Exhibit 1

Executive Officers and Directors of

Steel Partners Holdings GP Inc.

| Name and Position |

Present Principal Occupation |

Business Address |

| Warren G. Lichtenstein, Executive Chairman and Director |

Executive Chairman of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Jack L. Howard, President and Director |

President of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Ryan O’Herrin, Senior Vice President and Chief Financial Officer |

Senior Vice President and Chief Financial Officer of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Lon Rosen, Director |

Executive Vice President and Chief Marketing Officer for the Los Angeles Dodgers |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| John P. McNiff, Director |

Chairman of Discovery Capital Management, LLC, a multi-strategy hedge fund |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| James Benenson III, Director |

Director and Co-President of Summa Holdings, Inc. (“Summa”), a holding company, and director and Co-President of Industrial Manufacturing Company and Industrial Manufacturing Company International, subsidiaries of Summa that own various diversified industrial businesses |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Eric P. Karros, Director |

Television analyst for FOX Sports and works for the Los Angeles Dodgers |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Rory H. Tahari, Director |

Co-founder, State of Mind Partners, a strategic branding and investment firm |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Gary W. Tankard, Vice President and Chief Accounting Officer |

Vice President and Chief Accounting Officer of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Joseph Martin, Chief Administrative Officer and Chief Legal Officer |

Chief Administrative Officer and Chief Legal Officer of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

Executive Officers and Directors of

Steel Excel Inc.

| Name and Position |

Present Principal Occupation |

Business Address |

| Jack L. Howard, President and Director |

President of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Gary W. Tankard, Vice President and Director |

Vice President and Chief Accounting Officer of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Ryan O’Herrin, Senior Vice President and Director |

Senior Vice President and Chief Financial Officer of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

Executive Officers and Managers of Steel

Connect LLC

| Name and Position |

Present Principal Occupation |

Business Address |

| Warren G. Lichtenstein, Interim Chief Executive Officer |

Executive Chairman of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Jack L. Howard, Manager |

President of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Ryan O’Herrin, Senior Vice President, Chief Financial Officer, Treasurer and Manager |

Senior Vice President and Chief Financial Officer of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Gary W. Tankard, Chief Accounting Officer and Manager |

Vice President and Chief Accounting Officer of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

Executive Officers of Steel Connect

Sub LLC

| Name and Position |

Present Principal Occupation |

Business Address |

| Jack L. Howard, President |

President of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Gary W. Tankard, Vice President |

Vice President and Chief Accounting Officer of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

| Ryan O’Herrin, Senior Vice President |

Senior Vice President and Chief Financial Officer of Steel Partners Holdings GP Inc., the General Partner of Steel Partners Holdings L.P., a global diversified holding company |

c/o Steel Partners Holdings L.P.

590 Madison Avenue, 32nd Floor

New York, NY 10022 |

Exhibit 99.1

Steel Connect Issues Public Letter to DMC

Global Board

Reiterates Interest in Potential Acquisition

of DMC and Calls on the Company to Facilitate Comprehensive Due Diligence

Urges DMC to Constructively Engage around

Steel’s Other Proposals, Including the Acquisition of DynaEnergetics and NobelClad for $185-$200 Million in Cash, and the Purchase

of Preferred Stock to Allow DMC to Acquire Remaining 40% of Arcadia

Troubled by Company’s Continued

Destruction of Stockholder Value, Disappointing Financial Results, Failed Succession Planning and Seemingly Stalled Strategic Review Process

Disturbed by Excessive $4.5 Million Compensation

Package – Which is Not Tied to any Value Creation Metrics – Granted to Executive Chairman and Interim CEO James O’Leary,

who is Conflicted and No Longer Independent

New York – January 27, 2025 –

Steel Connect, Inc. (together with its affiliates, “Steel”), which beneficially owns approximately 9.9% of the outstanding

shares of DMC Global Inc. (Nasdaq: BOOM) (the “Company” or “DMC”), today issued a public letter to the Company’s

Board of Directors (the “Board”). The full text of the letter is below.

January 27, 2025

Board of Directors

DMC Global Inc.

11800 Ridge Parkway, Suite 300

Broomfield, Colorado 80021

Dear DMC Board Members,

We have consistently attempted to engage with

you in a constructive manner to help maximize value for all stockholders – of which we are the largest. We have made three actionable

proposals to the Board:

| - | Our first proposal in May 2024 to acquire all the outstanding shares of DMC we do not already own for

$16.50 per share in cash: |

| - | Our second proposal in September 2024 to acquire the Company’s DynaEnergetics and NobelClad businesses

for between $185-$200 million in cash and DMC stock that we own; and |

| - | Our third proposal in November 2024 to purchase preferred stock (similar to the preferred stock that the

Company could have issued upon the exercise of the Arcadia put right) to enable DMC to acquire the remaining 40% portion of the Arcadia

business. |

As a reminder, in January 2024, the Board publicly

announced it would run a process to sell its DynaEnergetics and NobelClad businesses. After 10 months and likely substantial advisory

fees, the Board failed to complete any transactions whatsoever.

