and handling are classified as shipping revenue. The Company has elected to recognize the cost

for freight and shipping when control over vehicles has transferred to the customer as an operating expense. The Company has reported

shipping expenses of $6,208 and $20,768 for the three months ended June 30, 2024, and 2023, respectively, and $21,699 and $41,334 for

the six months ended June 30, 2024, and 2023, respectively, included in General and Administrative Expenses.

Services

and other revenue

Services

and other revenue consist of non-warranty after-sales vehicle services. Revenue is typically recognized at a point in time when services

and replacement parts are provided.

Miscellaneous

income

Miscellaneous

income consists of late fees charged for receivables not paid within the terms of the customer agreement based upon the outstanding customer

receivable balance. This revenue is earned when a customer’s receivable balance becomes delinquent, and its collection is reasonably

assured and is calculated using a stated late fee rate multiplied by the outstanding balance that is subject to a late fee charge.

Basic

and Diluted Income (Loss) Per Share

Basic

earnings per share excludes dilution for common stock equivalents and is computed by dividing net income or loss attributable to common

stockholders by the weighted average number of shares of common stock outstanding for the period. Diluted EPS is calculated based on

the weighted average number of shares of common stock plus the effect of dilutive potential common shares outstanding during the period.

Potentially dilutive securities consist of common stock options, restricted stock units, contingently issuable shares and convertible

preferred securities. The dilutive effect of stock options, restricted stock units and contingently issuable shares is reflected in diluted

EPS by application of the treasury stock method. The dilutive effect of convertible preferred securities is reflected in the diluted

EPS by application of the “if-converted” method. The “if-converted” method is only assumed in periods where such

application would be dilutive. Basic and diluted net income (loss) per share is determined by dividing income (loss) by the weighted average ordinary shares outstanding

during the period. For all periods presented with a net loss, the shares underlying the ordinary share options and warrants have been

excluded from the calculation because their effect would be anti-dilutive. Therefore, the weighted-average shares outstanding used to

calculate both basic and diluted loss per share is the same for periods with a net loss. For all periods presented with a net loss, the

shares underlying the common stock options and warrants have been excluded from the calculation because their effect would be anti-dilutive.

Therefore, the weighted-average shares outstanding used to calculate both basic and diluted loss per share are the same for periods with

a net loss.

Recently

Adopted Accounting Pronouncements

In

June 2022, the FASB issued ASU 2022-03, Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual

Sale Restrictions (“ASU 2022-03”), which clarifies the guidance in Accounting Standards Codification Topic 820, Fair Value

Measurement (“Topic 820”), when measuring the fair value of an equity security subject to contractual restrictions that prohibit

the sale of an equity security and introduces new disclosure requirements for equity securities subject to contractual sale restrictions

that are measured at fair value in accordance with Topic 820. ASU 2022-03 is effective for fiscal years beginning after December 15,

2023, including interim periods within those fiscal years, and early adoption is permitted. Management does not believe the adoption

of any of these accounting pronouncements has had or will have a material impact on the Company’s unaudited condensed consolidated

financial statements.

Recent

Accounting Pronouncements

In

November 2023, the FASB issued Update 2023-07-Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures which requires

disclosure of the title and position of the Chief Operating Decision Maker (“CODM”), an explanation of how the CODM uses

the reported measure of segment profit or loss in assessing segment performance and deciding how to allocate resources, and disclosure

of significant expenses regularly provided to the CODM that are included within the reported measure of segment profit or loss. The amendments

of ASU 2023-07 are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after

December 15, 2024. Early adoption is permitted and should be applied retrospectively to all periods presented. The Company is currently

evaluating the impact of this standard, including timing of adoption.

In

December 2023, the FASB issued Update 2023-09-Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which enhances the disclosure

requirements for income tax rate reconciliation, domestic and foreign income taxes paid, and unrecognized tax benefits. The amendments

of ASU 2023-09 are effective for annual periods beginning after December 15, 2024. Early adoption is permitted and should be applied

prospectively. The Company is currently evaluating the impact of this standard, including timing of adoption.

In

March 2024, the FASB issued ASU 2024-02, Codification Improvements—Amendments to Remove References to the Concepts Statements,

to remove references to various FASB Concepts Statements based on suggestions received from stakeholders on the Accounting Standards

Codification and other incremental improvements to GAAP. ASU 2024-02 is effective for fiscal years beginning after December 15, 2024.

The Company is currently evaluating the impact that adopting this new accounting standard would have on the Company’s condensed

consolidated financial statements.

NOTE

4. REVENUES

Disaggregation

of Revenue

Revenue

by type was as follows:

SCHEDULE

OF DISAGGREGATION OF REVENUE

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue type | |

| | | |

| | | |

| | | |

| | |

| Product revenue | |

$ | — | | |

$ | 127,106 | | |

$ | 37,775 | | |

$ | 247,388 | |

| Service Revenue | |

| — | | |

| — | | |

| 18,249 | | |

| — | |

| Miscellaneous Income | |

| — | | |

| — | | |

| 1,261 | | |

| 9,390 | |

| Shipping revenue | |

| — | | |

| 12,438 | | |

| 1,066 | | |

| (4,150 | ) |

| Total

Revenue | |

$ | — | | |

$ | 139,544 | | |

$ | 58,351 | | |

$ | 252,628 | |

Warranty

Reserve

The

Company records a reserve for warranty repairs upon the initial delivery of vehicles to its dealer network. The Company provides a product

warranty on each vehicle including powertrain, battery pack and electronics package. Such warranty matches the product warranty provided

by its supply chain for warranty parts for all unaltered vehicles and is not considered a separate performance obligation. The supply

chain warranty does not cover warranty-based labor needed to replace a part under warranty. Warranty reserves include management’s

best estimate of the projected cost of labor to repair/replace all items under warranty. The Company reserves a percentage of all dealer-based

sales to cover an industry-standard warranty fund to support dealer labor warranty repairs. The warranty reserve is recorded as a component

of cost of revenues in the statement of operations. As of June 30, 2024, and December 31, 2023, warranty reserves were recorded within

accrued expenses of $403,778 and $401,440, respectively.

NOTE

5. INVENTORY

Inventory,

net of any inventory allowances, consisted of the following:

SCHEDULE OF INVENTORY

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Raw materials | |

$ | 2,862,305 | | |

$ | 3,252,280 | |

| Work-in-progress | |

| 251,583 | | |

| 179,702 | |

| Finished goods | |

| 200,120 | | |

| - | |

| Total inventory, net | |

$ | 3,314,008 | | |

$ | 3,431,982 | |

During

the three and six months ended June 30, 2024, depreciation for fleet inventory was $200,120 and $200,120, respectively. There were no

vehicles in fleet inventory during the three and six months ended June 30, 2023.

During

the three and six months ended June 30, 2024, a $856,361 and $1,622,609 impairment of inventory adjustment was recorded in cost of goods

sold, related to the Vanish product. Included in the impairment of inventory adjustment during the three and six months ended June 30,