1001 Fannin StreetSuite 1500HoustonTexasNovember 4, 20240001486159falseCommon StockCHRDThe Nasdaq Stock Market LLC00014861592024-04-082024-04-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________

FORM 8-K

____________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2024

____________________________________________________________________

CHORD ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________________________________________

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-34776 | | 80-0554627 |

(State or other jurisdiction of

incorporation or organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| | |

1001 Fannin Street, Suite 1500 | | |

Houston, Texas | | 77002 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (281) 404-9500

Not Applicable.

(Former name or former address, if changed since last report)

____________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | CHRD | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On November 4, 2024, Chord Energy Corporation (the “Company”) (i) completed the semi-annual borrowing base redetermination, which affirmed the current borrowing base of $3.0 billion and the aggregate elected revolving commitment amounts of $1.5 billion and (ii) with respect to the Amended and Restated Credit Agreement dated as of July 1, 2022 , by and among the Company, Oasis Petroleum North America LLC, a Delaware limited liability company, Wells Fargo Bank, N.A., as administrative agent, and the other parties party the Credit Facility (the “Credit Facility”) entered into a Sixth Amendment to the Credit Facility (the “Sixth Amendment”). The Sixth Amendment extended the Borrower’s ability to incur Permitted Pari Team Loan Debt and/or Permitted Junior Lien Term Loan Debt (each as defined in the Credit Facility) by one-year, now ending on December 1, 2025. The next scheduled redetermination is expected to occur in or around April 2025.

The foregoing description of the Sixth Amendment is a summary only, does not purport to be complete, and is qualified in its entirety by reference to the full text of the Sixth Amendment, which is attached hereto as Exhibit 10.1 and incorporated by reference into this Item 1.01.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 2.03 by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| | |

| Exhibit No. | | Description of Exhibit |

| | |

| | |

| 10.1 | | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | CHORD ENERGY CORPORATION (Registrant) |

| | | |

| Date: November 8, 2024 | | | | By: | /s/ Shannon B. Kinney |

| | | | | Shannon B. Kinney |

| | | | | Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary |

| | |

Sixth Amendment

To

Amended and Restated Credit Agreement

Dated as of November 4, 2024

Among

Chord Energy Corporation,

as Parent,

Oasis Petroleum North America LLC,

As Borrower,

the other Credit Parties party hereto,

Wells Fargo Bank, National Association,

as Administrative Agent, Issuing Bank and Swingline Lender

and

The Lenders Party Hereto

|

SIXTH AMENDMENT TO

AMENDED AND RESTATED CREDIT AGREEMENT

THIS SIXTH AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT (this “Sixth Amendment”) dated as of November 4, 2024, is among: Chord Energy Corporation, a Delaware corporation (the “Parent”); Chord Energy LLC, a Delaware limited liability company (f/k/a Oasis Petroleum LLC) (“Chord LLC”), Oasis Petroleum North America LLC, a Delaware limited liability company (the “Borrower”); the other Guarantors listed on the signature pages hereto; each of the Lenders party hereto; and Wells Fargo Bank, National Association, as administrative agent for the Lenders (in such capacity, together with its successors in such capacity, the “Administrative Agent”) and as the issuing bank (in such capacity, the “Issuing Bank”).

R E C I T A L S:

A.The Parent, Chord LLC, the Borrower, the Administrative Agent and the Lenders are parties to that certain Amended and Restated Credit Agreement dated as of July 1, 2022 (as amended, amended and restated, restated, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”), pursuant to which the Lenders have made certain extensions of credit available to and on behalf of the Borrower.

B.The Parent, the Borrower, the Administrative Agent, the Issuing Bank and the Lenders party hereto desire to amend certain provisions of the Credit Agreement as set forth herein effective as of the Sixth Amendment Effective Date (as defined below), subject to the terms and conditions hereof.

NOW, THEREFORE, in consideration of the premises and the mutual covenants herein contained, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

Section 1.Defined Terms. Each capitalized term used herein but not otherwise defined herein has the meaning given such term in the Credit Agreement, as amended by this Sixth Amendment. Unless otherwise indicated, all section references in this Sixth Amendment refer to sections of the Credit Agreement.

Section 2.Amendments to Credit Agreement. In reliance on the representations, warranties, covenants and agreements contained in this Sixth Amendment, and subject to the conditions precedent contained in Section 3 hereof, effective as of the Sixth Amendment Effective Date, the Credit Agreement shall be amended as follows:

2.1Amendments to Section 1.02.