While stockholders wait patiently, no progress

on this strategic review or our proposals has been publicly communicated other than a statement that the sales process for DynaEnergetics

and NobelClad was terminated and a brief public statement that our initial proposal of $16.50 per share for the entire Company was inadequate.

This lack of engagement and urgency from the Board has been disappointing.

DMC Needs to Run a Real Process

While the Company and its advisors continue

to explore a potential sale of the Company, this process appears to have suffered from serious flaws. The Company’s financial and

business information has been in many cases delayed, incomplete, and seemingly inaccurate. In view of this, we find it hard to believe

that anyone, including Steel Connect, could make a bid for the Company as a whole or Arcadia based on a valuation significantly above

the current stock price of $7.31 per share, especially given the Arcadia put/call obligation that remains outstanding.

Nevertheless, we reiterate our interest in participating

in the process. It is critical, however, that we receive timely responses to our due diligence requests, and it is our hope that, through

this diligence, the Company can demonstrate a higher valuation than today’s stock price.

At the same time, we remain interested in acquiring

DynaEnergetics and NobelClad, as we indicated in our September 17, 2024 public letter, for between $185-$200 million, on a debt-free,

cash-free basis. We reiterate our earlier proposal to acquire these two businesses, and now are proposing to simplify our bid by providing

that the acquisition consideration would be fully in cash. We hereby request a response from the Board to this proposal by the close of

business on January 31, 2025.

We also reiterate our proposal to purchase preferred

stock from the Company so that it may acquire the remaining 40% portion of the Arcadia business and remove the overhang of the put/call

obligation. As described in our November 13, 2024 letter to the Board, we would be willing to purchase from the Company Series A convertible

preferred stock, on the same terms as the Series A preferred stock which the Company is permitted to issue to the Munera family in the

event the Munera family were to exercise its Arcadia put option. We would be willing to fund the entirety of this preferred stock issuance

– an amount equal to $162 million minus the existing debt at Arcadia.

We believe that any of the above potential transactions

would create superior value for DMC stockholders, as opposed to the alternative of inaction and remaining a standalone Company with the

Arcadia overhang. Our conclusion is based on the following facts, to which we would like to call your attention – and that of our

fellow stockholders:

Massive Destruction of Stockholder Value at DMC

The Company’s Board has overseen the

continued destruction of stockholder value. Total stockholder return is exceedingly poor and significantly trails key indices over several

time periods.

| TOTAL STOCKHOLDER RETURNS1 |

| |

1 Year |

3 Years |

5 Years |

Since Steel’s First Proposal Became

Public (June 13, 2024) |

| DMC |

-57.52 |

-82.40 |

-82.61 |

-44.70 |

| Russell 2000 |

19.23 |

18.47 |

48.24 |

14.08 |

| S&P 500 |

27.03 |

44.86 |

100.14 |

13.17 |

Source: Bloomberg.

Missed Expectations

DMC has frequently missed its targeted guidance

and recently downgraded its expectations for 2024. This disturbing pattern of disappointing stockholders was extended most recently when,

in October 2024, DMC reported preliminary financial results stating it would miss prior Q3 guidance.2Then, perhaps unsurprisingly, DMC announced that it would only be providing guidance on consolidated sales and adjusted

EBITDA going forward – citing “volatility and uncertainty in its energy and construction markets.”3

1 Based on the closing price of DMC stock on January 24, 2025.

2 See “DMC Global Provides Business and Strategic Review Update; Announces Governance Changes,” October 21, 2024, https://ir.dmcglobal.com/news-events/press-releases/detail/159/dmc-global-provides-business-and-strategic-review-update.

3 See “DMC Global Reports Third Quarter Financial Results,” Nov. 4, 2024, https://ir.dmcglobal.com/news-events/press-releases/detail/161/dmc-global-reports-third-quarter-financial-results.

Disastrously Structured Arcadia Transaction

In 2021, the Board entered into a poorly designed

and ultimately disastrous transaction to acquire a 60% interest in Arcadia from an ex-DMC director, Gerard Munera, for $282.5 million

in cash and DMC stock.4 The Company clearly

overpaid for the Arcadia business. In addition, Munera and his family retained a 40% interest in the business and received the ability

to put that interest to DMC at a minimum price of $162 million, net of debt. While the Board recently decided to pay Munera $2.5 million

to have him temporarily refrain from exercising his put right, this liability remains a major obligation that must be dealt with –

especially as part of any acquisition of Arcadia or the Company as a whole. The Company has also mismanaged this business since the acquisition

and has recently written down more than $140 million of the investment. Ultimately, the Board oversaw what amounted to a substantial wealth

transfer from the Company’s stockholders to an ex-Board member and his family.

