0001723580FALSE00017235802024-08-142024-08-140001723580bfi:CommonStockParValue00001PerShareMember2024-08-142024-08-140001723580bfi:RedeemableWarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember2024-08-142024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________

FORM 8-K

_______________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 14, 2024

_______________________________________

BurgerFi International, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________

| | | | | | | | |

| 001-38417 | Delaware | 82-2418815 |

(Commission File Number) | (State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification No.) |

| | | | | |

200 West Cypress Creek Rd., Suite 220 Fort Lauderdale, FL | 33309 |

| (Address of Principal Executive Offices) | (Zip Code) |

(954) 618-2000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, If Changed Since Last Report)

_______________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | BFI | | The Nasdaq Stock Market LLC |

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share | | BFIIW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

Resignations of Directors

On August 14, 2024, Allison Greenfield, Vivian Lopez-Blanco and Gregory Mann resigned from the board of directors (the “Board”) of BurgerFi International, Inc. (the “Company”), effective immediately. Their resignations were not a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Appointment of Director

On August 14, 2024, the Board appointed David J. Gordon to the Board as an independent Class B director, effective immediately, for a term until his successor is elected and qualified or until his earlier resignation or removal. Mr. Gordon will be a nominee for election as a Class B director at the 2027 annual meeting of stockholders for a three-year term. The Board has also appointed Mr. Gordon as a member of the following committees of the Board: Audit Committee, Compensation Committee, and Nominating Committee.

There are no arrangements or understandings between Mr. Gordon and any other person pursuant to which he was selected as a director. There are no family relationships between Mr. Gordon and any of the Company’s directors or executive officers. Mr. Gordon has no direct or indirect material interest in any existing or currently proposed transaction that would require disclosure under Item 404(a) of Regulation S-K.

Unless and until otherwise disclosed, Mr. Gordon will participate in the standard independent director compensation arrangements established by the Company.

Appointment of Chief Restructuring Officer

On August 14, 2024, the board of directors of the Company appointed Jeremy Rosenthal to serve as the Company’s Chief Restructuring Officer (“CRO”), effective immediately.

Mr. Rosenthal, age 48, has served as a partner at Force Ten Partners, LLC (“Force 10”) since October 2018. In connection therewith, Mr. Rosenthal has served as chief executive officer, chief restructuring officer, independent director or trustee for companies in a variety of industries. Prior to joining Force 10, Mr. Rosenthal was a restructuring partner at the international law firm Sidley Austin LLP. Mr. Rosenthal received his J.D. from the University of California at Los Angeles School of Law, graduating Order of the Coif, and Bachelor of Arts degree from the University of California, Berkeley.

The appointment of Mr. Rosenthal as CRO is made pursuant to the Engagement Agreement, dated June 19, 2024 (the “Engagement Agreement”), by and between the Company, its subsidiaries and Force 10.

There are no family relationships between Mr. Rosenthal and any of the Company’s directors or executive officers. Mr. Rosenthal has no direct or indirect material interest in any existing or currently proposed transaction that would require disclosure under Item 404(a) of Regulation S-K.

Mr. Rosenthal will not receive any compensation directly from the Company. Instead, pursuant to the Engagement Agreement, the Company agreed, among other things, to pay Force 10 an hourly rate for the services of Mr. Rosenthal as set forth in the Engagement Agreement.

The foregoing summary of the Engagement Agreement as it applies to Mr. Rosenthal is not complete and is qualified in its entirety by reference to the full text of the Engagement Agreement, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | |

| Exhibit No. | Description |

| 10.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 20, 2024

| | | | | | | | |

| BURGERFI INTERNATIONAL, INC. | |

| | |

| By: | /s/ Christopher Jones | |

| Christopher Jones, Chief Financial Officer | |

FORCE'tO 5271 Ca.lifomia Sdte 270 Irvine, Calfomia 92617 Irorccloparmcrs.com (949) 357 -2360 Jvre '19 , 2024 ButgerFl Intemational Inc. 200 W Cypress Creek Rd Suite 220 Fort Lauderdale FL 33309 -ttn: David Heidecom, Board Chair Re: Force Teo Parmers- LLC - Eogagemeot -lgreemenr Dear {r. Heidecom: We appteciate the oppornrnity to szork nrith BurgerFi lotematiooal Inc., a Delawa.te corporation, and its subsidiaries (each a "eqlqpary" and collectively, "CslEpasics') This Engagement Agreement ("Agreemef,d') conftms aod sets foth the tetms and conditions of the engagemeot betweeo the Companies aad Force Ten Partners, LLC ("!orce-:O') tegatding the scope of the se.ririces to be performed by Force 10 (the 'Enmsement') and rhe basis of comoensation for those services. 1. Desctiption of Services. (r) Executive Sersices - Chief Restucturiog OfEcer. Dutiag the term of this Engagement, Force 10 shall provide Jererny Rosential to t}re Companies to serve as cLief restructuring offrcer ('eBQ") for each Compafly. IfJercmy Rosenthal is uoable to serve as CRO, Force 10 and the Companies will v,ork collaboratively to select a feplacement CRO. The CRO will work uoder the directioo of, and report to, the Spe&l Committee of the Board of Directors (collectively, the'!q44gl') ofeach respective Compary to: (i) manage the Companies' restructuring efforts; (ii) manage the Compaoies' efforts to reorganize theit assets and liabilities for tle beiefit of their respective stakeholders, induding, vrithout limitation, authorizing the CRO to administer aod carry out each Company's duties as a debtor-in-possession, if applicable; and (iii) such other duties as directed by the Board and agteed to by the CRO. (1r) Restructudng Services. Jeremy Roseothal, as CRO, aod Force t0 in aid of the CRO, will seek to utilie tle Companies' employees to efficiendy provide the following services (' eestsrslrri4gsesases"), as appropriate: (i) Manage the restructuring efhbs of ttre Companies, supervise the Corapanies' professionals and ptovide periodic reports to tie Boatd; (ii) Assist legal coursel and the Companies irr executing tle Companies' restflicturing efforts; (*) Assist io cornection rvith motioos, iesponses, or other couat activity as directed by legal couosel; (r) Evaluate and develop testuctudng plans and other strateglc altetoatives for maximizing the value of the Companies'and their assets. The CRO, in coordinatioo vith the Compades' othet professionals, oay recommcrd to the Board various plaos aod strategrc altematives &om time to time, aad upon receipt of Boatd's approval of

G) (d) G) (0 a proposed coulse of action, the CRO shall use commercially reaso[able efforts to attempt to implement such couse ofaction, subject, as applicablg to the approval of any coud of competeot jurisdictiorr; (") Assist ir negotiatioos with the Companies' ctedirors and the Companies' efforts to maf,age accouDts pafble aod accouots receivable; aod (", Preparc and offer declarations, repots, depositions, and testimony- Additional Personnel. To address and handle the Restructuring Sewices, the CRO may utilize, through Force 10, additional personnel witl appropriate professiooal expelence. Reporting. The CRO shall act under the ditection, contuol, and guidaoce of the Boatd and shall sen'e at the Board's pleasure. Force 10 Persoonel. The CRO will coatinue to be eogaged by F'orcc 10 while rendering selvices to the Companies. The CRO and Force 10 will continue to work on u

') policies, employee record maioteDaoce, business expeose reimbursements' vage statements, wage penalties, employee classification as independent contactors o! exempt emplo]-ees, ot any othet condition ofemployment. These respoosibilities are retained by thc Compaoy. (r") Neithet the CRO not Force 10 nor any ofits personoel assume any responsibility for the Company's decisioa to pursue, or not pursue anl business strategy, or to effect, or not to effect any Transaction. Force 10 and its persoonel shall ooly be responsible for the implementation the ptoposals approved by the Board and only to the extent aod in the manner authodzed by and directed by the Board. (") Neitler the CRO nor Fotce 10 not any ofits personnel assurae any responsibility for &e Compaoy's Elings with Securities and Exchange Commissioo, NASDAQ, an1' other secuiities malket, or afly aPplicable regulator. (i; trIodi6catioos. Ttris Engagement is fluid, and the specific scope of services may chaoge. In the event &cLrmstaoces atise and the scope oftequested services expands, Fotce 10 aud the Boatd will consult with tespect to amendmeots and modiEcations to ttris Engagement. Compensation. In coosideration of Fotce 10's acceptance of this Engagement, ttre Company agrees: (") Eoudy-Eecs. To pay Force 10 fot the houdy rate ofits personnel engaged in providiog scrvices pulsuaot to tle Engagement. The idtial houtly tates agreed to for t}re Engagehent aic: Partnets $695-$950 IaoaghgDirectors $495-$650 Directots $425-$500 Analysts $255-$400 F-orce 10 genen adiusts its houdy rates oo an annual basis aod &e above rates teflect the cutrent rates fot the calendat year 2022. 'lhe CRO's houtly fee is $950. 0r) Expenses. The Compaoies shall reimbursc the CRO and Fotce 10 for their rcasonable aod documented out-of-pocket expeoses incurred in connection with the Eogagcment, includilg ttavel, lodgiog, dtrplicatiog, comPute! research, messenger sewices, and telephone charges; provided that expenses Eust be pre-approved by the Special Committec of the Boatd of Directors for costs orceedirrg $10,000 in a giver: calendat month. {c) Pal,ment Terms. The Companies shall pay Force 10's hourly fees aod reimbutse its expenses within ten (10) business days of the Board's receipt ofan invoice for such services and itemized expeflses. (d) B.o@i4er. As rcasonably practicable aftet the executioo ofthis -gteement, the Compaaies shall pay Force 10 an advance parlrent retainet in tle amouot of$75,000. Fotce 10 will deposit the retainer il1 its geoeral accouot (and shall not be held i,r tlust, escrorff ot otherwise held as security). Forcc 10 may apply the letairei to any amouats outstadding at the termioation of this Engagement. Force 10 shall remit to the aPProPriate Company the remaining balance of the retainer follouiog the terminatioo of the Engagement and upon the satisfactioo of all of the Compaoies' obligations herer.rnder' (,f 8 $ Force 10 il