(a)Each of the following definitions is hereby amended and restated in its entirety to read as follows:

“Agreement” means this Amended and Restated Credit Agreement, including any schedules and exhibits hereto, as amended by the First Amendment, the Second Amendment, the Third Amendment, the Fourth Amendment, the Fifth Amendment, and the Sixth Amendment, and as the same may from time to time be further amended, restated, amended and restated, supplemented or modified.

(b)Each of the following definitions is hereby added to Section 1.02 in its appropriate alphabetical order to read as follows:

“Sixth Amendment” means that certain Sixth Amendment to Amended and Restated Credit Agreement, dated as of November 4, 2024 among the Parent, the Borrower, the other Guarantors, the Administrative Agent, the Issuing Bank and the Lenders party thereto.

2.2Amendment to Section 9.02(c). Section 9.02(c) is hereby amended by replacing the phrase “incurred on or prior to December 1, 2024” contained therein with the phrase “incurred on or prior to December 1, 2025”.

Section 3.Conditions Precedent. This Sixth Amendment shall become effective as of the date when each of the following conditions is satisfied (or waived in accordance with Section 12.02 of the Credit Agreement) (the “Sixth Amendment Effective Date”):

3.1Executed Counterparts of Sixth Amendment. The Administrative Agent shall have received from the Borrower, each Guarantor and the Majority Lenders (in such number as may be requested by the Administrative Agent) executed counterparts of this Sixth Amendment signed on behalf of such Person.

3.2Fees and Expenses. The Administrative Agent shall have received all fees and other amounts due and payable by the Credit Parties on or prior to the Sixth Amendment Effective Date, including, to the extent invoiced at least two (2) Business Days prior to the Sixth Amendment Effective Date, reimbursement or payment of all reasonable out-of-pocket expenses required to be reimbursed or paid by the Borrower pursuant to the Credit Agreement.

3.3No Default. No Default, Event of Default or Borrowing Base Deficiency shall have occurred and be continuing as of the Sixth Amendment Effective Date prior to and after giving effect to the terms of this Sixth Amendment.

The Administrative Agent is hereby authorized and directed to declare the Sixth Amendment Effective Date to have occurred when it has received documents confirming or certifying, to the satisfaction of the Administrative Agent, compliance with the conditions set forth in this Section 3 or the waiver of such conditions as permitted hereby. Such declaration shall be final, conclusive and binding upon all parties to the Credit Agreement for all purposes.

Section 4.Miscellaneous.

4.1Confirmation and Effect. The provisions of the Credit Agreement, as amended by this Sixth Amendment, shall remain in full force and effect following the effectiveness of this Sixth Amendment. Each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof”, “herein” or any other word or words of similar import shall mean and be a reference to the Credit Agreement as amended hereby, and each reference in any other Loan Document to the Credit Agreement or any word or words of similar import shall be and mean a reference to the Credit Agreement as amended hereby.

4.2No Waiver. Neither the execution by the Administrative Agent or the Lenders of this Sixth Amendment, nor any other act or omission by the Administrative Agent or the Lenders or their officers in connection herewith, shall be deemed a waiver by the Administrative Agent or the Lenders of any Defaults or Events of Default which may exist, which may have occurred prior to the date of the effectiveness of this Sixth Amendment or which may occur in the future under the Credit Agreement and/or the other Loan Documents. Similarly, nothing contained in this Sixth Amendment shall directly or indirectly in any way whatsoever either: (a) impair, prejudice or otherwise adversely affect the Administrative Agent’s or the Lenders’ right at any time to exercise any right, privilege or remedy in connection with the Loan Documents with respect to any Default or Event of Default, (b) except to the extent expressly set forth herein, amend or alter any provision of the Credit Agreement, the other Loan Documents, or any other contract or instrument, or (c) constitute any course of dealing or other basis for altering any obligation of the Borrower or any right, privilege or remedy of the Administrative Agent or the Lenders under the Credit Agreement, the other Loan Documents, or any other contract or instrument.

