false

0001854583

0001854583

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

August 14, 2024

Date of Report (Date of

earliest event reported)

COLLECTIVE AUDIENCE, INC.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-40723 |

|

86-2861807 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

85 Broad Street 16-079

New York, NY 10004

(Address of Principal

Executive Offices and Zip Code)

Registrant’s telephone

number, including area code:

(808) 829-1057

(Former name or former

address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

CAUD |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

As previously disclosed in those Current Reports on

Form 8-K filed with the Securities and Exchange Commission (the “Commission”) on January 10, 2024, April 25, 2024 and May

30, 2024, by the Company, on December 22, 2023, April 19, 2024 and May 23, 2024, respectively, Collective Audience, Inc. (the “Company”),

received notification letters (the “Nasdaq Notices”) from the Listing Qualifications Department of The Nasdaq Stock Market

LLC (“Nasdaq Qualifications Department”) advising the Company that it was not in compliance with the Nasdaq Stock Market LLC

(the “Nasdaq”) continued listing requirements under (i) Nasdaq Listing Rule 5250(c)(1) (the “Reports Rule”) as

a result of its failure to timely file its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Form 10-K”)

and its Quarterly Report on Form 10-Q for its fiscal quarter ended March 31, 2024 (the “Form 10-Q,” and together with the

Form 10-K, the “Delinquent Reports”) (ii) Nasdaq’s Listing Rule 5450(b)(2)(A) requiring the market value of listed securities

to be above $50,000,000 for continued listing (the “MVLS Rule”) and (iii) that the market value of publicly held shares had

fallen below the minimum $15,000,000 million requirement for continued listing under Listing Rule 5450(b)(2)(C) Pursuant to the Nasdaq

Notices, the Company was provided until June 19, 2024 to regain compliance with the MVLS Rule and MVPHS Rule and submit the Delinquent

Reports with the Commission. As of August 14, 2024, the Company has filed all the Delinquent Reports and all other periodic reports required

under the Securities and Exchange Act of 1934, as amended, with the Commission.

On August 14, 2024, the Company received a letter

(the “Nasdaq Delisting Notice”) from the staff of Nasdaq stating that Nasdaq Hearings Panel (the “Panel”) has

determined to delist the Company’s common stock, and pursuant to which the trading of the Company’s securities will be suspended

at the open of business on August 16, 2024. The Company is considering all available options, including an appeal to the Nasdaq Listing

and Hearing Review Council (“Council”); however an appeal will not stay the decision of the Nasdaq Hearings Panel.

The Company’s common stock will begin trading,

under its current trading symbol “CAUD”, on the OTC Pink Market operated on the OTC Markets system effective with the open

of the markets on August 16, 2024. The Company intends to apply to have its common stock quoted on the OTCQB Venture Market on the OTC

Markets; however, there can be no assurances that its common stock will be approved, or will continue, to be traded on such market.

In connection with the Nasdaq Delisting Notice, Nasdaq

will complete the delisting by filing a Form 25-NSE Notification of Delisting with the Commission after applicable appeal periods have

lapsed.

The Company has 15 days after the date it received

notice of the Panel’s decision to request that the Council review the decision, or the Council may, on its own motion, determine

to review the Panel’s decision within 45 calendar days after the Company was notified of the decision.

The Company plans to continue to make all required

SEC filings, including those on Forms 10-K, 10-Q and 8-K, and will remain subject to all SEC rules and regulations applicable to reporting

companies under the Securities Exchange Act of 1934. The Company plans to continue to maintain compliance with all Nasdaq corporate governance

requirements notwithstanding the trading suspension and move to the OTC Markets Group platform, and to provide annual financial statements

audited by a Public Company Accounting Oversight Board auditor and unaudited interim financial reports, prepared in accordance with GAAP.

Item 7.01. Regulation

FD Disclosure.

On August 15, 2024, the

Company issued a press release regarding its receipt of the Nasdaq Delisting Notice. A copy of the foregoing press release is attached

as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated by reference herein.