4. 6. Term. (u) The tetm of this Eogagement sball commence as of tle date set fortl above and shall continue until the Engagement is completed uoless terminated with ot without cause by either the Company or Force 10 on drirty (30) days priot wtittea notice, in vzhich event all compensation ard expenses ov'ing to Force 10 through the date of such termination (including fees and expenses incurred pdor to but invoiced aftet such terminafion) shall be immediately due and payable. ,,11 prowisions of thi.s Agteement setting forth rights or obligatioas that extend beyond the termination ofthe Agieemeot shall suwive aod shall contioue to bind the partics. @) Force 10 may withdrav ftom this Engagement and termiaate its obligations hereundcr and the CRO and aoy other officers and/or maoages of the Companies may resign ftom thet respective positioos upon written notice to the Board tf aty of the Compaoies make it uaethical ot unreasooably difficult fot the CRO, Force 10 or its personnel to hrlfill the terms of this Engagement o! otherwise perfolrn their duties under this Engagement. No,udit. Forcc l0 and its personael arc oot beiog requested to perfoft and are not agreeing to undertake arl accouoting audit, rcview, or compilation, or any other qpe of finaocial statement reporting engagemeqt tlat is subject to the rules of tle ametican lnstitute of Certifred Public Accountaots, the Securities Exchange Coomissioo, or anv other state or flational professiooal or regulatory body. No Third-Partv Beneficiarv. The Comoanies acklou ledoe that all advicc and work oroducr siven bv Force 10 or any ofits persoonel in cooneciion with this Engagemeflt is intended solely for the beneht and use of tie Companies, including its maragement and Boatd, io their capacities as such, in considedog the matters to which this Eogagement relates. Without Fotce 10's specific case-by-case written approval, the Companies agree that the advice and any work product shall not be used for any other purpose and that thev shall oot be teproduced, disseminated, quoted or refetied to other t}raIr for the exclusive purpose of accomplishing the tasks ttrat are tle subject matter of this Engagement during the term of this Engagemeot, except as othetwise required by law. Conflicts. (") The CRO and Force 1 0 are riot curendy awate of aoy telationship that v,ould cteate a coflfuct ofinterest with aoy of the Companies or those panies-in-interest of which you have made us aware. Because the CRO is a Enancial coosultant and indepeodeot 6duciary and Force 10 is a financial advisory aod consulting 6rm that sen'es clients ir numerous cases and industtics, both io and out of court, it is possible that the CRO and/or Force 10 may bave rendered sewices to or have business associations with other eotities or people which had or har.e or may have relationships with aay ofthe Companies, includiog creditors ofthe Companies. -fhe CRO and Force 10 will not rcptesent the interests of any such entities or people in conoection with this matter. (b) Each Company and each of theit subsidiades acknowledges aad agrees that the sen ices provided uodet this Engagement are being provided on behalf of each of them and each of them hereby waives any and all conllicts ofinterest ftrat may arise on account of the sewices being provided oo behalf of any of th& afEliates or subsidiaries. Based oo orrt cunenr ufldelstaoding of the finaocial and busincss relationships between the Companies it appears there is alignmeot of interest between each Company, To the exteot an unknown aod unforeseen irrecoocilable conflict between tle Compaoies aad tie Board for a Company concludes that the CRO caoaot be thc CRO ofeach Company, each Company agtees that the CRO u,ill remain the CRO of BurgerFl Intemational Inc., aod resign as the CRO ofthe other Companies. r:f B { Force 10 | 4