Conflicted and Excessively Compensated Executive Chairman

We believe the $4.5 million compensation package

recently granted to Executive Chairman and Interim President and CEO James O’Leary is outrageous and runs counter to stockholders’

best interests. Under this package, Mr. O’Leary has been given a base salary of $500,000, been granted a total of $2 million in

restricted stock, and is eligible to receive a cash payment of $2 million by June of this year.

Mr. O’Leary’s lump sum payment

does not appear to be tied to any metrics that align his interests with stockholders. His compensation arrangement is not related

to the Company’s financial performance or value creation and seems to be the result of a complacent Board. This is not surprising,

given how the Board has wasted cash on a revolving door of outside advisors and on payments to departing executives as described below.

Moreover, Mr. O’Leary was elected to the

Board as an independent director. Now, as Interim President and CEO of the Company, he is not independent and is clearly conflicted with

respect to the Company’s strategic review process. His significant compensation, which again is not tied to DMC’s performance,

calls into serious question his commitment to the best interests of all shareholders in this process.

Failed Succession Planning and Irresponsible Executive Severance

Payments

The Board has utterly failed in its duty to

properly plan for leadership succession and has approved an outlandish amount of executive severance for a Company of its size. Over approximately

the past two years, DMC has had four CEOs, co-CEOs, or interim CEOs, and those who have departed have received a total of more than $4

million in severance payments. Arcadia has cycled through three Presidents in as many years. Arcadia has also had excessive turnover throughout

its management team, and now has an Interim President who does not appear to have any experience managing a P&L. This type of churn

is not healthy for any business and is emblematic of the Board’s failure to install competent leadership.

***

4 See “DMC Global Completes Acquisition of 60% Controlling Interest in Arcadia Inc.,” Dec. 23, 2021, https://ir.dmcglobal.com/news-events/press-releases/detail/16/dmc-global-completes-acquisition-of-60-controlling.

In closing, we believe the Company should redeem

its poison pill, which was instituted in June 2024 without stockholder approval. We believe it runs directly contrary to the best interests

of stockholders to limit investor purchases at a time when the Company’s stock has been declining precipitously. In our view, the

pill serves purely as an entrenchment mechanism.

We call on the Board to act swiftly to address

our concerns and respond to our proposals. We reserve all rights to take any action we deem necessary to protect stockholders’ best

interests.

Sincerely,

Warren Lichtenstein

Executive Chairman, Steel Connect LLC

Contact:

Longacre Square Partners

Joe Germani

jgermani@longacresquare.com

Exhibit 99.2

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k)(1)(iii) under

the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of a Statement

on Schedule 13D (including amendments thereto) with respect to the Common Stock, par value $0.05 per share, of DMC Global Inc. This Joint

Filing Agreement shall be filed as an Exhibit to such Statement.

| Dated: January 29, 2025 |

STEEL PARTNERS HOLDINGS L.P. |

| |

|

| |

By: |

Steel Partners Holdings GP Inc.

General Partner |

| |

|

|

| |

By: |

/s/ Maria Reda |

| |

|

Maria Reda, Secretary |

| |

STEEL PARTNERS HOLDINGS GP INC. |

| |

|

| |

By: |

/s/ Maria Reda |

| |

|

Maria Reda, Secretary |

| |

SPH GROUP LLC |

| |

|

| |

By: |

Steel Partners Holdings GP Inc.

Managing Member |

| |

|

|

| |

By: |

/s/ Maria Reda |

| |

|

Maria Reda, Secretary |

| |

SPH GROUP HOLDINGS LLC |

| |

|

| |

By: |

Steel Partners Holdings GP Inc.

Manager |

| |

|

|

| |

By: |

/s/ Maria Reda |

| |

|

Maria Reda, Secretary |

| |

STEEL EXCEL INC. |

| |

|

| |

By: |

/s/ Maria Reda |

| |

|

Maria Reda, Secretary |

| |

STEEL CONNECT LLC |

| |

|

| |

By: |

/s/ Maria Reda |

| |

|

Maria Reda, Secretary |

| |

STEEL CONNECT SUB LLC |

| |

|

| |

By: |

/s/ Maria Reda |

| |

|

Maria Reda, Secretary |

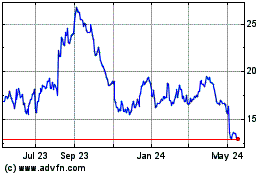

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Dec 2024 to Jan 2025

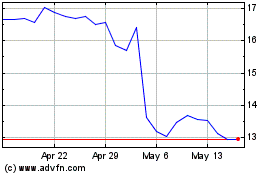

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jan 2024 to Jan 2025