false

0001854583

0001854583

2024-05-23

2024-05-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

May

23, 2024

Date

of Report (Date of earliest event reported)

COLLECTIVE

AUDIENCE, INC.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-40723 |

|

86-2861807 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

85

Broad Street 16-079

New

York, NY 10004

(Address

of Principal Executive Offices and Zip Code)

Registrant’s

telephone number, including area code:

(808)

829-1057

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value

$0.0001 per share |

|

CAUD |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

On

May 23, 2024, Collective Audience, Inc., a Delaware corporation, (the “Company”) received a notification letter (the “Notice”)

from The Nasdaq Stock Market, LLC (“Nasdaq”) indicating that the Company was not in compliance with Nasdaq Listing Rule 5250(c)(1)

(the “Rule”), which requires listed companies to timely file all required periodic financial reports with the Securities

and Exchange Commission, due to the Company’s failure to timely file its Quarterly Report on Form 10-Q for the fiscal quarter ended

March 31, 2024 (the “Form 10-Q”). As previously reported, on April 24, 2024 the Company was notified by Nasdaq (the “Annual

Report Notice”) that it was not in compliance with the Rule due to the Company’s failure to timely file its Annual Report

on Form 10-K for the fiscal year ended December 31, 2023 (the “Form 10-K” and together with the Form 10-Q, the “Reports”).

The

Notice has no immediate effect on the listing of the Company’s common stock on The Nasdaq Global Market, and, therefore, the Company’s

listing remains fully effective.

Pursuant

to the Rule, the Company has 60 calendar days from receipt of the Annual Report Notice, or until June 24, 2024, to submit the Reports

or a plan to regain compliance with the Rule. If Nasdaq accepts the Company’s plan, then Nasdaq may grant an exception of up to

180 calendar days from the due date of the Form 10-K, or until September 27, 2024, to regain compliance. If the Company does not regain

compliance within the allotted compliance period, including any exception period that may be granted, if applicable, Nasdaq will provide

notice that the Company’s common stock will be subject to delisting. The Company would then be entitled to appeal that determination

to a Nasdaq hearings panel.

The

Company intends to file the Reports as promptly as possible in order to regain compliance with the Rule. However, if the Company does

not submit the Reports by June 24, 2024, the Company will submit a plan by such date to Nasdaq that outlines, as definitively as possible,

the steps the Company will take to promptly file the Reports and regain compliance.

There

can be no assurance that the Company will regain compliance with the Rule, secure an exception of 180 calendar days from the Form 10-K’s

due date to regain compliance, or maintain compliance with other Nasdaq listing requirements described in this Current Report on Form

8-K (the “Current Report”) as well as those previously disclosed.

Item 7.01. Regulation

FD Disclosure.

On May 30, 2024, the Company issued a press release

regarding the above Nasdaq deficiencies. A copy of the foregoing press release is attached as Exhibit 99.1 to this Current Report and

is incorporated by reference herein.

This Current Report, including Exhibit 99.1, contains

forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks, uncertainties

and assumptions that are difficult to predict. Such forward-looking statements are subject to risks and uncertainties that are often difficult

to predict, are beyond the Company’s control, and which may cause results to differ materially from expectations, including the

risk that the Company’s intention to regain compliance with the Rule or maintain compliance with other Nasdaq listing requirements. The Company does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

The information set forth under Item 7.01 of this

Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated by reference into

any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in

any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission

as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial

Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated: May 30, 2024 |

COLLECTIVE AUDIENCE, INC. |

| |

|

| |

By: |

/s/

Peter Bordes |

| |

Name: |

Peter Bordes |

| |

Title: |

Chief Executive Officer |

3

Exhibit 99.1

Collective Audience Receives Additional Nasdaq Notification Regarding Continued Listing Requirements

New York, NY, May 30, 2024 – Collective Audience, Inc. (NASDAQ-GM:

CAUD) has received an additional notification from the listing qualifications department of The Nasdaq Stock Market. Similar to the previous

notifications announced on April 25, the new notification has no immediate effect on the continued listing of the company’s common

stock on the Nasdaq Global Market.

In the new notification, Nasdaq indicated that the company is not in compliance

with the continued listing requirements regarding the timely filing of its quarterly report on Form 10-Q for the quarter ended March 31,

2024. The company has until June 24, 2024, to submit a plan to regain compliance. However, the company anticipates it will file the Form

10-Q ahead of the June deadline.

“Like with the delay in our Form 10-K for 2023, the delay in filing

our 10-Q for the first quarter of this year is due to the lengthy de-SPAC transaction we completed at the end of last year and the additional

time we need to complete the related accounting,” commented Collective Audience CEO, Peter Bordes. “Our objective is to use

this time to set the company on a solid reporting foundation going forward, and we appreciate the additional time Nasdaq has allowed to

complete this process and to regain compliance.”