1. 8. Confidentiality. Force 10 and its personnel shall keep confideotial all non-public information received from the Companies in coojunction with this Engagement, except (i) as requested by the Compaoies or its legal counsel (ii) as required by legal proceediogs; or (iii) as reasonably rcquired in the petformance of this Eogageraent. All coofidentiality obligations shall cease as to any part of such ioformauon that is or becomes public othe! than as a result ofa breach of this provision. Iodemni.6cadon and LimiLanoos on l-rabrhrl. G) The Coopanies shall indemnifi and hold hatmless rhe CRO to the grcatest extent plovided in their respective orgaoizaiotal documents for indemnifyiog any other ofEcer of the Company. Furthermore. thc Companies shall indemni!, and hold hannless Force 10 and each of its personnel iacludiog the CRO, together with its oftcers, members, partners, ditectors, employees and agenls leach an "lndemdfied Panl-), from and againsr aay losses, clairts. damages and liabilities, joinr ot several (collecrively. the "Damagcs"), ro wtrrch such Indemfrifred Party may become subject in conoection with or otherwise relating to or arisrog from aoy services contemplated by this Engagemeot or performance of sen'ices by an Indemaified Party thereurrder, indudiog aoy liability to or on account of aoy employees of any Company, aod will ieimburse each lademni6ed Paty for all fees aqd teasonable and documerted out-of-pocket expenses (including the fees and reasonable aod documeoted c,ut- of-pocket expenses of couosel) (collectively, "Expenses") as incurred in conocction with investigatiog, preparing, pr.usuiog or defending aqv threateded or peoding claim, actioo, proceeding or rnvestigation (collectiseiy. '-PtoEscd:s5) aflsrlg lhere&om, whelber or sor such Iodemnified Patty is a formal party to such Proceeding; p19f idsd, however, thar rhc Companies will not be liable to aoy speci-Ec hdemnifred Party to the extent that any Damages arc found in a 6nal oon-appealable judgment by a court of competent iurisdiction to have resulted ftom, the gross negligence or wilhi misconduct of such specific lndemniiied Party seeking indemliEcatioq hereunder- No Iodemnified Party shal have aov liability (whethct direct oi indirect, in conttact, tort or othefwise) to the Companies or any person assertirg claims orr behalf of Companies' arising out ofor in connection with ary sewices contemplated by this Eogagement or the performance of serr.ices by aoy lndemnified Party thereuoder except to the extent that any Damages are fouod in a 6lal non appealable judgmeot by a court of competeat jurisdiction to have resulted &om, the gross aegligence or q/illful miscooduct of the lndernaified Party. (b) If for aay reason other thao in accordance urith this Eogagement, the fotcgoiog indernaity is uoavailable to an Iodemniied Party or insufficient to hold an Indemaihed Party hatmless, the Compaaies aglee to contiibutc to the a.mouot paid or payable by an Iodemnified Party as a result of such Damages (ioclu.ling all Expenses incurred) in such proportion as is appropriate to reflect the relative benefits to the Cornpanies' and/or its stakeholdes or beneEciaries on the one hand, and Force 10 oq the other hand, in connection with the matters covered by tiis Engagemeflt aod this Sectioo 8 ot, if the fotegoing allocation is not permitted by applicable law, not only such relative beneFtts but also the telative faults of such parties as well as any relevant equitable considetatioos. The Coropanies agree that fot purposes of this paragaph the relative beoc6ts to the Companies' and/or its stakeholders or beoeficiaties and Force 10 ir connection u,ith tbe matters covered by this Eogagement and this Section 8 will be deemed to be in the same proportioo that tle total value paid or received or to be paid or received by Compaaies' and/ot its stakeholders or beneficiaries io conoection rvith the Damages, bears to t}le fees paid to Force 10 under the Engagemeot; p!:qyide<!, houzevel that (a) in no e!-ent vill the toal cootribution of all Indemoi6ed Paties to all such Damages e-xceed the amouot of fees actually leceived aad retained by Force 10 undet tlis Engagement (excludiog any amouflts received by Force 10 as reimbutsement of expeoses) and @) the Companies shall have no obligation to make afly contribution to the exteot that any Damages are found in a fmal oon- Force 10 I 5 of 8

