Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

17 August 2024 - 6:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

| | | | | | | | |

| (Check One): | | ☐ Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q ☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR |

| |

| | For Period Ended: July 1, 2024 |

| |

| | ☐ Transition Report on Form 10-K |

| |

| | ☐ Transition Report on Form 20-F |

| |

| | ☐ Transition Report on Form 11-K |

| |

| | ☐ Transition Report on Form 10-Q |

| |

| | For the Transition Period Ended: |

| | |

| |

Nothing in this Form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

BurgerFi International, Inc.

Full Name of Registrant

N/A

Former Name if Applicable

200 West Cypress Creek Rd., Suite 220

Address of Principal Executive Office (Street and Number)

Fort Lauderdale, FL 33309

City, State and Zip Code

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| | | | | | | | | | | | | | |

| | (a) | | The reason described in reasonable detail in Part III of this Form could not be eliminated without unreasonable effort or expense; |

| | (b) | | The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| | (c) | | The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

BurgerFi International, Inc. (the “Company”) could not file its Quarterly Report on Form 10-Q for the quarter ended July 1, 2024 (the “Form 10-Q”) by the prescribed time period without unreasonable effort and expense because the Company encountered delays in completing the preparation and review of our financial statements for inclusion in the Form 10-Q due to the Company’s ongoing assessment of goodwill and intangible assets for potential impairment.

PART IV — OTHER INFORMATION

| | | | | | | | | | | |

| (1) | Name and telephone number of person to contact in regard to this notification |

| Christopher Jones, Chief Financial Officer | (954) | 618-2000 |

| (Name) | (Area Code) | (Telephone Number) |

| (2) | Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). Yes No |

| (3) | Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? Yes No If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made. |

The Company anticipates that the Company’s financial statements for the quarter ended July 1, 2024 to be included in the Form 10-Q will reflect significant changes in results of operations from the quarter ended July 3, 2023 due to significant adverse developments that occurred with respect to the Company’s business and liquidity.

The Company is currently in ongoing discussion of the PPE Impairment charges. The Company anticipates recording impairment losses of $3 million in relation to Fixed Assets and $ 6.7 million in relation to ROU Assets.

The Company expects to report that, for the quarter ended July 1, 2024, the Company’s restaurant sales decreased by approximately $1.8 million or 4% as compared to the quarter ended July 3, 2023. This decrease was primarily driven by a decrease in same-store sales at BurgerFi and Anthony’s, including the closure of underperforming BurgerFi corporate-owned locations, which was partially offset by the additional revenue from the two acquired BurgerFi restaurants from franchisees during 2023.

The Company expects to report the total consolidated restaurant level operating expenses as a percentage of restaurant sales of 91.0% for the quarter ended July 1, 2024, as compared to 86.2% for the quarter ended July 3, 2023, a 480 basis points increase, driven primarily by higher wages and lower sales leverage on expenses. Furthermore, the price in chicken wings year over year, is up $1.70 from July 3, 2023, as chicken wing prices continue to rise steadily.

The Company expects to report a significantly higher net loss of $18.4 million for the quarter ended July 1, 2024, as compared with a net loss of $6.0 million for the quarter ended July 3, 2023. Net loss increased primarily due to lower operating income, higher general and administrative expenses, and higher restructuring costs.

The Company expects to report a cash and cash equivalents balance of approximately $4.4 million as of July 1, 2024. As of August 14, 2024, the day prior to the filing of this report, the Company had a cash and cash equivalents balance of approximately $4.4 million. Management is continuing to review the Company’s liquidity position and related disclosures. However, based on the Company’s liquidity position at July 1, 2024 and currently as well as the Company’s current forecast of operating results and cash flows (and notwithstanding the Emergency Protective Advance Agreement entered into between the Company and its senior and junior lenders on August 9, 2024), absent any other action, there is substantial doubt about the Company’s ability to continue to operate as a going concern.

In light of a previously disclosed event of default under the Company’s credit agreement (and the subsequent expiration of the senior lender’s forbearance with respect to such default) that allows the senior lender at any time to declare the debt due and payable immediately, the Company expects that if the senior lender calls the debt sooner than its maturity date, the Company would be unable to repay the debt and the senior lender could foreclose on its security interest and liquidate or take possession of some or all of the assets of the Company and its subsidiaries. This would materially harm the Company’s business, financial condition and results of operations and could require the Company to curtail, or even to cease, its operations. The Company further expects that if the Company does not receive adequate relief from its senior lender and additional sufficient liquidity from potential liquidity providers or from sales of the Company’s assets to meet its current obligations, it may seek protection under applicable bankruptcy laws.

As discussed in the Company’s press release on May 30, 2024, the Company has been reviewing strategic alternatives in light of the Company’s liquidity challenges. The Company has been seeking additional financing, attempting to sell some or all of its assets or the entire Company, and managing its cash flows by among other things reviewing and prioritizing certain obligations over others, and the Company continues to discuss possible outcomes with its lenders. There is no assurance that the Company will be able to restructure its obligations, obtain additional financing, and/or sell assets on terms and conditions that will permit the Company to meet its current obligations.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Form 12b-25 includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The Company’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company’s control and are difficult to predict. Factors that may cause such differences include but are not limited to risks and uncertainties related to the risks set forth under “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended January 1, 2024 and in the Company’s other filings with the SEC as well as risks relating to completion of the assessment and valuation of goodwill, the timing of such completion, any potential adjustments to the Company’s financial statements to be included in the Form 10-Q, the Company’s ability to effectuate any strategic alternative(s) it has been considering, the Company’s ability to raise any funds to enhance its liquidity and satisfy its current obligations, whether the Company’s senior lender would agree to forbear on exercising any

remedies available to them as a result of the event of default currently existing under the Company’s credit facilities, and the possibility that the Company’s senior lender could declare the Company’s debt due and payable at any time as a result of such event of default. The Company cautions that the foregoing list of factors is not exclusive. The Company cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based, except as required by law.

BurgerFi International, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Date: August 16, 2024 | By: | | /s/ Christopher Jones |

| Name: Christopher Jones |

| Title: Chief Financial Officer |

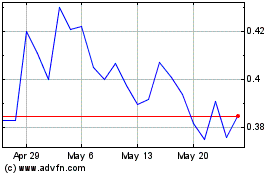

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Jan 2025 to Feb 2025

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Feb 2024 to Feb 2025