“As we’ve worked to complete this accounting process, we have

also continued to advance the deployment of our IP, refocused specifically on audience-based performance advertising and media,”

continued Bordes. “This has included the official launch of our innovative and groundbreaking AdTech platform, AudienceDesk™

powered by AudienceCloud™.”

The company also announced valuable new additions to its board, two new

major partnerships, and two significantly accretive acquisitions which the company is working to close over the coming weeks.

“Despite these reporting delays, our continued progress along these

fronts supports our confidence in our plans for growth and market expansion,” added Bordes, “and that we have the right foundation

in place to regain Nasdaq compliance and continue to build shareholder value over the long term.”

For additional information regarding the Nasdaq notifications and related

terms, please see the Form 8-K the company filed today with the SEC and available at sec.gov.

About Collective Audience

Collective Audience provides an innovative audience-based performance advertising and media platform for brands, agencies and publishers.

The company has introduced a new open, interconnected, data driven, digital advertising and media ecosystem that will uniquely eliminate

many inefficiencies in the digital ad buyer and seller process for brands, agencies and publishers. It will deliver long sought-after

visibility, complementary technology, and unique audience data that drives focus on performance, brand reach, traffic and transactions.

For the AdTech providers and media buyers who

come onto Collective Audience’s platform, they will be able to leverage audience data as a new asset class, powered by AI as an

intelligence layer to guide decision-making.

To learn more, visit collectiveaudience.co.

Important Cautions Regarding Forward-Looking Statements

This press release includes certain statements that are not historical

facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,”

“would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical

matters. All statements, other than statements of present or historical fact included in this press release, regarding the company’s

future financial performance, as well as the company’s strategy, future operations, estimated financial position, estimated revenues

and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. These statements are based

on various assumptions, whether or not identified in this press release, and on the current expectations of the management of Collective

Audience and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and

are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction or a definitive statement of fact

or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events

and circumstances are beyond the control of Collective Audience. Potential risks and uncertainties that could cause the actual results

to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, our need for additional

capital which may not be available on commercially acceptable terms, if at all, which raises questions about our ability to continue as

a going concern; our ability to file our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 within the period provided

by Nasdaq to do so, and/or to timely submit an acceptable plan to regain compliance with the Nasdaq continued listing rules within the

period provided by Nasdaq; our ability to timely file our subsequent periodic reports with the SEC; our ability to maintain the listing

of our common stock on Nasdaq; our ability to consummate previously announced pending acquisitions of BeOp and/or DSL Digital; changes

in domestic and foreign business, market, financial, political and legal conditions; unanticipated conditions that could adversely affect

the company; the overall level of consumer demand for Collective Audience’s products/services; general economic conditions and other

factors affecting consumer confidence, preferences, and behavior; disruption and volatility in the global currency, capital, and credit

markets; the financial strength of Collective Audience’s customers; Collective Audience’s ability to implement its business

strategy; changes in governmental regulation, Collective Audience’s exposure to litigation claims and other loss contingencies;

disruptions and other impacts to Collective Audience’s business, as a result of the COVID-19 pandemic and government actions and

restrictive measures implemented in response; ; any breaches of, or interruptions in, Collective Audience’s information systems;

changes in tax laws and liabilities, legal, regulatory, political and economic risks. More information on potential factors that could

affect Collective Audience’s financial results is included from time to time in Collective Audience’s public reports filed

with the SEC. If any of these risks materialize or Collective Audience’s assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking statements. There may be additional risks that Collective Audience presently

knows, or that Collective Audience currently believes are immaterial, that could also cause actual results to differ from those contained

in the forward-looking statements. In addition, forward-looking statements reflect Collective Audience’s expectations, plans or

forecasts of future events and views as of the date of this press release. Nothing in this press release should be regarded as a representation

by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking

statements will be achieved. Collective Audience anticipates that subsequent events and developments will cause their assessments to change.

However, while Collective Audience may elect to update these forward-looking statements at some point in the future, Collective Audience

specifically disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied upon

as representing Collective Audience’s assessments as of any date subsequent to the date of this press release. Accordingly, undue

reliance should not be placed upon the forward-looking statements.

Company Contact:

Peter Bordes, CEO

Collective Audience, Inc.

Email contact

Investor Contact:

Ron Both

CMA Investor Relations

Tel (949) 432-7566

Email contact

Media Contact:

Tim Randall

CMA Media Relations

Tel (949) 432-7572

Email contact

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

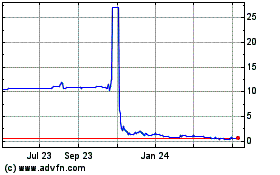

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Feb 2025 to Mar 2025

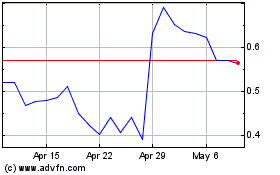

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Mar 2024 to Mar 2025