The information set forth

under Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated

by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference

language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed

an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Forward Looking Statement.

The Company cautions you that statements included

in this Current Report, including in Exhibit 99.1 attached hereto, that are not a description of historical facts are forward-looking

statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue”

or the negatives of these terms or other similar expressions. These statements are based on the Company’s current beliefs and expectations.

These forward-looking statements include statements regarding the Company’s ability to successfully appeal Nasdaq’s delisting

determination, or if it does, its ability to regain and maintain compliance with the listing standards of Nasdaq. The inclusion of forward-looking

statements should not be regarded as a representation by the Company that any of its plans will be achieved. Actual results may differ

from those set forth in this Report due to the risks and uncertainties inherent in the Company’s business. These forward-looking

statements are based on information currently available to the Company and its current plans or expectations and are subject to a number

of uncertainties and risks that could significantly affect its current plans to file periodic reports with the Commission. You are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the Company undertakes no obligation

to revise or update this Report to reflect events or circumstances after the date hereof. All forward-looking statements are qualified

in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: August 15, 2024 |

COLLECTIVE AUDIENCE, INC. |

| |

|

| |

By: |

/s/ Peter Bordes |

| |

Name: |

Peter Bordes |

| |

Title: |

Chief Executive Officer |

3

Exhibit 99.1

Collective Audience to Transition to OTC Markets Following Delisting from Nasdaq Global Market

Company Received Notice of Delisting Yesterday

from Nasdaq without Traditionally Granted Grace Period as it Pursues Potential Appeal to Continue Trading on Nasdaq

New York, NY, August 15, 2024 –

Collective Audience, Inc. (Nasdaq: CAUD), a leading innovator of audience-based performance

advertising and media, announced its common stock will be suspended from trading on the Nasdaq Global Market effective upon the open of

trading on Friday, August 16, 2024 following a Nasdaq Hearings Panel determination to delist the company’s shares.

The company is currently arranging for its

stock to begin trading temporarily on the OTC Markets’ Pink Open Market at the opening of the markets on Friday, August 16, 2024,

while it pursues a request for reconsideration and contemplates filing an appeal to the Nasdaq Listing and Hearing Review Council. The

company already has a pending application with OTC Markets to list on the OTC Markets’ OTCQB Market for which the company believes

it fully qualifies.

Despite the company’s successful execution

of its compliance plan, including being current in its SEC reporting, the recent timely filing of its Form 10-Q for the three months ended

June 30, 2024, and the completion of two previously announced acquisitions, the Nasdaq appeal panel decided to deny any grace period or

extension to allow the company to transition to the Nasdaq Capital Market, citing the immediate drop in market trading price at the deSPAC

back in November 2023 as the deciding factor in their decision.

The company’s application to transfer

to the Nasdaq Capital Market, where it currently meets continued listing requirements, except for minimum bid price compliance (which

it had until October 2024 to resolve), was also denied. The company is currently evaluating its plan to potentially appeal the decision

in the 15 days allotted by Nasdaq for such an appeal.

Collective Audience is current with its SEC

reporting requirements and recently completed two transformative acquisitions. Following these acquisitions, the company reported that

it expects to generate on a pro forma basis positive EBITDA in 2024, with annual pro forma revenues on track to exceed $7.5 million.

“We strongly disagree with the Nasdaq

Hearings Panel’s decision, which disregards our recent achievements and compliance efforts, and as the company stands today being

compliant versus being compliant based on November of last year,” stated Collective Audience CEO, Peter Bordes. “It is unfortunate

that despite our full compliance and the significant progress we've made, including our recent acquisition of BeOp, a leading conversational

media platform, Nasdaq has chosen not to grant us the opportunity to continue trading based on volatile market conditions post-deSPAC

back in November 2023. We are confident in our long-term strategy and remain focused on delivering value to our shareholders.”