4.3Ratification and Affirmation; Representations and Warranties. Each Credit Party hereby: (a) acknowledges the terms of this Sixth Amendment, (b) ratifies and affirms its obligations under, and acknowledges its continued liability under, each Loan Document to which it is a party and agrees that each Loan Document to which it is a party remains in full force and effect as expressly amended hereby and (c) represents and warrants to the Lenders that as of the date hereof, after giving effect to the execution of this Sixth Amendment: (i) all of the representations and warranties contained in each Loan Document to which it is a party are true and correct in all material respects (or, if already qualified by materiality, Material Adverse Effect or a similar qualification, true and correct in all respects), except to the extent any such representations and warranties are expressly limited to an earlier date, in which case, such representations and warranties shall continue to be true and correct in all material respects (or, if already qualified by materiality, Material Adverse Effect or a similar qualification, true and correct in all respects) as of such specified earlier date and (ii) no Default or Event of Default has occurred and is continuing.

4.4Counterparts. This Sixth Amendment may be executed by one or more of the parties hereto in any number of separate counterparts, and all of such counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of this Sixth Amendment by facsimile or other electronic transmission (e.g., “pdf” or “tif”), including via DocuSign or other similar electronic signature technology shall be effective as delivery of a manually executed counterpart hereof.

4.5No Oral Agreement. This Sixth Amendment, the Credit Agreement and the other Loan Documents executed in connection herewith and therewith represent the final agreement between the parties and may not be contradicted by evidence of prior, contemporaneous, or unwritten oral agreements of the parties. There are no subsequent oral agreements between the parties.

4.6GOVERNING LAW. THIS SIXTH AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

4.7Payment of Expenses. In accordance with Section 12.03 of the Credit Agreement, the Borrower agrees to pay or reimburse the Administrative Agent for all of its reasonable out-of-pocket costs and reasonable expenses incurred in connection with this Sixth Amendment, any other documents prepared in connection herewith and the transactions contemplated hereby, including, without limitation, the reasonable fees and disbursements of Simpson Thacher & Bartlett LLP, as counsel to the Administrative Agent.

4.8Severability. Any provision of this Sixth Amendment which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

4.9Successors and Assigns. This Sixth Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

4.10Loan Document. This Sixth Amendment shall constitute a “Loan Document” under and as defined in Section 1.02 of the Credit Agreement.

4.11No Novation. The parties hereto agree that this Sixth Amendment does not in any way constitute a novation of the existing Credit Agreement, but is an amendment of the Credit Agreement.

[Signatures Begin Next Page]

IN WITNESS WHEREOF, the parties hereto have caused this Sixth Amendment to be duly executed as of the date first written above.

| | | | | | | | | | | |

| BORROWER: | | OASIS PETROLEUM NORTH AMERICA LLC |

| | | |

| | | |

| | By: | /s/ Richard Robuck |

| | Name: | Richard Robuck |

| | Title: | Executive Vice President and Chief

Financial Officer |

| | | | | | | | | | | |

| GUARANTORS: | | CHORD ENERGY CORPORATION |

| | CHORD ENERGY LLC |

| | CHORD ENERGY MARKETING LLC |

| | OASIS WELL SERVICES LLC |

| | OMS HOLDINGS LLC |

| | OASIS PETROLEUM PERMIAN LLC |

| | OASIS INVESTMENT HOLDINGS LLC |

| | WHITING HOLDINGS LLC |

| | WHITING OIL AND GAS CORPORATION |

| | SPARK CANADIAN HOLDINGS INC. |

| | SPARK ACQUISITION ULC |

| | ENERPLUS CORPORATION |

| | ENERPLUS ENERGY LTD. |

| | ENERPLUS RESOURCES U.S. INC. |

| | ENERPLUS USA 2006 ACQUISITION INC. |

| | ENERPLUS RESOURCES (USA) |

| | CORPORATION |

| | ENERPLUS WILLISTON I, LLC |

| | ENERPLUS WILLISTON II, LLC |

| | | |

| | By: | /s/ Richard Robuck |

| | Name: | Richard Robuck |

| | Title: | Executive Vice President and Chief

Financial Officer |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| ADMINISTRATIVE AGENT, | | |

| SWINGLINE LENDER, | | |

| ISSUING BANK AND LENDER: | WELLS FARGO BANK, NATIONAL |

| | ASSOCIATION, |

| | as Administrative Agent, Issuing Bank, a Swingline |

| | Lender and a Lender |

| | | |

| | By: | /s/ Michael Real |

| | Name: | Michael Real |

| | Title: | Managing Director |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | CITIBANK, N.A., as a Lender |