9. appealable judgnent by a court of competent iurisdiction to have tesulted ftom ttre gtoss negligeoce or willful miscoaduct of the applicable Indemnified Party. (.) The Companies shall not enter into any wair.er, release or setdement of any Proceeding (whether ot not Force 10 or aoy other Indemai6ed Party is a formal party to such Proceeding) ia respect of which indemaifrcation may be sought hereuldet u/itlout the prior written consent of Fotce 10 (which consent will aot be urueasonably withheld), unless such waiver, release or settlement 0) includes an unconditiooal release of Force 10 arad each IndemniEed Party from all liability arising out of such Proceeding and (r! does not contain any factual or legal admission by or with respect to any Indemoified Patty ot any adverse statement with respect to the character, professionalism, expertise or reputation of any Indemnifred Party or any action ot irracfion of any Indemnified Party. (d) If any IndeoniEed Party is entided to indemnificatioa under this Agteerneot with respect to any action or proceeding brought by a thiad paaty, the Companies shall be entided to assumc thc defense of ajy such action or proceeding with counsel reasonably satisfactow to tic Iodemnihed Parti. Upon assumption by the Compaoies of the defense of any such actioo or proceedrng. the Indemnifred Party shall have the right to participate ia such actioo or proceeding and tci retaio its own counsel but t1-re Companies shall oot be liable fot any 1egal expeases of other counsel subsequendy iocured by such Indemni6ed Party in conoection with the defense thereofunless (i) the Compaaies hawe agteed to pay such fees and expenses, (ii) the Companies shall have failed to employ counsel rcasonably satisfacto4 to the Indemniired Paty io a timely manaer, or (iii) the Iodemni{ied Party shall have been advised by counsel that there are actual or potential conflicting interests betweeo the Companies and the Indemnificd Pary, includi.r:g situations ill which there ale one or more legal dcfenses available to the Indemnifed Party that are different from or additional to those available to the Companics; provided, howevet, that thc Compaoies shall not, il comection with any oae such action or proceediag or separate but substautially similar actions or proceedings atising out of the same general allegations, be liable for the fees and exPenses of mole than ooe separate firm of attorneys at any timc for all IndemniEed Parties, except to the exteot ttrat Iocal counsel in addition to its reguJar counsel, is required in otder to effectively defend against such action or proceeding. G) The CRO and any other ofEcers or managers ptovided by Force 10 pursuant to this Eogagement shall bc insuted as ofFrcers ofthe Companies undet tle Companies' director and off,cer )iability insurance policies. The Company shall maintain dicctot aad officer litabiliry insurance purchased by the Company and shall maintaio such insurance and purchase an appropriate tail if the policies are to expire and not be replaced substantially similat or better policies for the peiod through which claims can be made against such persons. At Force 10's lequest the Comparies shall acquire approptiate additional insurance solely insuring the CR() and aov other officcrs ot maoagers provided by Force 10- (D The provisions of this Sectron 8 are contractual obligations, aod no chauge io applicable law or any of the Companies' otgafjzatiofral documents, bylaua or any otlet agteemeflt o! underraking or insurance policy shall affect the CRO's, Force 10's or any of Fotce 10's pcrsonnel's rights undet dris Section. lSt4t2ad_SeEralIl4b&ry. Each Company and each ofits subsldiaties hereby agrees that they are ezch joint and sevetally liable to Fotce 10 for the Companies' representations, wartanties, covenants, liabilities and ob@ations as set forth in this Engagcment. Folce 10 and its personnel tray seek to enforce, in their sole discretiorq aay of thet respectir.e rights and remedies against any Compaoy and any of thcir subsidiades in any otder and at any time. Limitations of Liabilitv. If Force 10 or any ofits personnel are otierwise in breach of or default undcr10. Force 10 l6ofS