As Collective Audience pursues its listing

options, including a potential appeal and/or applications to other national exchanges, it remains committed to its mission of empowering

brands, agencies, and publishers with advanced tools and data-driven applications that drive performance and efficiency.

Additional details on the delisting will be

made available in a Form 8-K filed by Collective Audience on www.sec.gov.

About

Collective Audience

Collective Audience is [re]imagining digital advertising for the Open Web. Its innovative AudienceCloud is one

of the leading audience-based advertising and media cloud infrastructure platforms for brands, agencies and publishers on the Open Web.

Its modular suite of data driven applications eliminates many inefficiencies from the traditional digital ad buyer and seller supply

path, and the process for brands, agencies and publishers. It empowers partners with all the advanced tools and audience data they need

on a single cloud platform, and drives focus on increased performance metrics, brand reach, traffic and transactions.

For the AdTech providers and media buyers

who come onto Collective Audience’s platform, they will be able to leverage audience data as a new asset class, powered by AI as

an intelligence layer to guide decision making.

To learn more, visit collectiveaudience.co.

Important Cautions Regarding Forward-Looking Statements

This press release includes certain statements that are not historical

facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,”

“would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical

matters. All statements, other than statements of present or historical fact included in this press release, regarding the company’s

future financial performance, as well as the company’s strategy, future operations, estimated financial position, estimated revenues

and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. These statements are based

on various assumptions, whether or not identified in this press release, and on the current expectations of the management of Collective

Audience and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and

are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction or a definitive statement of fact

or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events

and circumstances are beyond the control of Collective Audience. Potential risks and uncertainties that could cause the actual results

to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, changes in domestic

and foreign business, market, financial, political and legal conditions; unanticipated conditions that could adversely affect the company;

the overall level of consumer demand for Collective Audience’s or BeOp’s products/services; general economic conditions and

other factors affecting consumer confidence, preferences, and behavior; disruption and volatility in the global currency, capital, and

credit markets; the financial strength of Collective Audience’s and BeOp’s customers; Collective Audience’s and BeOp’s

ability to implement their business strategy; the ability to successfully integrate BeOp into Collective Audience’s operations;

changes in governmental regulation, Collective Audience’s exposure to litigation claims and other loss contingencies; disruptions

and other impacts to Collective Audience’s business, as a result of the COVID-19 pandemic and government actions and restrictive

measures implemented in response; Collective Audience’s ability to protect patents, trademarks and other intellectual property rights;

any breaches of, or interruptions in, Collective Audience’s information systems; changes in tax laws and liabilities, legal, regulatory,

political and economic risks. More information on potential factors that could affect Collective Audience’s financial results is

included from time to time in Collective Audience’s public reports filed with the SEC. If any of these risks materialize or Collective

Audience’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking

statements. There may be additional risks that Collective Audience presently knows, or that Collective Audience currently believes are

immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking

statements reflect Collective Audience’s expectations, plans or forecasts of future events and views as of the date of this press

release. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth

herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. Collective Audience

anticipates that subsequent events and developments will cause their assessments to change. However, while Collective Audience may elect

to update these forward-looking statements at some point in the future, Collective Audience specifically disclaims any obligation to do

so, except as required by law. These forward-looking statements should not be relied upon as representing Collective Audience’s

assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking

statements.

Collective Audience Contact:

Peter Bordes, CEO

Collective Audience, Inc.

Email contact

Investor & Media

Contact:

Ron Both

CMA Investor & Media Relations

Tel (949) 432-7566

Email contact

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

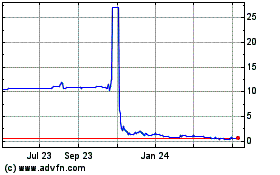

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Nov 2024 to Dec 2024

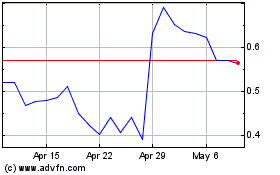

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Dec 2023 to Dec 2024