| | | |

| | By: | /s/ Cliff Vaz |

| | Name: | Cliff Vaz |

| | Title: | Vice President |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | JPMORGAN CHASE BANK, N.A., |

| | as a Lender |

| | | |

| | By: | /s/ Dalton Harris |

| | Name: | Dalton Harris |

| | Title: | Authorized Officer |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | ROYAL BANK OF CANADA, as a Lender |

| | | |

| | By: | /s/ Emilee Scott |

| | Name: | Emilee Scott |

| | Title: | Authorized Signatory |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | CAPITAL ONE, NATIONAL ASSOCIATION, |

| | as a Lender |

| | | |

| | By: | /s/ David Lee Garza |

| | Name: | David Lee Garza |

| | Title: | Vice President |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | CANADIAN IMPERIAL BANK OF |

| | COMMERCE, NEW YORK BRANCH, |

| | as a Lender |

| | | |

| | By: | /s/ Kevin A. James |

| | Name: | Kevin A. James |

| | Title: | Authorized Signatory |

| | | | | | | | | | | |

| | By: | /s/ Donovan C. Broussard |

| | Name: | Donovan C. Broussard |

| | Title: | Authorized Signatory |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | CITIZENS BANK, N.A., as a Lender |

| | | |

| | By: | /s/ Parker U. Mears |

| | Name: | Parker U. Mears |

| | Title: | Senior Vice President |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | ZIONS BANCORPORATION, N.A. DBA |

| | AMEGY BANK, as a Lender |

| | | |

| | By: | /s/ John Moffitt |

| | Name: | John Moffitt |

| | Title: | Senior Vice President |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | BOKF, NA DBA BANK OF TEXAS, as a Lender |

| | | |

| | By: | /s/ Mari Salazar |

| | Name: | Mari Salazar |

| | Title: | SVP, Regional Manager |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | TRUIST BANK, as a Lender |

| | | |

| | By: | /s/ Greg Krablin |

| | Name: | Greg Krablin |

| | Title: | Director |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | COMERICA BANK, as a Lender |

| | | |

| | By: | /s/ Britney P. Moore |

| | Name: | Britney P. Moore |

| | Title: | Vice President |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | REGIONS BANK, as a Lender |

| | | |

| | By: | /s/ Michael Kolosowsky |

| | Name: | Michael Kolosowsky |

| | Title: | Managing Director |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | GOLDMAN SACHS BANK USA, as a Lender |

| | | |

| | By: | /s/ Priyankush Goswami |

| | Name: | Priyankush Goswami |

| | Title: | Authorized Signatory |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | MIZUHO BANK, LTD., as a Lender |

| | | |

| | By: | /s/ Edward Sacks |

| | Name: | Edward Sacks |

| | Title: | Managing Director |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | PNC BANK, NATIONAL ASSOCIATION, as a |

| | Lender |

| | | |

| | By: | /s/ Thomas Magness |

| | Name: | Thomas Magness |

| | Title: | Assistant Vice President |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | U.S. BANK NATIONAL ASSOCIATION, as a |

| | Lender |

| | | |

| | By: | /s/ John C. Lozano |

| | Name: | John C. Lozano |

| | Title: | Senior Vice President |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | BANK OF AMERICA, N.A., as a Lender |

| | | |

| | By: | /s/ Alia Qaddumi |

| | Name: | Alia Qaddumi |

| | Title: | Director |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| | | | | | | | | | | |

| | FIFTH THIRD BANK, NATIONAL |

| | ASSOCIATION, as a Lender |

| | | |

| | By: | /s/ Dan Condley |

| | Name: | Dan Condley |

| | Title: | Managing Director |

Signature Page to Sixth Amendment to Amended and Restated Credit Agreement

(Oasis Petroleum North America LLC)

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

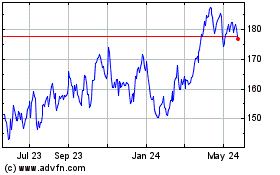

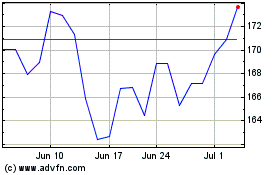

Chord Energy (NASDAQ:CHRD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Chord Energy (NASDAQ:CHRD)

Historical Stock Chart

From Mar 2024 to Mar 2025