11. 12. 13. 1,4. 15. this Engagement, then the maxrmum liability of Force 10 and such petsoorel h the agyegate v'ith rcG,=;ilil;.cho, d.f"Ut.null t l-U-lted to an amouot equal io tbe fees actually paid to liorce 10 (excluding any amounts ,..ot'"J iy Fo'ce 10 a' reimbutseient of expeoses) Pursuant to this Engagement as of such date' Successors aod Assigns. This Eogagemeot shall hure to rhe bene6t o( and be bioding upon' the Compaores aod Force 10 and 'bt" ":;;;;" ;essors and assigos',Neither partv may assrgo its rights and/or obligarioo" undcr this fnguj"-e'ot *"1::' 'h.t wdrirn conscnt of thc other parry' which conseot shaf not be unrcasooably withbeld' coodluoned o! dela!eo' -pplicable Law This Agreement shall be governcd bI' and coostrued.ro accordaoce uilh' the laws oF the Stare of California, wrrbout ,"raIt." l-o pt-crpltt of conflitt' oflaw 'ny acdon adstng from. or related in any way to thi" Eog'geteii 'f'^U lt Uti"gL "tly rn the Federal or state courts located ir California or in a court of compo.nilJ"ar.,i"" ".rL uny to-p"oy if such Company seeks chaptet 1 1 protection. Indepefldeot Cootractor' Force 10 and its personnel .serve as indenendent conEactors to the Comoaotes pursuaot to th" t"ttt of this Eogagemenr' This Eogagement does not crcate and shall nol ;""'J"Tr-;"il;;," " ttl'u"ttr'p'"if""1i!'r '"a 'g"'t' jo;i ventule' co-Parmers' employer aod ;;#;;;*r";,.utioothii ""i 'rt" i"',i* heleto e*pr"stv deov the existence of any such relationshiP, No.nornel-Clieot RelatiooshrP.o'r Provision of Legal Semce s Certain Force l0 oersoooel includrng r^".-. R^senrhJ- are afloroeys. Neitler rtris engagement nor aoy semces prooided bt Force 10 or its '":f"#;:'tr;;:;";t";;'-"'r shall-gi"e dsc to an ac-rual or imp,ted aitomev c,enr relationship between any *th 'd;;;;ti';;; Eo-p".'y or its of6cers' diectors or principals Tbe Compaoy agrees and u.tt"o*t"agt" t# oJO"/I rromIry of its of6ccrs' diectots or Pdncipals has aoy ,tromer-clieot relationship withJ e"-y- {ot""tl''t' o' "ay othet pe'sonnel affiliated u'ir-h Force l0 Ttre I:;;#: "i;:;;;;i. ,";;";;;e""-"" "i r"'lo' J ereml Rosenthar or anv or its persoorer ro nrovrrle lceal advi.", 't ttt t"t'"ttt iil""latJ uy I o"" l0' Jeremv i osco rhd and Fotce [ 0's person,el ,r.'fu.io"r. rdoi." ^d do oot constitute legl adwice' iriscellaneous. No amendmenr of t].,is fogagemenr or waiver of any provision hercof will be bindiog uoless scr forttr in a wtiting t'g""tll; ;;'C;rnpades and Force l0 No failurc or drlay by a parry ur exercistrg aoy right, powet ot privilege hereuoder will operate as waivet thereof' nor will any single or oartial excrcise thertorp'"tr'at uq::ilif"t-n'J"L"'tt"" thereof or tlre exercisc of anv orhcr ngbt' n.wer o! orivilese hereundcr ''i";;;;"y;t unenfotceabiliry of aot provrsioo of this letter H:L;, P.u;;T,;;;;; '"tidit, ; *r"1*"ugt1 of arv or-her Provision o[ this lenet asrcemeor' li.i*"*ii., ".ii;;"" in tuu foJce and effe.r. rhi. Engage-enr mar be executed in counterPans' each of which srill be deemed t;;;;;i uoa uu ii*rtitl ti[ tontott" ooe aod the same instrurneot. Signanrt"' dttit'o"d ttJti";t"aiy -li r"t" tt'" tto'e force aad effect as otigioal signatures' [Srgnatues oa follorving Page'] Force 10 7 of 8

If this ,Lgeement is acceptable to you, please execute and retum it to to its terms. a Delaware By' Name: Its: COMPANIES: a uela. By, Name: Its: FORCE TEN P your agaeement Fotce 10 | 8 of 8

v3.24.2.u1

Cover

|

Aug. 14, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 14, 2024

|

| Entity Registrant Name |

BurgerFi International, Inc.

|

| Entity File Number |

001-38417

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-2418815

|

| Entity Address, Address Line One |

200 West Cypress Creek Rd., Suite 220

|

| Entity Address, City or Town |

Fort Lauderdale

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33309

|

| City Area Code |

(954)

|

| Local Phone Number |

618-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001723580

|

| Common stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

BFI

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

BFIIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bfi_CommonStockParValue00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bfi_RedeemableWarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

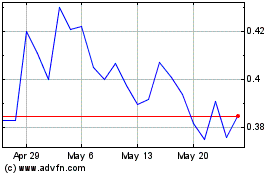

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Jan 2025 to Feb 2025

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Feb 2024 to Feb 2025