DMC Global Rejects Non-Binding Proposal from Steel Connect

12 February 2025 - 11:00PM

DMC Global Inc. (Nasdaq: BOOM) (“DMC” or the “Company”) today

rejected a non-binding proposal from Steel Connect to acquire all

of the outstanding shares of common stock of the Company, not

already owned by Steel Connect, for $10.18 per share in cash (the

“Proposal”).

DMC’s board of directors (the “Board”)

considered the Proposal in consultation with its legal and

financial advisors and in accordance with its fiduciary duties.

After considerable review and deliberation, the Board determined

the Proposal undervalues DMC’s business and its potential to drive

future risk-adjusted value for all stockholders.

The reasons for the Board’s rejection of the

non-binding Proposal include the following:

- The Steel Connect Proposal

fails to compensate stockholders for the turnaround at Arcadia and

its long-term value creation potential. DMC recently

recruited back Arcadia’s former president, Jim Schladen, to lead

the business. With Mr. Schladen’s return, Arcadia has refocused on

its core commercial operations while stabilizing and developing an

improvement plan for its high-end residential products. As a

regional architectural building products leader based in the Los

Angeles metro area, Arcadia is uniquely positioned to participate

in the long-term reconstruction of many neighborhoods destroyed by

the recent wildfires in Southern California.

- The Steel Connect Proposal

fails to compensate stockholders for any cyclical improvement at

DynaEnergetics and proactive steps taken during 2024 to strengthen

the business. DynaEnergetics, the world’s leading supplier

of factory-assembled well-perforating systems, is subject to

cyclical downturns in the energy industry, which can temporarily

overshadow otherwise strong operating fundamentals. Over the past

several months, DynaEnergetics has made significant progress

automating its North American manufacturing center, with cost

benefits that will be largely realized in the first half of 2025.

DynaEnergetics also has completed a substantial value engineering

initiative for its flagship DynaStage system. These improvements

will be particularly valuable in North America’s unconventional oil

and gas industry, which favors technology leaders and is expected

to benefit from an improved economic setting and more

energy-friendly regulatory environment.

- The Board believes Steel

Connect has repeatedly attempted to advance its interests over

those of DMC’s stockholders. Steel Connect has proposed an

investment in DMC to fund its obligations under its Arcadia joint

venture in exchange for shares of an identical preferred stock

instrument and substantial representation on the Board. The Board

determined that the terms proposed would destroy value for DMC

stockholders and enable Steel Connect to gain effective control of

DMC without paying an appropriate premium while diluting DMC’s

stockholders. Rather than accepting Steel Connect’s terms, DMC

successfully negotiated an extension of its obligations in respect

of the “put option” under the Arcadia joint venture until no

earlier than September 6, 2026, providing the Company with

significant optionality to reduce debt for the benefit of all

existing stockholders and refinance on potentially more favorable

terms at the appropriate time.

- DMC’s business is

stabilizing, CEO search efforts are underway, and DMC’s value

creation path is becoming clear. The Company expects

fourth quarter sales and adjusted EBITDA to exceed the high end of

its guidance range. The Board, with the assistance of a recognized

executive search firm, commenced a process to recruit a new CEO for

the long term. The Proposal undervalues DMC and its future value

creation prospects. The Proposal would capture the upside of the

important initiatives in progress or recently completed, that is

due to all of the Company’s stockholders.

- From the time of its

initial proposal to acquire the Company for $16.50 per share, to

the delivery of its latest proposal for $10.18 per share, Steel

Connect has repeatedly demonstrated it is not serious about

engaging in good faith with DMC. Despite the Company’s

efforts to engage with Steel Connect, it has never submitted an

actionable proposal to the Board. Steel Connect has received an

extraordinary level of access and opportunity to conduct due

diligence on DMC. Steel Connect’s claims to the contrary are

factually inaccurate.

Stockholders are not required to take any action

at this time.

AdvisorsBofA Securities is

acting as financial advisor to DMC. Womble Bond Dickinson (US) LLP

and Richards, Layton & Finger, P.A. are acting as DMC’s legal

advisors, Sodali & Co. is acting as its strategic stockholder

advisor, and Gagnier Communications LLC is its strategic

communications advisor.

About DMC GlobalDMC Global is

an owner and operator of innovative, asset-light manufacturing

businesses that provide unique, highly engineered products and

differentiated solutions. DMC’s businesses have established

leadership positions in their respective markets and consist of:

Arcadia, a leading supplier of architectural building products;

DynaEnergetics, which serves the global energy industry; and

NobelClad, which addresses the global industrial infrastructure and

transportation sectors. Based in Broomfield, Colorado, DMC trades

on Nasdaq under the symbol “BOOM.” For more information, visit:

HTTP://WWW.DMCGLOBAL.COM.

Safe Harbor Language This news

release contains certain forward-looking statements regarding the

Company, including the expectation that fourth quarter sales and

adjusted EBITDA will exceed the Company’s prior guidance range, the

potential benefits of Arcadia’s improvement initiatives and its

opportunities to participate in reconstruction efforts following

the recent fires in Los Angeles, the cost benefits of

DynaEnergetics’ automation and product redesign initiatives, and

the potential benefits of a more energy-friendly regulatory

environment. All of these statements are based on management’s

expectations as well as estimates and assumptions prepared by

management that, although they believe to be reasonable, are

inherently uncertain. These statements involve risks and

uncertainties, including, but not limited to, economic,

competitive, governmental and other factors outside of the

Company’s control that may cause its business, industry, strategy,

financing activities or actual results to differ materially. More

information on potential factors that could affect the Company and

its financial results is available in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections within the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023, and in other

documents that the Company has filed with, or furnished to, the

U.S. Securities and Exchange Commission. The Company does not

undertake any obligation to release public revisions to any

forward-looking statement, including, without limitation, to

reflect events or circumstances after the date of this news

release, or to reflect the occurrence of unanticipated events,

except as may be required under applicable securities laws.

CONTACT:Investors:Geoff

HighVice President of Investor Relations303-604-3924

Media:Riyaz Lalani or Dan GagnierGagnier

Communications416-305-1459DMCGLOBAL@GAGNIERFC.COM

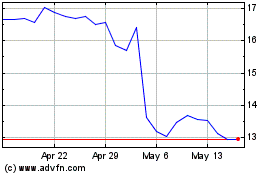

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jan 2025 to Feb 2025

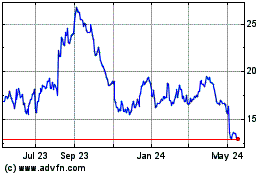

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Feb 2024 to Feb 2025